Last updated: 1/7/2012

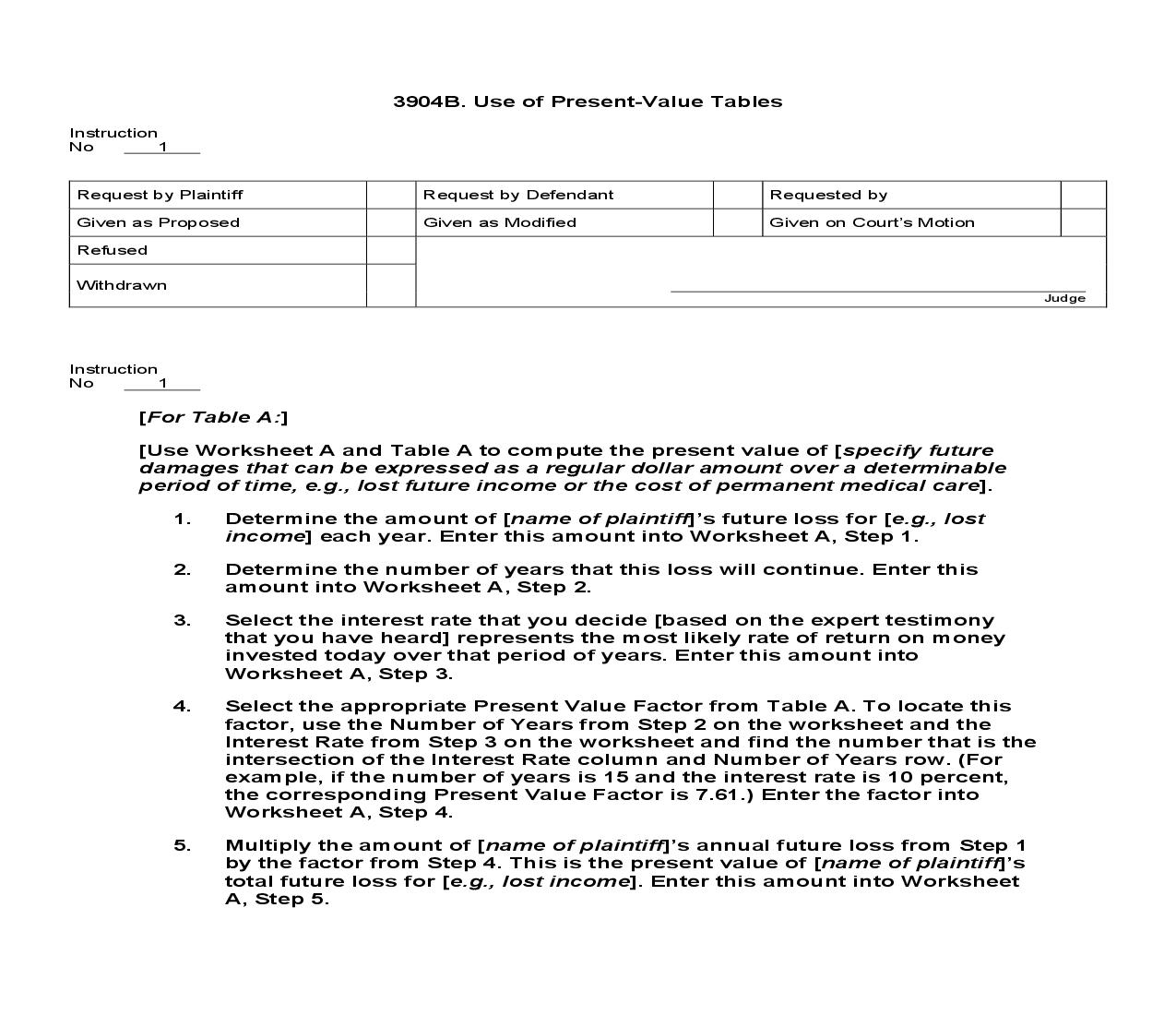

3904B. Use of Present-Value Tables

Start Your Free Trial $ 19.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

3904B. Use of Present-Value Tables Instruction No 1 Request by Plaintiff Given as Proposed Refused Withdrawn Request by Defendant Given as Modified Requested by Given on Court's Motion Judge Instruction No 1 [For Table A:] [Use Worksheet A and Table A to compute the present value of [specify future damages that can be expressed as a regular dollar amount over a determinable period of time, e.g., lost future income or the cost of permanent medical care]. 1. 2. 3. Determine the amount of [name of plaintiff]'s future loss for [e.g., lost income] each year. Enter this amount into Worksheet A, Step 1. Determine the number of years that this loss will continue. Enter this amount into Worksheet A, Step 2. Select the interest rate that you decide [based on the expert testimony that you have heard] represents the most likely rate of return on money invested today over that period of years. Enter this amount into Worksheet A, Step 3. Select the appropriate Present Value Factor from Table A. To locate this factor, use the Number of Years from Step 2 on the worksheet and the Interest Rate from Step 3 on the worksheet and find the number that is the intersection of the Interest Rate column and Number of Years row. (For example, if the number of years is 15 and the interest rate is 10 percent, the corresponding Present Value Factor is 7.61.) Enter the factor into Worksheet A, Step 4. Multiply the amount of [name of plaintiff]'s annual future loss from Step 1 by the factor from Step 4. This is the present value of [name of plaintiff]'s total future loss for [e.g., lost income]. Enter this amount into Worksheet A, Step 5. 4. 5. 3904B. Use of Present-Value Tables Instruction No 1 Request by Plaintiff Given as Proposed Refused Withdrawn Request by Defendant Given as Modified Requested by Given on Court's Motion Judge Instruction No 1 WORKSHEET A Step 1: Step 2: Step 3: Repeating identical annual dollar amount of future loss: Number of years that this loss will continue: Interest rate that represents a reasonable rate of return on money invested today over that period of years: Present Value Factor from Table A: Amount from Step 1 times Factor from Step 4: $ $ % Step 4: Step 5: Enter the amount from Step 5 on your verdict form as [name of plaintiff]'s total future economic loss for [e.g., lost income].] [For Table B:] [Use Worksheet B and Table B to compute the present value of [specify future damages that cannot be expressed as a repeating identical dollar amount over a determinable period of time, e.g., future surgeries]. 1. Determine the future years in which a future loss will occur. In Column A, starting with the current year, enter each year through the last year that you determined a future loss will occur. 