Last updated: 3/15/2016

Tax Information Designation And Power Of Attorney For Representation {DR 0145}

Start Your Free Trial $ 15.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

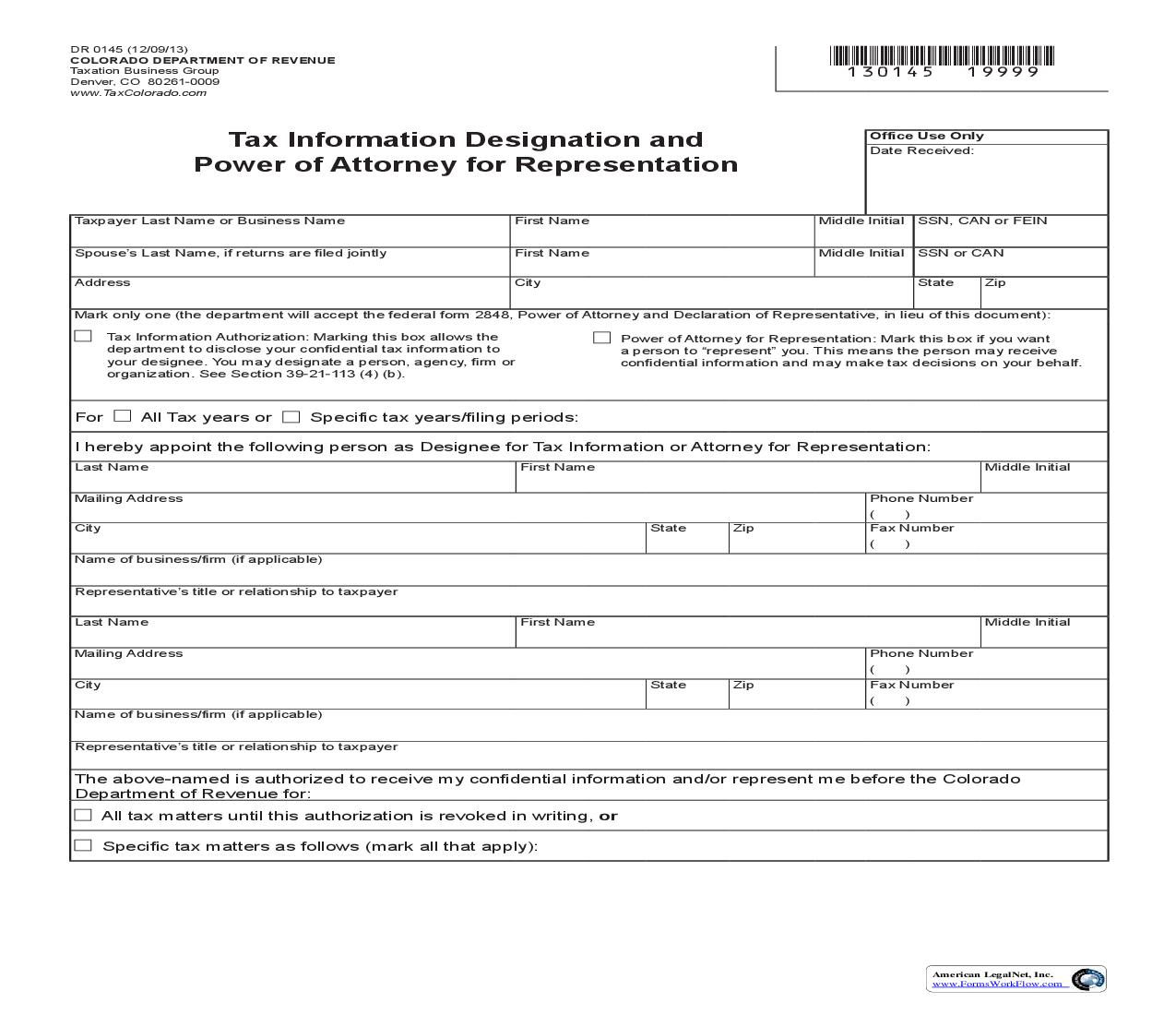

DR 0145 (12/09/13) COLORADO DEPARTMENT OF REVENUE Taxation Business Group Denver, CO 80261-0009 www.TaxColorado.com *130145==19999* Tax Information Designation and Power of Attorney for Representation Taxpayer Last Name or Business Name Spouse's Last Name, if returns are filed jointly Address First Name First Name City Office Use Only Date Received: Middle Initial SSN, CAN or FEIN Middle Initial SSN or CAN State Zip Mark only one (the department will accept the federal form 2848, Power of Attorney and Declaration of Representative, in lieu of this document): Tax Information Authorization: Marking this box allows the department to disclose your confidential tax information to your designee. You may designate a person, agency, firm or organization. See Section 39-21-113 (4) (b). Power of Attorney for Representation: Mark this box if you want a person to "represent" you. This means the person may receive confidential information and may make tax decisions on your behalf. For All Tax years or Specific tax years/filing periods: I hereby appoint the following person as Designee for Tax Information or Attorney for Representation: Last Name Mailing Address City Name of business/firm (if applicable) Representative's title or relationship to taxpayer Last Name Mailing Address City Name of business/firm (if applicable) Representative's title or relationship to taxpayer State Zip First Name Phone Number ( ) Fax Number ( ) Middle Initial State Zip First Name Phone Number ( ) Fax Number ( ) Middle Initial The above-named is authorized to receive my confidential information and/or represent me before the Colorado Department of Revenue for: All tax matters until this authorization is revoked in writing, or Specific tax matters as follows (mark all that apply): American LegalNet, Inc. www.FormsWorkFlow.com *130145==29999* State Sales Tax State Consumer Use Tax Individual Income Tax Corporate Income Tax Fiduciary Income Tax If other, please explain Period (MM/DD/YY-MM/DD/YY) Partnership Income Tax Withholding Income Tax All DepartmentAdministered Sales Taxes All DepartmentAdministered Consumer Use Taxes Other tax (specify) Period (MM/DD/YY-MM/DD/YY) Period (MM/DD/YY-MM/DD/YY) Period (MM/DD/YY-MM/DD/YY) Period (MM/DD/YY-MM/DD/YY) Period (MM/DD/YY-MM/DD/YY) Period (MM/DD/YY-MM/DD/YY) Period (MM/DD/YY-MM/DD/YY) Period (MM/DD/YY-MM/DD/YY) Period (MM/DD/YY-MM/DD/YY) Signature of Taxpayer(s) I acknowledge the following provision: Actions taken by a Power of Attorney representative are binding, even if the representative is not an attorney. Proceedings cannot later be declared legally defective because the representative was not an attorney. Corporate officers, partners, fiduciaries, or other qualified persons signing on behalf of the taxpayer(s): I am authorized to sign this form on behalf of the entity or person identified above as the taxpayer because: · I am the taxpayer · The taxpayer is a corporation, and I am the corporate officer · The taxpayer is a partnership, and I am a partner · The taxpayer is a trust, and I am the trustee · The taxpayer is a decedent's estate, and I am the estate