Last updated: 8/13/2013

Accounting Form

Start Your Free Trial $ 15.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

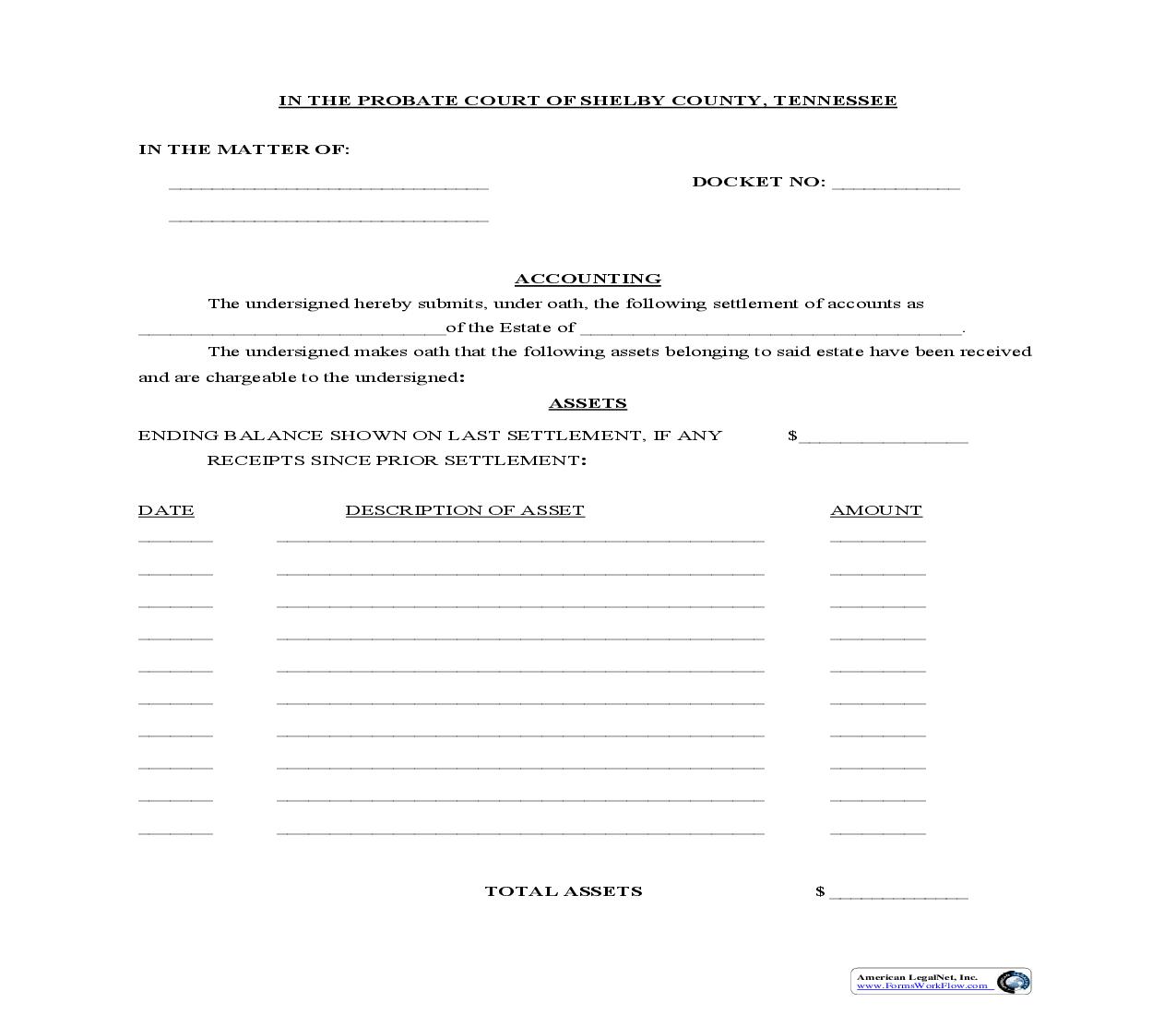

IN THE PROBATE COURT OF SHELBY COUNTY, TENNESSEE IN THE MATTER OF: ______________________________ ______________________________ DOCKET NO: ____________ ACCOUNTING The undersigned hereby submits, under oath, the following settlement of accounts as _____________________________of the Estate of ____________________________________. The undersigned makes oath that the following assets belonging to said estate have been received and are chargeable to the undersigned: ASSETS ENDING BALANCE SHOWN ON LAST SETTLEMENT, IF ANY RECEIPTS SINCE PRIOR SETTLEMENT: DATE _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ DESCRIPTION OF ASSET ______________________________________________ ______________________________________________ ______________________________________________ ______________________________________________ ______________________________________________ ______________________________________________ ______________________________________________ ______________________________________________ ______________________________________________ ______________________________________________ AMOUNT _________ _________ _________ _________ _________ _________ _________ _________ _________ _________ $________________ TOTAL ASSETS $ _____________ American LegalNet, Inc. www.FormsWorkFlow.com EXPENDITURES AND DISBURSEMENTS THE UNDERSIGNED MAKES OATH THAT THE FOLLOWING EXPENDITURES AND DISBURSEMENTS HAVE BEEN MADE AND FOR WHICH CREDIT SHOULD BE GIVEN: DATE PAYEE CHECK # DESCRIPTION AMOUNT TOTAL EXPENDITURES & DISBURSEMENTS $____________ American LegalNet, Inc. www.FormsWorkFlow.com SUMMARY TOTAL ASSETS TOTAL EXPENDITURES & DISBURSEMENTS BALANCE ON HAND ASSETS ON HAND TO REFLECT ABOVE BALANCE: ______________________________________________________________________________ ______________________________________________________________________________ ______________________________________________________________________________ ______________________________________________________________________________ TANGIBLE PERSONAL PROPERTY ______________________________________________________________________________ ______________________________________________________________________________ ______________________________________________________________________________ STATE OF TENNESSEE COUNTY OF SHELBY The undersigned solemnly makes oath that the foregoing settlement of account exhibits a full, true and just statement of each and every asset of said Estate for which the undersigned should be charged, and all expenditures and disbursements for which the undersigned is entitled to take credit. $_________________________ $_________________________ $_________________________ ______________________________ Subscribed and sworn to before me this___________day of____________________,20_____. _____________________________ Clerk of the Court or Notary Public NOTE: LOCAL RULES OF THE PROBATE COURT PROVIDE: (Local Rule XI: 10) (A)Entries on accountings should be specific, giving date, source, and amount. For example, do not just list "Deposit", but rather show as "12/21/01 Union Planters Bank Checking Account #854321-- $721.71". Another example might be: "7/15/04 Proceeds from Sale of 1999 Honda Accord -- $2.500.00." (B)All assets of the estate should be reflected on the accounting; however, tangible property, such as vehicles, boats, farm equipment, etc., shall be listed separately from the monetary portion of the accounting. Tangible property need not show a dollar value although approximations are permissible. Household furniture need not be itemized unless requested by an interested party. (D)If an accounting on a decedent's estate is filed more than two (2) years after the decedent's death, a notation on the accounting shall state why it is necessary to keep the estate open. American LegalNet, Inc. www.FormsWorkFlow.com