Last updated: 11/11/2019

Foreclosure Mediation Notice Of Community Based Resources {JD-CV-126}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

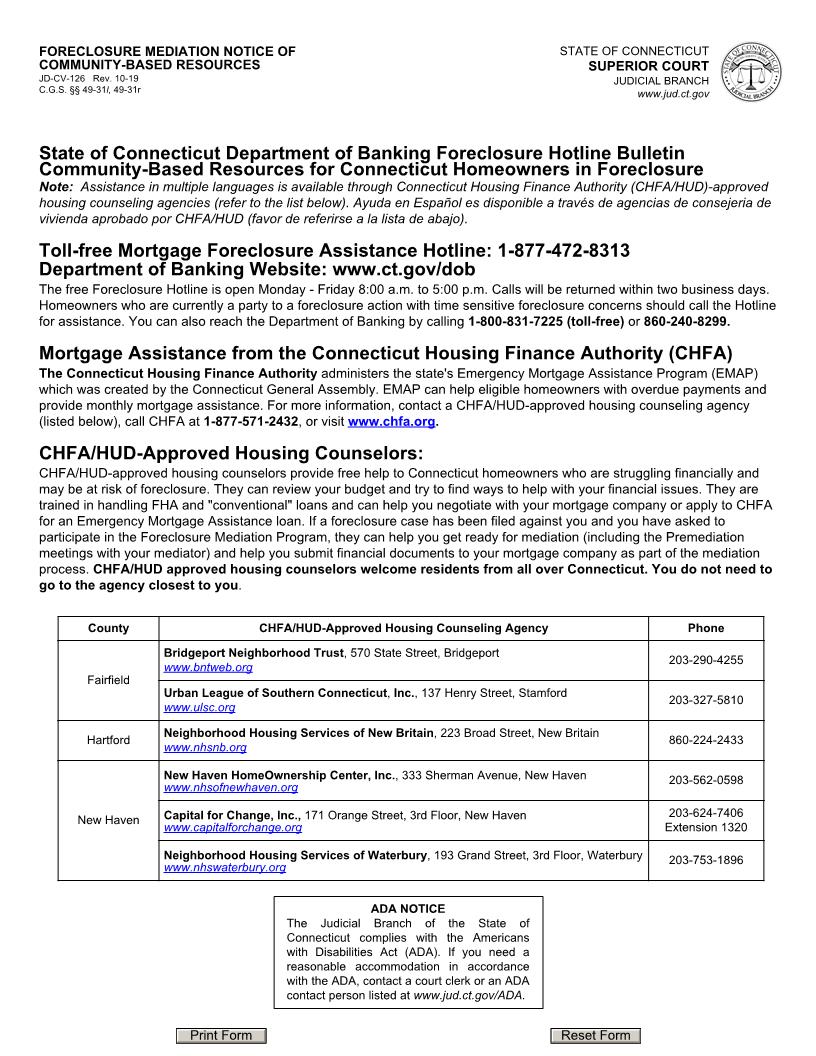

FORECLOSURE MEDIATION NOTICE OF COMMUNITY-BASED RESOURCES JD-CV-126 Rev. 10-17 C.G.S. 247 49-31lSTATE OF CONNECTICUT SUPERIOR COURT JUDICIAL BRANCH www.jud.ct.govState of Connecticut Department of Banking Foreclosure Hotline Bulletin Community-Based Resources for Connecticut Homeowners in Foreclosure Note: Assistance in multiple languages is available through Connecticut Housing Finance Authority (CHFA/HUD)-approved housing counseling agencies (refer to the list below). Ayuda en Espa361ol es disponible a trav351s de agencias de consejeria de vivienda aprobado por CHFA/HUD (favor de referirse a la lista de abajo). Toll-free Mortgage Foreclosure Assistance Hotline: 1-877-472-8313 Department of Banking Website: www.ct.gov/dob The free Foreclosure Hotline is open Monday - Friday 8:00 a.m. to 5:00 p.m. Calls will be returned within two business days. Homeowners who are currently a party to a foreclosure action with time sensitive foreclosure concerns should call the Hotline for assistance. You can also reach the Department of Banking by calling 1-800-831-7225 (toll-free) or 860-240-8299. Mortgage Assistance from the Connecticut Housing Finance Authority (CHFA) The Connecticut Housing Finance Authority administers the state's Emergency Mortgage Assistance Program (EMAP) which was created by the Connecticut General Assembly. EMAP can help eligible homeowners with overdue payments and provide monthly mortgage assistance. For more information, contact a CHFA/HUD-approved housing counseling agency (listed below), call CHFA at 1-877-571-2432, or visit www.chfa.org . CHFA/HUD-Approved Housing Counselors: CHFA/HUD-approved housing counselors provide free help to Connecticut homeowners who are struggling financially and may be at risk of foreclosure. They can review your budget and try to find ways to help with your financial issues. They are trained in handling FHA and "conventional" loans and can help you negotiate with your mortgage company or apply to CHFA for an Emergency Mortgage Assistance loan. If a foreclosure case has been filed against you and you have asked to participate in the Foreclosure Mediation Program, they can help you get ready for mediation (including the Premediation meetings with your mediator) and help you submit financial documents to your mortgage company as part of the mediation process. CHFA/HUD approved housing counselors welcome residents from all over Connecticut. You do not need to go to the agency closest to you. County CHFA/HUD-Approved Housing Counseling Agency Phone 203-290-4248 Bridgeport Neighborhood Trust, 570 State Street, Bridgeport www.bntweb.org Fairfield Hartford Capital for Change, Inc., 171 Orange Street, New Haven www.gnhclf.org New Haven Urban League of Southern Connecticut, Inc., 137 Henry Street, Stamford www.ulsc.org New Haven HomeOwnership Center, Inc., 333 Sherman Avenue, New Haven www.nhsofnewhaven.org/hoc 203-327-5810 203-777-6925 203-624-7406 203-753-1896 Neighborhood Housing Services of Waterbury, 161 North Main Street, Waterbury www.nhswaterbury.org 860-224-2433 Neighborhood Housing Services of New Britain, 223 Broad Street, New Britain www.nhsnb.org ADA NOTICE The Judicial Branch of the State of Connecticut complies with the Americans with Disabilities Act (ADA). If you need a reasonable accommodation in accordance with the ADA, contact a court clerk or an ADA contact person listed at www.jud.ct.gov/ADA. American LegalNet, Inc. Page 2 of 2JD-CV-126 Rev. 10-17Legal Resources Foreclosure Prevention Clinics: The Connecticut Fair Housing Center and the Department of Banking present free clinics for homeowners in foreclosure. The clinics offer information on the foreclosure process and on preparing for court from a Center attorney, and on resources for homeowners from the Department of Banking. After the presentations, homeowners can talk about their situations one-on-one with volunteer attorneys and paralegals. When scheduled in Hartford County, the clinic is held on the 3rd Tuesday