Last updated: 2/9/2021

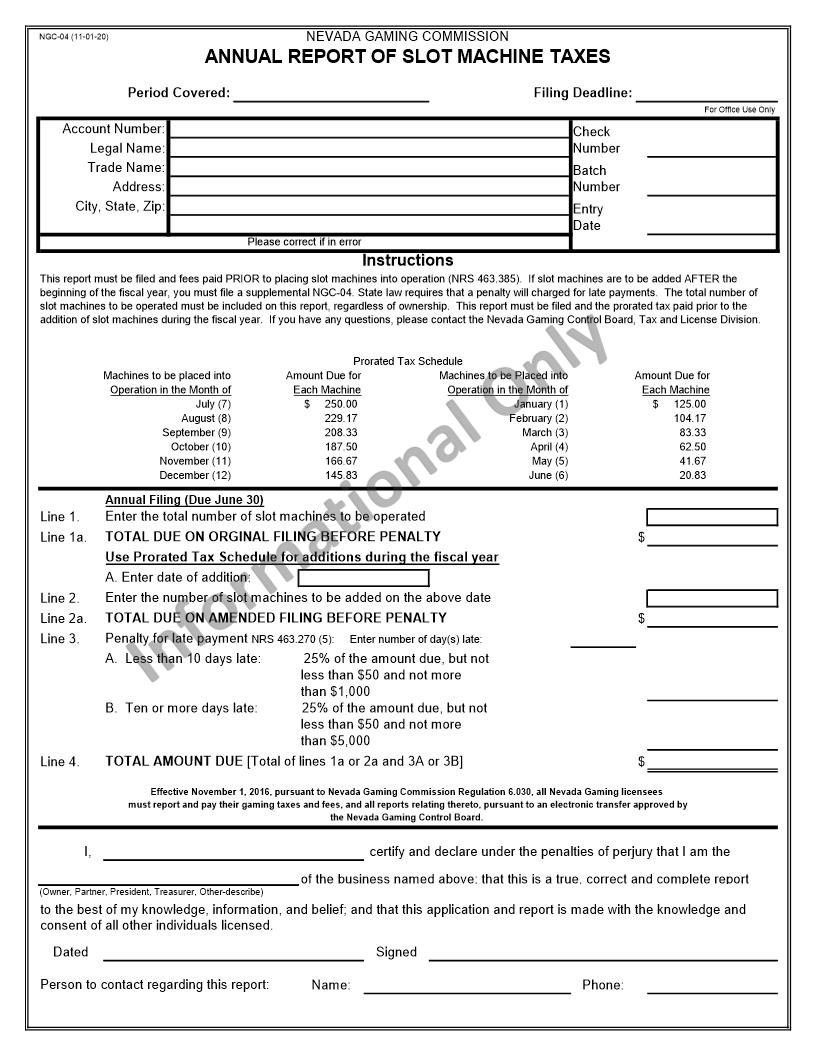

Annual Report Of Slot Machine Taxes {NGC-04}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

NGC-04 (04-01-18) Please correct if in error 250.00 $ 125.00 $ 229.17 104.17 208.33 83.33 187.50 62.50 166.67 41.67 145.83 20.83 Line 1. Line 1a. $ Line 2. Line 2a. $ Line 3. Line 4. $ I, certify and declare under the penalties of perjury that I am the of the business named above; that this is a true, correct and complete report x-noneto the best of my knowledge, information, and belief; and that this application and report is made with the knowledge and x-noneDatedx-noneSignedx-noneName:x-nonePhone: x-none NEVADA GAMING COMMISSION x-noneANNUAL REPORT OF SLOT MACHINE TAXES x-nonePeriod Covered: x-noneFiling Deadline: x-noneFor Office Use Only x-noneAccount Number: x-noneCheck Number x-noneLegal Name: x-noneTrade Name: x-noneBatch Number x-noneAddress: x-noneAmount Due for x-noneCity, State, Zip: x-noneEntry Date Each Machine x-noneJuly (7) x-noneJanuary (1) x-nonePlease correct if in error x-noneInstructions x-noneThis report must be filed and fees paid PRIOR to placing slot machines into operation (NRS 463.385). If slot machines are to be added AFTER the beginning of the fiscal year, you must file a supplemental NGC-04. State law requires that a penalty will charged for late payments. The total number of slot machines to be operated must be included on this report, regardless of ownership. This report must be filed and the prorated tax paid prior to the addition of slot machines during the fiscal year. If you have any questions, please contact the Nevada Gaming Control Board, Tax and License Division. x-noneProrated Tax Schedule x-noneMachines to be placed into x-noneAmount Due for x-noneMachines to be Placed into x-noneAugust (8) x-noneFebruary (2) x-noneSeptember (9) x-noneMarch (3) Operation in the Month of Each Machine Operation in the Month of x-noneDecember (12) x-noneJune (6) Annual Filing (Due June 30) x-noneOctober (10) x-noneApril (4) x-noneNovember (11) x-noneMay (5) x-noneEnter the total number of slot machines to be operated x-noneTOTAL DUE ON ORGINAL FILING BEFORE PENALTY Use Prorated Tax Schedule for additions during the fiscal year x-noneA. Enter date of addition: x-noneEnter the number of slot machines to be added on the above date x-noneTOTAL DUE ON AMENDED FILING BEFORE PENALTY x-nonePenalty for late payment NRS 463.270 (5): Enter number of day(s) late: x-noneA. Less than 10 days late: x-none25% of the amount due, but not x-noneless than $50 and not more x-nonethan $1,000 x-noneB. Ten or more days late: x-none25% of the amount due, but not x-noneless than $50 and not more x-nonethan $5,000 x-noneTOTAL AMOUNT DUE [Total of lines 1a or 2a and 3A or 3B] x-none(Owner, Partner, President, Treasurer, Other-describe) x-noneEffective November 1, 2016, pursuant to Nevada Gaming Commission Regulation 6.030, all Nevada Gaming licensees x-nonemust report and pay their gaming taxes and fees, and all reports relating thereto, pursuant to an electronic transfer approved by x-nonethe Nevada Gaming Control Board. x-noneRETURN ORIGINAL AND MAKE DUPLICATE FOR YOUR RECORDS x-noneconsent of all other individuals licensed. x-nonePerson to contact regarding this report: American LegalNet, Inc. www.FormsWorkFlow.com