Last updated: 5/3/2025

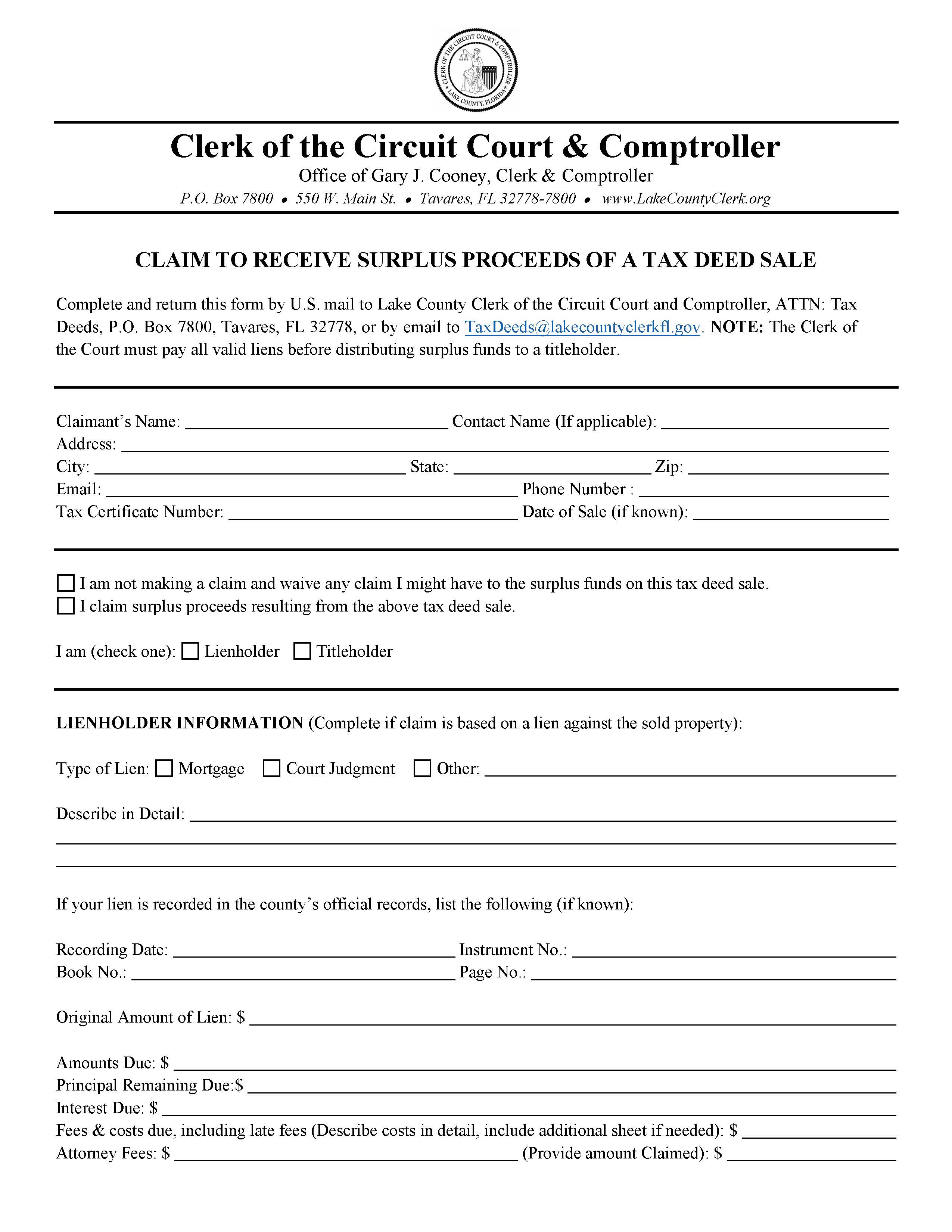

Claim To Receive Surplus Proceeds Of A Tax Deed Sale

Start Your Free Trial $ 14.00What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

CLAIM TO RECEIVE SURPLUS PROCEEDS OF A TAX DEED SALE. This form is used by individuals or entities—such as lienholders or former property owners (titleholders)—to request any surplus funds that remain after a tax deed sale of real property in Lake County, Florida. When a property is sold at a tax deed auction, and the sale amount exceeds the taxes owed and related costs, the remaining funds (called surplus proceeds) may be claimed by those who have a legal interest in the property. This form allows claimants to formally declare their interest and provide the necessary documentation, such as details about recorded liens or ownership history, to support their claim. It requires personal and property-specific information, outlines whether the claim is being made by a lienholder or a titleholder, and includes a sworn affidavit to be notarized. The form must be submitted to the Lake County Clerk of the Circuit Court and Comptroller either by mail or email. www.FormsWorkflow.com