Last updated: 4/19/2021

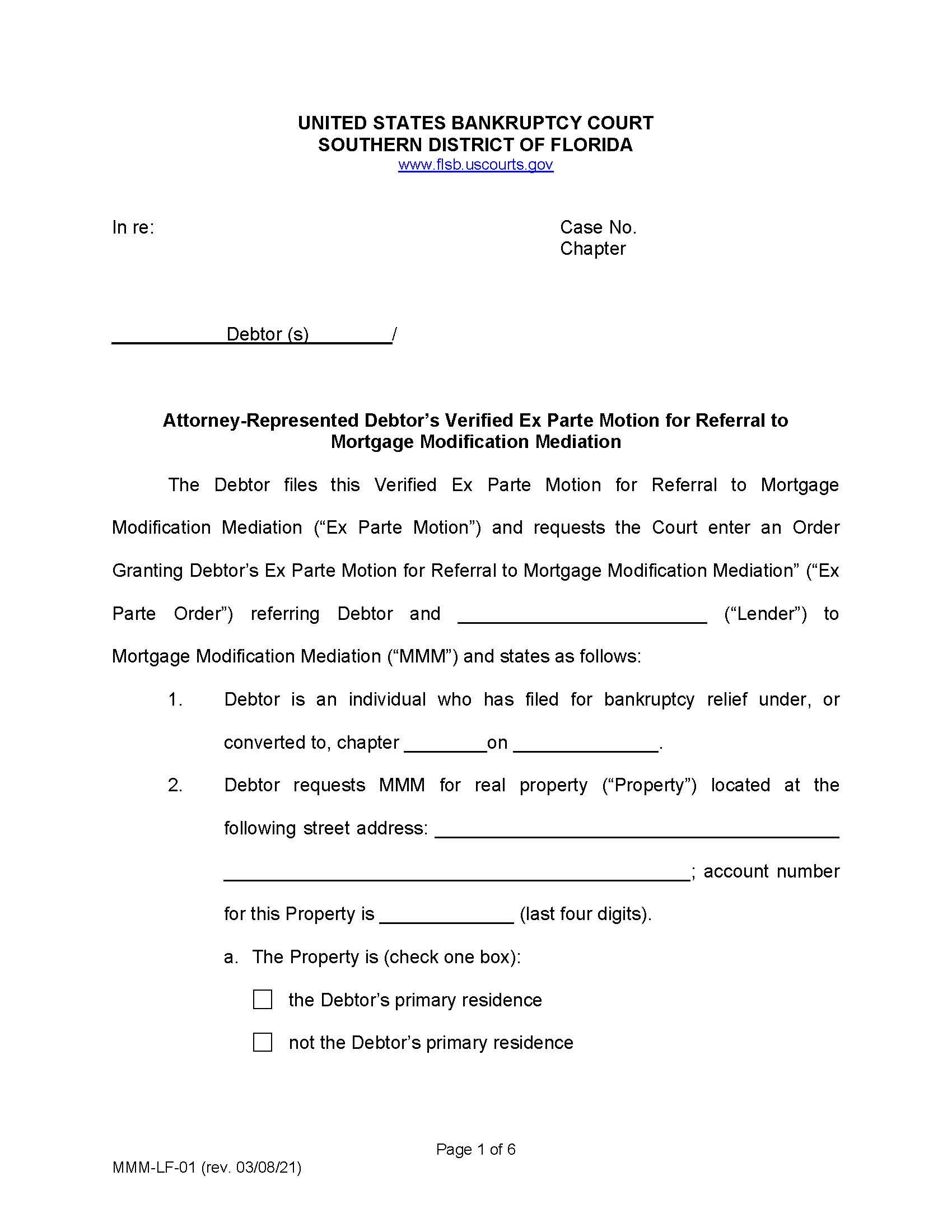

Attorney-Represented Debtors Ex Parte Motion Referral To Mortgage Mod Mediation {MMM-LF-01}

