Last updated: 2/23/2021

Application For Certificate Of Eligibility For REAP Benefits {REAP}

Start Your Free Trial $ 5.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

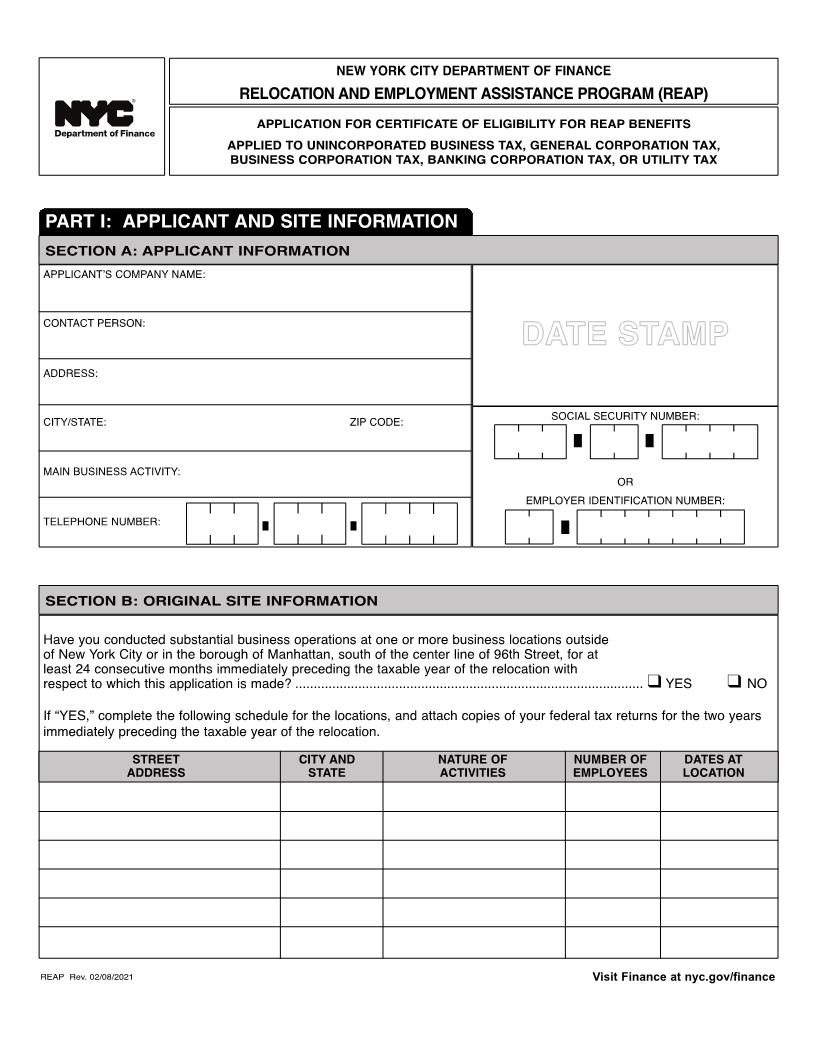

TM Finance RELOCATION AND EMPLOYMENT ASSISTANCE PROGRAM (REAP) APPLICATION FOR CERTIFICATE OF ELIGIBILITY FOR REAP BENEFITS APPLIED TO UNINCORPORATED BUSINESS TAX, GENERAL CORPORATION TAX, BANKING CORPORATION TAX, OR UTILITY TAX NEW YORK CITY DEPARTMENT OF FINANCE PART I: APPLICANT AND SITE INFORMATION APPLICANTS COMPANY NAME: CONTACT PERSON: ADDRESS: CITY/STATE: MAIN BUSINESS ACTIVITY: TELEPHONE NUMBER: ZIP CODE: SECTION A: APPLICANT INFORMATION DATE STAMP SOCIAL SECURITY NUMBER: EMPLOYER IDENTIFICATION NUMBER: OR Have you conducted substantial business operations at one or more business locations outside of New York City or in the borough of Manhattan, south of the center line of 96th Street, for at least 24 consecutive months immediately preceding the taxable year of the relocation with respect to which this application is made? .............................................................................................. STREET ADDRESS CITY AND STATE NATURE OF ACTIVITIES SECTION B: ORIGINAL SITE INFORMATION If "YES," complete the following schedule for the locations, and attach copies of your federal tax returns for the two years immediately preceding the taxable year of the relocation. NUMBER OF EMPLOYEES DATES AT LOCATION K YES K NO REAP Rev. 11/23/11 Visit Finance at nyc.gov/finance American LegalNet, Inc. www.FormsWorkFlow.com Application for Certificate of Eligibility for REAP Benefits SECTION C: RELOCATION SITE INFORMATION Page 2 1. On or after May 27, 1987, did you relocate to premises within New York City that are not located south of the center line of 96th Street in the borough of Manhattan? ............................... You may complete and submit a REAP application for an anticipated relocation, even if all the requested information is not yet available. a. BOROUGH: ADDRESS: If "YES," provide (a) the borough, block and lot number, the address of the premises you relocated to, and submit one of the following: a copy of the lease for the premises, a copy of the contract to purchase the premises, or a copy of the deed if you own the premises; AND (b) a brief description of the relocated business operations. BLOCK: LOT: K YES K NO b. DESCRIPTION OF RELOCATED BUSINESS OPERATIONS: 2. Do your activities, at the relocation premises, consist predominantly of any of the following: a. The retail sale (other than through the mail, by phone, or by means of the Internet) of tangible personal property to any person, for any purpose unrelated to the trade or business of such person? ................................................................................................... b. The sale of services to individuals that generally involve the physical, mental, and/or spiritual care of such individuals or the physical care of the personal property of any person unrelated to the trade or business of such person? ............................................ c. d. The lodging of guests at a building or portion thereof that is regularly used and kept open for such services, including an apartment hotel, a motel, or boarding house or club? .. IF YOU CHECKED "YES" TO ANY ITEM IN QUESTION 2, YOU DO NOT MEET THE REAP ELIGIBILITY CRITERIA. K YES K YES K YES K YES K YES K YES K YES K K K K K K K NO NO NO NO The provision of retail banking services? ................................................................................. 3. a. Did you relocate on or after July 1, 2003? ............................................................................... b. Do you own the premises to which you relocated, or if you lease the premises, does the term of the lease extend to a date at least three years after the relocation date and the lease commencement date? .............................................................................................. c. IF YOU ANSWERED "YES" TO 3a, 3b, AND 3c. DO NOT COMPLETE QUESTION 4. NO NO NO On or after July 1, 2003, were expenditures in excess of $25 per square foot made for improvements to the premises?.......................................................................................... 4. a. Do the premises to which you have relocated fit any of the following five categories? IF YOU ANSWERED "NO" TO ANY PART OF QUESTION 3, YOU MUST COMPLETE QUESTION 4. (1) Premises are wholly contained in real property that is eligible to receive benefits under the Citys Industrial and Commercial Abatement Program (ICAP)? .......... If YES, submit a copy of the lease and the ICAP Preliminary Certificate of Eligibility. K YES K NO American LegalNet, Inc. www.FormsWorkFlow.com Application for Certificate of Eligibility for REAP Benefits SECTION C - RELOCATION SITE INFORMATION - Continued Page 3 (2) Premises are wholly contained or situated on real property that has been leased from the New York City Industrial Development Agency?...................................... If YES, submit a copy of the lease. If YES, submit a copy of the lease. K YES K YES K YES K YES K YES K YES K YES K K K K K NO NO (3) Premises are wholly contained in or situated on real property that is owned by the City of New York? ................................................................................................... (4) Premises are wholly contained or situated on real property that is owned by the Port Authority or the New York State Urban Development Corporation or a subsidiary thereof? ..................................................................................................... (5) Premises are wholly contained in or situated on real property that would be eligible to receive benefits pursuant to the Citys ICAP Program, except that such property is exempt from real property taxation? ................................................................ 4. b. (1) Were the premises to which you relocated improved by construction or renovation? ..... (2) Answer this question only if you checked Question 4a (2): Was such construction or renovation made with the approval of the NYC Industrial Development Agency?......................................................................... If YES, submit a copy of the lease and the ICAP Preliminary Certificate of Eligibility. If YES, submit a copy of the lease. NO NO NO (3) Answer this question only if you checked Question 4a (3): K NO K NO (5) Were such expenditures made within 36 months, or, if the expenditures were in excess of $50 million, were they made within 72 months from the beginning of the renovations or construction?..