Last updated: 4/29/2020

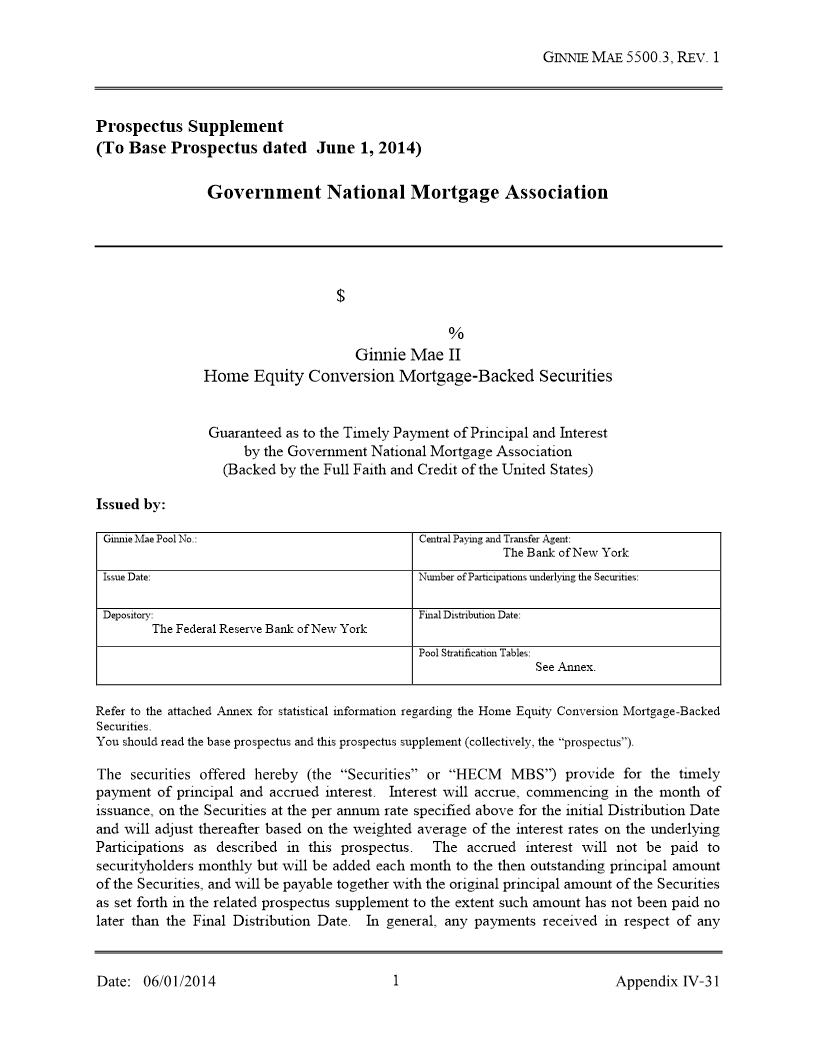

Prospectus Supplemental To Ginnie Mae II Home Equity Conversion Mortgage-Backed-Securities {HUD-11777-II}

