Last updated: 5/30/2015

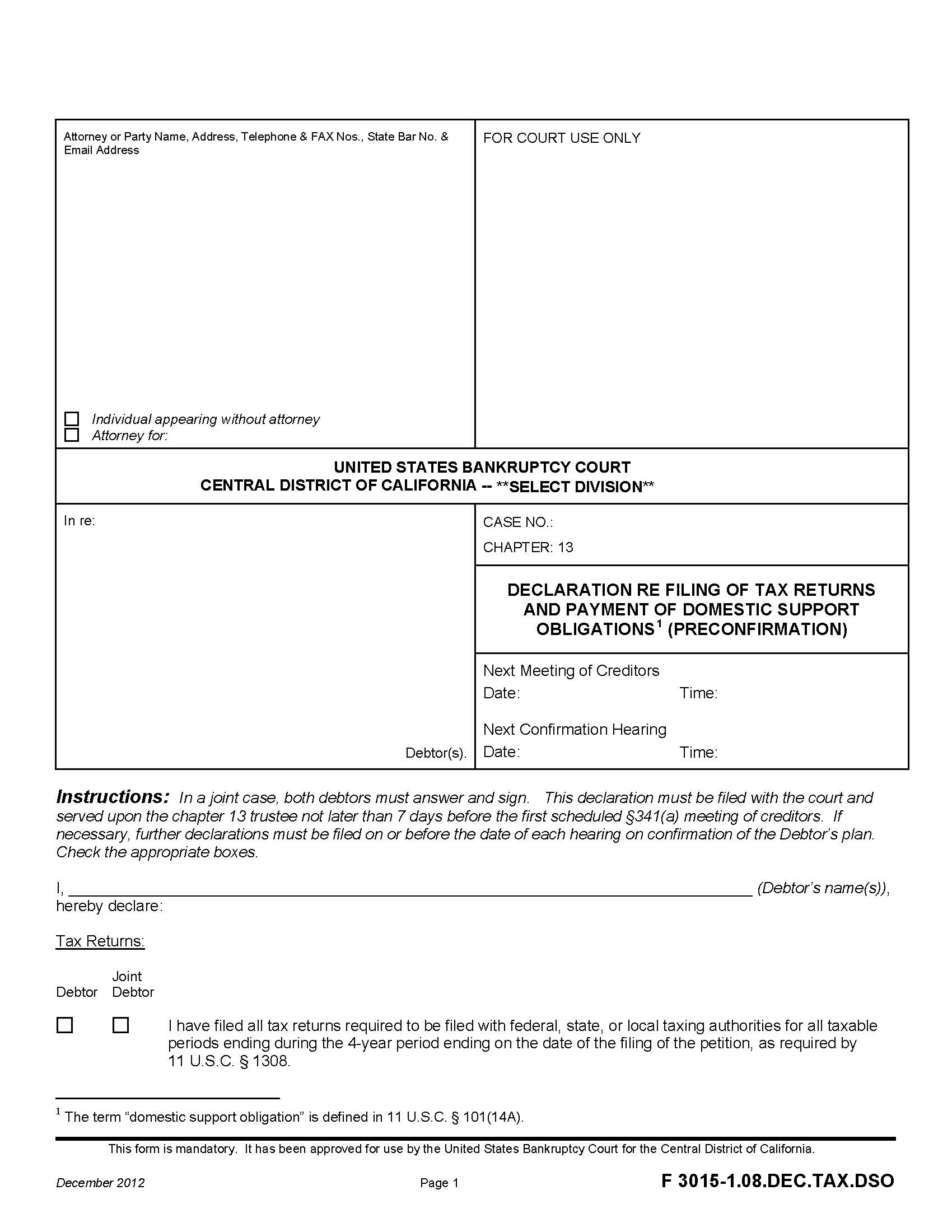

Declaration RE Filing Of Tax Returns And Payment Of Domestic Support {F 3015-1.08.DEC.TAX.DSO}

