Last updated: 10/2/2020

Tax Payer Status Affidavit

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

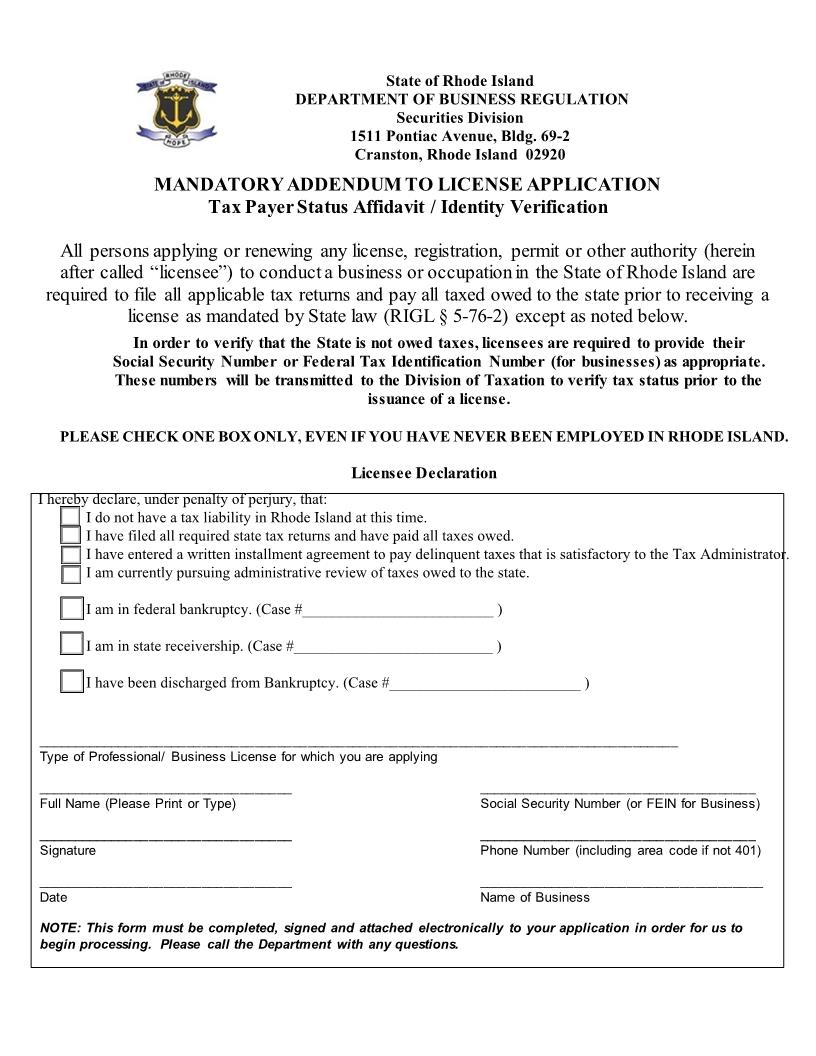

State of Rhode Island and Providence Plantations Department of Business Regulation Securities Division 1511 Pontiac Avenue John O. Pastore Complex Building 69-1 Cranston, RI 02920 TEL: (401) 462-9527 FAX: (401) 462-9645 TDD: 711 www.dbr.ri.gov EXHIBIT 1 MANDATORY ADDENDUM TO LICENSE APPLICATION Tax Payer Status Affidavit / Identity Verification All persons applying or renewing any license, registration, permit or other authority (herein after called "licensee") to conduct a business or occupation in the state of Rhode Island are required to file all applicable tax returns and pay all taxes owed to the state prior to receiving a license as mandated by state law (RIGL §5-76-2) except as noted below. In order to verify that the state is not owed taxes, licensees are required to provide their Social Security Number, or Federal Tax Identification Number (for businesses) as appropriate. These numbers will be transmitted to the Division of Taxation to verify tax status prior to the issuance of a license. PLEASE CHECK ONE BOX ONLY, EVEN IF YOU HAVE NEVER BEEN EMPLOYED IN RHODE ISLAND. Licensee Declaration I hereby declare, under penalty of perjury, that I have filed all required state tax returns and have paid all taxes owed. I have entered a written installment agreement to pay delinquent taxes that is satisfactory to the Tax Administrator. I am currently pursuing administrative review of taxes owed to the state. I am in federal bankruptcy. (Case # ) I am in state receivership. (Case # ) I have been discharged from Bankruptcy. (Case # ) Type of Professional/Business License for which you are applying Full Name (Please Print or Type) Signature Date Social Security Number (or FEIN for Business) Phone Number (including area code if not 401) Name of Business (If Applicable) NOTE: This form must be completed, signed and attached electronically to your application in order for us to begin processing. Please call the Department with any questions. American LegalNet, Inc. www.FormsWorkFlow.com