evening of the month and is run by the Connecticut Fair Housing Center and the University of Hartford Paralegal Studies Program. When scheduled in Fairfield County, the clinic is held on the 3rd Wednesday evening of the month, and is run by the Connecticut Fair Housing Center and Homes Saved By Faith. The Fairfield County clinics are sponsored by the mayors of Bridgeport, Stamford, and Norwalk. Call 1-888-247-4401 or visit www.ctfairhousing.org for more information. Judicial Branch Foreclosure Volunteer Attorney Program: Volunteer attorneys are available to give advice and answer questions about foreclosure at certain courthouses in the state. Homeowners facing foreclosure throughout Connecticut are welcome to attend. Call 860-263-2734 for additional information, or visit http://jud.ct.gov/volunteerattyprgm.htm . Foreclosure Manual for Self-Represented Homeowners: The Connecticut Fair Housing Center publishes 223Representing Yourself in Foreclosure: A Guide for Connecticut Homeowners,224 a free manual describing the foreclosure and mediation process for self-represented homeowners. Copies are available from CHFA/HUD-approved housing counselors, on www.ctfairhousing.org , or by calling the Center at 1-888-247-4401. Statewide Legal Services (SLS): SLS provides free legal advice and referrals for callers qualifying for its services (guidelines include income limits). Call 1-800-453-3320 or 860-344-0380 or visit www.slsct.org for more information. Court Service Centers: In certain Superior Court locations, Court Service Centers provide public access computers, printers, fax machines, copiers, phones, and work space for self-represented parties. Refer to www.jud.ct.gov , and go to the Quick Links menu on the home page of the Judicial website for more information. Lawyer Referral Services: County Bar Associations in Connecticut offer referral services that introduce homeowners to lawyers who can answer questions during an initial half-hour consultation. You can send an e-mail with your questions and availability. Services beyond the 1st half-hour fee will be at the attorney's usual fee.How Foreclosure Rescue Scams Work. People in foreclosure are often the target of 223foreclosure rescue scams.224Be very careful of non-lawyers who ask you to pay a fee for counseling, loan modification, foreclosure prevention, or a 223forensic audit224 of your loan documents, regardless of their promises or claims. Many out-of-state attorneys target Connecticut residents: you should never pay attorneys that you do not meet. Contact the Department of Banking for more information at 1-877-472-8313 or visit www.preventloanscams.org .Mortgage Crisis Job Training Program. The state-funded Mortgage Crisis Job Training Program is a project of TheWorkPlace, Inc., in partnership with the Connecticut Housing Finance Authority (CHFA), Capital Workforce Partners, and Connecticut's workforce system. The Program helps homeowners increase their job skills and earning potential. It offers customized employment services, job training scholarships, financial literacy, and credit counseling. For information call 1-866-683-1682 or go to www.workplace.org/mortgage-crisis-job-training-program/ . Financial Assistance Programs. Connecticut's 12 Community Action Agencies (CAAs) help people meet immediateneeds through services such as Eviction and Foreclosure Prevention, energy/heating assistance, food pantries, and weatherization. CAAs also empower people to improve their financial future through employment services, financial literacy training, and other programs. To locate your local CAA call the Connecticut Association for Community Action at 860-832-9438or visit: www.cafca.org/our-network .For more information on programs for homeowners facing financial distress, review the Department of Banking's materials on www.ct.gov/dob or call 1-877-472-8313. You can also call Info line at 2-1-1 for resources. County Fairfield Phone 203-335-4116 Email fcba@conversent.net Fee for 1/2 hour Consultation $35 Website www.fairfieldlawyerreferral.com Hartford* 860-525-6052 hcba@hartfordbar.org $25 www.hartfordbar.org New Haven 203-562-5750 NHCBAinfo@newhavenbar.org $35 www.newhav