Start Your Free Trial $ 15.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

F 3015-1.08.DEC.TAX.DSO, DECLARATION RE FILING OF TAX RETURNS AND PAYMENT OF DOMESTIC SUPPORT OBLIGATIONS (PRECONFIRMATION), LBR 3015-1(o) requires that for each year a case is pending after the confirmation of a plan, the debtor must timely file with the appropriate tax authority all tax returns that come due after commencement of the case and then provide copies of those documents to the chapter 13 trustee. 1. The documents must be submitted to the chapter 13 trustee within 14 days after it is filed with the appropriate tax agencies: the debtor’s federal and state tax returns; any request for extension of the deadline for filing a return; and the debtor’s forms W-2 and 1099. 2. The debtor must also file a document to demonstrate that documents were filed and submitted to the chapter 13 trustee. www.FormsWorkflow.com

Related forms

-

Debtors Notice Of Conversion Of Bankruptcy Case From Chapter 13 To Chapter 7

Debtors Notice Of Conversion Of Bankruptcy Case From Chapter 13 To Chapter 7

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Default Judgment Re Complaint To Avoid Junior Lien On Principal Residence

Default Judgment Re Complaint To Avoid Junior Lien On Principal Residence

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Debtors Notice Of Conversion Of Bankruptcy Case From Chapter 12 To Chapter 7

Debtors Notice Of Conversion Of Bankruptcy Case From Chapter 12 To Chapter 7

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Declaration Re Debtors Motion To Avoid Junior Lien On Principal Residence

Declaration Re Debtors Motion To Avoid Junior Lien On Principal Residence

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Individual Debtors Chapter 11 Plan Of Reorganization

Individual Debtors Chapter 11 Plan Of Reorganization

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Individual Debtors Disclosure Statement In Support Of Plan Of Reorganization

Individual Debtors Disclosure Statement In Support Of Plan Of Reorganization

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Proof Of Service Document

Proof Of Service Document

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Declaration Setting Forth Postpetition Preconfirmation Payments

Declaration Setting Forth Postpetition Preconfirmation Payments

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Summons And Notice Of Status Conference In Adversary Proceeding

Summons And Notice Of Status Conference In Adversary Proceeding

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Application For Payment Of Interim Fees And-Or Expenses (11 USC 331)

Application For Payment Of Interim Fees And-Or Expenses (11 USC 331)

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Corporate Ownership Statement Pursuant To FRPB 1007(a)(1)

Corporate Ownership Statement Pursuant To FRPB 1007(a)(1)

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Debtors Motion To Convert Case Under 11 USC 706(a) Or 1112(a)

Debtors Motion To Convert Case Under 11 USC 706(a) Or 1112(a)

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Notice Of Hearing On Application For Payment Of Interim Or Final Fees

Notice Of Hearing On Application For Payment Of Interim Or Final Fees

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Notice Of Motion And Motion For Relief From The Automatic Stay (Non-Bankruptcy Forum)

Notice Of Motion And Motion For Relief From The Automatic Stay (Non-Bankruptcy Forum)

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Statement Of Related Cases

Statement Of Related Cases

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Summons And Notice Of Status Conference In An Involuntary Bankruptcy Case

Summons And Notice Of Status Conference In An Involuntary Bankruptcy Case

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Debtors Motion For Authority To Incur Dept (Personal Property)

Debtors Motion For Authority To Incur Dept (Personal Property)

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Debtors Motion For Authority To Refinance Real Property Under LBR 3015-1(p)

Debtors Motion For Authority To Refinance Real Property Under LBR 3015-1(p)

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Debtors Motion For Authority To Sell Real Property Underl LBR 3015-1(p)

Debtors Motion For Authority To Sell Real Property Underl LBR 3015-1(p)

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Debtors Request For Voluntary Dismissal Of Chapter 13 Case

Debtors Request For Voluntary Dismissal Of Chapter 13 Case

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Declaration Of Current-Postpetition Income And Expenses

Declaration Of Current-Postpetition Income And Expenses

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Declaration RE Filing Of Tax Returns And Payment Of Domestic Support