Start Your Free Trial $ 21.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

GINNIE MAE 5500.3, REV. 1 Prospectus Supplement (To Base Prospectus dated October 1, 2007) Government National Mortgage Association $ [nt of Issue][1] [Initial HECM M]% [2] Ginnie Mae II Home Equity Conversion Mortgage-Backed Securities Guaranteed as to the Timely Payment of Principal and Interest by the Government National Mortgage Association (Backed by the Full Faith and Credit of the United States) Issued by: [ - ] (the "Ginnie Mae Issuer") [3] Ginnie Mae Pool No.: Central Paying and Transfer Agent: The Bank of New York Issue Date: Number of Participations underlying the Securities: Depository: Final Distribution Date: The Federal Reserve Bank of New York Pool Stratification Tables: See Annex. Refer to the attached Annex for statistical information regarding the Home Equity Conversion Mortgage-Backed Securities. You should read the base prospectus and this prospectus supplement (collectively, the "prospectus"). Date: 10/01/07 1 Appendix IV-31 American LegalNet, Inc. www.FormsWorkflow.com The securities offered hereby (the "Securities" or "HECM MBS") provide for the timely payment of principal and accrued interest. Interest will accrue, commencing in the month of issuance, on the Securities at the per annum rate specified above. The accrued interest will not be paid to securityholders but will be added each month to the then outstanding principal amount of the Securities, and will be payable together with the original principal amount of the Securities as set forth in the related prospectus supplement to the extent such amount has not been paid no later than the Final Distribution Date. In general, any payments received in respect of any HECMs prior to the Final Distribution Date will be passed through pro rata to the respective holders of participation interests in the outstanding advances made to a borrower relating to the HECM. In addition, the Ginnie Mae Issuer is obligated to cover any interest shortfalls resulting from borrower prepayments. It is uncertain when payments will be made in respect of your Securities. The Government National Mortgage Association ("Ginnie Mae"), a wholly-owned corporate instrumentality of the United States of America within the U.S. Department of Housing and Urban Development, guarantees the timely payment of principal and interest on each Class of Securities. The Ginnie Mae guaranty is backed by the full faith and credit of the United States of America. The Securities are exempt from the registration requirements of the Securities Act of 1933, as amended, and are "exempted securities" within the meaning of the Securities Exchange Act of 1934, as amended. OVERVIEW OF THE SECURITIES AND THE UNDERLYING HECMs The Securities are based on or backed by participation interests in advances made to borrowers and related amounts (each, a "Participation") in respect of a HECM, also commonly referred to as a "reverse mortgage loan," insured by the Federal Housing Administration ("FHA"). Ginnie Mae guarantees the timely payment of principal and interest on the Securities. The Ginnie Mae guaranty is backed by the full faith and credit of the United States of America. The HECMs to which the Participations relate are mortgage loans designed specifically for senior citizens to convert equity in their homes to monthly streams of income or lines of credit. HECMs were originated or acquired by and will be serviced by the parties as set forth herein. No interest or principal is due by the borrower in respect of any HECM until maturity, which generally does not occur until after the occurrence of a Maturity Event. A Maturity Event generally occurs (i) if a borrower dies and the property is not the principal residence of at least one surviving borrower, (ii) a borrower conveys all of his or her title in the mortgaged property and no other borrower retains title to the mortgaged property, (iii) the mortgaged property ceases to be the principal residence of a borrower for reasons other than death and the mortgaged property is not the principal residence of at least one surviving borrower, (iv) a borrower fails to occupy the mortgaged property for a period of longer than 12 consecutive months because of physical or mental illness and the mortgaged property is not the principal residence of at least one other borrower, or (v) the failure by the borrower to perform any of its obligations under the HECM. However, interest accrues on the HECM at the applicable mortgage interest rate and is Date: 10/01/07 2 Appendix IV-31 American LegalNet, Inc. www.FormsWorkflow.com added each month to the outstanding principal balance of the HECM. A borrower may prepay in whole or in part the outstanding balance of a HECM at any time without penalty. See "General Introduction to HECMs" in the Base Prospectus. The Ginnie Mae Issuer is permitted and obligated to purchase (such obligation is referred to hereinafter as a "Mandatory purchase event") all Participations related to a HECM when the outstanding principal amount of the related HECM is equal to or greater than 98% of the "maximum claim amount." Furthermore, a Ginnie Mae Issuer may, at its option, purchase all Participations related to any HECM (such option is referred to hereinafter as a "98% Optional purchase event") to the extent that any borrower's request for an additional advance in respect of any HECM, if funded, together with the outstanding principal amount of the related HECM is equal to or greater than 98% of the "maximum claim amount." The "maximum claim amount" of a HECM is the lesser of the appraised value of the property or the maximum principal amount for a one-unit dwelling that HUD can lawfully insure in respect of forward mortgages in the geographical area as provided in Section 203(b)(2) of the National Housing Act. See "Financial Characteristics of HECMs-- Obligation of Ginnie Mae Issuer to Purchase Participations Related to Mortgage Loans in Limited Circumstances" and "--Optional Purchase of Participations Related to HECMs" in the Base Prospectus. In addition, a Ginnie Mae Issuer may, at its option, purchase all Participations related to a HECM that becomes, and continues to be, due and payable in accordance with its terms (such option is referred to hereinafter as a "Due and payable purchase event," and collectively with the Mandatory purchase event and the 98% Optional purchase event, a "Ginnie Mae Issuer purchase event"). In connection with any Due and payable purchase event or any 98% Optional purchase ev

