Last updated: 3/30/2016

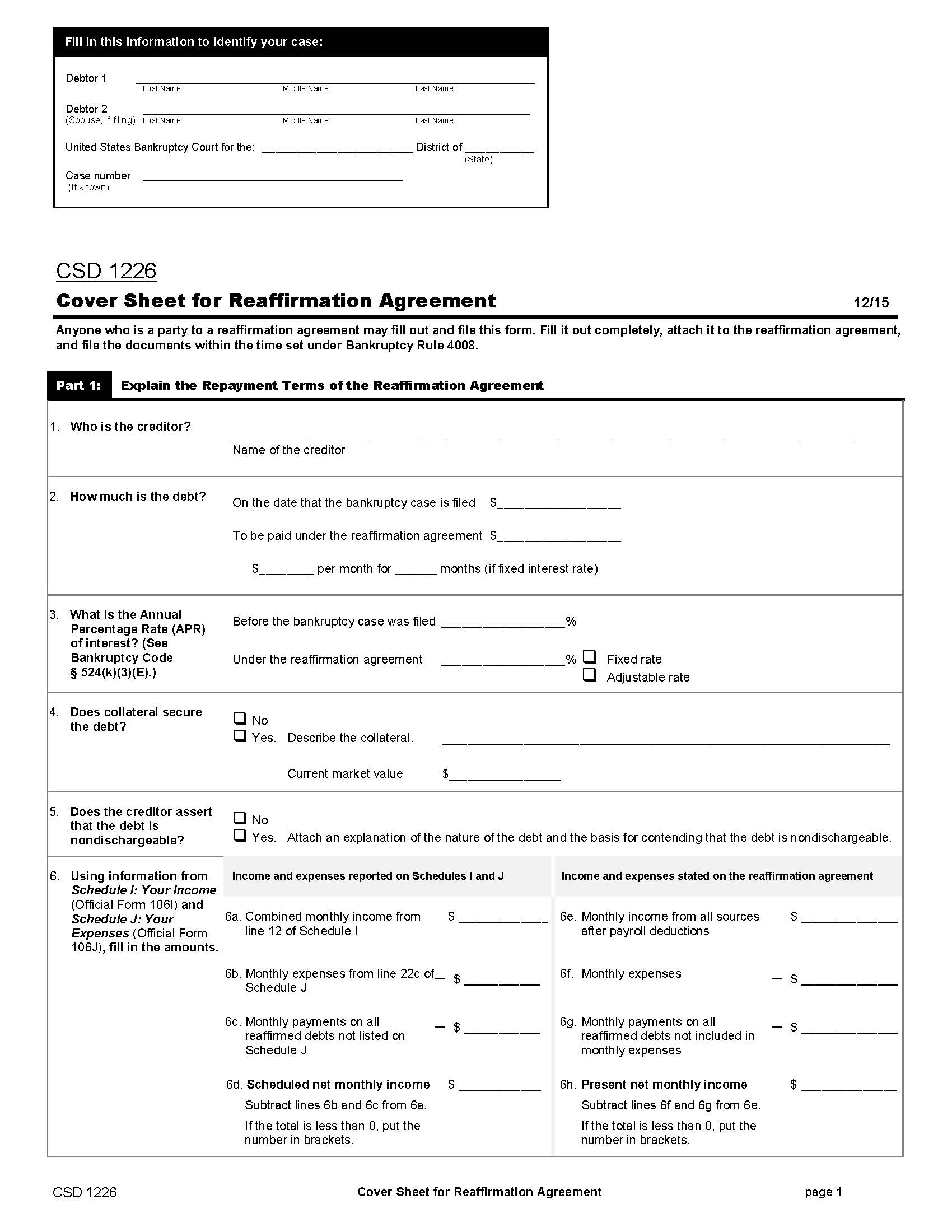

Reaffirmation Agreement Cover Sheet {CSD 1226}

Start Your Free Trial $ 29.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

CSD 1226, COVER SHEET FOR REAFFIRMATION AGREEMENT and REAFFIRMATION AGREEMENT, Reaffirming a debt is a serious financial decision. The law requires you to take certain steps to make sure the decision is in your best interest. If these steps are not completed, the reaffirmation agreement is not effective, even though you have signed it. 1. Read the disclosures in this Part A carefully. Consider the decision to reaffirm carefully. Then, if you want to reaffirm, sign the reaffirmation agreement in Part B (or you may use a separate agreement you and your creditor agree on). 2. Complete and sign Part D and be sure you can afford to make the payments you are agreeing to make and have received a copy of the disclosure statement and a completed and signed reaffirmation agreement. 3. f you were represented by an attorney during the negotiation of your reaffirmation agreement, the attorney must have signed the certification in Part C. 4. f you were not represented by an attorney during the negotiation of your reaffirmation agreement, you must have completed and signed Part E. 5. The original of this disclosure must be filed with the court by you or your creditor. If a separate reaffirmation agreement (other than the one in Part B) has been signed, it must be attached. 6. If the creditor is not a Credit Union and you were represented by an attorney during the negotiation of your reaffirmation agreement, your reaffirmation agreement becomes effective upon filing with the court unless the reaffirmation is presumed to be an undue hardship as explained in Part D. If the creditor is a Credit Union and you were represented by an attorney during the negotiation of your reaffirmation agreement, your reaffirmation agreement becomes effective upon filing with the court. 7. If you were not represented by an attorney during the negotiation of your reaffirmation agreement, it will not be effective unless the court approves it. The court will notify you and the creditor of the hearing on your reaffirmation agreement. You must attend this hearing in bankruptcy court where the judge will review your reaffirmation agreement. The bankruptcy court must approve your reaffirmation agreement as consistent with your best interests, except that no court approval is required if your reaffirmation agreement is for a consumer debt secured by a mortgage, deed of trust, security deed, or other lien on your real property, like your home. www.FormsWorkflow.com