Declaration RE Filing Of Tax Returns And Payment Of Domestic Support

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Request For Issuance Of Notice Of Transfer Of Claim

Request For Issuance Of Notice Of Transfer Of Claim

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Debtors Application For Order Confirming That Loan Modification Discussion

Debtors Application For Order Confirming That Loan Modification Discussion

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Declaration Of Agent For Standing Trustee

Declaration Of Agent For Standing Trustee

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Declaration Of RE Default Under Adequate Protection Order

Declaration Of RE Default Under Adequate Protection Order

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Declaration Re Postpetition Payments In Reply To Debtors Opposition

Declaration Re Postpetition Payments In Reply To Debtors Opposition

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Lessors Certification Of (1) Prepetition Eviction Action Seeking Possession

Lessors Certification Of (1) Prepetition Eviction Action Seeking Possession

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Lessors Objection To Debtors Certification And-Or Debtors Further Certification

Lessors Objection To Debtors Certification And-Or Debtors Further Certification

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Notice Of Motion And Motion For Relief From The Automatic Stay

Notice Of Motion And Motion For Relief From The Automatic Stay

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Notice Of Motion And Motion For Relief From The Automatic Stay

Notice Of Motion And Motion For Relief From The Automatic Stay

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Notice Of Motion And Motion For Relief From The Automatic Stay

Notice Of Motion And Motion For Relief From The Automatic Stay

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Notice Of Motion And Motion For Relief From The Automatic Stay

Notice Of Motion And Motion For Relief From The Automatic Stay

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Notice Of Motion And Motion In Individual Case For Order

Notice Of Motion And Motion In Individual Case For Order

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Notice Of Motion And Motion In Individual Case For Order

Notice Of Motion And Motion In Individual Case For Order

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Notice Of Motion And Motion Under LBR 2016-2 For Approval Of Cash Disbursements

Notice Of Motion And Motion Under LBR 2016-2 For Approval Of Cash Disbursements

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Notice Of Motion Under LBR 3015-1(n) and (w) To Modify Plan

Notice Of Motion Under LBR 3015-1(n) and (w) To Modify Plan

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Notice Of Objection To Claim

Notice Of Objection To Claim

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Notice Of Section 341(a) Meeting And Hearing On Confirmation

Notice Of Section 341(a) Meeting And Hearing On Confirmation

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Notice Of Transfer Of Claim Pursuant To FRBP 3001(e)

Notice Of Transfer Of Claim Pursuant To FRBP 3001(e)

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Notice Of Trustees-Debtors Request For A Copy Of Proof Of Claim

Notice Of Trustees-Debtors Request For A Copy Of Proof Of Claim

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Plan Ballot Summary

Plan Ballot Summary

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Response To Motion For Order To Terminate Annul Modify

Response To Motion For Order To Terminate Annul Modify

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Application For Order Setting Hearing On Shortened Notice (LBR 9075-1(b))

Application For Order Setting Hearing On Shortened Notice (LBR 9075-1(b))

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Debtors Complaint To Avoid Junior Lien On Principal Residence

Debtors Complaint To Avoid Junior Lien On Principal Residence

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Debtors Motion For Default Judgment RE Complaint To Avoid Junior Lien

Debtors Motion For Default Judgment RE Complaint To Avoid Junior Lien

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Debtors Notice Of Motion And Motion To Avoid Junior Lien

Debtors Notice Of Motion And Motion To Avoid Junior Lien

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Declaration To Be Filed With Motion Establishing Administrative Procedures

Declaration To Be Filed With Motion Establishing Administrative Procedures

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Joint Status Report LBR 7016-1(a)(2)

Joint Status Report LBR 7016-1(a)(2)

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Joint Status Report-Additional Party Attachment

Joint Status Report-Additional Party Attachment

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Motion For Default Judgment Under LBR 7055-1

Motion For Default Judgment Under LBR 7055-1

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Notice Of Motion And Motion To Avoid Lien

