Last updated: 4/18/2019

Motion To Approve Loan Modification Agreement {BTXN 310}

Start Your Free Trial $ 19.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

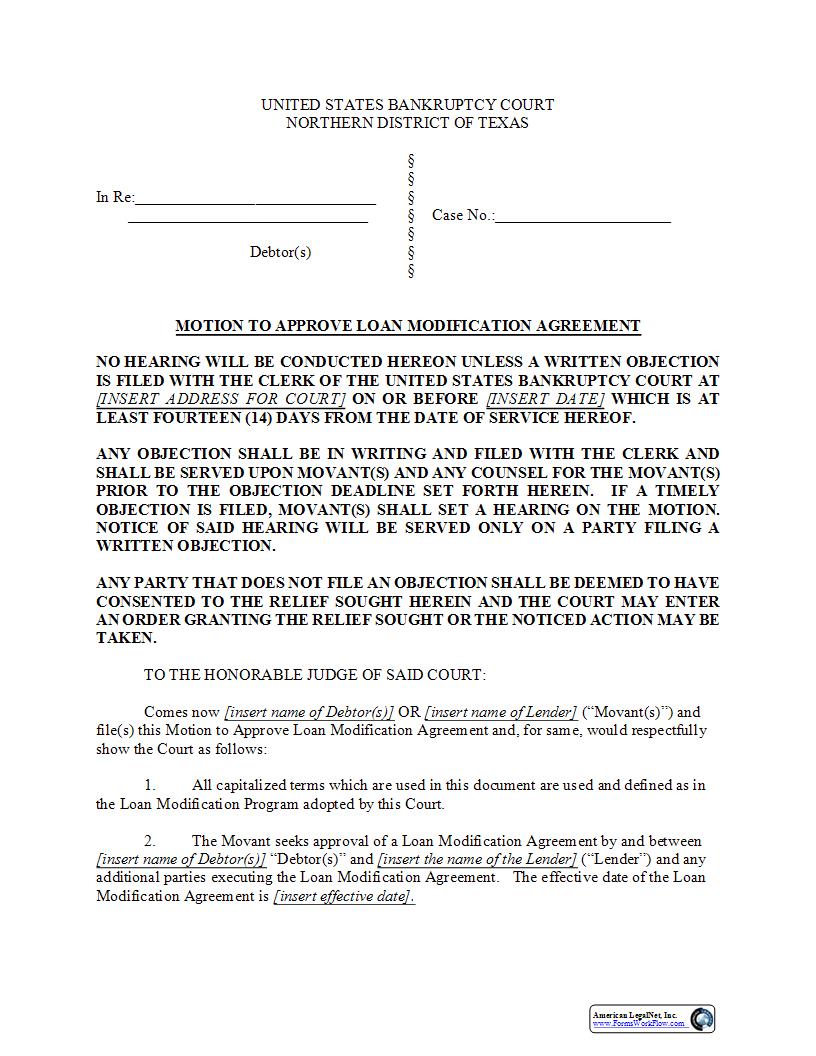

UNITED STATES BANKRUPTCY COURT NORTHERN DISTRICT OF TEXAS 247 247 In Re: 247 247 Case No.: 247 Debtor(s) 247 247 MOTION TO APPROVE LOAN MODIFICATION AGREEMENT NO HEARING WILL BE CONDUCTED HEREON UNLESS A WRITTEN OBJECTION IS FILED WITH THE CLERK OF THE UNITED STATES BANKRUPTCY COURT AT [INSERT ADDRESS FOR COURT] ON OR BEFORE [INSERT DATE] WHICH IS AT LEAST FOURTEEN (14) DAYS FROM THE DATE OF SERVICE HEREOF. ANY OBJECTION SHALL BE IN WRITING AND FILED WITH THE CLERK AND SHALL BE SERVED UPON MOVANT(S) AND ANY COUNSEL FOR THE MOVANT(S) PRIOR TO THE OBJECTION DEADLINE SET FORTH HEREIN. IF A TIMELY OBJECTION IS FILED, MOVANT(S) SHALL SET A HEARING ON THE MOTION. NOTICE OF SAID HEARING WILL BE SERVED ONLY ON A PARTY FILING A WRITTEN OBJECTION. ANY PARTY THAT DOES NOT FILE AN OBJECTION SHALL BE DEEMED TO HAVE CONSENTED TO THE RELIEF SOUGHT HEREIN AND THE COURT MAY ENTER AN ORDER GRANTING THE RELIEF SOUGHT OR THE NOTICED ACTION MAY BE TAKEN. TO THE HONORABLE JUDGE OF SAID COURT: Comes now [insert name of Debtor(s)] OR [insert name of Lender] (223Movant(s)224) and file(s) this Motion to Approve Loan Modification Agreement and, for same, would respectfully show the Court as follows: 1. All capitalized terms which are used in this document are used and defined as in the Loan Modification Program adopted by this Court. 2. The Movant seeks approval of a Loan Modification Agreement by and between [insert name of Debtor(s)] 223Debtor(s)224 and [insert the name of the Lender] (223Lender224) and any additional parties executing the Loan Modification Agreement. The effective date of the Loan Modification Agreement is [insert effective date]. American LegalNet, Inc. www.FormsWorkFlow.com BTXN 310 (rev 09/18) Motion to Approve Loan Modification Agreement Page 2 3. The names of all obligors on the Eligible Loan are [insert names of all obligors on the Eligible Loan]. The obligors are collectively referred to hereafter as 223Borrower224. 4. The address of the Eligible Property that secures the Eligible Loan is [insert the address of the property]. 5. The Eligible Property [is] [is not] the Debtor222s(s222) principal residence. 6. The original amount of the Eligible Loan was [insert the original loan amount]. 7. The following is a comparison of the current terms of the Eligible Loan and what the terms will be following the modification: Current Mortgage Modified Mortgage Principal Interest Rate Fixed [yes/no] Adjustable [yes/no] Term of the loan in months Date of the last payment MONTHLY PAYMENT: Principal and interest Monthly Escrow Total Monthly Payment American LegalNet, Inc. www.FormsWorkFlow.com BTXN 310 (rev 09/18) Motion to Approve Loan Modification Agreement Page 3 8. The following are the additional fees, costs or deposits, if any, charged to the Debtor(s) by the Lender pursuant to the Loan Modification Agreement, including any attorney fees claimed by the Lender with regard to the Loan Modification Matter: [insert an itemized list of all such fees, costs and deposits and give the total amount] This amount shall be [select one of the phrases below]: paid by the Debtor(s) in cash capitalized disbursed by the Chapter 13 Trustee [describe method of payment if different from the above]. Pursuant to the Loan Modification Program, Lender is not required to file a Notice of Fees, Expenses, and Charges pursuant to Rule 3002.1 of the Federal Rules of Bankruptcy Procedure with regard to these charges. If fees, expenses or charges are incurred after the effective date, the Lender may file a Notice of Fees, Expenses, and Charges in accordance with Rule 3002.1 of the Federal Rules of Bankruptcy Procedure, if applicable. 