Related forms

-

Exemption And Modification Claim Form Wage Execution

Exemption And Modification Claim Form Wage Execution

Connecticut/Statewide/Civil/ -

Interrogatories

Interrogatories

Connecticut/Statewide/Civil/ -

Motion For Continuance

Motion For Continuance

Connecticut/Statewide/Civil/ -

Petition For Examination Of Judgment Debtor And Notice Of Hearing

Petition For Examination Of Judgment Debtor And Notice Of Hearing

Connecticut/Statewide/Civil/ -

Withdrawal

Withdrawal

Connecticut/Statewide/Civil/ -

Foreclosure By Sale Committee Deed

Foreclosure By Sale Committee Deed

Connecticut/Statewide/Civil/ -

Foreclosure Worksheet

Foreclosure Worksheet

Connecticut/Statewide/Civil/ -

Notice Of Ex Parte Pre Judgment Remedy - Claim For Hearing To Dissolve Or Modify

Notice Of Ex Parte Pre Judgment Remedy - Claim For Hearing To Dissolve Or Modify

Connecticut/Statewide/Civil/ -

Property Execution Proceedings Application Order Execution

Property Execution Proceedings Application Order Execution

Connecticut/Statewide/Civil/ -

Property Execution Proceedings Claim For Determination Of Interests In Disputed Property

Property Execution Proceedings Claim For Determination Of Interests In Disputed Property

Connecticut/Statewide/Civil/ -

Consent Of Parties To Referral To Judge Trial Referee Civil Matters For Trial Judgment And Appeal

Consent Of Parties To Referral To Judge Trial Referee Civil Matters For Trial Judgment And Appeal

Connecticut/Statewide/Civil/ -

Sales Agreement Forclosure

Sales Agreement Forclosure

Connecticut/Statewide/Civil/ -

Request For Action Administrative And Tax Appeals

Request For Action Administrative And Tax Appeals

Connecticut/Statewide/Civil/ -

Expert Discovery Schedule Proposal Or Request For Scheduling Conference

Expert Discovery Schedule Proposal Or Request For Scheduling Conference

Connecticut/Statewide/Civil/ -

Mortgage Foreclosure Standing Order Federal Loss Mitigation Programs

Mortgage Foreclosure Standing Order Federal Loss Mitigation Programs

Connecticut/Statewide/Civil/ -

Application For Waiver Of Fees

Application For Waiver Of Fees

Connecticut/Statewide/Civil/ -

Statement Of Service (Delivery)