Related forms

-

Settlement Statement Optional Form For Transactions Without Sellers

Settlement Statement Optional Form For Transactions Without Sellers

Official Federal Forms/US Department Of Housing And Urban Development/ -

Settlement Statement

Settlement Statement

Official Federal Forms/US Department Of Housing And Urban Development/ -

ACH Debit Authorization

ACH Debit Authorization

Official Federal Forms/US Department Of Housing And Urban Development/ -

Advice Of Allotment

Advice Of Allotment

Official Federal Forms/US Department Of Housing And Urban Development/ -

Assignment-Assumption Agreement

Assignment-Assumption Agreement

Official Federal Forms/US Department Of Housing And Urban Development/ -

Assistance Award-Amendment

Assistance Award-Amendment

Official Federal Forms/US Department Of Housing And Urban Development/ -

Selection Roster

Selection Roster

Official Federal Forms/US Department Of Housing And Urban Development/ -

Statement

Statement

Official Federal Forms/US Department Of Housing And Urban Development/ -

Authority For Release Of Information

Authority For Release Of Information

Official Federal Forms/US Department Of Housing And Urban Development/ -

Classified Document Destruction Certificate

Classified Document Destruction Certificate

Official Federal Forms/US Department Of Housing And Urban Development/ -

Correspondence Change Request

Correspondence Change Request

Official Federal Forms/US Department Of Housing And Urban Development/ -

Statement

Statement

Official Federal Forms/US Department Of Housing And Urban Development/ -

Status Report On Actions Promised On GAO Report Recommendations

Status Report On Actions Promised On GAO Report Recommendations

Official Federal Forms/US Department Of Housing And Urban Development/ -

Deposit Agreement

Deposit Agreement

Official Federal Forms/US Department Of Housing And Urban Development/ -

Disposition Report

Disposition Report

Official Federal Forms/US Department Of Housing And Urban Development/ -

Denial Of Reasonable Accomodation Request

Denial Of Reasonable Accomodation Request

Official Federal Forms/US Department Of Housing And Urban Development/ -

Document Control Register

Document Control Register

Official Federal Forms/US Department Of Housing And Urban Development/ -

Document Control Register

Document Control Register

Official Federal Forms/US Department Of Housing And Urban Development/ -

Excess Records Files And Publications Clean-Up Report

Excess Records Files And Publications Clean-Up Report

Official Federal Forms/US Department Of Housing And Urban Development/ -

Field Issue Resolution System Input Record

Field Issue Resolution System Input Record

Official Federal Forms/US Department Of Housing And Urban Development/ -

Grant Award-Amendment

Grant Award-Amendment

Official Federal Forms/US Department Of Housing And Urban Development/ -

Classified Document Receipt

Classified Document Receipt

Official Federal Forms/US Department Of Housing And Urban Development/ -

Liquidation Schedule (GNMA)

Liquidation Schedule (GNMA)

Official Federal Forms/US Department Of Housing And Urban Development/ -

Articles Of Incorporation Of Association

Articles Of Incorporation Of Association

Official Federal Forms/US Department Of Housing And Urban Development/ -

Residual Receipts Note Nonprofit Mortgagors

Residual Receipts Note Nonprofit Mortgagors

Official Federal Forms/US Department Of Housing And Urban Development/ -

Cash Receipt Voucher

Cash Receipt Voucher

Official Federal Forms/US Department Of Housing And Urban Development/ -

Chronology Of Actions

Chronology Of Actions

Official Federal Forms/US Department Of Housing And Urban Development/ -

Clearance Log

Clearance Log

Official Federal Forms/US Department Of Housing And Urban Development/ -

FHA Legal Requirements For Closing

FHA Legal Requirements For Closing

Official Federal Forms/US Department Of Housing And Urban Development/ -

By-Laws Of Association

By-Laws Of Association

Official Federal Forms/US Department Of Housing And Urban Development/ -

Request For Permission To Commence Construction Prior To Initial Endorsement

Request For Permission To Commence Construction Prior To Initial Endorsement

Official Federal Forms/US Department Of Housing And Urban Development/ -

Travel Voucher Attachment

Travel Voucher Attachment

Official Federal Forms/US Department Of Housing And Urban Development/ -

Regional Fund Assignment

Regional Fund Assignment

Official Federal Forms/US Department Of Housing And Urban Development/ -

Loan Contract And Trust Agreement (Low-And Moderate-Income Sponsor Assistance)

