Last updated: 3/20/2017

Nonresident Partner Shareholder Or Member Agreement {DR 0107}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

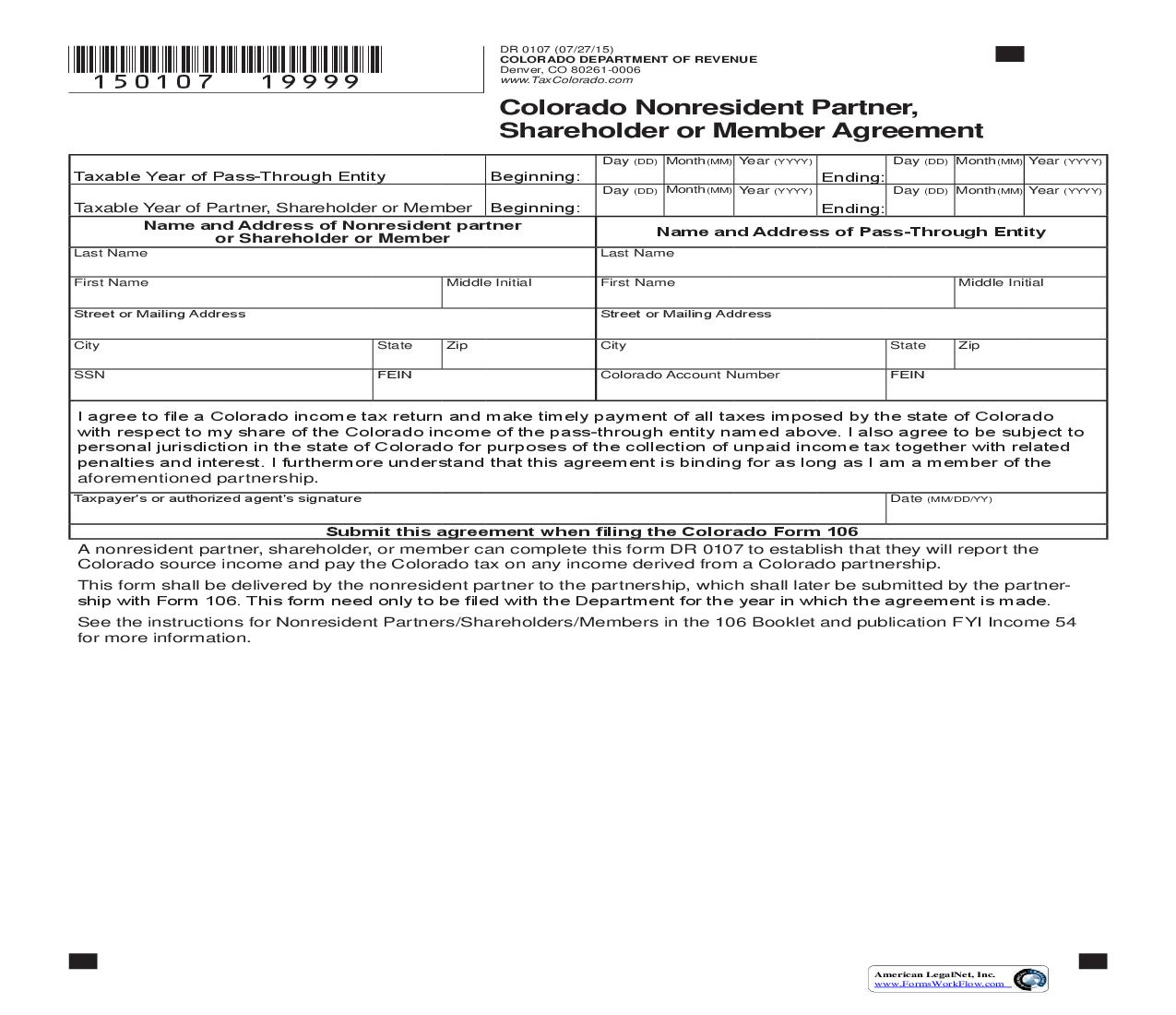

*150107==19999* DR 0107 (07/27/15) COLORADO DEPARTMENT OF REVENUE Denver, CO 80261-0006 www.TaxColorado.com Colorado Nonresident Partner, Shareholder or Member Agreement Day (DD) Month (MM) Year (YYYY) Day (DD) Month (MM) Year (YYYY) Taxable Year of Pass-Through Entity Beginning: Day (DD) Month (MM) Year (YYYY) Ending: Day (DD) Month (MM) Year (YYYY) Taxable Year of Partner, Shareholder or Member Beginning: Name and Address of Nonresident partner or Shareholder or Member Last Name First Name Street or Mailing Address City SSN State FEIN Zip Middle Initial Ending: Name and Address of Pass-Through Entity Last Name First Name Street or Mailing Address City Colorado Account Number State FEIN Zip Middle Initial I agree to file a Colorado income tax return and make timely payment of all taxes imposed by the state of Colorado with respect to my share of the Colorado income of the pass-through entity named above. I also agree to be subject to personal jurisdiction in the state of Colorado for purposes of the collection of unpaid income tax together with related penalties and interest. I furthermore understand that this agreement is binding for as long as I am a member of the aforementioned partnership. Taxpayer's or authorized agent's signature Date (MM/DD/YY) Submit this agreement when filing the Colorado Form 106 A nonresident partner, shareholder, or member can complete this form DR 0107 to establish that they will report the Colorado source income and pay the Colorado tax on any income derived from a Colorado partnership. This form shall be delivered by the nonresident partner to the partnership, which shall later be submitted by the partnership with Form 106. This form need only to be filed with the Department for the year in which the agreement is made. See the instructions for Nonresident Partners/Shareholders/Members in the 106 Booklet and publication FYI Income 54 for more information. American LegalNet, Inc. www.FormsWorkFlow.com