Statement Of Service (Delivery)

Connecticut/Statewide/Civil/ -

Continuation Of Parties

Continuation Of Parties

Connecticut/Statewide/Civil/ -

Foreclosure Mediation Notice To Homeowner Or Religious Organization

Foreclosure Mediation Notice To Homeowner Or Religious Organization

Connecticut/Statewide/Civil/ -

Application For Case Referral Land Use Litigation Docket

Application For Case Referral Land Use Litigation Docket

Connecticut/Statewide/Civil/ -

Request For Judicial Aletnative Dispute Resolution (J-ADR)

Request For Judicial Aletnative Dispute Resolution (J-ADR)

Connecticut/Statewide/Civil/ -

Foreclosure Motion For Interim Committee Fees And Expenses

Foreclosure Motion For Interim Committee Fees And Expenses

Connecticut/Statewide/Civil/ -

Decree Of Foreclosure No Redemption

Decree Of Foreclosure No Redemption

Connecticut/Statewide/Civil/ -

Motion For Judgment Of Foreclosure By Market Sale

Motion For Judgment Of Foreclosure By Market Sale

Connecticut/Statewide/Civil/ -

Motion For Supplemental Judgment Foreclosure By Market Sale

Motion For Supplemental Judgment Foreclosure By Market Sale

Connecticut/Statewide/Civil/ -

Foreclosure By Market Sale Committee Deed

Foreclosure By Market Sale Committee Deed

Connecticut/Statewide/Civil/ -

Foreclosure Mediation Petition For Reinclusion

Foreclosure Mediation Petition For Reinclusion

Connecticut/Statewide/Civil/ -

Motion To Open Judgment

Motion To Open Judgment

Connecticut/Statewide/Civil/ -

Foreclosure Mediation Supplemental Information By Party

Foreclosure Mediation Supplemental Information By Party

Connecticut/Statewide/Civil/ -

Foreclosure Mediation Notice Of Community Based Resources

Foreclosure Mediation Notice Of Community Based Resources

Connecticut/Statewide/Civil/ -

Motion For First Order Of Notice - Foreclosure Action

Motion For First Order Of Notice - Foreclosure Action

Connecticut/Statewide/Civil/ -

First Order Of Upon Attachment Of Estate Of Nonresident

First Order Of Upon Attachment Of Estate Of Nonresident

Connecticut/Statewide/Civil/ -

Online Dispute Resolution Answer

Online Dispute Resolution Answer

Connecticut/1 Statewide/Civil/ -

Online Dispute Resolution Request To Return To Regular Docket

Online Dispute Resolution Request To Return To Regular Docket

Connecticut/1 Statewide/Civil/ -

Online Dispute Resolution Plaintiff Participation Notice

Online Dispute Resolution Plaintiff Participation Notice

Connecticut/1 Statewide/Civil/ -

Certificate Of Closed Pleadings

Certificate Of Closed Pleadings

Connecticut/Statewide/Civil/ -

Foreclosure Plaintiffs Bid At Foreclosure Sale And Committees Response

Foreclosure Plaintiffs Bid At Foreclosure Sale And Committees Response

Connecticut/Statewide/Civil/ -

Proceedings For Enforcement Of Municipal Regulations And Ordinances Including Parking

Proceedings For Enforcement Of Municipal Regulations And Ordinances Including Parking

Connecticut/Statewide/Civil/ -

Continuation Of Parties

Continuation Of Parties

Connecticut/Statewide/Civil/ -

Forclosure Mediation Objection

Forclosure Mediation Objection

Connecticut/Statewide/Civil/ -

Application For Civil Protection Order

Application For Civil Protection Order

Connecticut/Statewide/Civil/ -

Affidavit Civil Protection Order

Affidavit Civil Protection Order

Connecticut/Statewide/Civil/ -

Motion For Extension Of Civil Protection Order

Motion For Extension Of Civil Protection Order

Connecticut/Statewide/Civil/ -

Civil Protection Order Information Form

Civil Protection Order Information Form

Connecticut/Statewide/Civil/ -

Request For Arguement Non Arguable Civil Short Calendar Matter

Request For Arguement Non Arguable Civil Short Calendar Matter

Connecticut/Statewide/Civil/ -

Exemption Claim Form Property Execution

Exemption Claim Form Property Execution

Connecticut/Statewide/Civil/ -

Exemption Claim Form Financial Institution Execution

Exemption Claim Form Financial Institution Execution

Connecticut/Statewide/Civil/ -

Motion To Open Judgment (Small Claims And Housing Matters)