Related forms

-

Application By Trustee Debtor-In-Possession To Defer Payment Of Fee For Filing Complaint

Application By Trustee Debtor-In-Possession To Defer Payment Of Fee For Filing Complaint

California/Federal/USBC Southern/General/ -

Application By Trustee To Defer Payment Of Fee For Motion To Reopen Case

Application By Trustee To Defer Payment Of Fee For Motion To Reopen Case

California/Federal/USBC Southern/General/ -

Application By Trustee To Pay Expenses Without Notice To Creditors

Application By Trustee To Pay Expenses Without Notice To Creditors

California/Federal/USBC Southern/General/ -

Application For The Appointment Of An Appraiser

Application For The Appointment Of An Appraiser

California/Federal/USBC Southern/General/ -

Application To Employ Auctioneer

Application To Employ Auctioneer

California/Federal/USBC Southern/General/ -

Appraisers Application For Compensation And Reimbursement Of Expenses

Appraisers Application For Compensation And Reimbursement Of Expenses

California/Federal/USBC Southern/General/ -

Caption For Adversary Proceedings

Caption For Adversary Proceedings

California/Federal/USBC Southern/General/ -

Caption For Bankruptcy Cases

Caption For Bankruptcy Cases

California/Federal/USBC Southern/General/ -

Case Questionnaire In Connection With Mediation Procedure

Case Questionnaire In Connection With Mediation Procedure

California/Federal/USBC Southern/General/ -

Declaration By Attorney Representation General Partners Filing Voluntary Petition

Declaration By Attorney Representation General Partners Filing Voluntary Petition

California/Federal/USBC Southern/General/ -

Declaration Re Electronic Filing Of Petition Schedules And Statements

Declaration Re Electronic Filing Of Petition Schedules And Statements

California/Federal/USBC Southern/General/ -

Documents Required For Processing An Application For Unclaimed Funds

Documents Required For Processing An Application For Unclaimed Funds

California/Federal/USBC Southern/General/ -

Excerpts From Local Bankruptcy Rules Specifically Relating To Relief From Stay Motions

Excerpts From Local Bankruptcy Rules Specifically Relating To Relief From Stay Motions