Start Your Free Trial $ 21.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

MMM-LF-01 - ATTORNEY-REPRESENTED DEBTOR’S VERIFIED EX PARTE MOTION FOR REFERRAL TO MORTGAGE MODIFICATION MEDIATION. This form is used in the United States Bankruptcy Court (Southern District of Florida) to request that a debtor and their lender be referred to Mortgage Modification Mediation (MMM). It allows a debtor who has filed for bankruptcy to seek a mortgage modification or other mortgage-related relief. The debtor can request mediation for properties such as their primary residence or other real estate. The motion outlines the debtor's current bankruptcy status, mortgage details, modification goals, and steps taken to prepare for mediation, such as submitting necessary fees and paperwork. The form also allows for requests related to loan modifications, deeds in lieu of foreclosure, or property surrender options, and includes provisions for pro bono mediation if applicable. The document must be verified by the debtor and served to relevant parties. www.FormsWorkflow.com

Related forms

-

Application To Withdraw Unclaimed Funds

Application To Withdraw Unclaimed Funds

Florida/Federal/USBC Southern/ -

Certificate Of Proponent Of Plan On Acceptance Of Plan Report On Amount To Be Deposited

Certificate Of Proponent Of Plan On Acceptance Of Plan Report On Amount To Be Deposited

Florida/Federal/USBC Southern/ -

Confirmation Affidavit

Confirmation Affidavit

Florida/Federal/USBC Southern/ -

Debtor In Possessions Application For Employment Of Attorney

Debtor In Possessions Application For Employment Of Attorney

Florida/Federal/USBC Southern/ -

Notice Of Clerks Designation Of Mediator

Notice Of Clerks Designation Of Mediator

Florida/Federal/USBC Southern/ -

Notice Of Selection Of Mediator

Notice Of Selection Of Mediator

Florida/Federal/USBC Southern/ -

Order Approving Employment Of Trustees Attorney

Order Approving Employment Of Trustees Attorney

Florida/Federal/USBC Southern/ -

Order Converting Case Under Chapter 7 To Case Under Chapter 12

Order Converting Case Under Chapter 7 To Case Under Chapter 12

Florida/Federal/USBC Southern/ -

Order Of Referral To Mediation

Order Of Referral To Mediation

Florida/Federal/USBC Southern/ -

Order Reopening Case To Add Omitted Creditors

Order Reopening Case To Add Omitted Creditors

Florida/Federal/USBC Southern/ -

Order Reopening Case To Administer Additional Assets

Order Reopening Case To Administer Additional Assets

Florida/Federal/USBC Southern/ -

Report Of Mediator

Report Of Mediator

Florida/Federal/USBC Southern/ -

Application For Compensation For Professional Services Or Reimbursement Of Expenses-Attorney

Application For Compensation For Professional Services Or Reimbursement Of Expenses-Attorney

Florida/Federal/USBC Southern/ -

Claim Of Exemption And Request For Hearing

Claim Of Exemption And Request For Hearing

Florida/Federal/USBC Southern/ -

Debtors Notice Of Filing Payroll And Sales Tax Reports

Debtors Notice Of Filing Payroll And Sales Tax Reports

Florida/Federal/USBC Southern/ -

Notice Of Compliance By Attorney For Debtor-Local Rule 2083-1(B) Claims Review Requirement

Notice Of Compliance By Attorney For Debtor-Local Rule 2083-1(B) Claims Review Requirement

Florida/Federal/USBC Southern/ -

Trustees Application For Employment Of Attorney

Trustees Application For Employment Of Attorney

Florida/Federal/USBC Southern/ -

Writ Of Execution To The United States Marshall

Writ Of Execution To The United States Marshall

Florida/Federal/USBC Southern/ -

Rights And Responsibilities Agreement

Rights And Responsibilities Agreement

Florida/Federal/USBC Southern/ -

Ballot And Deadline For Filing Ballot Accepting Or Rejecting Plan

Ballot And Deadline For Filing Ballot Accepting Or Rejecting Plan

Florida/Federal/USBC Southern/ -

Order Establishing Procedures To Permit Monthly Payment Of Interim Fee Applications Of Chapter 11 Professionals

