Last updated: 8/11/2022

Professional Articles Of Organization {0010}

Start Your Free Trial $ 17.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

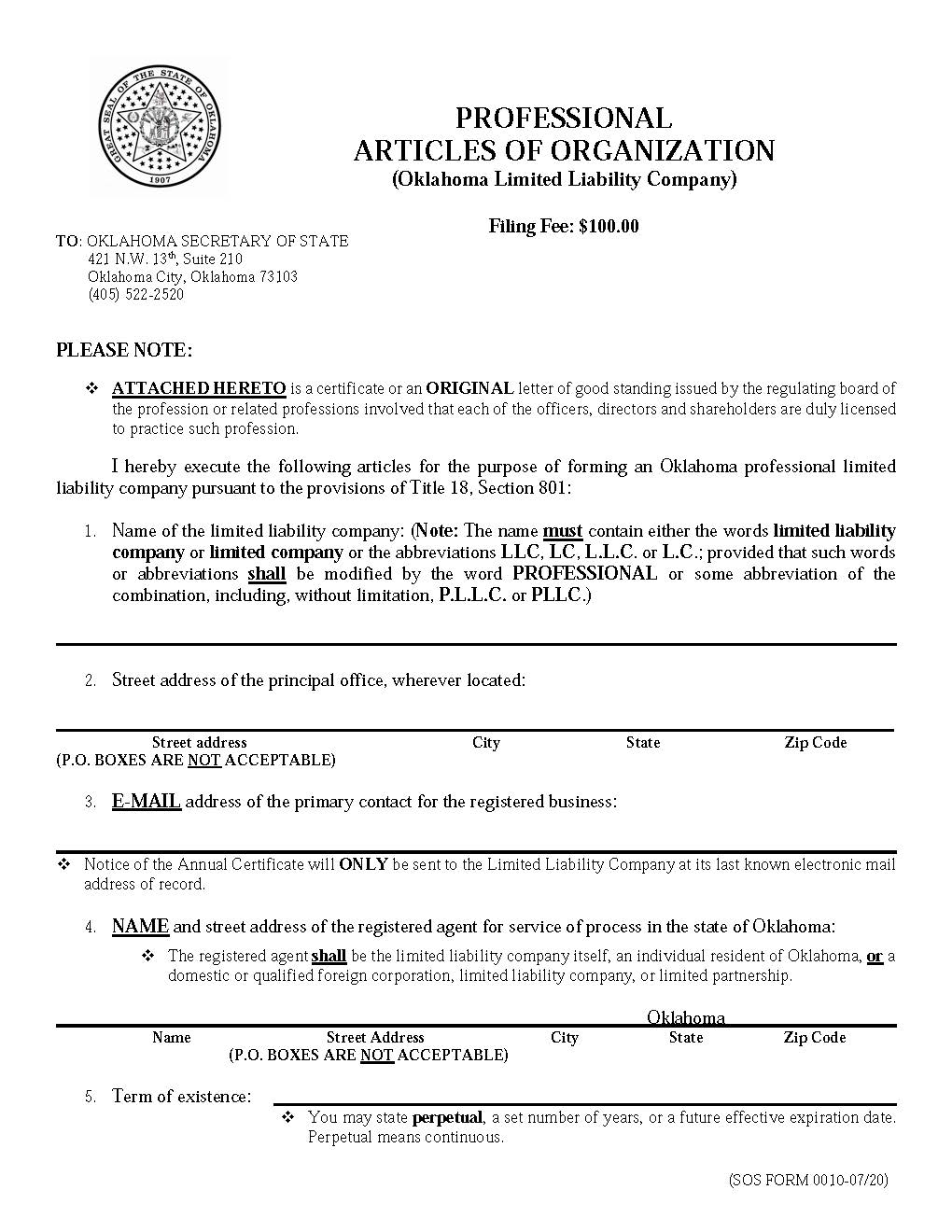

SOS FORM 0010 - PROFESSIONAL ARTICLES OF ORGANIZATION (Oklahoma Limited Liability Company). This form provides comprehensive guidance for establishing a professional limited liability company (PLLC) in the state of Oklahoma, in accordance with Title 18, Section 801 of the Oklahoma Statutes. This type of entity is specifically designed for licensed professionals, such as doctors, lawyers, or accountants, who are forming a business to render professional services. To organize a PLLC, the applicant must file signed professional articles of organization with the Oklahoma Secretary of State, accompanied by a certificate or original letter from the appropriate regulating board confirming that all owners or managers involved are duly licensed to practice the specified profession in Oklahoma. The filing requires a $100 fee and must meet several statutory requirements, including choosing a compliant business name modified by “Professional” or its abbreviation (e.g., PLLC), providing a physical address for the principal place of business, designating a registered agent located in Oklahoma, stating the term of the company’s existence (which can be perpetual), and specifying the professional service(s) to be rendered. The PLLC must list an email address for official communications and annual reporting. The form must be signed by at least one person, who may or may not be a member of the company. Instructions also highlight tax considerations and optional electronic return of documents. www.FormsWorkflow.com