Last updated: 8/13/2013

Inventory And Proposed Property Management Plan

Start Your Free Trial $ 23.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

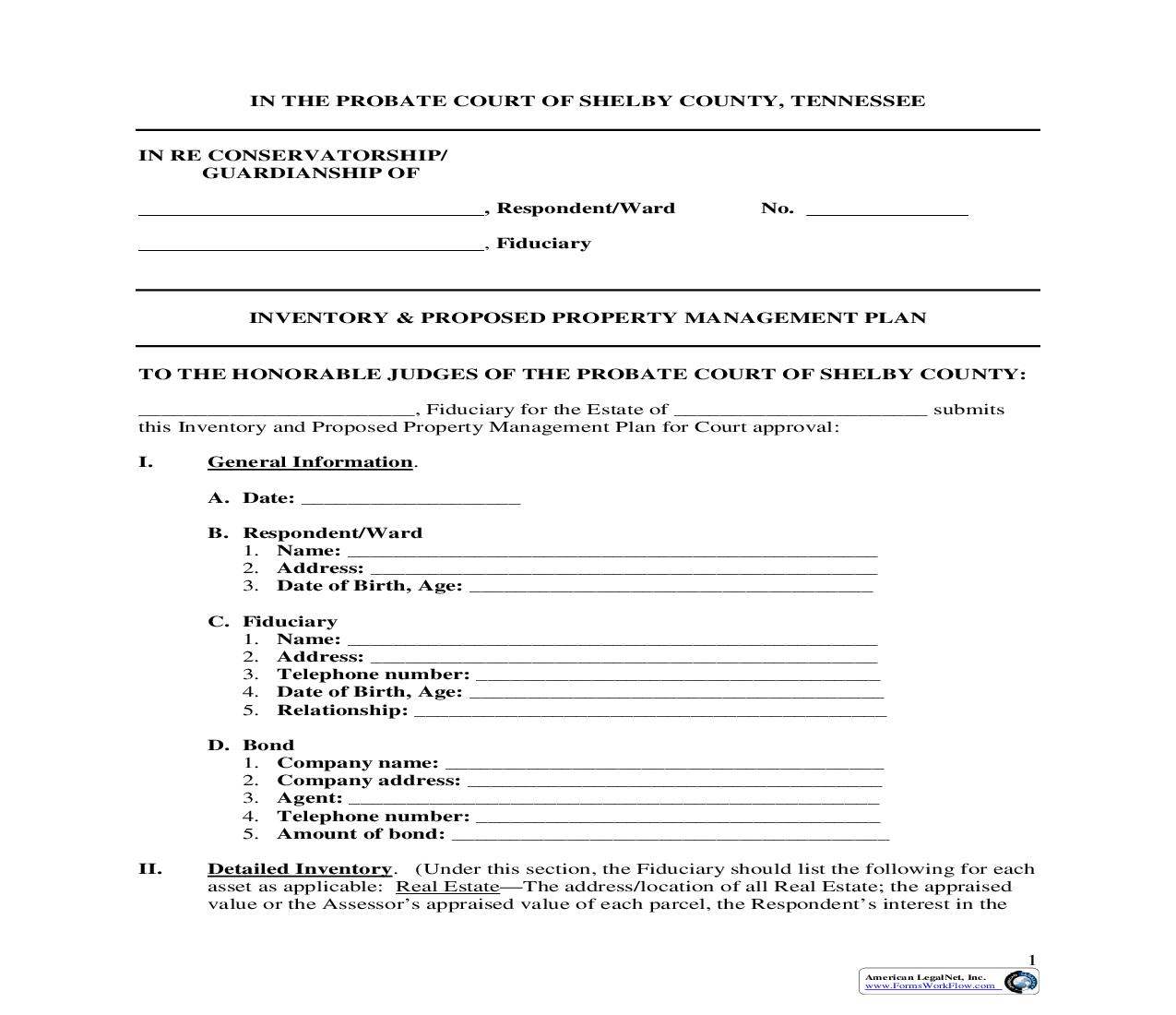

IN THE PROBATE COURT OF SHELBY COUNTY, TENNESSEE IN RE CONSERVATORSHIP/ GUARDIANSHIP OF , Respondent/Ward , Fiduciary No. INVENTORY & PROPOSED PROPERTY MANAGEMENT PLAN TO THE HONORABLE JUDGES OF THE PROBATE COURT OF SHELBY COUNTY: ________________________, Fiduciary for the Estate of ______________________ submits this Inventory and Proposed Property Management Plan for Court approval: I. General Information. A. Date: ___________________ B. Respondent/Ward 1. Name: ______________________________________________ 2. Address: ____________________________________________ 3. Date of Birth, Age: ___________________________________ C. Fiduciary 1. Name: ______________________________________________ 2. Address: ____________________________________________ 3. Telephone number: ___________________________________ 4. Date of Birth, Age: ____________________________________ 5. Relationship: _________________________________________ D. Bond 1. Company name: ______________________________________ 2. Company address: ____________________________________ 3. Agent: ______________________________________________ 4. Telephone number: ___________________________________ 5. Amount of bond: ______________________________________ II. Detailed Inventory. (Under this section, the Fiduciary should list the following for each asset as applicable: Real Estate--The address/location of all Real Estate; the appraised value or the Assessor's appraised value of each parcel, the Respondent's interest in the 1 American LegalNet, Inc. www.FormsWorkFlow.com property; Stocks and Bond--The types of investments, the last four digits of each account, the investment broker's name and address, the fair market value of and the net income for each account; Cash and Notes--The name and address of the financial institution(s); the last four digits of each account, the amount, anticipated income, and the name on the account; Life Insurance Policies--The type of policy, the face value of each policy, the named beneficiary; the cash value; Jointly Owned Property--The type of property, the name and address of all joint owners, the percentage owned by the Respondent; and Miscellaneous--The name and address of the institutions the last four digits of each account, the fair market value of the account, net income; business addresses, the valuation of each business, the Respondent's/Ward's interest in the business.) A. B. C. D. E. F. Real Estate Stocks and Bonds Bank Accounts, Cash, and Notes Life Insurance Policies Jointly Owned Property Miscellaneous Property 1. Retirement Accounts 2. Partnerships 3. Annuities 4. Social Security 5. Tangible Property Monthly Income Total Value of Assets G. H. III. Proposed Property Management Plan. (Under this section, the Fiduciary should detail the management plan for each type asset listed under Item II. The plan should cover foreseeable issues that will be filed in future petitions relative to each asset; thus, the plan for some assets may be short-term, while others may be longer-term. Under the appropriate section, you should also include the any plans to make application for governmental or employment