Order Establishing Procedures To Permit Monthly Payment Of Interim Fee Applications Of Chapter 11 Professionals

Florida/Federal/USBC Southern/ -

Order Jointly Administering Chapter 11 Cases

Order Jointly Administering Chapter 11 Cases

Florida/Federal/USBC Southern/ -

Order Jointly Administering Chapter 7 Cases

Order Jointly Administering Chapter 7 Cases

Florida/Federal/USBC Southern/ -

Debtor Certificate Of Compliance And Request For Confirmation Of Chapter 13 Plan

Debtor Certificate Of Compliance And Request For Confirmation Of Chapter 13 Plan

Florida/Federal/USBC Southern/ -

Pretrial Order In An Adversary Proceeding

Pretrial Order In An Adversary Proceeding

Florida/Federal/USBC Southern/ -

Certificate Of Service (Certificate Of Compliance With Local Rule 9073-1(D)) (Sample And Form)

Certificate Of Service (Certificate Of Compliance With Local Rule 9073-1(D)) (Sample And Form)

Florida/Federal/USBC Southern/ -

Declaration Regarding Payment Advices

Declaration Regarding Payment Advices

Florida/Federal/USBC Southern/ -

Objection To Claim On Shortened Notice

Objection To Claim On Shortened Notice

Florida/Federal/USBC Southern/ -

Objection To Claim

Objection To Claim

Florida/Federal/USBC Southern/ -

Order Sustaining Objection To Claim

Order Sustaining Objection To Claim

Florida/Federal/USBC Southern/ -

Ch 7 Trustees Motion Dismiss Debtor Failure To Appear 1st Creditors Meeting

Ch 7 Trustees Motion Dismiss Debtor Failure To Appear 1st Creditors Meeting

Florida/Federal/USBC Southern/ -

Final Report And Motion For Entry Of Final Decree

Final Report And Motion For Entry Of Final Decree

Florida/Federal/USBC Southern/ -

Trustees Summary Of Requested Fees And Expenses

Trustees Summary Of Requested Fees And Expenses

Florida/Federal/USBC Southern/ -

Affidavit Of Claimant (Sample And Form)

Affidavit Of Claimant (Sample And Form)

Florida/Federal/USBC Southern/ -

Affidavit Of Proposed Attorney For Debtor In Possession (Sample And Form)

Affidavit Of Proposed Attorney For Debtor In Possession (Sample And Form)

Florida/Federal/USBC Southern/ -

Affidavit Of Proposed Attorney For Trustee (Sample And Form)

Affidavit Of Proposed Attorney For Trustee (Sample And Form)

Florida/Federal/USBC Southern/ -

Order Granting Ex Parte Motion To Excuse Compliance Under Local Rule 5005-4 (Sample And Form)

Order Granting Ex Parte Motion To Excuse Compliance Under Local Rule 5005-4 (Sample And Form)

Florida/Federal/USBC Southern/ -

Individual Debtor Certificate For Confirmation Re Payment Of Domestic Support - (For Ch11) Filing Of Required Tax

Individual Debtor Certificate For Confirmation Re Payment Of Domestic Support - (For Ch11) Filing Of Required Tax

Florida/Federal/USBC Southern/ -

Order Granting Motion To Value And Determining Secured Status Of Lien On Real Property (Sample And Form)

Order Granting Motion To Value And Determining Secured Status Of Lien On Real Property (Sample And Form)

Florida/Federal/USBC Southern/ -

Application For Approval Of Employment Of Auctioneer (Sample And Form)

Application For Approval Of Employment Of Auctioneer (Sample And Form)

Florida/Federal/USBC Southern/ -

Chapter 11 Case Management Summary (Sample And Form)

Chapter 11 Case Management Summary (Sample And Form)

Florida/Federal/USBC Southern/ -

Notice Of Intent To Request Redaction Of Transcript (Sample And Form)

