Last updated: 1/3/2017

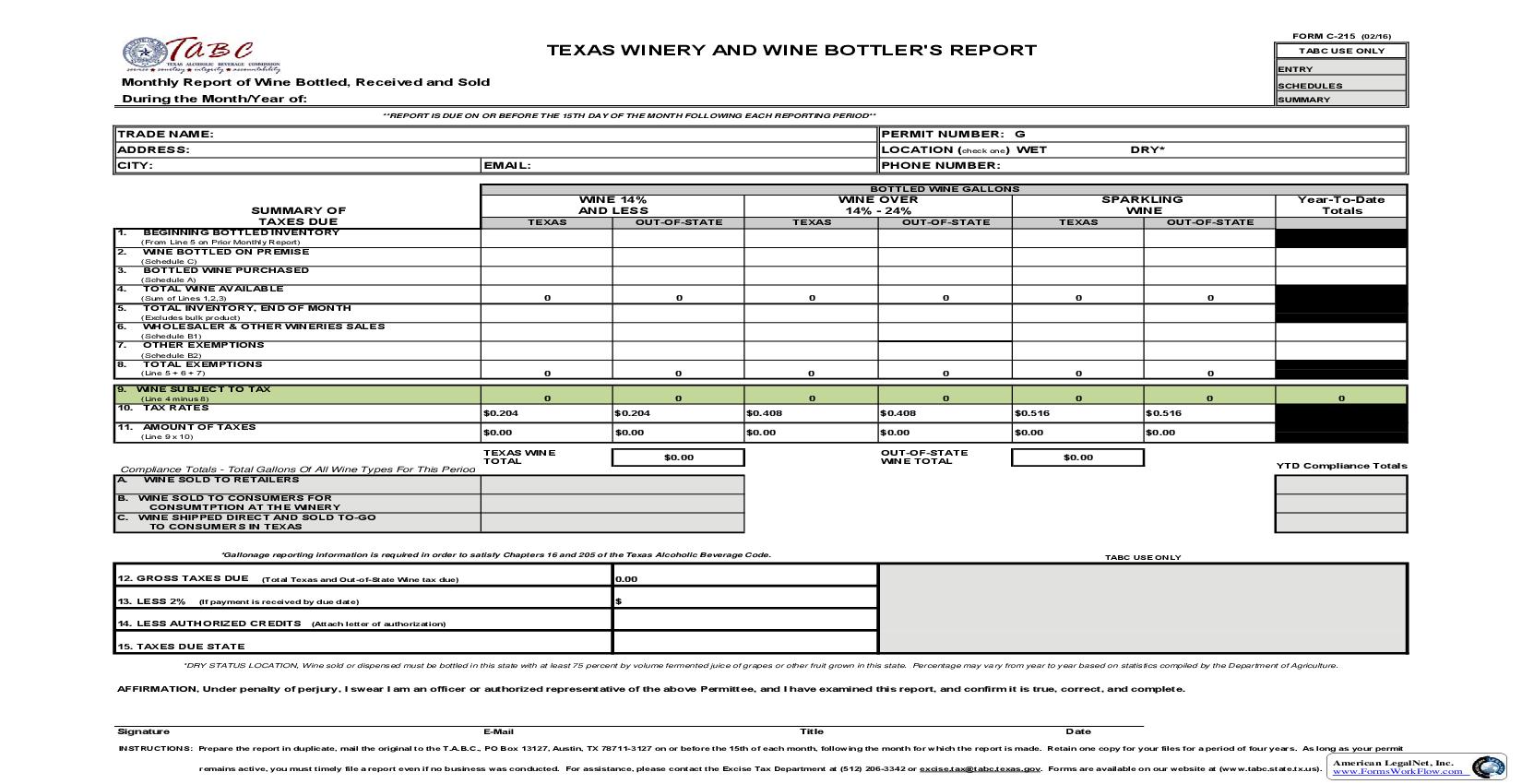

Texas Winery And Wine Bottlers Report {C-215}

Start Your Free Trial $ 5.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

FORM C-215 (02/16) TEXAS WINERY AND WINE BOTTLER'S REPORT Monthly Report of Wine Bottled, Received and Sold During the Month/Year of: **REPORT IS DUE ON OR BEFORE THE 15TH DAY OF THE MONTH FOLLOWING EACH REPORTING PERIOD** TABC USE ONLY ENTRY SCHEDULES SUMMARY TRADE NAME: ADDRESS: CITY: EMAIL: PERMIT NUMBER: G LOCATION (check one) WET PHONE NUMBER: BOTTLED WINE GALLONS DRY* SUMMARY OF TAXES DUE 1. 2. 3. 4. 5. 6. 7. 8. BEGINNING BOTTLED INVENTORY (From Line 5 on Prior Monthly Report) WINE 14% AND LESS TEXAS OUT-OF-STATE TEXAS WINE OVER 14% - 24% OUT-OF-STATE TEXAS SPARKLING WINE OUT-OF-STATE Year-To-Date Totals WINE BOTTLED ON PREMISE (Schedule C) BOTTLED WINE PURCHASED (Schedule A) TOTAL WINE AVAILABLE (Sum of Lines 1,2,3) 0 0 0 0 0 0 TOTAL INVENTORY, END OF MONTH (Excludes bulk product) WHOLESALER & OTHER WINERIES SALES (Schedule B1) OTHER EXEMPTIONS (Schedule B2) TOTAL EXEMPTIONS (Line 5 + 6 + 7) 0 0 $0.204 $0.00 TEXAS WINE TOTAL $0.204 $0.00 0 0 $0.408 $0.00 $0.00 0 0 $0.408 $0.00 0 0 $0.516 $0.00 0 0 $0.516 $0.00 $0.00 0 0 0 9. WINE SUBJECT TO TAX (Line 4 minus 8) 10. TAX RATES 11. AMOUNT OF TAXES (Line 9 x 10) OUT-OF-STATE WINE TOTAL Compliance Totals - Total Gallons Of All Wine Types For This Period A. WINE SOLD TO RETAILERS B. WINE SOLD TO CONSUMERS FOR CONSUMTPTION AT THE WINERY C. WINE SHIPPED DIRECT AND SOLD TO-GO TO CONSUMERS IN TEXAS YTD Compliance Totals *Gallonage reporting information is required in order to satisfy Chapters 16 and 205 of the Texas Alcoholic Beverage Code. TABC USE ONLY 12. GROSS TAXES DUE 13. LESS 2% (Total Texas and Out-of-State Wine tax due) 0.00 $ (If payment is received by due date) 14. LESS AUTHORIZED CREDITS (Attach letter of authorization) 15. TAXES DUE STATE *DRY STATUS LOCATION, Wine sold or dispensed must be bottled in this state with at least 75 percent by volume fermented juice of grapes or other fruit grown in this state. Percentage may vary from year to year based on statistics compiled by the Department of Agriculture. AFFIRMATION, Under penalty of perjury, I swear I am an officer or authorized representative of the above Permittee, and I have examined this report, and confirm it is true, correct, and complete. Signature E-Mail Title Date INSTRUCTIONS: Prepare the report in duplicate, mail the original to the T.A.B.C., PO Box 13127, Austin, TX 78711-3127 on or before the 15th of each month, following the month for which the report is made. Retain one copy for your files for a period of four years. As long as your permit remains active, you must timely file a report even if no business was conducted. For assistance, please contact the Excise Tax Department at (512) 206-3342 or excise.tax@tabc.texas.gov. Forms are available on our website at (www.tabc.state.tx.us). American LegalNet, Inc. www.FormsWorkFlow.com