Motion To Open Judgment (Small Claims And Housing Matters)

Connecticut/Statewide/Civil/ -

Answer Small Claims

Answer Small Claims

Connecticut/Statewide/Civil/ -

Foreclosure Motion For Approval Of Committee Sale Approval Of Committee Deed Acceptance Of Comittee Report

Foreclosure Motion For Approval Of Committee Sale Approval Of Committee Deed Acceptance Of Comittee Report

Connecticut/Statewide/Civil/ -

Foreclosure Return Of Sale With Proceeds

Foreclosure Return Of Sale With Proceeds

Connecticut/Statewide/Civil/ -

Foreclosure Motion For Possession

Foreclosure Motion For Possession

Connecticut/Statewide/Civil/ -

Foreclosure Motion For Advice

Foreclosure Motion For Advice

Connecticut/Statewide/Civil/ -

Forclosure Return Of Sale No Proceeds

Forclosure Return Of Sale No Proceeds

Connecticut/Statewide/Civil/ -

First Order Of Notice In Foreclosure Action

First Order Of Notice In Foreclosure Action

Connecticut/Statewide/Civil/ -

Application For Examination Of Judgment Debtor And Notice Of Remote Hearing

Application For Examination Of Judgment Debtor And Notice Of Remote Hearing

Connecticut/Statewide/Civil/ -

Small Claims Motion To Modify Order Of Payments

Small Claims Motion To Modify Order Of Payments

Connecticut/Statewide/Civil/ -

Request For Nondisclosure Of Location Information Civil Protection Order

Request For Nondisclosure Of Location Information Civil Protection Order

Connecticut/1 Statewide/Civil/ -

Request For Additional TIme For Service Of Ex Parte Civil Protection Order

Request For Additional TIme For Service Of Ex Parte Civil Protection Order

Connecticut/Statewide/Civil/ -

Petition For Writ Of Habeas Corpus Conviction Proceeding Sentence Calculation

Petition For Writ Of Habeas Corpus Conviction Proceeding Sentence Calculation

Connecticut/Statewide/Civil/ -

Petition For Writ Of Habeas Corpus Conditions Of Confinement Medical Treatment

Petition For Writ Of Habeas Corpus Conditions Of Confinement Medical Treatment

Connecticut/Statewide/Civil/ -

Petition For Writ Of Habeas Corpus Disciplinary Action

Petition For Writ Of Habeas Corpus Disciplinary Action

Connecticut/Statewide/Civil/ -

Small Claims Motion For Order Of Payments

Small Claims Motion For Order Of Payments

Connecticut/Statewide/Civil/ -

Small Claims Motion To Order Judgment Satisfied

Small Claims Motion To Order Judgment Satisfied

Connecticut/Statewide/Civil/ -

Satisfaction Of Judgment

Satisfaction Of Judgment

Connecticut/Statewide/Civil/ -

Scheduling Order

Scheduling Order

Connecticut/Statewide/Civil/ -

Wage Execution Proceedings Application Order Execution

Wage Execution Proceedings Application Order Execution

Connecticut/Statewide/Civil/ -

Financial Institution Execution Proceedings - Judgment Debtor Who Is Natural Person - Application And Execution

Financial Institution Execution Proceedings - Judgment Debtor Who Is Natural Person - Application And Execution

Connecticut/Statewide/Civil/ -

Financial Institution Execution Proceedings - Judgement Debtor Who Is Not Natural Person - Application And Execution

Financial Institution Execution Proceedings - Judgement Debtor Who Is Not Natural Person - Application And Execution

Connecticut/Statewide/Civil/ -

Petition For Order Re Commission On Human Right And Opportunities And Notice Of Hearing

Petition For Order Re Commission On Human Right And Opportunities And Notice Of Hearing

