Last updated: 10/15/2019

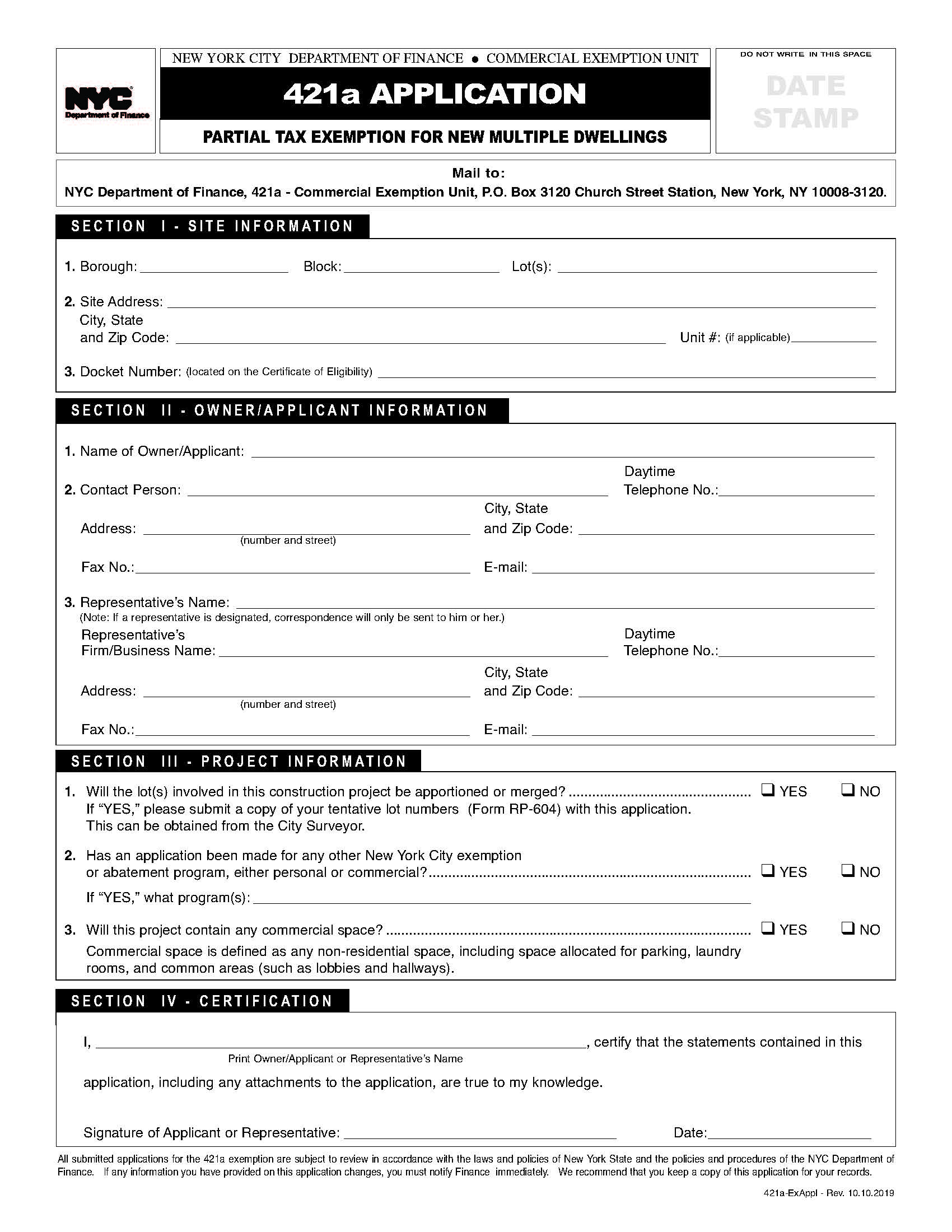

421a Application Partial Tax Exemption For New Multiple Dwellings {DoF-421a}

Start Your Free Trial $ 5.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

421a APPLICATION PARTIAL TAX EXEMPTION FOR NEW MULTIPLE DWELLINGS. This is a New York City Department of Finance form used by property owners or developers to request a property tax exemption for newly constructed multiple dwellings under the 421a program. The form collects detailed site, owner, and project information, including HPD-issued Preliminary and Final Certificates of Eligibility, and determines whether the project includes commercial space or other tax programs. Applicants must mail the completed form and certificates to the Department of Finance’s Commercial Exemption Unit. The 421a program provides partial property tax exemptions for up to 35 years, with benefit schedules based on project type and duration. www.FormsWorkflow.com