Notice Of Motion And Motion To Avoid Lien

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Notice Of Motion And Motion To Avoid Lien

Notice Of Motion And Motion To Avoid Lien

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Notice Of Motion For

Notice Of Motion For

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Notice Of Non-Opposition

Notice Of Non-Opposition

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Notice Of Opposition And Request For A Hearing

Notice Of Opposition And Request For A Hearing

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Notice Of Sale Of Estate Property

Notice Of Sale Of Estate Property

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Request For Clerk To Enter Default Under LBR 7055-1(a)

Request For Clerk To Enter Default Under LBR 7055-1(a)

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Request For Disclosure Of Discovery Documents Under LBR 7026-2(d)

Request For Disclosure Of Discovery Documents Under LBR 7026-2(d)

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Statement Of Disinterestedness For Employment Of Professional Person

Statement Of Disinterestedness For Employment Of Professional Person

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Statement Pursuant To LBR 4001-2 Regarding Cash Collateral Stipulations

Statement Pursuant To LBR 4001-2 Regarding Cash Collateral Stipulations

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Summons And Notice Of Hearing On Petition Pursuant To 11 USC

Summons And Notice Of Hearing On Petition Pursuant To 11 USC

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Trustees Comments On Or Objection To

Trustees Comments On Or Objection To

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Trustees Comments On Or Objection To Application For Supplemental Fees

Trustees Comments On Or Objection To Application For Supplemental Fees

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Trustees Notice Of Motion And Motion For Order Continuing

Trustees Notice Of Motion And Motion For Order Continuing

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Notice Of Lodgment Of Order In Bankruptcy Case

Notice Of Lodgment Of Order In Bankruptcy Case

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Notice Of Lodgment Of Order Or Judgment In Adversary Proceeding

Notice Of Lodgment Of Order Or Judgment In Adversary Proceeding

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Notice Of Motion And Motion For Order Determining Value Of Collateral

Notice Of Motion And Motion For Order Determining Value Of Collateral

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Order Re Notice Of Motion And Motion For Order Determining Value

Order Re Notice Of Motion And Motion For Order Determining Value

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Debtors Motion To Extend Time To File Case Opening Documents

Debtors Motion To Extend Time To File Case Opening Documents

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Default Judgment (Without Prior Judgment)

Default Judgment (Without Prior Judgment)

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Order Approving Reaffirmation Agreement

Order Approving Reaffirmation Agreement

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Order Disapproving Reaffirmation Agreement

Order Disapproving Reaffirmation Agreement

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Order Granting Application And Setting Hearing On Shortened Notice-Denying Application

Order Granting Application And Setting Hearing On Shortened Notice-Denying Application

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Order Granting Motion For (1) Relief From The Automatic Stay

Order Granting Motion For (1) Relief From The Automatic Stay

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Order Granting Motion For Order Imposing A Stay Or Continuing

Order Granting Motion For Order Imposing A Stay Or Continuing

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Order Granting Debtors Application For Order Confirming That Loan Modification

Order Granting Debtors Application For Order Confirming That Loan Modification

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Order Granting Trustees Motion For Order Continuing The Automatic Stay

Order Granting Trustees Motion For Order Continuing The Automatic Stay

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Order Granting-Denying Motion To Avoid Judicial Lien

Order Granting-Denying Motion To Avoid Judicial Lien

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Order On

Order On

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Order On Application For Payment Of Interim Fees And-Or Expenses

Order On Application For Payment Of Interim Fees And-Or Expenses

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Order On Application For Supplemental Fees

Order On Application For Supplemental Fees

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Order On Application Of Non-Resident Attorney To Appear In A Specific Case

Order On Application Of Non-Resident Attorney To Appear In A Specific Case

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Order On Debtors Motion To Covert Case

Order On Debtors Motion To Covert Case

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Order On Motion To Avoid Junior Lien On Principal Residence

Order On Motion To Avoid Junior Lien On Principal Residence

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Order On Motion To Avoid Lien

Order On Motion To Avoid Lien

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Order On Objections To Claim

