Last updated: 10/2/2020

Charitable Organizations Application

Start Your Free Trial $ 17.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

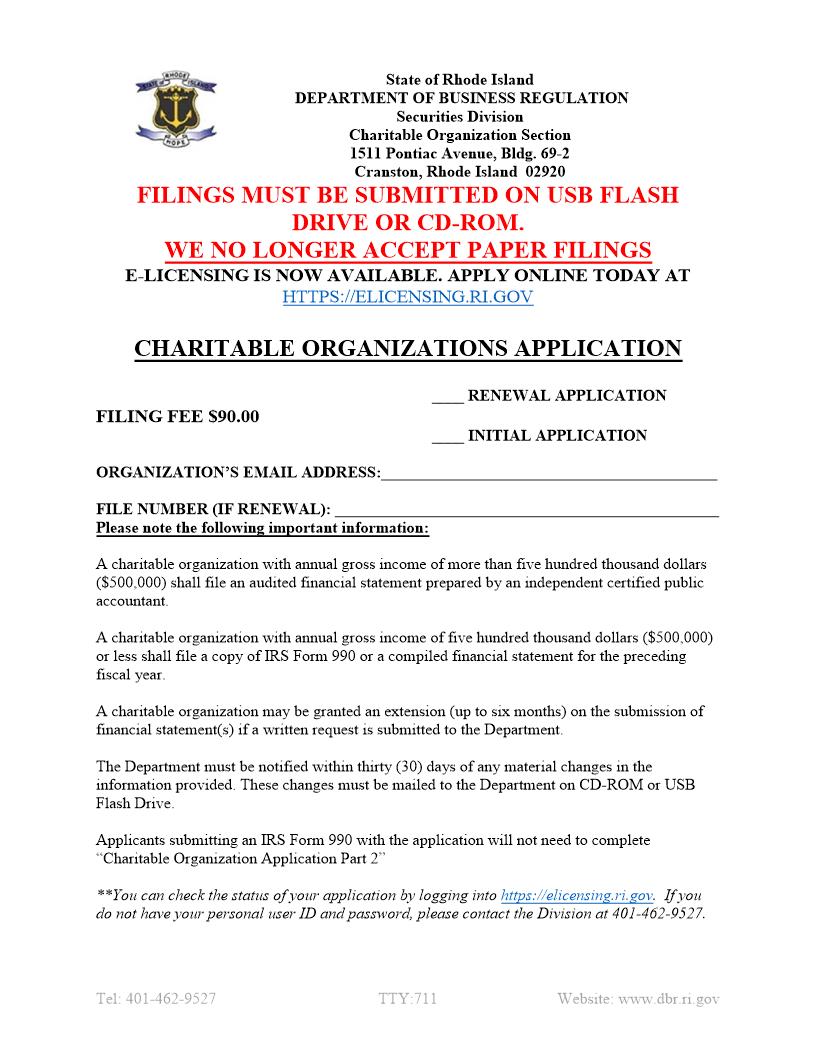

State of Rhode Island and Providence Plantations DEPARTMENT OF BUSINESS REGULATION SECURITIES DIVISION CHARITABLE ORGANIZATION SECTION 1511 Pontiac Avenue, Bldg. 69-1 Cranston, Rhode Island 02920 FILINGS MUST BE SUBMITTED ON CD-ROM. WE NO LONGER ACCEPT PAPER FILINGS CHARITABLE ORGANIZATIONS APPLICATION ______ RENEWAL APPLICATION FILING FEE $90.00 ______ INITIAL APPLICATION ORGANIZATION'S E-MAIL ADDRESS: __________________________________ FILE NUMBER (if renewal): _____________________________________________ Please Note the Following Important Information: A charitable organization with annual gross income of more than five hundred thousand dollars ($500,000) shall file an audited financial statement prepared by an independent certified public accountant. The organization may also file a copy of IRS Form 990. A charitable organization with annual gross income of five hundred thousand dollars ($500,000) or less shall file a copy of IRS Form 990 or a compiled financial statement for the preceding fiscal year. A charitable organization may be granted an extension (up to six months) on the submission of financial statement(s) if a written request is submitted to the Department. The Department must be notified within 30 days of any material changes in the information provided. These changes must be mailed to the Department on CD-ROM. Applicants submitting an IRS Form 990 with the application will not need to complete "Charitable Organization Application Part 2" https://elicensing.ri.gov You can check the status of your application by logging into https://elicensing.ri.gov with your Personal User ID and Password. If you do not have your Personal User ID and Password, please contact the Division at 401-462-9527. Tel: 401-462-9527 Fax: 401-462-9645 TTY: 711 Web Site: www.dbr.ri.gov American LegalNet, Inc. www.FormsWorkFlow.com Charitable Organization Application Part 1 1. Organization's name: _________________________________________________________________ 2. Name or names under which organization intends to solicit contributions: _____________________________________________________________________________________ _____________________________________________________________________________________ 3. EIN: ______________________________________________________________________________ 4. Principal address and phone number(s): _____________________________________________________________________________________ _____________________________________________________________________________________ 3. Contact Information (Name, address, e-mail and phone number): _____________________________________________________________________________________ _____________________________________________________________________________________ 4. If the charitable organization does not maintain an office, provide the name and address of person with custody of financial records: _____________________________________________________________________________________ _____________________________________________________________________________________ 5. List all other states where the organization is licensed/registered: _____________________________________________________________________________________ _____________________________________________________________________________________ 6. (a) State the percentage of contributions received in the immediately preceding year that was spent for fund raising and administration: ___________________________________________________________ (b) If exact percentage is unavailable, please provide estimate: ________________________________ 7. Where applicable, please attach the following documents: IRS Form 990, Audited Financial Statement, or Compiled Financial Statements List of the addresses of the Organization and the addresses of any offices in this state. A list of name(s) and address(es) of all professional fund raisers and fundraising counsel who are acting or have agreed to act in this state on behalf of the organization. A copy of the contract(s) for the professional fund raiser and fundraising counsel services. American LegalNet, Inc. www.FormsWorkFlow.com Charitable Organization Application Part 2 **If a copy of IRS Form 990 is submitted along with the application, you do not have to complete this section** 8. If applicable, provide the Internal Revenue Code for Tax Exempt Status:________________________ 9. Location where the Organization was established:___________________________________________ 10. Date when the Organization was established: _____________________________________________ 11. Form of Organization: _______________________________________________________________ 12. Date Fiscal Year Ends (Month, Day):____________________________________________________ 13. A general description of the uses for which the contributions will be applied. _____________________________________________________________________________________ _____________________________________________________________________________________ 14. Name of and amount of compensation paid to the five (5) individuals whose annual compensation exceeds the reporting requirements on IRS Form 990. Name Amount of Compensation 15. Where applicable, please attach the following documents: A list of all chapters, branches, affiliates and other organizations that shared contributions or other revenue raised in this state. (Contributions transferred through United Way, federated fund, or an incorporated community appeal need not be included.) A list of the names and addresses of the officers, directors, trustees, partners, senior level executive employees, members and managers (if a Limited Liability Company), as well as those persons responsible for the day to day operations of the organization. American LegalNet, Inc. www.FormsWorkFlow.com Disclosures 16. Has any government agency or court enjoined the applicant, its officers, directors, members, trustees or senior-level executives from soliciting contributions? Yes _____No _____ If yes, please provide details:_______________________________________________________________________________ _____________________________________________________________________________________ 17. Has applicant's license or registration been suspended, canceled, or had any other administrative action taken against it by any governmental agency? Yes _____No _____ If yes, please provide details:________________________________________________________________