benefits.) A. B. C. D. E. F. Real Estate Stocks and Bonds Bank Accounts, Cash, and Notes Life Insurance Policies Jointly Owned Property Miscellaneous Property 1. Retirement Accounts 2. Partnerships 3. Annuities 4. Social Security 5. Tangible Property 2 American LegalNet, Inc. www.FormsWorkFlow.com IV. Proposed Expenses. Monthly/Annual Expenses. This section is for the Court's use to identify valid monthly expenses. Under this section, the Fiduciary should list each monthly expense and its relative amount. Copies of existing monthly invoices should be attached. Categories may be expanded as needed, just as, inapplicable categories may be deleted. Entries must remain in this order, however. At the end of each section, the Fiduciary is asked to provide an estimated annual total. Thus, the total annual expense for each category below will serve as the `Annual Total Not To Exceed' amount for that category for accounting purposes. (Slight fluctuation will be allowable under many of the categories due to inflation, fees, etc.) Expense Admin. Expenses (court cost, bond, atty. fees, etc.) Payee Amount Bond Fee for Conservator (est.) Fee for tax preparer (est.) TOTAL MONTHLY EXPENSE TOTAL ANNUAL EXPENSE Bank Charges Fee Other charge TOTAL MONTHLY EXPENSE TOTAL ANNUAL EXPENSE Medical-ordinary & necessary Medical Optometry Dental TOTAL MONTHLY EXPENSE TOTAL ANNUAL EXPENSE Support & Maintenance Housing (mortgage, rent, nursing home, etc.) $______________ $______________ $______________ $______________ $______________ $ _____________ Utilities Telephone Cellular Phone 3 American LegalNet, Inc. www.FormsWorkFlow.com Cable/Satellite Internet Food Clothing Personal care expenses Home health services Housing supplies Home maintenance/repair Automobile note Automobile maintenance Transportation (if no auto) Credit Card Payments Counseling/Tutoring Tuition School supplies Clubs Recreation/Entertainment Emergency fund Other TOTAL MONTHLY EXPENSE TOTAL ANNUAL EXPENSE Personal Expenses Personal Allowance Birthday Vacation Christmas Church offering TOTAL MONTHLY EXPENSE TOTAL ANNUAL EXPENSE Insurance Medical Property Auto Life Burial TOTAL MONTHLY EXPENSE TOTAL ANNUAL EXPENSE $______________ $______________ $______________ $______________ $______________ $______________ 4 American LegalNet, Inc. www.FormsWorkFlow.com Taxes Federal income tax Property tax--County Property tax--City TOTAL MONTHLY EXPENSE TOTAL ANNUAL EXPENSE Other Expenses $______________ $______________ TOTAL MONTHLY EXPENSES TOTAL ANNUAL EXPENSES GRAND TOTAL ANNUAL EXPENSES V. $______________ $______________ $______________ Trusts. (Under this section, the Fiduciary should name and describe all Trusts under which the Respondent/Ward is a beneficiary. The description should include the name of the Trustee, the Trust property, as well as the type of and purpose for the Trust.) Lawsuits. (Under this section, the Fiduciary should detail each lawsuit involving the Respondent/Ward to the degree possible. Included in the detail should be the case style, court, file number, the cause(s) of action, anticipated income or possible exposure, and the anticipated date of resolution.) Other Liabilities. (Under this section, the Fiduciary should detail any present legal obligations of the Respondent/Ward that would not be considered care, maintenance, support,