Related forms

-

Assignment

Assignment

Texas/Statewide/Alcoholic Beverage Commission/ -

Assignment (For Conduct Surety Purposes Only)

Assignment (For Conduct Surety Purposes Only)

Texas/Statewide/Alcoholic Beverage Commission/ -

Assignment (For Performance Bond Purposes Only)

Assignment (For Performance Bond Purposes Only)

Texas/Statewide/Alcoholic Beverage Commission/ -

Letter Of Credit

Letter Of Credit

Texas/Statewide/Alcoholic Beverage Commission/ -

Winery Festival Certificate Request

Winery Festival Certificate Request

Texas/Statewide/Alcoholic Beverage Commission/ -

Application For Two Year Renewal Of Mixed Beverage Permit (Food And Beverage){MB-FB}

Application For Two Year Renewal Of Mixed Beverage Permit (Food And Beverage){MB-FB}

Texas/Statewide/Alcoholic Beverage Commission/ -

Texas Winery And Wine Bottlers Report

Texas Winery And Wine Bottlers Report

Texas/Statewide/Alcoholic Beverage Commission/ -

Vehicles Transporting Alcohol

Vehicles Transporting Alcohol

Texas/Statewide/Alcoholic Beverage Commission/ -

Off-Premise Prequalification Packet

Off-Premise Prequalification Packet

Texas/Statewide/Alcoholic Beverage Commission/ -

Product Registration Application For Distilled Spirit

Product Registration Application For Distilled Spirit

Texas/Statewide/Alcoholic Beverage Commission/ -

Product Registration Application For Malt Beverage

Product Registration Application For Malt Beverage

Texas/Statewide/Alcoholic Beverage Commission/ -

On-Premise Prequalification Packet

On-Premise Prequalification Packet

Texas/Statewide/Alcoholic Beverage Commission/ -

Request For Approval Of Computer Bookkeeping System

Request For Approval Of Computer Bookkeeping System

Texas/Statewide/Alcoholic Beverage Commission/ -

Personal History Sheet

Personal History Sheet

Texas/Statewide/Alcoholic Beverage Commission/ -

Irrevocable Letter Of Credit (For Performance Bond Purposes Only)

Irrevocable Letter Of Credit (For Performance Bond Purposes Only)

Texas/Statewide/Alcoholic Beverage Commission/ -

Performance Bond

Performance Bond

Texas/Statewide/Alcoholic Beverage Commission/ -

Irrevocable Letter Of Credit (For Conduct Surety Purposes Only)

Irrevocable Letter Of Credit (For Conduct Surety Purposes Only)