California/Federal/USBC Southern/General/ -

Fee Application Summary - Exhibit A

Fee Application Summary - Exhibit A

California/Federal/USBC Southern/General/ -

Judgment By Default Disallowing Claim Of Exemptions

Judgment By Default Disallowing Claim Of Exemptions

California/Federal/USBC Southern/General/ -

Judgment By Default

Judgment By Default

California/Federal/USBC Southern/General/ -

List Of Exhibits Submitted By Attorney

List Of Exhibits Submitted By Attorney

California/Federal/USBC Southern/General/ -

Memorandum Request For Production Of Claims Register

Memorandum Request For Production Of Claims Register

California/Federal/USBC Southern/General/ -

Memorandum Request To Set Claims Bar Date-Chapter 7 Cases Only

Memorandum Request To Set Claims Bar Date-Chapter 7 Cases Only

California/Federal/USBC Southern/General/ -

Motion For Relief From Automatic Stay - Real And Personal Property

Motion For Relief From Automatic Stay - Real And Personal Property

California/Federal/USBC Southern/General/ -

Motion For Relief From Automatic Stay Unlawful Detainer

Motion For Relief From Automatic Stay Unlawful Detainer

California/Federal/USBC Southern/General/ -

Notice Of Change Of Address

Notice Of Change Of Address

California/Federal/USBC Southern/General/ -

Notice Of Related Case

Notice Of Related Case

California/Federal/USBC Southern/General/ -

Opposition To Motion For Relief From Automatic Stay

Opposition To Motion For Relief From Automatic Stay

California/Federal/USBC Southern/General/ -

Order Appointing Appraiser

Order Appointing Appraiser

California/Federal/USBC Southern/General/ -

Order Appointing Auctioneer

Order Appointing Auctioneer

California/Federal/USBC Southern/General/ -

Order Appointing Mediator And Assignment To Mediation

Order Appointing Mediator And Assignment To Mediation

California/Federal/USBC Southern/General/ -

Order Approving Interim Final Application For Compensation And Reimbursement Of Expenses

Order Approving Interim Final Application For Compensation And Reimbursement Of Expenses

California/Federal/USBC Southern/General/ -

Order Converting Case Under Chap 13 To Case Under Chap 7 On Motion By A Party In Interest

Order Converting Case Under Chap 13 To Case Under Chap 7 On Motion By A Party In Interest

California/Federal/USBC Southern/General/ -

Order Converting Case Under Chapter 11 To Case Under Chapter 12

Order Converting Case Under Chapter 11 To Case Under Chapter 12

California/Federal/USBC Southern/General/ -

Order Converting Case Under Chapter 7 To Case Under Chapter 12

Order Converting Case Under Chapter 7 To Case Under Chapter 12

California/Federal/USBC Southern/General/ -

Order Converting Case Under Chapter 7 To Case Under Chapter 13

Order Converting Case Under Chapter 7 To Case Under Chapter 13

California/Federal/USBC Southern/General/ -

Order Converting Chapter 11 Case To Case Under Chapter 7

Order Converting Chapter 11 Case To Case Under Chapter 7

California/Federal/USBC Southern/General/ -

Order Dismissing Chapter 13 Case After Hearing

Order Dismissing Chapter 13 Case After Hearing

California/Federal/USBC Southern/General/ -

Order For Compensation Of Appraiser

Order For Compensation Of Appraiser

California/Federal/USBC Southern/General/ -

Order For Compensation Of Auctioneer

Order For Compensation Of Auctioneer

California/Federal/USBC Southern/General/ -

Order On Noncontested Motion Dismissing Chapter 13 Case

Order On Noncontested Motion Dismissing Chapter 13 Case

California/Federal/USBC Southern/General/ -

Order On Noncontested Motion For Relief From Automatic Stay Real and Personal Property

Order On Noncontested Motion For Relief From Automatic Stay Real and Personal Property

California/Federal/USBC Southern/General/ -

Order On Noncontested Motion For Relief From Automatic Stay Unlawful Detainer

Order On Noncontested Motion For Relief From Automatic Stay Unlawful Detainer

California/Federal/USBC Southern/General/ -

Order Upon Conversion Of Case Under Chap 12 To Case Under Chap 7 By Debtor

Order Upon Conversion Of Case Under Chap 12 To Case Under Chap 7 By Debtor

California/Federal/USBC Southern/General/ -

Praecipe

Praecipe

California/Federal/USBC Southern/General/ -

Pre Trial Order

Pre Trial Order

California/Federal/USBC Southern/General/ -

Proof Of Right To Payment Of Dividend From Unclaimed Funds

Proof Of Right To Payment Of Dividend From Unclaimed Funds

California/Federal/USBC Southern/General/ -

Report Of Abandonment Of Real Property

Report Of Abandonment Of Real Property

California/Federal/USBC Southern/General/ -

Report Of Sale

Report Of Sale

California/Federal/USBC Southern/General/ -

Request By Trustee For Copywork And Certification Without Prepayment Of Fees

Request By Trustee For Copywork And Certification Without Prepayment Of Fees

California/Federal/USBC Southern/General/ -

Request For Extension Of Time To Produce Transcript On Appeal And Order Thereon

Request For Extension Of Time To Produce Transcript On Appeal And Order Thereon

California/Federal/USBC Southern/General/ -

Request For Issuance Of Writ Of Attachment

Request For Issuance Of Writ Of Attachment

California/Federal/USBC Southern/General/ -

Request For Production Of Transcript On Appeal

Request For Production Of Transcript On Appeal

California/Federal/USBC Southern/General/ -

Request For Services Or Equipment For Participants With Communications Disabilities

