Last updated: 5/20/2025

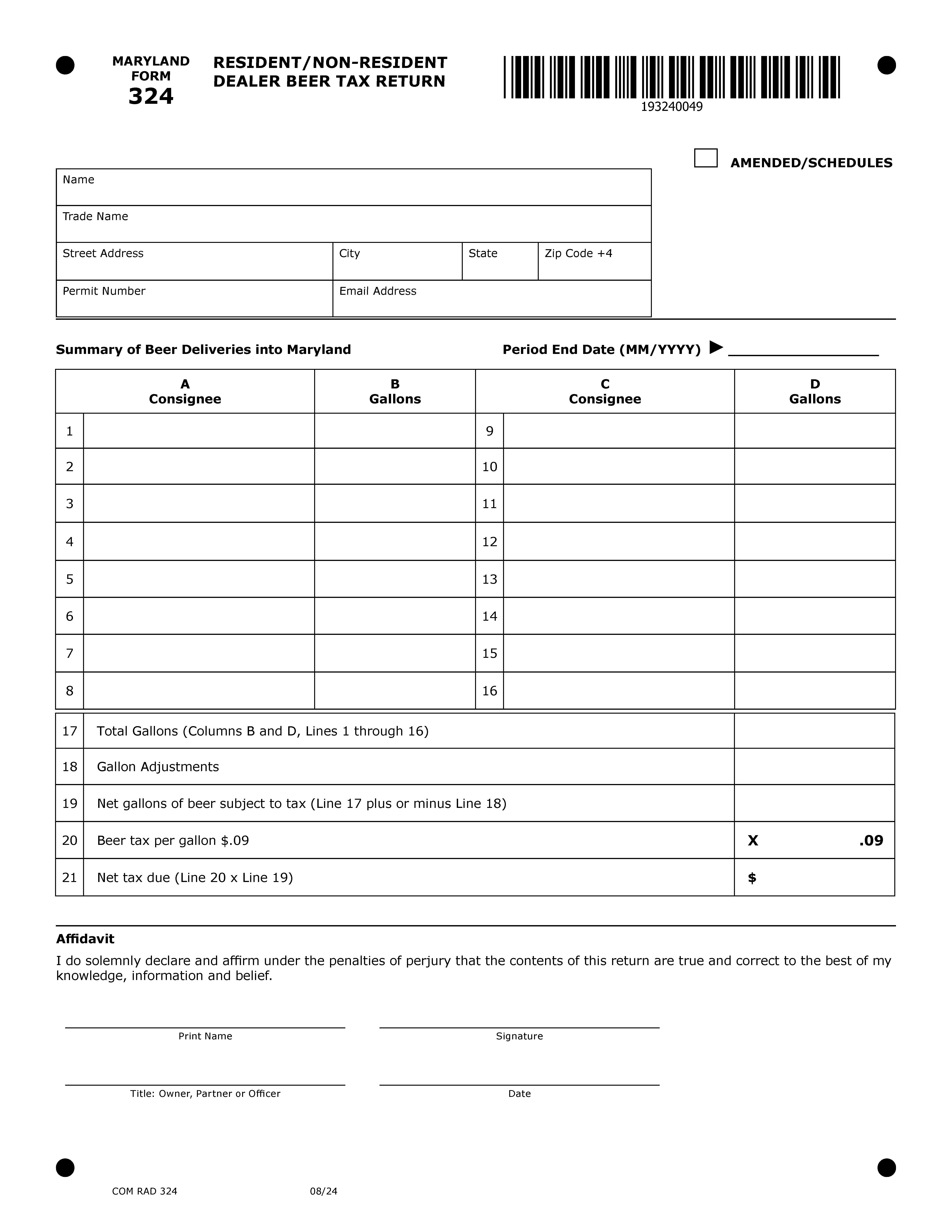

Non Resident And Resident Dealer Beer Tax Return {RAD 324}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

