Last updated: 7/18/2019

Annual Report Of Self Insurers Payroll {26}

Start Your Free Trial $ 15.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

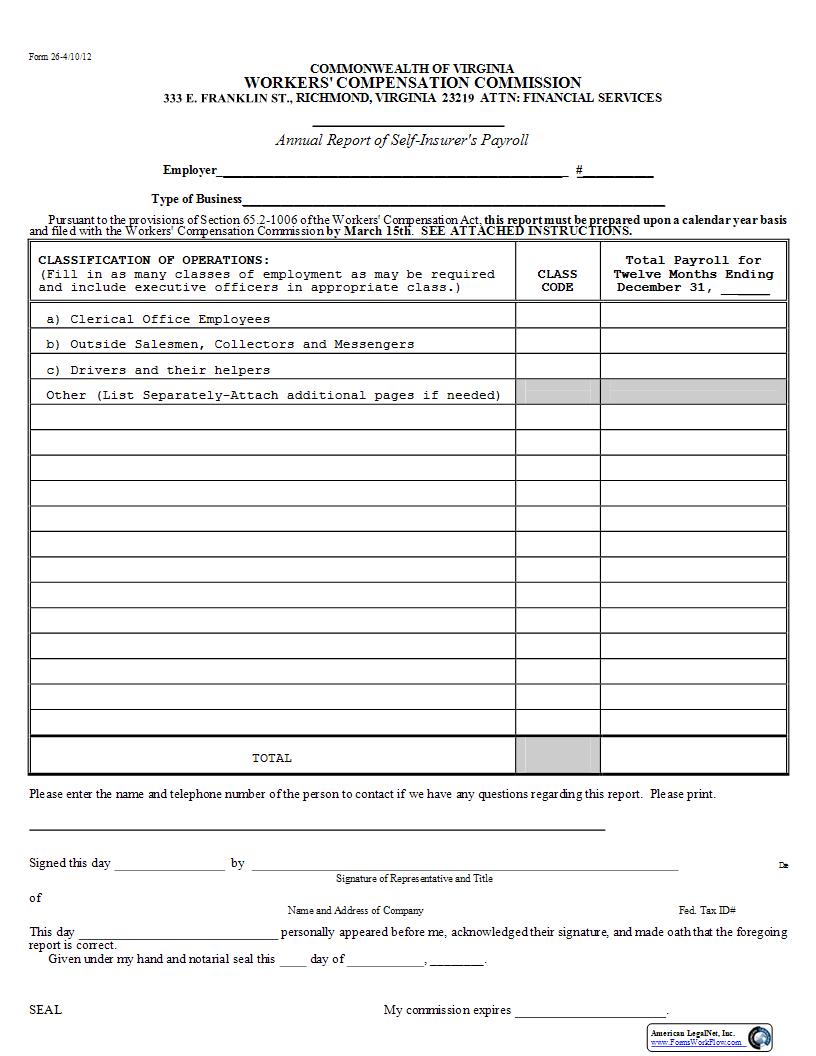

Form 26-4/10/12 COMMONWEALTH OF VIRGINIAWORKERS' COMPENSATION COMMISSION RICHMOND, VIRGINIA 232 ATTN: FINANCIAL SERVICES Annual Report of Self-Insurer's Payroll Employer # Type of Business Pursuant to the provisions of Section 65.2-1006 of the Workers' Compensation Act, this report must be prepared upon a calendar year basis and filed with the Workers' Compensation Commission by March 15th. SEE ATTACHED INSTRUCTIONS. CLASSIFICATION OF OPERATIONS: (Fill in as many classes of employment as may be required and include executive officers in appropriate class.) CLASS CODE Total Payroll for Twelve Months Ending December 31, a)Clerical Office Employees b)Outside Salesmen, Collectors and Messengers c)Drivers and their helpers Other (List Separately-Attach additional pages if needed) TOTAL Please enter the name and telephone number of the person to contact if we have any questions regarding this report. Please print. Signed this day by Date Signature of Representative and Titleof Name and Address of Company Fed. Tax ID#This day personally appeared before me, acknowledged their signature, and made oath that the foregoing report is correct. Given under my hand and notarial seal this day of , . SEAL My commission expires . American LegalNet, Inc. www.FormsWorkFlow.com Effective 1/1/96 FORM 26 INSTRUCTIONS Type or print on the form all required information. Any changes from classifications reported in the prior year should be documented in a letter attached to the report. Employer - Enter the company name that appears on the Self-Insurance Certificate that was issued. # - the 5-digit number assigned by the Va. Workers222 Compensation Commission. (See mailing label for number.) Type of Business - Briefly describe the scope of the business. Classification of Operations - You must enter a brief description for all necessary classifications. Under 223Basic Guidelines for Assigning Classifications224 is information to assist you in determining the correct classifications for your operations. --Report only one payroll amount for each unique classification code. Class Code - Enter the appropriate NCCI code for each classification. Total Payroll for ... - Enter the calendar year being reported. (If reporting for a period other than a full calendar year please indicate on the form.) List the total payroll, on the corresponding line, for each classification reported. BASIC GUIDELINES FOR ASSIGNING CLASSIFICATIONS Generally, it is the business of the employer that is classified, not the separate employments, occupations or operations within the business. The governing classification at a specific job or location is the classification, other than a standard exception classification, that produces the greatest amount of payroll. (These guidelines are intended to be used only for reporting payroll to the Va. Workers222 Compensation Commission. Instructions for any other workers222 compensation classification program may be obtained from NCCI.) EXPLANATION OF CLASSIFICATIONS 1. Basic Classifications - All classifications are basic classifications other than the standard exception classifications. Basic classifications describe the business of an employer, such as: Business Classifications Manufacture of a Product Furniture Mfg. A process Engraving A General Type or Character Of Business Hardware Store A Service Package Delivery 2. Standard Exception Classifications - Employees within the definition of a standard exception classification are not included in a basic classification unless the basic classification specifically includes those employees. The standard exception classifications are defined below: a. Clerical Office Employees-Code 8810 - This classification applies only to employees who work in areas physically separated from other operations by structural partitions and in which work of clerical office employees as defined in this rule is performed exclusively. If such an employee has any other duty, the total payroll of that employee shall be