Texas/Statewide/Alcoholic Beverage Commission/ -

Conduct Surety Bond

Conduct Surety Bond

Texas/Statewide/Alcoholic Beverage Commission/ -

Cash Credit Law Exception Request

Cash Credit Law Exception Request

Texas/Statewide/Alcoholic Beverage Commission/ -

Affidavit (Bank Error Or Freeze)

Affidavit (Bank Error Or Freeze)

Texas/Statewide/Alcoholic Beverage Commission/ -

Manual Notice Of Payment Of Default

Manual Notice Of Payment Of Default

Texas/Statewide/Alcoholic Beverage Commission/ -

Manual Reporting Of Notice Of Default

Manual Reporting Of Notice Of Default

Texas/Statewide/Alcoholic Beverage Commission/ -

Request For Payment Agreement

Request For Payment Agreement

Texas/Statewide/Alcoholic Beverage Commission/ -

Application For Destruction Of Alcohol Beverages

Application For Destruction Of Alcohol Beverages

Texas/Statewide/Alcoholic Beverage Commission/ -

Alcoholic Beverage Inventory}

Alcoholic Beverage Inventory}

Texas/Statewide/Alcoholic Beverage Commission/ -

Application For Bond Exemption

Application For Bond Exemption

Texas/Statewide/Alcoholic Beverage Commission/ -

Manual Reporting Affidavit (Cash Law - Malt Beverages)

Manual Reporting Affidavit (Cash Law - Malt Beverages)

Texas/Statewide/Alcoholic Beverage Commission/ -

Overview To Request For Payment Agreement

Overview To Request For Payment Agreement

Texas/Statewide/Alcoholic Beverage Commission/ -

Partnership

Partnership

Texas/Statewide/Alcoholic Beverage Commission/ -

Limited Liability Company

Limited Liability Company

Texas/Statewide/Alcoholic Beverage Commission/ -

Corporation

Corporation

Texas/Statewide/Alcoholic Beverage Commission/ -

Power Of Attorney Designating Service Agent

Power Of Attorney Designating Service Agent

Texas/Statewide/Alcoholic Beverage Commission/ -

Ownership Information

Ownership Information

Texas/Statewide/Alcoholic Beverage Commission/ -

Owner Of Property

Owner Of Property

Texas/Statewide/Alcoholic Beverage Commission/ -

Sublessor

Sublessor

Texas/Statewide/Alcoholic Beverage Commission/ -

Application For Out-Of-State Winery Direct Shippers Permit

Application For Out-Of-State Winery Direct Shippers Permit

Texas/Statewide/Alcoholic Beverage Commission/ -

Product Registration Application For Wine

Product Registration Application For Wine

Texas/Statewide/Alcoholic Beverage Commission/ -

Fee Interest Bond

Fee Interest Bond

Texas/Statewide/Alcoholic Beverage Commission/ -

Carriers Report

Carriers Report

Texas/Statewide/Alcoholic Beverage Commission/ -

Private Club Renewal

Private Club Renewal

Texas/Statewide/Alcoholic Beverage Commission/ -

Changes To Business Information

Changes To Business Information

Texas/Statewide/Alcoholic Beverage Commission/ -

Nonresident Sellers Report

Nonresident Sellers Report

Texas/Statewide/Alcoholic Beverage Commission/ -

Application For Forwarding Center Authority

Application For Forwarding Center Authority

Texas/Statewide/Alcoholic Beverage Commission/ -

Complaint Form

Complaint Form

Texas/Statewide/Alcoholic Beverage Commission/ -

Nonresident Malt Beverage Report

Nonresident Malt Beverage Report

Texas/Statewide/Alcoholic Beverage Commission/ -

Texas Wholesaler Report

Texas Wholesaler Report

Texas/Statewide/Alcoholic Beverage Commission/ -

Brewers Report

Brewers Report

Texas/Statewide/Alcoholic Beverage Commission/ -

Promotional Permit

Promotional Permit

Texas/Statewide/Alcoholic Beverage Commission/ -

Distillers Report

Distillers Report

Texas/Statewide/Alcoholic Beverage Commission/ -

Private Club Application

Private Club Application

Texas/Statewide/Alcoholic Beverage Commission/ -

Verification Of Use Of Facilities Form

Verification Of Use Of Facilities Form

Texas/Statewide/Alcoholic Beverage Commission/ -

Brewpub Report

Brewpub Report

Texas/Statewide/Alcoholic Beverage Commission/ -

Distributor Report

Distributor Report

Texas/Statewide/Alcoholic Beverage Commission/ -

Private Club Registration Permittee Order And Invoice For Temporary Membership Cards

Private Club Registration Permittee Order And Invoice For Temporary Membership Cards

Texas/Statewide/Alcoholic Beverage Commission/ -

Warehouse Report

Warehouse Report

Texas/Statewide/Alcoholic Beverage Commission/ -

Out-Of-State Winery Direct Shipper Permit Renewal

Out-Of-State Winery Direct Shipper Permit Renewal

Texas/Statewide/Alcoholic Beverage Commission/

Form Preview

Contact Us

Success: Your message was sent.

Thank you!