3904B. Use of Present-Value Tables Instruction No 1 Request by Plaintiff Given as Proposed Refused Withdrawn Request by Defendant Given as Modified Requested by Given on Court's Motion Judge Instruction No 1 2. Determine the amount of [name of plaintiff]'s future loss for [e.g., future surgeries] for each year that you determine the loss will occur. Enter these future losses in Column B on the worksheet. Enter $0 if no future loss occurs in a given year. Select the interest rate that you decide [based on the expert testimony that you have heard] represents a reasonable rate of return on money invested today over the number of years determined in Step 2. Enter this rate in Column C on the worksheet for each year that future-loss amounts are entered in Column B. Select the appropriate Present Value Factor from Table B for each year for which you have determined that a loss will occur. To locate this factor, use the Number of Years from Column A on the worksheet and the Interest Rate in Column C on the worksheet and find the number that is the intersection of the Interest Rate column and Number of Years row from the table. (For example, for year 15, if the interest rate is 10 percent, the corresponding Present Value Factor is 0.239.) Enter the appropriate Present Value Factors in Column D. For the current year, the Present Value Factor is 1.000. It is not necessary to select an interest rate for the current year in Step 3. Multiply the amount in Column B by the factor in Column D for each year for which you determined that a loss will occur and enter these amounts in Column E. Add all of the entries in Column E and enter this sum into Total Present Value of Future Loss. 3. 4. 5. 6. 3904B. Use of Present-Value Tables Instruction No 1 Request by Plaintiff Given as Proposed Refused Withdrawn Request by Defendant Given as Modified Requested by Given on Court's Motion Judge Instruction No 1 Enter the amount from Step 6 on your verdict form as [name of plaintiff]'s total future economic loss for [e.g., future surgeries].] Worksheet B Year A B Dollar Amount of Future Loss Each Year $ $ $ $ $ $ $ $ $ $ C Interest Rate Not applicable % % % % % % % % % % % % % D Present Value Factor 1.000 E Present Value of Future Loss $ $ $ $ $ $ $ $ $ $ $ $ $ $ Current year (20__) Year 1 (20__) Year 2 (20__) Year 3 (20__) Year 4 (20__) Year 5 (20__) Year 6 (20__) Year 7 (20__) Year 8 (20__) Year 9 (20__) Year 10 (20__) $ Year 11 (20__) $ Year 12 (20__) $ Year 13 (20__) $ 3904B. Use of Present-Value Tables Instruction No 1 Request by Plaintiff Given as Proposed Refused Withdrawn Request by Defendant Given as Modified Requested by Given on Court's Motion Judge Instruction No 1 Year 14 (20__) $ Year 15 (20__) $ Year 16 (20__) $ Year 17 (20__) $ Year 18 (20__) $ Year 19 (20__) $ Year 20 (20__) $ Year 21 (20__) $ Year 22 (20__) $ Year 23 (20__) $ Year 24 (20__) $ % % % % % % % % % % % $ $ $ $ $ $ $ $ $ $ $ $ $ Year 25 (20__) $ % Total Present Value of Future Loss (add all amounts in Column E) ________________________________________________________________________________ New December 2010