Notice Of Intent To Request Redaction Of Transcript (Sample And Form)

Florida/Federal/USBC Southern/ -

Order Approving Employment Of Auctioneer (Sample And Form)

Order Approving Employment Of Auctioneer (Sample And Form)

Florida/Federal/USBC Southern/ -

Motion To Value And Determine Secured Status Of Lien On Personal Property

Motion To Value And Determine Secured Status Of Lien On Personal Property

Florida/Federal/USBC Southern/ -

Order Granting Motion To Value And Determine Secured Status Of Lien On Personal Property

Order Granting Motion To Value And Determine Secured Status Of Lien On Personal Property

Florida/Federal/USBC Southern/ -

Order Jointly Administering Chapter 15 Cases

Order Jointly Administering Chapter 15 Cases

Florida/Federal/USBC Southern/ -

Order Reinstating Chapter 13 Case

Order Reinstating Chapter 13 Case

Florida/Federal/USBC Southern/ -

Motion To Value And Determine Secured Status Of Lien On Real Property

Motion To Value And Determine Secured Status Of Lien On Real Property

Florida/Federal/USBC Southern/ -

Order Awarding Final Trustee And Professional Fees And Expenses

Order Awarding Final Trustee And Professional Fees And Expenses

Florida/Federal/USBC Southern/ -

Order Awarding Final Trustees Fees And Expenses

Order Awarding Final Trustees Fees And Expenses

Florida/Federal/USBC Southern/ -

Debtors Certificate Compliance Motion Discharge Pre Plan Completion Objection Deadline

Debtors Certificate Compliance Motion Discharge Pre Plan Completion Objection Deadline

Florida/Federal/USBC Southern/ -

Order Determining Debtor Has Cured Default Paid All Required Postpetition Amounts

Order Determining Debtor Has Cured Default Paid All Required Postpetition Amounts

Florida/Federal/USBC Southern/ -

Summary Of Fee Application Of Counsel Or Accountant

Summary Of Fee Application Of Counsel Or Accountant

Florida/Federal/USBC Southern/ -

Ex Parte Motion To Approve Mortgage Modification Agreement With (Lender)

Ex Parte Motion To Approve Mortgage Modification Agreement With (Lender)

Florida/Federal/USBC Southern/ -

Order Granting Motion To Approve Mortgage Modification Agreement With (Lender)

Order Granting Motion To Approve Mortgage Modification Agreement With (Lender)

Florida/Federal/USBC Southern/ -

Ex Parte Motion To Excuse Compliance Under Local Rule 5005-4(B) (Sample And Form)

Ex Parte Motion To Excuse Compliance Under Local Rule 5005-4(B) (Sample And Form)

Florida/Federal/USBC Southern/ -

Debtors Notice Of Compliance With Requirements For Amending Creditor Information

Debtors Notice Of Compliance With Requirements For Amending Creditor Information

Florida/Federal/USBC Southern/ -

Final Report Of Mortgage Modification Mediator

Final Report Of Mortgage Modification Mediator

Florida/Federal/USBC Southern/ -

Notice Of Clerks Designation Of Mortgage Modification Mediator

Notice Of Clerks Designation Of Mortgage Modification Mediator

Florida/Federal/USBC Southern/ -

Lenders Consent To Attend And Participate In Mortgage Modification Mediation

Lenders Consent To Attend And Participate In Mortgage Modification Mediation

Florida/Federal/USBC Southern/ -

Self-Represented Debtors Motion To Approve Mortgage Modification Agreement With (Lender)

Self-Represented Debtors Motion To Approve Mortgage Modification Agreement With (Lender)

Florida/Federal/USBC Southern/ -

Third Partys Consent To Attend And Participate In Mortgage Modification Mediation

Third Partys Consent To Attend And Participate In Mortgage Modification Mediation

