Last updated: 4/19/2021

National Medical Support Notice Part A

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

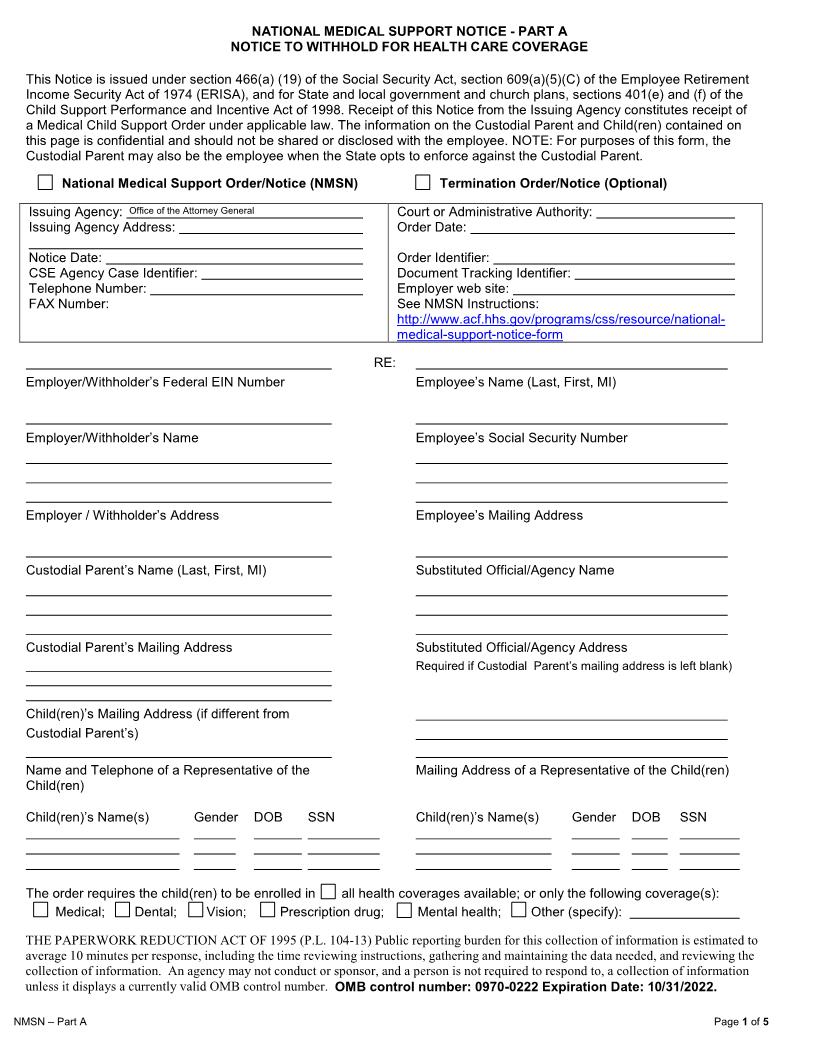

NATIONAL MEDICAL SUPPORT NOTICE - PART A NOTICE TO WITHHOLD FOR HEALTH CARE COVERAGE This Notice is issued under section 466(a)(19) of the Social Security Act, section 609(a)(5)(C) of the Employee Retirement Income Security Act of 1974 (ERISA), and for State and local government and church plans, sections 401(e) and (f) of the Child Support Performance and Incentive Act of 1998. (CSPIA) Receipt of this Notice from the Issuing Agency constitutes receipt of a Medical Child Support Order under applicable law. The information on the Custodial Parent and Child(ren) contained on this page is confidential and should not be shared or disclosed with the employee. NOTE: For purposes of this form, the Custodial Parent may also be the employee when the State opts to enforce against the Custodial Parent. Issuing Agency: Office of the Attorney General Child Support Division - Medical Support Unit Issuing Agency Address: P.O. Box 1328 Austin, Texas 78767-1328 Notice Date: <F002> CSE Agency Case Identifier: <F003> Telephone Number: (800) 522-2421 FAX Number: (855) 329-6676 <F041> , <F042> , County, Texas Order Date: <F043> Order Identifier: <F040> Document Tracking Identifier:<F019> Employer web site: www.employer.texasattorneygeneral.gov See NMSN Instructions: www.acf.hhs.gov/programs/css/resource/national-medicalsupport-notice-form Court or Administrative Authority: ____________________________________________________ Employer/Withholder's Federal EIN Number RE: ____________________________________________ Employee's Name (Last, First, MI) _________________________________________________ Employer/Withholder's Name ___________________________________________ Employee's Social Security Number <F062> <F063> <F064> ___________________________________________________ Employer/Withholder's Address <F027> <F028> ______________________________________________ Employee's Mailing Address ___________________________________________________________ Custodial Parent's Name (Last, First, MI) ___________________________________________ <F032> <F033> <F034> c/o P.O. Box 1328 Austin, Texas 78767-1328 Custodial Parent's Mailing Address Substituted Official/Agency Name ___________________________________________ ___________________________________________ ___________________________________________ Substituted Official/Agency Address (Required if Custodial Parent's mailing address is left blank) _________________________________________________ Child(ren)'s Mailing Address (if different from Custodial Parent's) Office of the Attorney General, Child Support Division Telephone Number: (800) 522-2421 - Fax: (855) 329-6676 Name and Telephone of a Representative of the Child(ren) Medical Support Unit P.O. Box 1328 Austin, TX 78767-1328 Mailing Address of a Representative of the Child(ren) Child(ren)'s Name(s) <F068> <F071> <F074> <F077> <F080> Gender <F110> <F111> <F112> <F113> <F114> DOB <F069> <F072> <F075> <F078> <F081> SSN <F070> <F073> <F076> <F079> <F082> Child(ren)'s Name(s) <F083> <F086> <F089> <F092> <F095> Gender <F115> <F116> <F117> <F118> <F119> DOB <F084> <F087> <F090> <F093> <F096> SSN <F085> <F088> <F091> <F094> <F097> The order