Order On Objections To Claim

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Order RE Motion In Individual Case For Order Confirming Termination Of Stay

Order RE Motion In Individual Case For Order Confirming Termination Of Stay

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Order RE Motion To Avoid Junior Lien On Principal Residence

Order RE Motion To Avoid Junior Lien On Principal Residence

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Status Conference And Scheduling Order

Status Conference And Scheduling Order

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Default Judgment (Based On Prior Judgment)

Default Judgment (Based On Prior Judgment)

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Order Granting Motion For Relief From The Automatic Stay (Non-Bankruptcy Forum)

Order Granting Motion For Relief From The Automatic Stay (Non-Bankruptcy Forum)

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Order Denying Motion For Relief From The Automatic Stay

Order Denying Motion For Relief From The Automatic Stay

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Order Granting Motion For Relief From Automatic Stay (Real Property)

Order Granting Motion For Relief From Automatic Stay (Real Property)

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Order Granting Motion For Relief From Stay

Order Granting Motion For Relief From Stay

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Notice Of Voluntary Dismissal Of A Contested Matter

Notice Of Voluntary Dismissal Of A Contested Matter

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Notice Of Voluntary Dismissal Of An Adversary Proceeding

Notice Of Voluntary Dismissal Of An Adversary Proceeding

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Order Granting Motion For Relief From The Automatic Stay (Personal Property)

Order Granting Motion For Relief From The Automatic Stay (Personal Property)

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Chapter 11 Disclosure Statement

Chapter 11 Disclosure Statement

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Chapter 11 Plan

Chapter 11 Plan

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Motion For Protective Order-To Restrict Access To Filed Documents

Motion For Protective Order-To Restrict Access To Filed Documents

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Order For Protective Order-To Restrict Access To Filed Documents

Order For Protective Order-To Restrict Access To Filed Documents

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Chapter 7 Trustees Motion To Dismiss Bankruptcy Case And Declaration

Chapter 7 Trustees Motion To Dismiss Bankruptcy Case And Declaration

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Debtors Request To Activate Electronic Noticing (DeBN)

Debtors Request To Activate Electronic Noticing (DeBN)

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Debtors Request To Deactivate Electronic Noticing (DeBN)

Debtors Request To Deactivate Electronic Noticing (DeBN)

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Debtors Request To Update Electronic Noticing (DeBN)

Debtors Request To Update Electronic Noticing (DeBN)

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Declaration Of Debtor Re Postpetition Income And Expenses

Declaration Of Debtor Re Postpetition Income And Expenses

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Notice Of Joint Adminstration Of Cases And Requirements For Filing

Notice Of Joint Adminstration Of Cases And Requirements For Filing

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Notice Of Status Conference Re Removal Of Action

Notice Of Status Conference Re Removal Of Action

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Order On Motion To Approve Joint Administration Of Cases

Order On Motion To Approve Joint Administration Of Cases

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Substitution Of Attorney

Substitution Of Attorney

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Amended Statement Of Social Security Number(s)

Amended Statement Of Social Security Number(s)

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Notice Of Intent To Request Redaction Of Transcript

Notice Of Intent To Request Redaction Of Transcript

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Notice Of Motion And Motion In Individual Chapter 11 Case

Notice Of Motion And Motion In Individual Chapter 11 Case

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Notice Of Motion And Motion In Individual Chapter 11 Case

Notice Of Motion And Motion In Individual Chapter 11 Case

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Notice Of Motion And Motion In Individual Chapter 11 Case

Notice Of Motion And Motion In Individual Chapter 11 Case

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Notice Of Motion And Motion In Individual Chapter 11 Case

Notice Of Motion And Motion In Individual Chapter 11 Case

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Notice Of Motion And Motion In Individual Chapter 11 Case

Notice Of Motion And Motion In Individual Chapter 11 Case

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Order Re Motion In Individual Chapter 11 Case To Authorize

Order Re Motion In Individual Chapter 11 Case To Authorize

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Order Re Motion To (1) Authorize Payment Of Prepetition Payroll