Loan Contract And Trust Agreement (Low-And Moderate-Income Sponsor Assistance)

Official Federal Forms/US Department Of Housing And Urban Development/ -

Record Of Imprest Fund Emergency Salary Payment

Record Of Imprest Fund Emergency Salary Payment

Official Federal Forms/US Department Of Housing And Urban Development/ -

Record Of Employee Interview

Record Of Employee Interview

Official Federal Forms/US Department Of Housing And Urban Development/ -

Bond Guaranteeing Sponsors Performance

Bond Guaranteeing Sponsors Performance

Official Federal Forms/US Department Of Housing And Urban Development/ -

Overtime Authorization

Overtime Authorization

Official Federal Forms/US Department Of Housing And Urban Development/ -

Newly Insured Case Binder Shipping List

Newly Insured Case Binder Shipping List

Official Federal Forms/US Department Of Housing And Urban Development/ -

Record Of Clearances

Record Of Clearances

Official Federal Forms/US Department Of Housing And Urban Development/ -

Report Of Investigation

Report Of Investigation

Official Federal Forms/US Department Of Housing And Urban Development/ -

Miscellaneous Disbursement Voucher

Miscellaneous Disbursement Voucher

Official Federal Forms/US Department Of Housing And Urban Development/ -

Accomodation Request For Persons With Disabilites

Accomodation Request For Persons With Disabilites

Official Federal Forms/US Department Of Housing And Urban Development/ -

Model Form Mortgagees Title Evidence

Model Form Mortgagees Title Evidence

Official Federal Forms/US Department Of Housing And Urban Development/ -

Mortgagors Oath

Mortgagors Oath

Official Federal Forms/US Department Of Housing And Urban Development/ -

Multifamily Insurance Benefit Claim (Payment Information Treasury Financial Communication System)

Multifamily Insurance Benefit Claim (Payment Information Treasury Financial Communication System)

Official Federal Forms/US Department Of Housing And Urban Development/ -

Project Mortgage Servicing Control Record

Project Mortgage Servicing Control Record

Official Federal Forms/US Department Of Housing And Urban Development/ -

Property Insurance Requirements

Property Insurance Requirements

Official Federal Forms/US Department Of Housing And Urban Development/ -

Personal Undertaking

Personal Undertaking

Official Federal Forms/US Department Of Housing And Urban Development/ -

Off-Site Bond

Off-Site Bond

Official Federal Forms/US Department Of Housing And Urban Development/ -

Receipt

Receipt

Official Federal Forms/US Department Of Housing And Urban Development/ -

Regulatory Agreement For Non Profit And Public Mortgagors

Regulatory Agreement For Non Profit And Public Mortgagors

Official Federal Forms/US Department Of Housing And Urban Development/ -

Requisition For Supplies Equipment Forms Publications And Procurement

Requisition For Supplies Equipment Forms Publications And Procurement

Official Federal Forms/US Department Of Housing And Urban Development/ -

Request For Endorsement Of Credit Instrument Certificate Of Mortgagee Mortgagor

Request For Endorsement Of Credit Instrument Certificate Of Mortgagee Mortgagor

Official Federal Forms/US Department Of Housing And Urban Development/ -

Good Faith Estimate

Good Faith Estimate

Official Federal Forms/US Department Of Housing And Urban Development/ -

Corporate Guaranty Agreement

Corporate Guaranty Agreement

Official Federal Forms/US Department Of Housing And Urban Development/ -

Time Limit And Mentoring Agreement

Time Limit And Mentoring Agreement

Official Federal Forms/US Department Of Housing And Urban Development/ -

Custodians Certification For Construction Securities

Custodians Certification For Construction Securities

Official Federal Forms/US Department Of Housing And Urban Development/ -

Graduated Payment Mortgage Or Growing Mortgage Pool Or Loan Package Composition

Graduated Payment Mortgage Or Growing Mortgage Pool Or Loan Package Composition

Official Federal Forms/US Department Of Housing And Urban Development/ -

Issuers Monthly Summary Report

Issuers Monthly Summary Report

Official Federal Forms/US Department Of Housing And Urban Development/ -

Prospectus GNMA I Single-Family Mortgages

Prospectus GNMA I Single-Family Mortgages

Official Federal Forms/US Department Of Housing And Urban Development/ -

Prospectus GNMA II Growing Equity Mortgages

Prospectus GNMA II Growing Equity Mortgages

Official Federal Forms/US Department Of Housing And Urban Development/ -

Prospectus GNMA I

Prospectus GNMA I

Official Federal Forms/US Department Of Housing And Urban Development/ -

Issuers Monthly Accounting Report (GNMA Mortgage-Backed Securities Program)