Florida/Federal/USBC Southern/ -

Debtors Notice Of Selection Of Mortgage Modification Mediator

Debtors Notice Of Selection Of Mortgage Modification Mediator

Florida/Federal/USBC Southern/ -

Request For Copies Of Archived Case Files (NARA)

Request For Copies Of Archived Case Files (NARA)

Florida/Federal/USBC Southern/ -

Order Approving Employment Of Debtor In Possessions Attorney

Order Approving Employment Of Debtor In Possessions Attorney

Florida/Federal/USBC Southern/ -

Notice Of Deposit Of Funds With US Bankruptcy Court Clerk

Notice Of Deposit Of Funds With US Bankruptcy Court Clerk

Florida/Federal/USBC Southern/ -

Order Converting Case Under Chapter 7 To Chapter 11

Order Converting Case Under Chapter 7 To Chapter 11

Florida/Federal/USBC Southern/ -

Certificate Of Subchapter V Debtor Acceptance Of Plan Report On Deposit

Certificate Of Subchapter V Debtor Acceptance Of Plan Report On Deposit

Florida/4 Federal/USBC Southern/ -

Confirmation Affidavit For Subchapter V Debtor

Confirmation Affidavit For Subchapter V Debtor

Florida/4 Federal/USBC Southern/ -

Debtors Request To Receive Notices Electronically Under DeBN Program

Debtors Request To Receive Notices Electronically Under DeBN Program

Florida/4 Federal/USBC Southern/ -

Agreed Ex Parte Motion To Abate 3002.1 Notices And Reconcile Annually

Agreed Ex Parte Motion To Abate 3002.1 Notices And Reconcile Annually

Florida/4 Federal/USBC Southern/ -

Joint Pretrial Stipulation

Joint Pretrial Stipulation

Florida/4 Federal/USBC Southern/ -

Notice Of Substitution Of Counsel

Notice Of Substitution Of Counsel

Florida/4 Federal/USBC Southern/ -

Motion For Discharge Notice Of Deadline To Object (Deceased Debtor)

Motion For Discharge Notice Of Deadline To Object (Deceased Debtor)

Florida/4 Federal/USBC Southern/ -

Order Granting Agreed Ex Parte Motion To Abate 3002.1 Notices

Order Granting Agreed Ex Parte Motion To Abate 3002.1 Notices

Florida/4 Federal/USBC Southern/ -

Attorney-Represented Debtors Ex Parte Motion Referral To Mortgage Mod Mediation

Attorney-Represented Debtors Ex Parte Motion Referral To Mortgage Mod Mediation

Florida/Federal/USBC Southern/ -

Attorney-Represented Debtors Verified Out Of Time Motion For Referral To MMM

Attorney-Represented Debtors Verified Out Of Time Motion For Referral To MMM

Florida/Federal/USBC Southern/ -

Verification Of Qualification To Act As Mediator

Verification Of Qualification To Act As Mediator

Florida/Federal/USBC Southern/ -

Debtors Response To 3002.1 Notice In Relation To Claim

Debtors Response To 3002.1 Notice In Relation To Claim

Florida/4 Federal/USBC Southern/ -

Application For Individuals To Pay The Filing Fee In Installments

Application For Individuals To Pay The Filing Fee In Installments

Florida/4 Federal/USBC Southern/ -

Subpoena For Rule 2004 Examination

Subpoena For Rule 2004 Examination

Florida/Federal/USBC Southern/ -

Notice Of Rule 2004 Examination

Notice Of Rule 2004 Examination

Florida/Federal/USBC Southern/ -

Acknowledgment Of Responsibility Live Access CM-ECF Full Attorney Privileges

Acknowledgment Of Responsibility Live Access CM-ECF Full Attorney Privileges

Florida/Federal/USBC Southern/ -

Acknowledgment Of Responsibility Live Access CM-ECF Trustee-US Trustee Privileges

Acknowledgment Of Responsibility Live Access CM-ECF Trustee-US Trustee Privileges