9. The payments due under the Loan Modification Agreement are $ [insert amount] and the first payment is due on or before [insert first payment due date] and shall be paid thereafter as set forth in the Loan Modification Agreement until the Lender is paid in full pursuant to the modified loan. Pursuant to the Loan Modification Program, Lender is not required to file a Notice of Payment Change pursuant to Rule 3002.1 of the Federal Rules of Bankruptcy Procedure with regard to this payment change. The name and address of the entity which is to receive the payments is as follows: [Insert name of entity receiving payments] [Insert address of entity receiving payments] If the payment amount changes after the effective date of the Loan Modification Agreement, the Lender may file a Notice of Payment Changes in accordance with Rule 3002.1 of the Federal Rules of Bankruptcy Procedure, if applicable. 10. Debtor(s) and any other Borrower will be current upon the approval of the Loan Modification Agreement if that is obtained prior to [insert date] and the Debtor(s) and any other Borrower will be current if the approval is obtained after that date, provided the payments due under the modified loan are made timely. American LegalNet, Inc. www.FormsWorkFlow.com BTXN 310 (rev 09/18) Motion to Approve Loan Modification Agreement Page 4 11. Check one of the statements below: If the loan modification is approved, any arrearage provided for in the Chapter 13 Plan is no longer to be paid by the Chapter 13 Trustee, the Debtor(s) or any other Borrower. The total amount of any arrearage to be paid through the Plan, including amounts already disbursed by the Chapter 13 Trustee, is $[insert amount]. The Chapter 13 Trustee should be authorized to modify the total amount of the arrearage to be paid through the Plan to Lender without the necessity of the Lender filing an amended proof of claim or any notice or pleading pursuant to Rule 3002 .1 of the Federal Bankruptcy Rules and Procedures. 12. If the Chapter 13 Trustee is holding Reserved Funds, he/she should be authorized to disburse the Reserved Funds, if any, to the debtor222s(s222) attorney to be applied to all outstanding attorney222s fees until the outstanding balance of any attorney222s fees is paid in full and, thereafter, shall disburse any remaining Reserved Funds to satisfy the claims of other creditors, which disbursements should be made in accordance with the provisions of the Plan and all applicable Rules and Procedures. The Trustee should be authorized to make such disbursements without further modification of the Chapter 13 Plan. 13. The following is a list of any additional documents any party to this Loan Modification Agreement must execute to effectuate this Loan Modification Agreement, if any: [list additional documents here] 14. The fully executed Loan Modification Agreement is attached hereto as Exhibit 223A224 and is incorporated herein by reference. 15. Contemporaneously with the filing of this Notice, a copy of it will be uploaded to the Portal. WHEREFORE, PREMISES CONSIDERED, Movant prays for an Order of this Court: (1) Approving the terms of the Loan Modification Agreement; (2) Authorizing the Chapter 13 Trustee or the Debtor(s), as provided in the Loan Modification Program, to take the actions and make the disbursements described in this Motion or in the Loan Modification Agreement without modification of the Chapter 13 Plan and without further order of the Court; (3) Authorizing the payment of any additional fees, costs or deposits as set out in the Motion; (4) Finding that the Debtor(s) will be current to the Lender subject to the conditions American LegalNet, Inc. www.FormsWorkFlow.com BTXN 310 (rev 09/18) Motion to Approve Loan Modification Agreement Page 5 described herein; (5) Deeming any proof of claim filed by the Lender to be amended consistent with the terms set out in this Motion and the Loan Modification Agreement and finding that Lender is not required to file an amended proof of claim; (6) Finding that the Lender is not required to file a Notice of Payment Change or a Notice of Fees, Expenses, and Charges pursuant to Rule 3002.1 of the Federal Rules of Bankruptcy Procedure with regard to any payment obligation disclosed in this Motion; (7) Finding that the Lender may file a Notice of Payment Changes and/or a Notice of Fees, Expenses, and Charges in accordance with Rule 3002.1 of the Federal Rules of Bankruptcy Procedure regarding any payment changes that occur or any fees, expenses