Last updated: 2/10/2021

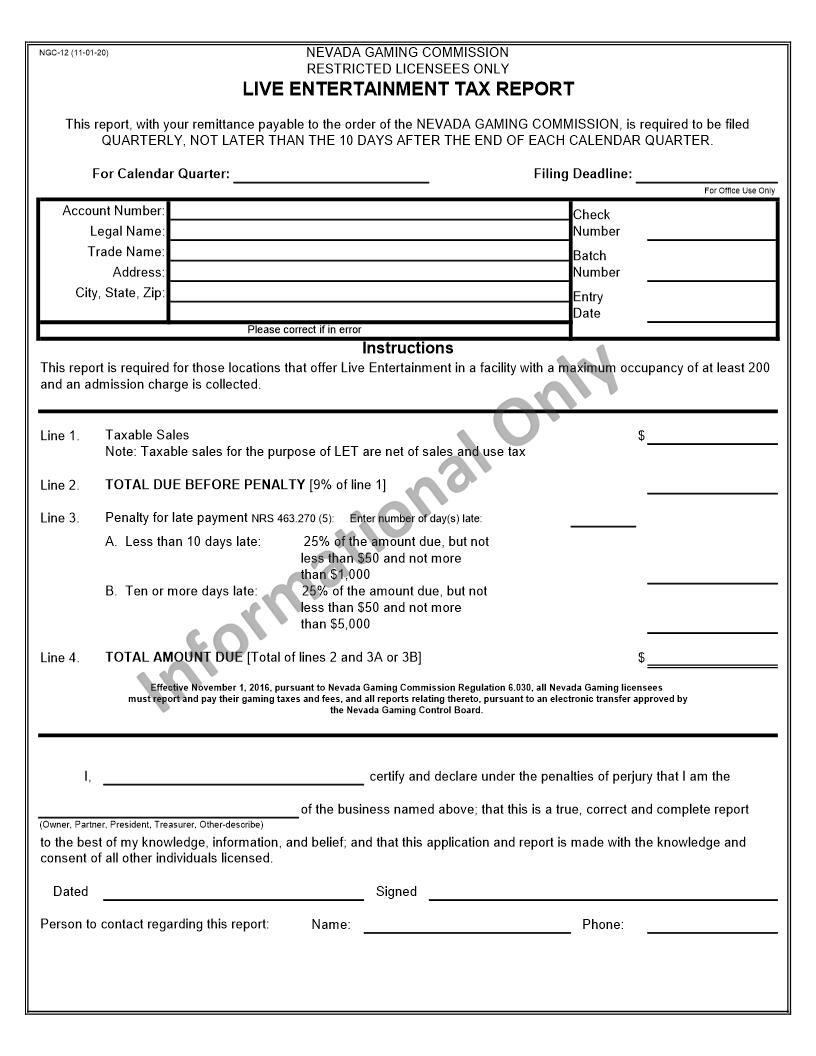

Live Entertainment Tax Report Restricted Licensees {NGC-12}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

NGC-12 (04-01-18) Please correct if in error Line 1. $ Line 2. Line 3. Line 4. $ x-none I,x-none certify and declare under the penalties of perjury that I am the x-noneof the business named above; that this is a true, correct and complete report x-noneto the best of my knowledge, information, and belief; and that this application and report is made with the knowledge and x-noneDatedx-noneSignedx-noneName:x-nonePhone: x-nonePerson to contact regarding this report: x-noneRETURN ORIGINAL AND MAKE DUPLICATE FOR YOUR RECORDS x-none(Owner, Partner, President, Treasurer, Other-describe) x-noneconsent of all other individuals licensed. x-nonemust report and pay their gaming taxes and fees, and all reports relating thereto, pursuant to an electronic transfer approved by x-nonethe Nevada Gaming Control Board. x-nonethan $5,000 x-noneTOTAL AMOUNT DUE [Total of lines 2 and 3A or 3B] x-noneEffective November 1, 2016, pursuant to Nevada Gaming Commission Regulation 6.030, all Nevada Gaming licensees x-noneless than $50 and not more x-nonethan $1,000 x-noneB. Ten or more days late: x-none25% of the amount due, but not x-noneless than $50 and not more x-noneNote: Taxable sales for the purpose of LET are net of sales and use tax x-noneTOTAL DUE BEFORE PENALTY [10% of line 1] x-nonePenalty for late payment NRS 463.270 (5): Enter number of day(s) late: x-noneA. Less than 10 days late: x-none25% of the amount due, but not x-nonePlease correct if in error x-noneInstructions x-noneTaxable Sales x-noneThis report is required for those locations that offer Live Entertainment in a facility with a maximum occupancy of at least 200 and an admission charge is collected. This report should only be completed for the quarter beginning July 1, 2015 and prior. x-noneCity, State, Zip: x-noneEntry Date x-noneTrade Name: x-noneBatch Number x-noneAddress: x-noneFor Office Use Only x-noneAccount Number: x-noneCheck Number x-noneLegal Name: x-none NEVADA GAMING COMMISSION x-noneRESTRICTED LICENSEES ONLY x-noneLIVE ENTERTAINMENT TAX REPORT x-noneThis report, with your remittance payable to the order of the NEVADA GAMING COMMISSION, is required to be filed QUARTERLY, NOT LATER THAN THE 10 DAYS AFTER THE END OF EACH CALENDAR QUARTER. x-noneFor Calendar Quarter: x-noneFiling Deadline: American LegalNet, Inc. www.FormsWorkFlow.com