Order Re Motion To (1) Authorize Payment Of Prepetition Payroll

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Order Re Notice Of Motion And Motion In Individual Chapter 11

Order Re Notice Of Motion And Motion In Individual Chapter 11

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Order Re Notice Of Motion And Motion In Individual Chapter 11 Case

Order Re Notice Of Motion And Motion In Individual Chapter 11 Case

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Order Re Notice Of Motion And Motion In Individual Chapter 11 Case

Order Re Notice Of Motion And Motion In Individual Chapter 11 Case

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Notice Of Motion And Motion In Chapter 11 Case

Notice Of Motion And Motion In Chapter 11 Case

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Notice Of Motion And Motion In Individual Chapter 11 Case

Notice Of Motion And Motion In Individual Chapter 11 Case

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Transcript Redaction Request

Transcript Redaction Request

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Order Granting-Denying Motion In Chapter 11 Case

Order Granting-Denying Motion In Chapter 11 Case

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Order Re Motion In Individual Chapter 11 Case To Authorize

Order Re Motion In Individual Chapter 11 Case To Authorize

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Summary Of Amended Schedule Master Mailing List And-Or Statements

Summary Of Amended Schedule Master Mailing List And-Or Statements

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Order On Trustees Motion For Approval Of Cash Disbursement

Order On Trustees Motion For Approval Of Cash Disbursement

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Attorneys Disclosure Of Postpetition Compensation Arrangement With Debtor

Attorneys Disclosure Of Postpetition Compensation Arrangement With Debtor

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Notice Of Motion And Motion For Order Setting Bar Date

Notice Of Motion And Motion For Order Setting Bar Date

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Debtors Attorneys Disclosure Of Compensation Arrangement In Individual Chapter 7 Case

Debtors Attorneys Disclosure Of Compensation Arrangement In Individual Chapter 7 Case

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Declaration By Debtor(s) As To Whether Income Was Received

Declaration By Debtor(s) As To Whether Income Was Received

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Declaration Of Contribution To Chapter 13 Plan

Declaration Of Contribution To Chapter 13 Plan

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Notice Of Opportunity To Request A Hearing On Motion

Notice Of Opportunity To Request A Hearing On Motion

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Notice Of Trustees Intent To Pay Administrative Expenses Totaling 5000

Notice Of Trustees Intent To Pay Administrative Expenses Totaling 5000

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Order Setting Bar Date For Filing Proofs Of Claim

Order Setting Bar Date For Filing Proofs Of Claim

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Request That The Clerk Issue Another Summons And Notice

Request That The Clerk Issue Another Summons And Notice

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Statement Regarding Cash Collateral Or Debtor In Possession Financing

Statement Regarding Cash Collateral Or Debtor In Possession Financing

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Notice Of Bar Date For Filing Proof Of Claims

Notice Of Bar Date For Filing Proof Of Claims

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Debtors Objection To Lessors Certification And Notice Of Hearing

Debtors Objection To Lessors Certification And Notice Of Hearing

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Declaration That No Party Requested A Hearing On Motion

Declaration That No Party Requested A Hearing On Motion

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Notice Of Motion For Order Without Hearing (LBR 9013-1(p) or (q))

Notice Of Motion For Order Without Hearing (LBR 9013-1(p) or (q))

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Notice Of Transcript(s) Designated For An Appeal

Notice Of Transcript(s) Designated For An Appeal

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Application For Waiver Of The Appellate Filing Fee In A Chapter 7 Case

Application For Waiver Of The Appellate Filing Fee In A Chapter 7 Case

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Debtors Certificate Of Compliance Under 11 USC 1328(a) And Application

Debtors Certificate Of Compliance Under 11 USC 1328(a) And Application

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Chapter 11 Status Conference Report (Initial)

Chapter 11 Status Conference Report (Initial)

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Order On Motion (A) To Deposit Funds Into The Courts Registry

Order On Motion (A) To Deposit Funds Into The Courts Registry

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Order On Final Fee Applications Allowing Payment