Request For Services Or Equipment For Participants With Communications Disabilities

California/Federal/USBC Southern/General/ -

Request For Special Charges By Chapter 11 Plan Proponent

Request For Special Charges By Chapter 11 Plan Proponent

California/Federal/USBC Southern/General/ -

Request For Special Charges By Trustee

Request For Special Charges By Trustee

California/Federal/USBC Southern/General/ -

Request To Review Copy Files By Authorized Copy Service

Request To Review Copy Files By Authorized Copy Service

California/Federal/USBC Southern/General/ -

Roster Of State And Federal Agencies

Roster Of State And Federal Agencies

California/Federal/USBC Southern/General/ -

Summary Of Balloting On Chapter 11 Plan

Summary Of Balloting On Chapter 11 Plan

California/Federal/USBC Southern/General/ -

Trustees Application For Immediate Private Sale Without Notice

Trustees Application For Immediate Private Sale Without Notice

California/Federal/USBC Southern/General/ -

Trustees Interim Report Number

Trustees Interim Report Number

California/Federal/USBC Southern/General/ -

Trustees Report Of No Distribution

Trustees Report Of No Distribution

California/Federal/USBC Southern/General/ -

Order On (Template For Adversaries)

Order On (Template For Adversaries)

California/Federal/USBC Southern/General/ -

Order On (Template For Cases)

Order On (Template For Cases)

California/Federal/USBC Southern/General/ -

Order On (Lodged Template For Cases)

Order On (Lodged Template For Cases)

California/Federal/USBC Southern/General/ -

Order On (Lodged Template For Adversaries)

Order On (Lodged Template For Adversaries)

California/Federal/USBC Southern/General/ -

Case Questionnaire In Connection With Mediation Procedure

Case Questionnaire In Connection With Mediation Procedure

California/Federal/USBC Southern/General/ -

Exemplification Certificate

Exemplification Certificate

California/Federal/USBC Southern/General/ -

Declaration Re Filing Of Petition Schedules And Statements On Diskette

Declaration Re Filing Of Petition Schedules And Statements On Diskette

California/Federal/USBC Southern/General/ -

Application For Order To Appear For Examination

Application For Order To Appear For Examination

California/Federal/USBC Southern/General/ -

Order Approving Trustees Application To Pay Expenses Without Notice To Creditors

Order Approving Trustees Application To Pay Expenses Without Notice To Creditors

California/Federal/USBC Southern/General/ -

Order Template For Relief From Stay

Order Template For Relief From Stay

California/Federal/USBC Southern/General/ -

Order Shortening Time For Hearing On (Template For Adversaries)

Order Shortening Time For Hearing On (Template For Adversaries)

California/Federal/USBC Southern/General/ -

Order Shortening Time For Hearing For Relief From Stay

Order Shortening Time For Hearing For Relief From Stay

California/Federal/USBC Southern/General/ -

Findings Of Fact And Conclusions Of Law Re (Lodged Template For Adversaries)

Findings Of Fact And Conclusions Of Law Re (Lodged Template For Adversaries)

California/Federal/USBC Southern/General/ -

Findings Of Fact And Conclusion Of Law (Lodged) For Relief From Stay

Findings Of Fact And Conclusion Of Law (Lodged) For Relief From Stay

California/Federal/USBC Southern/General/ -

Findings Of Fact And Conclusions Of Law Re (Template For Adversaries)

Findings Of Fact And Conclusions Of Law Re (Template For Adversaries)

California/Federal/USBC Southern/General/ -

Findings Of Fact And Conclusions Of Law Re (Template For Cases)

Findings Of Fact And Conclusions Of Law Re (Template For Cases)

California/Federal/USBC Southern/General/ -

Findings Of Fact And Conclusion Of Law For Relief From Stay

Findings Of Fact And Conclusion Of Law For Relief From Stay

California/Federal/USBC Southern/General/ -

Order To Appear For Examination

Order To Appear For Examination

California/Federal/USBC Southern/General/ -

Exhibit A (To CSD 1181 Required With Fee Notices)

Exhibit A (To CSD 1181 Required With Fee Notices)

