Last updated: 8/18/2023

Financial Disclosure Statement {FA-4139V}

Start Your Free Trial $ 25.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

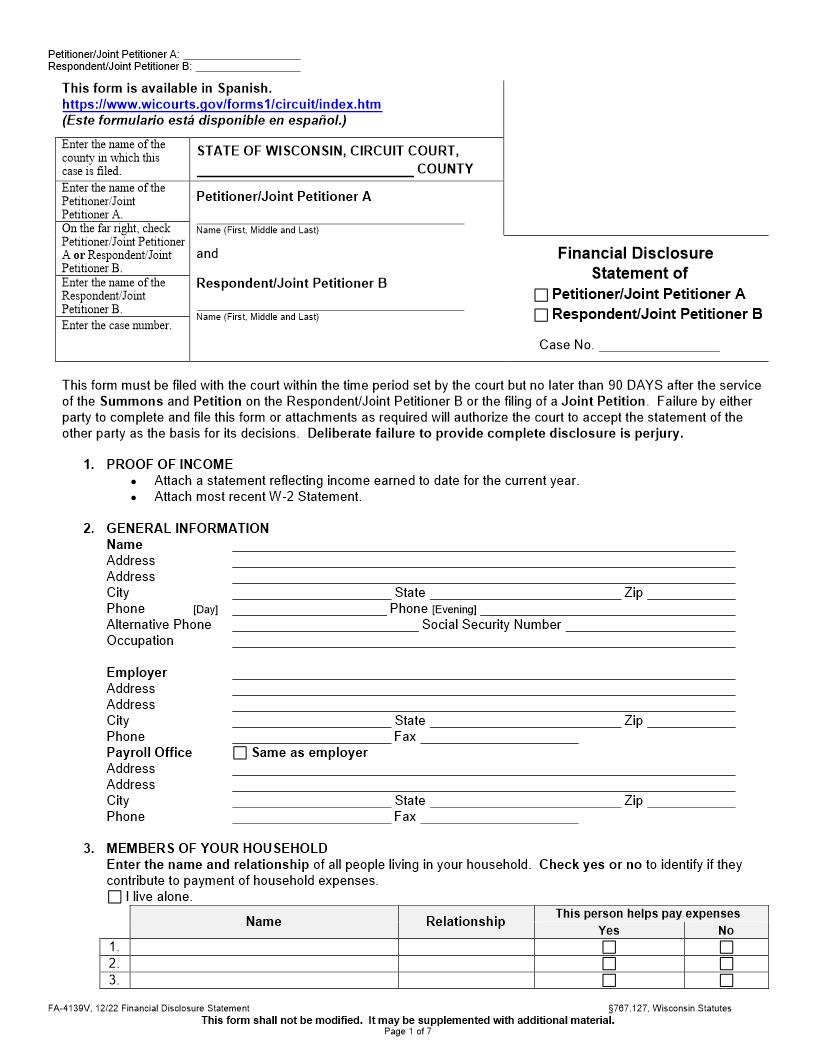

Petitioner/Joint Petitioner A: Respondent/Joint Petitioner B: FA-4139V, 05/17 Financial Disclosure Statement 247767.127, Wisconsin Statutes This form shall not be modified. It may be supplemented with additional material. Page 1 of 8 Enter the name of the county in which this case is filed. STATE OF WISCONSIN, CIRCUIT COURT, COUNTY Enter the name of the Petitioner/ Joint Petitioner A . IN RE : T HE MARRIAGE OF Petitioner/Joint Petitioner A Name (First, Middle and Last) a nd On the far right, check Petitioner/Joint Petitioner A or Res pondent/Joint Petitioner B. Financial Disclosure Statement of Petitioner/Joint Petitioner A Respondent/Joint Petitioner B Case No. Enter the name of the Respondent/ Joint Petitioner B. Respondent/Joint Petitioner B Name (First, Middle and Last) Enter the case number. This form must be filed with the court within the time period set by the court but no later than 90 DAYS after the service of the Summons and Petition on the Respondent/Joint Petitioner B or the filing of a Joint Petition. Failure by either party to complete and file this form or attachments as required will authorize the court to accept the statement of the other party as the basis for its decisions. Deliberate failure to provide complete disclosure is perjury. 1. PROOF OF INCOME Attach a statement reflecting income earned to date for the current year. Attach most recent W-2 Statement. 2. GENERAL INFORMATION Name Address Address City State Zip Phone [Day] Phone [Evening] Alternative Phone: Social Security Number Occupation Employer Address Address City State Zip Phone Fax Payroll Office Same as employer Address Address City State Zip Phone Fax American LegalNet, Inc. www.FormsWorkFlow.com Petitioner/Joint Petitioner A: Respondent/Joint Petitioner B: FA-4139V, 05/17 Financial Disclosure Statement 247767.127, Wisconsin Statutes This form shall not be modified. It may be supplemented with additional material. Page 2 of 8 3. MEMBERS OF YOUR HOUSEHOLD Enter the name and relationship of all people living in your household. Check yes or no to identify if they contribute to payment of household expenses. I live alone. Name Relationship This person helps pay expenses Yes No 1. 2. 3. 4. 5. 6. 7. 8. 4. MONTHLY INCOME Income from wages / salary is received : (check one) To calculate monthly gross income use the multiplier shown: weekly - multiply weekly income by 4.3 3 every other week (bi - weekly) m ultipl y bi - weekly income by 2.17 monthly twice a month - multiply semi - monthly income by 2 M ONTHLY GROSS INCOME 1. 1 Gross monthly income (before taxes and deductions) from salary and wages, including commissions, allowances and overtime. (See above how to calculate.) 2. Pensions and retirement funds received 3. Social Security benefits received 4. Disability and Unemployment Insurance received 5. Public Assistance Funds received 6. Interest and Dividends received 7. 7 Child Support and maintenance (spousal support) received from any prior marriage/relationship 8. Rental payments received (from property you rent to others) 9. Bonuses re ceived 10. Other sources of income received: (please specify) 11. 12. 13. Total Gross Income (add lines 1 - 12) MONTHLY DEDUCTIONS 14. Number of tax exemptions claimed 15. Monthly federal income tax withheld 16. Monthly state income tax withheld 17. Social Security 18. Medicare 19. Medical insurance 20. Other insurances 21. Union or other dues 22. Retirement or pension fund 23. Savings plan 24. Credit union 25. Child support or spousal support payments 26. Other deductions: (please specify) 27. 