Order On Final Fee Applications Allowing Payment

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Exhibit Tag (Plaintiff)

Exhibit Tag (Plaintiff)

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Exhibit Tag (Defendant)

Exhibit Tag (Defendant)

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Attachment C To Chapter 13 Plan Avoidance Of Real Property Judicial Liens

Attachment C To Chapter 13 Plan Avoidance Of Real Property Judicial Liens

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Attachment D To Chapter 13 Plan Avoidance Of Non-Possessory Nonpurchase Money

Attachment D To Chapter 13 Plan Avoidance Of Non-Possessory Nonpurchase Money

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Chapter 13 Trustees Notice Of Motion And Motion For Entry Of Order

Chapter 13 Trustees Notice Of Motion And Motion For Entry Of Order

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Chapter 13 Trustees Order Deeming Claim Satisfied

Chapter 13 Trustees Order Deeming Claim Satisfied

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Order Denying Claim Objection For Failure To Prosecute

Order Denying Claim Objection For Failure To Prosecute

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Attachment B To Chapter 13 Plan Valuation Lien Avoidance

Attachment B To Chapter 13 Plan Valuation Lien Avoidance

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Verification Of Master Mailing List Of Creditors

Verification Of Master Mailing List Of Creditors

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Order On Trustees Motion Under LBR 2016-2 For Authorization To Employ Paraprofessionals

Order On Trustees Motion Under LBR 2016-2 For Authorization To Employ Paraprofessionals

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Trustees Notice Of Motion And Motion Under LBR 2016-2

Trustees Notice Of Motion And Motion Under LBR 2016-2

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Motion Under LBR 3015-1(n) And (w) To Modify Plan Or Suspend Plan Payments

Motion Under LBR 3015-1(n) And (w) To Modify Plan Or Suspend Plan Payments

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Order Confirming Chapter 13 Plan

Order Confirming Chapter 13 Plan

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Chapter 13 Plan

Chapter 13 Plan

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Subchapter V Trustees Estimated Fees And Expenses For Purposes Of Plan Confirmation

Subchapter V Trustees Estimated Fees And Expenses For Purposes Of Plan Confirmation

California/4 Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Subchapter V Status Report

Subchapter V Status Report

California/4 Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Notice Of Motion And Motion For Order Establishing Adequate Protection

Notice Of Motion And Motion For Order Establishing Adequate Protection

California/4 Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Order Granting Motion For Order Establishing Adequate Protection

Order Granting Motion For Order Establishing Adequate Protection

California/4 Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Change Of Mailing Address

Change Of Mailing Address

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Application Of Attorney For Debtor For Additional Fees And Related Expenses

Application Of Attorney For Debtor For Additional Fees And Related Expenses

California/4 Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Application Of Attorney For Debtor For Allowance Of Fees

Application Of Attorney For Debtor For Allowance Of Fees

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Rights And Responsibilities Agreement Between Chapter 13 Debtors And Their Attorneys

Rights And Responsibilities Agreement Between Chapter 13 Debtors And Their Attorneys

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Application Of Non-Resident Attorney To Appear In A Specific Case (LBR 2090-1)

Application Of Non-Resident Attorney To Appear In A Specific Case (LBR 2090-1)

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Declaration Verifying Software Generated Signature(s)

Declaration Verifying Software Generated Signature(s)

California/Federal/USBC Central/Local/F Thru F / -

Order And Notice Setting Hearing On Chapter 15 Petition For Recognition

Order And Notice Setting Hearing On Chapter 15 Petition For Recognition

California/Federal/USBC Central/Local/F Thru F / -

Debtors Motion To Reopen Case And For Extension Of Time

Debtors Motion To Reopen Case And For Extension Of Time

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/ -

Order On Debtors Motion To Reopen Case And For Extension

Order On Debtors Motion To Reopen Case And For Extension

California/Federal/USBC Central/Local/F 1010-1 Thru F 9075-1/

Form Preview

Contact Us

Success: Your message was sent.

Thank you!