assigned to the highest rated classification of operations to which the employee is exposed. b. Drivers, Chauffeurs and Their Helpers-Code 7380 - employees engaged in such duties on or in connection with a vehicle. This classification includes garage employees and employees using bicycles in their operations. c. Salesperson, Collectors or Messengers-Outside-Code 8742 - are employees engaged in such duties away from the employer222s premises. Not for employees who deliver merchandise. Employees who deliver merchandise shall be assigned to the classification applicable in that risk to drivers even though they also collect or sell. 3. General Inclusions - Some operations appear to be separate businesses, but they are included within the scope of all classifications other than the standard exception classifications. These operations are called general inclusions and are: a. Commissaries and restaurants for the company222s employees. To be assigned to a separate classification if conducted in connection with construction, erection, lumbering or mining operations. b. Manufacture of containers such as bags, barrels, bottles, boxes, cans, cartons or packing cases by the employer for use in the operations of the insured. c. Hospitals or medical facilities operated by the insured for its employees. d. Maintenance or repair of the insured222s bldgs. or equipment by the insured222s employees. e. Printing or lithographing by the insured on its own products. A general inclusion operation shall be separately classified only if: -Such operation constitutes a separate and distinct business of the insured ,or -It is specifically excluded by the classification wording, or American LegalNet, Inc. www.FormsWorkFlow.com -The principal business is described by a standard exception classification. 4. General Exclusions - Some operations in a business are so unusual that they are excluded from basic classifications. They are classified separately unless specifically included in the basic classification wording. These are: a. Aircraft operation - All operations of the flying and ground crews. (The number of passenger seats is to be reported in addition to any other appropriate classifications.) b. New construction or alterations by the insured222s employees. c. Stevedoring, including tallying and checking incidental to stevedoring. d. Sawmill operations - sawing logs into lumber by equipment such as circular carriage or band carriage saws, including operations incidental to the sawmill. e. Employer operated day care service. ASSIGNMENT OF CLASSIFICATIONS 1. Object of Classification Procedure The object of the classification procedure is to assign the one basic classification which best describes the business of the employer within a state. Subject to certain exceptions described in this rule, each classification includes all the various types of labor found in a business. It is the business which is classified, not the individual employments, occupations or operations within a business. Additional classifications shall be assigned as provided below. 2. Classification of Separate Legal Entities Each separate legal entity insured under one certificate shall be assigned to the basic classification which describes its entire business within a state. 3. Business Not Described by a Manual Classification If there is no classification which describes the business, the classification which most closely describes the business shall be assigned. 4. Assignment of Additional Basic Classifications If a classification requires operations or employees to be separately rated or if an employer operates a secondary business within a state, an additional basic classification may be assigned if the following conditions are met. a. The insured222s business is described by a basic classification that requires certain operations to be separately rated. b. The insured engages in construction or erection operations, farm operations, repair operations, or operates a mercantile business. c. The insured operates more than one business in a state. 5. Business Described by a Standard Exception Classification If the principal business is described by a standard exception c