28. Total Monthly Deductions (add lines 14 27) MONTHLY NET INCOME (subtract line 28 from line 13) American LegalNet, Inc. www.FormsWorkFlow.com Petitioner/Joint Petitioner A: Respondent/Joint Petitioner B: FA-4139V, 05/17 Financial Disclosure Statement 247767.127, Wisconsin Statutes This form shall not be modified. It may be supplemented with additional material. Page 3 of 8 5. ANTICIPATED MONTHLY EXPENSES My Monthly Expenses 1. Rent or mortgage payment (primary residence) 2. Real Estate Property taxes (residence) 3. Repairs and maintenance (including maintenance of appliances and furnishings) 4. Food (include eating out) and household supplies 5. Utilities (electricity, heat, water, sewage, trash) 6. Telephone (local, long distance & cellular) 7. Cable and Internet Services 8. Laundry and dry cleaning 9. Clothing and shoes 10. Medical, dental and prescription drug expenses (not covered by insurance) 11. - excluding insurance that is paid through payroll deductions) 12. Childcare (babysitting and day care) 13. Child support or spousal support payments (due to previous marriage or relationship) (Exclude payments made through payroll deductions) 14. School expenses (child and adult education) 15. Entertainment (include clubs, social obligations, travel, recreation) 16. Incidentals (grooming, tobacco, alcohol, gifts, holidays and special occasions) 17. Transportation (other than automobile) 18. Auto payments (loans/leases) 19. Auto expenses (gas, oil, repairs, maintenance) 20. Newspapers, magazines, books 21. Care and maintenance of pets (food, vet, grooming) 22. Payments to any dependents not living in your home and not included in a category above (including college age children) 23. Hobbies 24. Other taxes than those listed above (exclude payroll deductions) 25. Other expenses (include expenses of other real properties owned, professional services such as counseling and tax/legal advice, etc) Other Monthly installment payments: 26. Mortgage (other than primary mortgage) 27. Other vehicle payments 28. Credit card debt (total minimum monthly payments) 29. Court ordered obligations 30. Student loans 31. Personal loans TOTAL MONTHLY EXPENSES (Add lines 1 - 31) American LegalNet, Inc. www.FormsWorkFlow.com Petitioner/Joint Petitioner A: Respondent/Joint Petitioner B: FA-4139V, 05/17 Financial Disclosure Statement 247767.127, Wisconsin Statutes This form shall not be modified. It may be supplemented with additional material. Page 4 of 8 6. ASSETS: List ALL assets that you own individually and together with the other party without regard to how they have been or will be divided later. If you do not have assets in an asset column. If you need more space, please attach additional sheets. A = Joint Petitioner A B = Joint Petitioner B T = Together Ownership or Title Held by Current Possession Estimated Value Today Household Items A B T A B T Amount Owed Household furniture & accessories Household appliances Kitchen equipment China, silver, crystal Jewelry Clothing Antiques Art Electronic equipment Sports equipment Recreational vehicles, boats Tools Other Other Automobiles: Year, Make, Model A B T A B T Amount Owed Estimated Value Today American LegalNet, Inc. www.FormsWorkFlow.com Petitioner/Joint Petitioner A: Respondent/Joint Petitioner B: FA-4139V, 05/17 Financial Disclosure Statement 247767.127, Wisconsin Statutes This form shall not be modified. It may be supplemented with additional material. Page 5 of 8 Life Insurance Name of Company & Policy # A B T Beneficiary Face Amount Cash Value Today Business Interests Name of Business & Address A B T Type of Business % of Ownership Value MINUS Indebtedness Securities: Stocks, Bonds, Mutual Funds, Commodity Accounts Name of Company & # of shares Ownership or Title held by A = Joint Petitioner A B = Joint Petitioner B T = Together Value Today A B T Pension, Retirement Accounts, Deferred Compensation, 401K Plans, IRAs, Profit Sharing, etc. Name of Company & Type of Plan A B T % Vested if known Date of Valuation Value Today American LegalNet, Inc. www.FormsWorkFlow.com Petitioner/Joint Petitioner A: Respondent/Joint Petitioner B: FA-4139V, 05/17 Financial Disclosure Statement 247767.127, Wisconsin Statutes This form shall not be modified. It may be supplemented with additional material. Page 6 of 8 Cash and Deposit Accounts (Savings and Checking) Name of Bank or Financial Institution A B T Type of Account Account # Last 4 digits Balance Today Other Personal Property Description of Asset A B T Type of Property Value Assets Acquired Description of Asset Ownership Acquired by Date Acquired Value Tod