Florida/Federal/USBC Southern/ -

Notice Regarding Opposing Motions For Summary Judgment

Notice Regarding Opposing Motions For Summary Judgment

Florida/Federal/USBC Southern/ -

Debtors Certificate Compliance Motion Discharge Objection Deadline Cases Filed 040122 On

Debtors Certificate Compliance Motion Discharge Objection Deadline Cases Filed 040122 On

Florida/Federal/USBC Southern/ -

Debtors Certificate Compliance-Motion Discharge-Deadline Objection (Cases Filed 040119 On)

Debtors Certificate Compliance-Motion Discharge-Deadline Objection (Cases Filed 040119 On)

Florida/Federal/USBC Southern/ -

Debtors Certificate Compliance-Motion Discharge-Deadline Objection (Cases Filed 040122 On)

Debtors Certificate Compliance-Motion Discharge-Deadline Objection (Cases Filed 040122 On)

Florida/Federal/USBC Southern/ -

Order Setting Filing And Disclosure Requirements For Pretrial And Trial

Order Setting Filing And Disclosure Requirements For Pretrial And Trial

Florida/4 Federal/USBC Southern/ -

Order Approving Disclosure Statement Setting Hearings And Deadlines Describing Obligations

Order Approving Disclosure Statement Setting Hearings And Deadlines Describing Obligations

Florida/Federal/USBC Southern/ -

Motion To Appear Pro Hac Vice

Motion To Appear Pro Hac Vice

Florida/Federal/USBC Southern/ -

Order Conditionally Approving Disclosure Statement Setting Hearing On Chap 11 Plan

Order Conditionally Approving Disclosure Statement Setting Hearing On Chap 11 Plan

Florida/Federal/USBC Southern/ -

Acknowledgment Of Responsibility Live Access To CM-ECF Limited Privileges

Acknowledgment Of Responsibility Live Access To CM-ECF Limited Privileges

Florida/Federal/USBC Southern/ -

Affidavit Of Auctioneer (Sample And Form)

Affidavit Of Auctioneer (Sample And Form)

Florida/Federal/USBC Southern/ -

Order Of Dismissal (Adversary Proceeding Pursuant To Settlement)

Order Of Dismissal (Adversary Proceeding Pursuant To Settlement)

Florida/Federal/USBC Southern/ -

Order Setting Evidentiary Hearing Chapter 13 (Deadlines) (Short Form) (Judge Isicoff)

Order Setting Evidentiary Hearing Chapter 13 (Deadlines) (Short Form) (Judge Isicoff)

Florida/Federal/USBC Southern/ -

Order Setting Requirements For Evidentiary Hearing Chapter 13 (Long Form) (Judge Isicoff)

Order Setting Requirements For Evidentiary Hearing Chapter 13 (Long Form) (Judge Isicoff)

Florida/Federal/USBC Southern/ -

Order Denying Approval Of Reaffirmation Agreement (Judge Isicoff)

Order Denying Approval Of Reaffirmation Agreement (Judge Isicoff)

Florida/Federal/USBC Southern/ -

Order Approving Reaffirmation Agreement (After Hearing) (Judge Isicoff)

Order Approving Reaffirmation Agreement (After Hearing) (Judge Isicoff)

Florida/Federal/USBC Southern/ -

Exhibit Register

Exhibit Register

Florida/Federal/USBC Southern/ -

Application For Search Of Bankruptcy Records

Application For Search Of Bankruptcy Records

Florida/Federal/USBC Southern/ -

Archives Request Form

Archives Request Form

Florida/Federal/USBC Southern/ -

Order Admitting Attorney Pro Hac Vice

Order Admitting Attorney Pro Hac Vice

Florida/Federal/USBC Southern/ -

Order For Payment Of Unclaimed Funds

Order For Payment Of Unclaimed Funds

Florida/Federal/USBC Southern/ -

Order Granting Self-Represented Debtors Verified Motion For Referral To MMM

Order Granting Self-Represented Debtors Verified Motion For Referral To MMM

Florida/Federal/USBC Southern/ -

Order Reinstating Chapter 7 Case

Order Reinstating Chapter 7 Case

Florida/Federal/USBC Southern/ -

Order Setting Hearing Approval Of Disclosure Statement Confirmation Of Ch 11 Plan