324 - RESIDENT/NON-RESIDENT DEALER BEER TAX RETURN. This form is used by licensed beer dealers, whether located within Maryland or outside the state, to report and remit taxes on beer delivered into Maryland. This form must be filed monthly and is due by the 15th day of the month following the reporting period. The form requires dealers to list each consignee in Maryland who received beer shipments and report the number of gallons delivered to each. The total number of gallons is then used to calculate the net tax owed, based on Maryland’s beer tax rate of $0.09 per gallon. Adjustments to gallon totals must be supported by documentation. Dealers must also submit this return along with Form COM/RAD 030 and pay any taxes due either online or by check or money order payable to the Comptroller of Maryland. The return must be signed under penalty of perjury by an authorized individual such as the owner, partner, or corporate officer. www.FormsWorkflow.com

Related forms

-

Claim For Refund Of Tax On Beer On Reservations

Claim For Refund Of Tax On Beer On Reservations

Maryland/Statewide/Comptroller/Regulatory And Enforcement Division/Alcohol And Tobacco Tax Bureau/ -

Beer Franchise Form

Beer Franchise Form

Maryland/Statewide/Comptroller/Regulatory And Enforcement Division/Alcohol And Tobacco Tax Bureau/ -

Beer Bond

Beer Bond

Maryland/Statewide/Comptroller/Regulatory And Enforcement Division/Alcohol And Tobacco Tax Bureau/ -

Direct Wine Shipper Bond

Direct Wine Shipper Bond

Maryland/Statewide/Comptroller/Regulatory And Enforcement Division/Alcohol And Tobacco Tax Bureau/ -

Wine And Liquor Bond

Wine And Liquor Bond

Maryland/Statewide/Comptroller/Regulatory And Enforcement Division/Alcohol And Tobacco Tax Bureau/ -

Wine Bond

Wine Bond

Maryland/Statewide/Comptroller/Regulatory And Enforcement Division/Alcohol And Tobacco Tax Bureau/ -

Application For An Additional License Location

Application For An Additional License Location

Maryland/Statewide/Comptroller/Regulatory And Enforcement Division/Alcohol And Tobacco Tax Bureau/ -

Application For Fuel-Alcohol Permit

Application For Fuel-Alcohol Permit

Maryland/Statewide/Comptroller/Regulatory And Enforcement Division/Alcohol And Tobacco Tax Bureau/ -

Beer Bond (Non-Resident Or Resident Dealer)

Beer Bond (Non-Resident Or Resident Dealer)

Maryland/Statewide/Comptroller/Regulatory And Enforcement Division/Alcohol And Tobacco Tax Bureau/ -

Direct Wine Shippers Permit Application

Direct Wine Shippers Permit Application

Maryland/Statewide/Comptroller/Regulatory And Enforcement Division/Alcohol And Tobacco Tax Bureau/ -

Keg Registration Booklet Order Form

Keg Registration Booklet Order Form

Maryland/Statewide/Comptroller/Regulatory And Enforcement Division/Alcohol And Tobacco Tax Bureau/ -

Statewide Caterers License Catered Event Certificate And Notice

Statewide Caterers License Catered Event Certificate And Notice

Maryland/Statewide/Comptroller/Regulatory And Enforcement Division/Alcohol And Tobacco Tax Bureau/ -

Family Beer And Wine Facility Permit Report

Family Beer And Wine Facility Permit Report

Maryland/Statewide/Comptroller/Regulatory And Enforcement Division/Alcohol And Tobacco Tax Bureau/ -

Direct Wine Shipper Tax Return

Direct Wine Shipper Tax Return

Maryland/Statewide/Comptroller/Regulatory And Enforcement Division/Alcohol And Tobacco Tax Bureau/ -

Recapitulation Of Beer Deliveries To Retailers By Political Subdivision

Recapitulation Of Beer Deliveries To Retailers By Political Subdivision

Maryland/Statewide/Comptroller/Regulatory And Enforcement Division/Alcohol And Tobacco Tax Bureau/ -

Family Beer And Wine Facility Detail Report

Family Beer And Wine Facility Detail Report

Maryland/Statewide/Comptroller/Regulatory And Enforcement Division/Alcohol And Tobacco Tax Bureau/ -

Alcohol Awareness Permit Application

Alcohol Awareness Permit Application

Maryland/Statewide/Comptroller/Regulatory And Enforcement Division/Alcohol And Tobacco Tax Bureau/ -

Application For Class E, F Or G License

Application For Class E, F Or G License

Maryland/Statewide/Comptroller/Regulatory And Enforcement Division/Alcohol And Tobacco Tax Bureau/ -

