Last updated: 8/9/2022

Form 21 Bill Of Costs {21}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

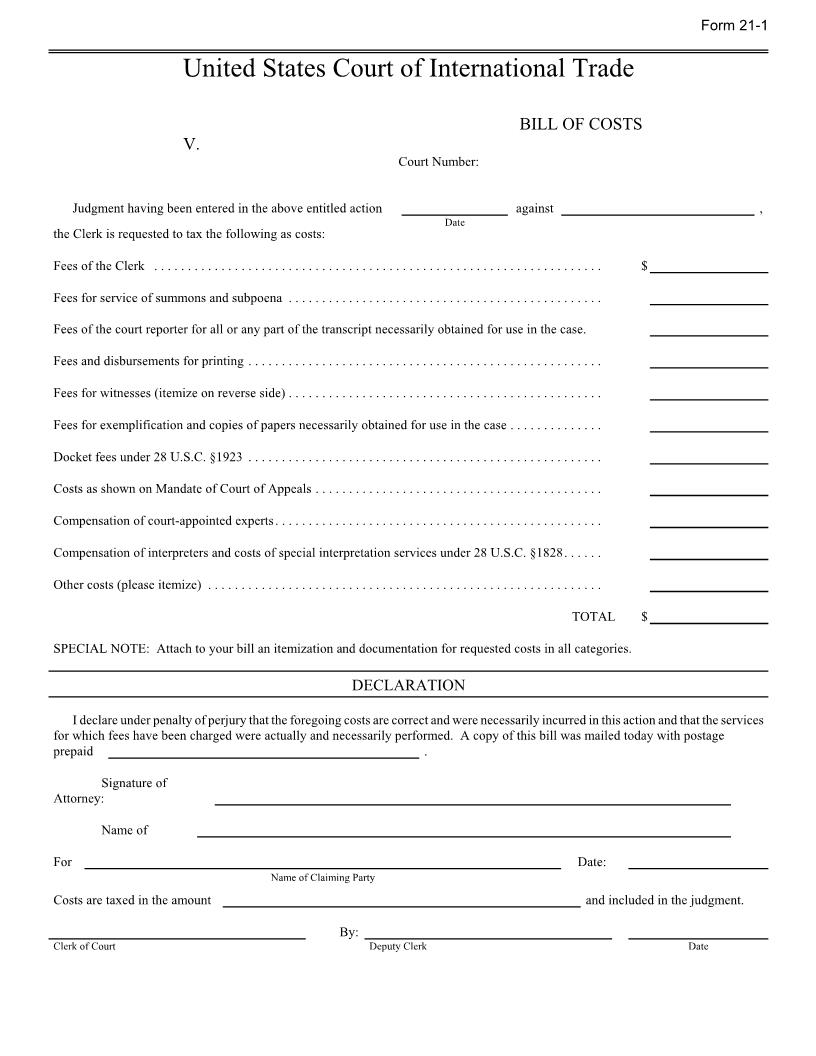

Form 21-1 United States Court of International TradeBILL OF COSTSV.Court Number:Judgment having been entered in the above entitled actionagainst,Datethe Clerk is requested to tax the following as costs:Fees of the Clerk ...................................................................$Fees for service of summons and subpoena...............................................Fees of the court reporter for all or any part of the transcript necessarily obtained for use in the case.Fees and disbursements for printing.....................................................Fees for witnesses (itemize on reverse side)..............................................Fees for exemplification and copies of papers necessarily obtained for use in the case..............Docket fees under 28 U.S.C. 2471923.....................................................Costs as shown on Mandate of Court of Appeals...........................................Compensation of court-appointed experts................................................Compensation of interpreters and costs of special interpretation services under 28 U.S.C. 2471828.....Other costs (please itemize)...........................................................TOTAL$SPECIAL NOTE: Attach to your bill an itemization and documentation for requested costs in all categories.DECLARATIONI declare under penalty of perjury that the foregoing costs are correct and were necessarily incurred in this action and that the servicesfor which fees have been charged were actually and necessarily performed. A copy of this bill was mailed today with postage prepaid.Signature ofAttorney:Name ofFor Date:Name of Claiming PartyCosts are taxed in the amountand included in the judgment.By:Clerk of CourtDeputy ClerkDate American LegalNet, Inc. www.FormsWorkFlow.com Form 21-2 WITNESS FEES (computation, cf. 28 U.S.C. 2471821 for statutory fees)ATTENDANCESUBSISTENCEMILEAGETotal CostNAME AND RESIDENCETotalTotalTotalEach WitnessDaysCostDaysCostMilesCostTOTALNOTICESection 1924, Title 28, U.S. Code (effective September 1, 1948) provides:223Verification of bill of costs.224223Before any bill of costs is taxed, the party claiming any item of cost or disbursement shall attach theretoan affidavit, made by himself or by his duly authorized attorney or agent having knowledge of the facts, thatsuch item is correct and has been necessarily incurred in the case and that the services for which fees havebeen charged were actually and necessarily performed.224See also Section 1920 of Title 28, which reads in part as follows:223A bill of costs shall be filed in the case and, upon allowance, included in the judgment or decree.224Counsel are directed to the following provisions of the Rules:Rule 6(d) 223When a party may or must act within a specified time after being served and service is made underRule 5(b)(2)(C) (mail), (D) (overnight delivery), (E) (leaving it with the clerk), or (G) (other means consentedto), 5 days are added after the period would otherwise expire under Rule 6(a).224Rule 54 (d) 223Unless a federal statute, these rules, or a court order provides otherwise, costs -- other than attorney222sfees -- should be allowed to the prevailing party. But costs against the United States, its officers, and itsagencies may be imposed only to the extent allowed by law. The clerk may tax costs on 14 day222s notice. Onmotion served within the next 7 days, the court may review the clerk222s action.224Rule 58(f)(In Part)223Entry of judgment may not be delayed, nor the time for appeal extended, in order to tax costs ***224(Added May 25, 2004, eff. Sept. 1, 2004; Dec. 6, 2011, eff. Jan. 1, 2012; Mar. 20, 2018, eff. Apr. 23, 2018.) American LegalNet, Inc. www.FormsWorkFlow.com