Connecticut/Statewide/Civil/ -

Affidavit Of Service Petition For Order Re Commission On Human Rights

Affidavit Of Service Petition For Order Re Commission On Human Rights

Connecticut/Statewide/Civil/ -

Answer To Complaint Civil Cases Only

Answer To Complaint Civil Cases Only

Connecticut/Statewide/Civil/ -

Application For Referral Of Case To The Individual Calendaring Program

Application For Referral Of Case To The Individual Calendaring Program

Connecticut/Statewide/Civil/ -

Application For Referral Of Case To The Complex Litigation Docket (CLD)

Application For Referral Of Case To The Complex Litigation Docket (CLD)

Connecticut/Statewide/Civil/ -

Foreclosure Mediation Motion To Request Later Mediation

Foreclosure Mediation Motion To Request Later Mediation

Connecticut/Statewide/Civil/ -

Small Claims Motion To Transfer To The Regular Docket

Small Claims Motion To Transfer To The Regular Docket

Connecticut/Statewide/Civil/ -

Affidavit In Support Of Small Claims Motion To Transfer To Regular Docket

Affidavit In Support Of Small Claims Motion To Transfer To Regular Docket

Connecticut/Statewide/Civil/ -

Affidavit Of Debt Re Motion For Default For Failure To Appear Judgment And Order For

Affidavit Of Debt Re Motion For Default For Failure To Appear Judgment And Order For

Connecticut/Statewide/Civil/ -

Foreclosure By Sale Committee Report

Foreclosure By Sale Committee Report

Connecticut/Statewide/Civil/ -

Certificate Of Judgment Strict Foreclosure

Certificate Of Judgment Strict Foreclosure

Connecticut/Statewide/Civil/ -

Certificate Of Judgment Foreclosure By Sale

Certificate Of Judgment Foreclosure By Sale

Connecticut/Statewide/Civil/ -

Foreclosure By Sale Fact Sheet - Notice To Bidders

Foreclosure By Sale Fact Sheet - Notice To Bidders

Connecticut/Statewide/Civil/ -

Scheduling Order By Agreement

Scheduling Order By Agreement

Connecticut/Statewide/Civil/ -

Motion For Default For Failure To Appear Order For Weekly Payment

Motion For Default For Failure To Appear Order For Weekly Payment

Connecticut/Statewide/Civil/ -

Application For Issuance Of Subpoena

Application For Issuance Of Subpoena

Connecticut/Statewide/Civil/ -

Foreclosure Mediation Certificate

Foreclosure Mediation Certificate

Connecticut/Statewide/Civil/ -

Post Judgment Remedies Interrogatories

Post Judgment Remedies Interrogatories

Connecticut/Statewide/Civil/ -

Request For Judgment Upon Filing Following Civil Penalty

Request For Judgment Upon Filing Following Civil Penalty

Connecticut/Statewide/Civil/ -

Small Claims Writ And Notice Of Suit

Small Claims Writ And Notice Of Suit

Connecticut/Statewide/Civil/ -

Notice Of Application For Prejudgment Remedy - Claim For Hearing To Contest Application Or Claim Exemption

Notice Of Application For Prejudgment Remedy - Claim For Hearing To Contest Application Or Claim Exemption

Connecticut/Statewide/Civil/ -

Notice Of Coerced Debt Review

Notice Of Coerced Debt Review

Connecticut/Statewide/Civil/ -

Summons Civil

Summons Civil

Connecticut/Statewide/Civil/ -

Administrative Appeal Under 4-183 Notice Of Filing

Administrative Appeal Under 4-183 Notice Of Filing

Connecticut/Statewide/Civil/ -

Administrative Appeal Under 4-183 Citation

Administrative Appeal Under 4-183 Citation

Connecticut/Statewide/Civil/ -

Application And Execution For Ejectment Mortgage Foreclosure

Application And Execution For Ejectment Mortgage Foreclosure

Connecticut/Statewide/Civil/ -

Caseflow Request

Caseflow Request

Connecticut/Statewide/Civil/ -

Request For Adjudication Of Discovery Or Deposition Dispute

Request For Adjudication Of Discovery Or Deposition Dispute

Connecticut/Statewide/Civil/

Form Preview

Contact Us

Success: Your message was sent.

Thank you!