Order For Additional Vehicle Identification Cards

Order For Additional Vehicle Identification Cards

Maryland/Statewide/Comptroller/Regulatory And Enforcement Division/Alcohol And Tobacco Tax Bureau/ -

Application For Charity Wine Auction Permit

Application For Charity Wine Auction Permit

Maryland/Statewide/Comptroller/Regulatory And Enforcement Division/Alcohol And Tobacco Tax Bureau/ -

Application For A Private Bulk Sale Permit

Application For A Private Bulk Sale Permit

Maryland/Statewide/Comptroller/Regulatory And Enforcement Division/Alcohol And Tobacco Tax Bureau/ -

Application For Bulk Transfer Permit

Application For Bulk Transfer Permit

Maryland/Statewide/Comptroller/Regulatory And Enforcement Division/Alcohol And Tobacco Tax Bureau/ -

Non Profit Festival Application Permit Application

Non Profit Festival Application Permit Application

Maryland/Statewide/Comptroller/Regulatory And Enforcement Division/Alcohol And Tobacco Tax Bureau/ -

Application For Manufactures And Wholesalers Licenses

Application For Manufactures And Wholesalers Licenses

Maryland/Statewide/Comptroller/Regulatory And Enforcement Division/Alcohol And Tobacco Tax Bureau/ -

Application For Change In License Location

Application For Change In License Location

Maryland/Statewide/Comptroller/Regulatory And Enforcement Division/Alcohol And Tobacco Tax Bureau/ -

Occupation Record And Financial Statement Of Individual License Applicant

Occupation Record And Financial Statement Of Individual License Applicant

Maryland/Statewide/Comptroller/Regulatory And Enforcement Division/Alcohol And Tobacco Tax Bureau/ -

Application For Class C Special License

Application For Class C Special License

Maryland/Statewide/Comptroller/Regulatory And Enforcement Division/Alcohol And Tobacco Tax Bureau/ -

Solicitors Permit Application

Solicitors Permit Application

Maryland/Statewide/Comptroller/Regulatory And Enforcement Division/Alcohol And Tobacco Tax Bureau/ -

Application For A Statewide Caterers License

Application For A Statewide Caterers License

Maryland/Statewide/Comptroller/Regulatory And Enforcement Division/Alcohol And Tobacco Tax Bureau/ -

Common Carriers Permit Application For Direct Wine Shipment

Common Carriers Permit Application For Direct Wine Shipment

Maryland/Statewide/Comptroller/Regulatory And Enforcement Division/Alcohol And Tobacco Tax Bureau/ -

Application For An Off Site Permit

Application For An Off Site Permit

Maryland/Statewide/Comptroller/Regulatory And Enforcement Division/Alcohol And Tobacco Tax Bureau/ -

Application For A Brewery Special Event Permit

Application For A Brewery Special Event Permit

Maryland/Statewide/Comptroller/Regulatory And Enforcement Division/Alcohol And Tobacco Tax Bureau/ -

Non Resident And Resident Dealer Beer Tax Return

Non Resident And Resident Dealer Beer Tax Return

Maryland/Statewide/Comptroller/Regulatory And Enforcement Division/Alcohol And Tobacco Tax Bureau/ -

Request For Maryland Release Of Foreign Beer

Request For Maryland Release Of Foreign Beer

Maryland/Statewide/Comptroller/Regulatory And Enforcement Division/Alcohol And Tobacco Tax Bureau/ -

Permit Application

Permit Application

Maryland/Statewide/Comptroller/Regulatory And Enforcement Division/Alcohol And Tobacco Tax Bureau/ -

Application For National Family Beer And Or Wine Exhibit Permit

Application For National Family Beer And Or Wine Exhibit Permit

Maryland/Statewide/Comptroller/Regulatory And Enforcement Division/Alcohol And Tobacco Tax Bureau/ -

Wholesalers Monthly Beer Report

Wholesalers Monthly Beer Report

Maryland/Statewide/Comptroller/Regulatory And Enforcement Division/Alcohol And Tobacco Tax Bureau/ -

Intent To Participate In An Off Site Event Form

Intent To Participate In An Off Site Event Form

Maryland/Statewide/Comptroller/Regulatory And Enforcement Division/Alcohol And Tobacco Tax Bureau/

Form Preview

Contact Us

Success: Your message was sent.

Thank you!