Order Setting Hearing Approval Of Disclosure Statement Confirmation Of Ch 11 Plan

Florida/Federal/USBC Southern/ -

Order Setting Hearing Confirmation Of Plan Deadline For Filing Objections

Order Setting Hearing Confirmation Of Plan Deadline For Filing Objections

Florida/4 Federal/USBC Southern/ -

Order Setting Hearing On Approval Of Disclosure Statement-Deadline For Filing Objections

Order Setting Hearing On Approval Of Disclosure Statement-Deadline For Filing Objections

Florida/Federal/USBC Southern/ -

Order Setting Hearing On Confirmation Of Plan Setting Deadline For Filing Objections (Sample And Form)

Order Setting Hearing On Confirmation Of Plan Setting Deadline For Filing Objections (Sample And Form)

Florida/Federal/USBC Southern/ -

Self-Represented Debtors Verified Motion Referral To Mortgage Modification Mediation

Self-Represented Debtors Verified Motion Referral To Mortgage Modification Mediation

Florida/Federal/USBC Southern/ -

Cover Sheet Items Conventionally Submitted Sealing Or In Camera Review (LF-72)

Cover Sheet Items Conventionally Submitted Sealing Or In Camera Review (LF-72)

Florida/Federal/USBC Southern/ -

Order Granting Attorney-Represented Debtors Out Of Time Motion Referral To MMM

Order Granting Attorney-Represented Debtors Out Of Time Motion Referral To MMM

Florida/Federal/USBC Southern/ -

Order Granting Debtors Verified Ex Parte Motion For Referral To MMM

Order Granting Debtors Verified Ex Parte Motion For Referral To MMM

Florida/Federal/USBC Southern/ -

Transcript Request Form

Transcript Request Form

Florida/Federal/USBC Southern/ -

Agreed Order To Employer To Deduct And Remit And For Related Matters

Agreed Order To Employer To Deduct And Remit And For Related Matters

Florida/Federal/USBC Southern/ -

Bill Of Costs

Bill Of Costs

Florida/Federal/USBC Southern/ -

Debtors Certificate Of Compliance Motion Issuance Of Discharge Filed On Or After 412025

Debtors Certificate Of Compliance Motion Issuance Of Discharge Filed On Or After 412025

Florida/Federal/USBC Southern/ -

Notice Of Deadline To Object To Debtors Statement Re 11 USC 522(q)(1)

Notice Of Deadline To Object To Debtors Statement Re 11 USC 522(q)(1)

Florida/Federal/USBC Southern/ -

Order Converting Case Under Chapter 11 To Case Under Chapter 7

Order Converting Case Under Chapter 11 To Case Under Chapter 7

Florida/Federal/USBC Southern/ -

Order Converting Case Under Chapter 13 To Chapter 11

Order Converting Case Under Chapter 13 To Chapter 11

Florida/Federal/USBC Southern/ -

Order Converting Case Under Chapter 13 To Case Under Chapter 7

Order Converting Case Under Chapter 13 To Case Under Chapter 7

Florida/Federal/USBC Southern/ -

Order Converting Case Under Chapter 7 To Case Under Chapter 13 (After Hearing)

Order Converting Case Under Chapter 7 To Case Under Chapter 13 (After Hearing)

Florida/Federal/USBC Southern/ -

Order Converting Case Under Chapter 7 To Case Under Chapter 13 (Negative Notice)

Order Converting Case Under Chapter 7 To Case Under Chapter 13 (Negative Notice)

Florida/Federal/USBC Southern/ -

Request For Compact Disc (CD) Of Audio Recording Of Court Proceeding

Request For Compact Disc (CD) Of Audio Recording Of Court Proceeding

Florida/4 Federal/USBC Southern/

Form Preview

Contact Us

Success: Your message was sent.

Thank you!