Issuers Monthly Accounting Report (GNMA Mortgage-Backed Securities Program)

Official Federal Forms/US Department Of Housing And Urban Development/ -

IPIA Request For Labels (Order Control)

IPIA Request For Labels (Order Control)

Official Federal Forms/US Department Of Housing And Urban Development/ -

Projected Pool Report (Guaranty Program-GNMA Mortgage-Backed Securities)

Projected Pool Report (Guaranty Program-GNMA Mortgage-Backed Securities)

Official Federal Forms/US Department Of Housing And Urban Development/ -

Prospectus GNMA II

Prospectus GNMA II

Official Federal Forms/US Department Of Housing And Urban Development/ -

Issuers Monthly Serial Notes Accounting Schedule (GNMA Mortgage-Backed Securities Program)

Issuers Monthly Serial Notes Accounting Schedule (GNMA Mortgage-Backed Securities Program)

Official Federal Forms/US Department Of Housing And Urban Development/ -

Prospectus GNMA I

Prospectus GNMA I

Official Federal Forms/US Department Of Housing And Urban Development/ -

Prospectus Supplemental To Ginnie Mae II Home Equity Conversion Mortgage-Backed-Securities

Prospectus Supplemental To Ginnie Mae II Home Equity Conversion Mortgage-Backed-Securities

Official Federal Forms/US Department Of Housing And Urban Development/ -

Prospectus Supplement-Ginnie Mae II Home Equity Conversion Mortgage-Backed Securities

Prospectus Supplement-Ginnie Mae II Home Equity Conversion Mortgage-Backed Securities

Official Federal Forms/US Department Of Housing And Urban Development/ -

Reasonable Accommodation Information Reporting Form

Reasonable Accommodation Information Reporting Form

Official Federal Forms/US Department Of Housing And Urban Development/ -

Issuers Monthly Remittance Advice

Issuers Monthly Remittance Advice

Official Federal Forms/US Department Of Housing And Urban Development/ -

Prospectus GNMA I Construction And Loan Securities

Prospectus GNMA I Construction And Loan Securities

Official Federal Forms/US Department Of Housing And Urban Development/ -

Issuers Monthly Serial Note Remittance Advice

Issuers Monthly Serial Note Remittance Advice

Official Federal Forms/US Department Of Housing And Urban Development/ -

Prospectus GNMA I Graduated Payment Mortgages

Prospectus GNMA I Graduated Payment Mortgages

Official Federal Forms/US Department Of Housing And Urban Development/ -

Prospectus GNMA I Growing Equity Mortgages

Prospectus GNMA I Growing Equity Mortgages

Official Federal Forms/US Department Of Housing And Urban Development/ -

Certificate Of Sanitization (HUD Only)

Certificate Of Sanitization (HUD Only)

Official Federal Forms/US Department Of Housing And Urban Development/ -

HUD Records Destruction Form (Housing)

HUD Records Destruction Form (Housing)

Official Federal Forms/US Department Of Housing And Urban Development/ -

Certification And Agreement

Certification And Agreement

Official Federal Forms/US Department Of Housing And Urban Development/ -

Release Of Security Interest

Release Of Security Interest

Official Federal Forms/US Department Of Housing And Urban Development/ -

Multifamily Insurance Benefit Claim

Multifamily Insurance Benefit Claim

Official Federal Forms/US Department Of Housing And Urban Development/ -

Prospectus GNMA II Adjustable Rate Mortgages

Prospectus GNMA II Adjustable Rate Mortgages

Official Federal Forms/US Department Of Housing And Urban Development/ -

Prospectus GNMA II Single-Family Mortgages

Prospectus GNMA II Single-Family Mortgages

Official Federal Forms/US Department Of Housing And Urban Development/ -

Request For Release Of Documents

Request For Release Of Documents

Official Federal Forms/US Department Of Housing And Urban Development/

Form Preview

Contact Us

Success: Your message was sent.

Thank you!