Last updated: 3/28/2025

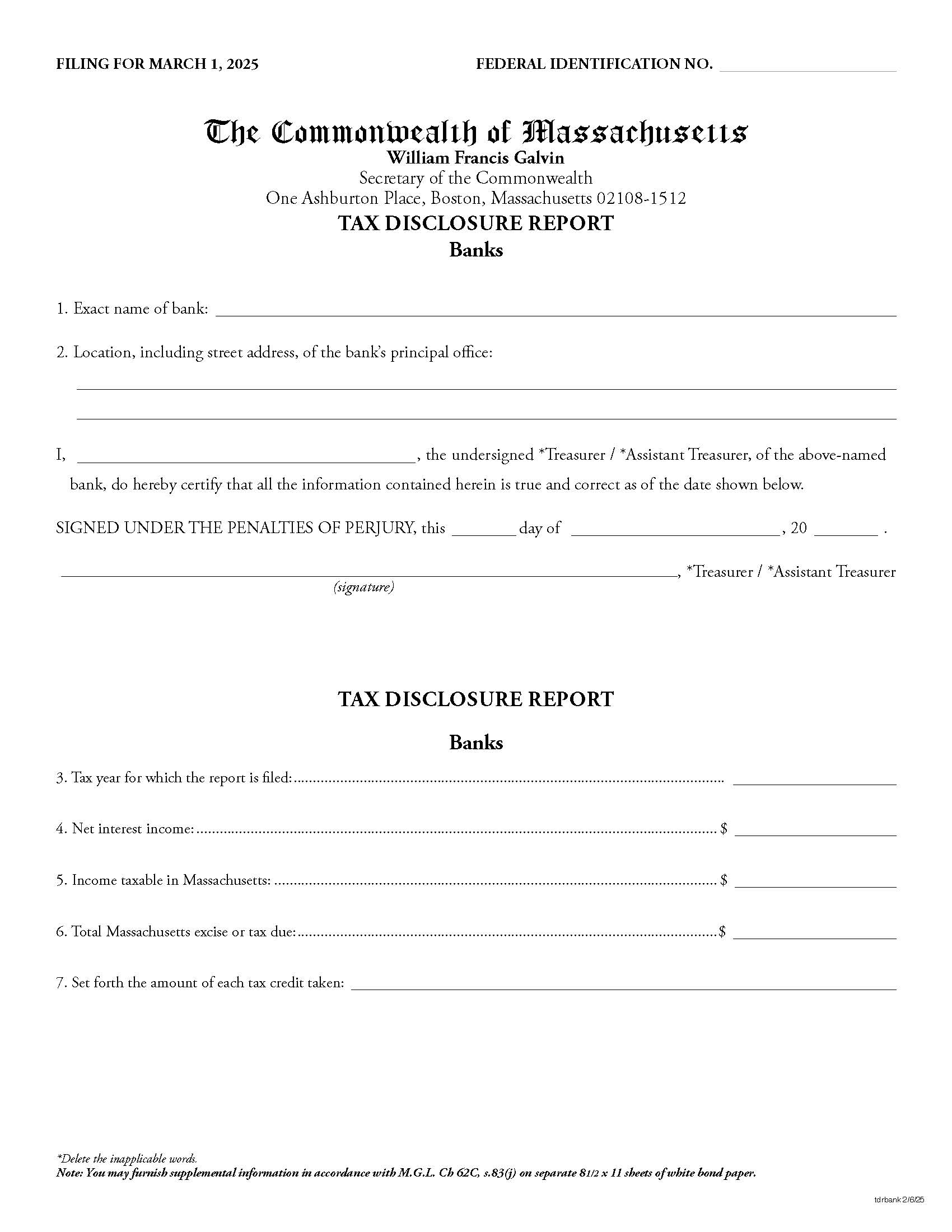

Tax Disclosure Report-Banks

Start Your Free Trial $ 0.00What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

TAX DISCLOSURE REPORT - BANKS. This form is used by banks operating in Massachusetts to report certain tax-related information to the Commonwealth. This form is required under Massachusetts General Laws Chapter 62C, Section 83(j), and provides details about the bank's tax liabilities. Specifically, the report includes the bank's net interest income, income taxable in Massachusetts, the excise or tax due, and any tax credits taken. The report must be completed by the bank’s Treasurer or Assistant Treasurer and includes the bank’s exact name and principal office address. It also asks for the tax year for which the report is filed, as well as financial data, such as the net interest income from the bank’s federal financial reports, the amount of taxable income in Massachusetts, the excise tax owed, and any credits against that tax. www.FormsWorkflow.com