requires the child(ren) to be enrolled in [<F098>] all health coverages available; or only the following coverage(s): <F100> Medical; <F101> Dental; <F102> Vision; <F103> Prescription drug; <F104> Mental Health; <F105> Other (specify): <F106>_____________________________________________________________________________________________________________. THE PAPERWORK REDUCTION ACT OF 1995 (P.L. 104-13) Public reporting burden for this collection of information is estimated to average 10 minutes per response, including the time reviewing instructions, gathering and maintaining the data needed, and reviewing the collection of information. An agency may not conduct or sponsor, and a person is not required to respond to, a collection of information unless it displays a currently valid OMB control number. OMB control number: 0970-0222. Expiration Date: 08/31/2016. Employer Name: <F004> Employer Federal EIN: <F054> Non-Custodial Parent: <F024> <F025> <F026> Non-Custodial Parent SSN: <F022> Bar Code (with FSN): <F019> OAG Case Number: <F003> Cause Number: <F040> Page 1 of 5 Form 3N009 American LegalNet, Inc. www.FormsWorkFlow.com NMSN - Part A April 2014 LIMITATIONS ON WITHHOLDING The total amount withheld for both cash and medical support cannot exceed the applicable Consumer Credit Protection Act (CCPA) percentage (%) of the employee's aggregate disposable weekly earnings. The employer may not withhold more under this National Medical Support Notice than the lesser of: 1. The amounts allowed by the Federal Consumer Credit Protection Act (15 U.S.C., section 1673(b)); The amounts allowed by the State of the employee's principal place of employment; or The amounts allowed for health insurance premiums by the child support order, as indicated here:_______ . 2. 3. The Federal limit applies to the aggregate disposable weekly earning (ADWE). ADWE is the net income left after making mandatory deductions such as State, Federal, local taxes; Social Security taxes; and Medicare taxes. As required under section 2.b.2 of the Employer Responsibilities on page 4, complete item 5 of the Employer Response to notify the Issuing Agency that enrollment cannot be completed because of prioritization or limitations on withholding. PRIORITY OF WITHHOLDING If withholding is required for employee contributions to one or more plans under this notice and for a support obligation under a separate notice and available funds are insufficient for withholding for both cash and medical support contributions, the employer must withhold amounts for purposes of cash support and medical support contributions in accordance with the law, if any, of the State of the employee's principal place of employment requiring prioritization between cash and medical support, as described here: Texas law requires that the employee contributions for health insurance are withheld first before withholding for cash support (cash child support, cash medical support, or cash spousal support).[TFC § 101.010] If an employer is faced with two or more NMSNs and cannot comply with all of the notices, the employer should comply with the notices in the order in which they were first received. As required under section 2.b.2 of the Employer Responsibilities on page 4, complete item 5 of the Employer Response to notify the Issuing Agency that enrol