administrator · The taxpayer is a receivership, and I am the receiver · Other (if none of the above, then explain what representative capacity you have for the taxpayer) If a tax matter concerns a joint return, both spouses must sign if joint representation is requested. Taxpayers filing jointly may authorize separate representatives. Signature Title (if applicable) Spouse Signature (if joint representation) Print Name Print Name Date (MM/DD/YY) Daytime telephone number ( ) Date (MM/DD/YY) Declaration of Representative -- I am authorized to represent the taxpayer(s) identified above for the tax matter(s) specified. Signature Date (MM/DD/YY) Title Note: This authorization form automatically revokes and replaces all earlier tax information designations and/or earlier powers of attorney for representation on file with the Colorado Department of Revenue for the same tax matters and years or periods covered by this form. Attach a copy of any other tax information authorization or power of attorney you want to remain in effect. If you do not want to revoke a prior authorization, taxpayer sign here Spouse signature if returns are filed jointly Please complete the following, if known (for routing purposes only). Otherwise, you may mail this document or submit an electronically scanned copy of the document through Revenue Online, www.Colorado.gov/RevenueOnline Revenue Employee Division Telephone Number ( ) Section Fax Number ( ) Send to: Colorado Department of Revenue Denver, CO 80261-0009 If this tax information authorization or power of attorney form is not signed, it will be returned. American LegalNet, Inc. www.FormsWorkFlow.com Instructions for DR 0145 This form is used for two purposes: Tax information disclosure authorization. You authorize the department to disclose your confidential tax information to another person. This person will not receive original notices we send to you. Power of attorney for representation. You authorize another person to represent you and act on your behalf. The person must meet the qualifications listed here. Unless you specify differently, this person will have full power to do all things you might do, with as much binding effect, including, but not limited to: providing information; preparing, signing, executing, filing, and inspecting returns and reports; and executing statute of limitation extensions and closing agreements. SSN: Social Security Number CAN: Colorado Account Number FEIN: Federal Employer Identification Number This form is effective on the date signed. Authorization terminates when the department receives written revocation notice or a new form is executed (unless the space provided on the front is initialed indicating that prior forms are still valid). If this tax information designation and power of attorney for representation form is used for taxpayers on a joint return, both the primary taxpayer and spouse must sign this form. Unless the appointed representative has a fiduciary relationship to the taxpayer (for example, personal representative, trustee, guardian, conservator), an original Notice of Deficiency will be mailed to the taxpayer as required by law. A copy will be provided to the appointed representative when requested. For corporations, "taxpayer" as used on this form, must be the corporation that is subject to Colorado tax. List fi