California/Federal/USBC Southern/General/ -

Final Decree

Final Decree

California/Federal/USBC Southern/General/ -

Finding Of Fact And Conclusions Of Law Re (Lodged Template For Cases)

Finding Of Fact And Conclusions Of Law Re (Lodged Template For Cases)

California/Federal/USBC Southern/General/ -

Order Shortening Time For Hearing On (Template For Cases)

Order Shortening Time For Hearing On (Template For Cases)

California/Federal/USBC Southern/General/ -

Trustees Notice Of Intent To Distribute Estate

Trustees Notice Of Intent To Distribute Estate

California/Federal/USBC Southern/General/ -

Application For Release Of Rent Deposit Pursuant To 11 USC 362(I)

Application For Release Of Rent Deposit Pursuant To 11 USC 362(I)

California/Federal/USBC Southern/General/ -

Mediators Certificate Of Compliance (Relief From Stay Motions)

Mediators Certificate Of Compliance (Relief From Stay Motions)

California/Federal/USBC Southern/General/ -

Notice Of Hearing And Motion On Agreement To Reaffirm A Debt

Notice Of Hearing And Motion On Agreement To Reaffirm A Debt

California/Federal/USBC Southern/General/ -

Notice Of Failure To Comply With Filing Requirements

Notice Of Failure To Comply With Filing Requirements

California/Federal/USBC Southern/General/ -

Statement Of Social Security Number (California Southern District)

Statement Of Social Security Number (California Southern District)

California/Federal/USBC Southern/General/ -

Order Converting Case Under Chapter 7 To Case Under Chapter 11

Order Converting Case Under Chapter 7 To Case Under Chapter 11

California/Federal/USBC Southern/General/ -

Application For Compensation And Confirmation Of Chapter 13 Plan

Application For Compensation And Confirmation Of Chapter 13 Plan

California/Federal/USBC Southern/General/ -

Application For Confirmation Of Chapter 13 Plan And Order Thereon

Application For Confirmation Of Chapter 13 Plan And Order Thereon

California/Federal/USBC Southern/General/ -

Order On Motion For Exemption Re Credit Counseling

Order On Motion For Exemption Re Credit Counseling

California/Federal/USBC Southern/General/ -

Post Confirmation Order Modifying Chapter 13 Plan

Post Confirmation Order Modifying Chapter 13 Plan

California/Federal/USBC Southern/General/ -

Debtors Motion To Value Real Property

Debtors Motion To Value Real Property

California/Federal/USBC Southern/General/ -

Order Granting Debtors Motion To Value Real Property

Order Granting Debtors Motion To Value Real Property

California/Federal/USBC Southern/General/ -

Reaffirmation Agreement Cover Sheet

Reaffirmation Agreement Cover Sheet

California/Federal/USBC Southern/General/ -

Rights And Responsibilities Of Chapter 7 Debtors And Their Attorney

Rights And Responsibilities Of Chapter 7 Debtors And Their Attorney

California/Federal/USBC Southern/General/ -

Substitution Of Attorney And Order Thereon

Substitution Of Attorney And Order Thereon

California/Federal/USBC Southern/General/ -

Supplement To Schedule I And-Or J

Supplement To Schedule I And-Or J

California/Federal/USBC Southern/General/ -

Chapter 11 Individual Combined Plan Of Reorganization And Disclosure Statemen

Chapter 11 Individual Combined Plan Of Reorganization And Disclosure Statemen

California/Federal/USBC Southern/General/ -

Final Decree In Individual Chapter 11 Case

Final Decree In Individual Chapter 11 Case

California/Federal/USBC Southern/General/ -

Notice Of Change In Lead Attorney Within Law Firm

Notice Of Change In Lead Attorney Within Law Firm

California/Federal/USBC Southern/General/ -

Order Granting Conditional Approval Of Individual Chapter 11 Combined Plan

Order Granting Conditional Approval Of Individual Chapter 11 Combined Plan

California/Federal/USBC Southern/General/ -

Order On Trustees Application For Immediate Private Sale Without Notice

Order On Trustees Application For Immediate Private Sale Without Notice

California/Federal/USBC Southern/General/ -

Certification To Court Of Appeals By All Parties

Certification To Court Of Appeals By All Parties

California/Federal/USBC Southern/General/ -

US Trustees Notice Of Hearing And Motion

US Trustees Notice Of Hearing And Motion

California/Federal/USBC Southern/General/ -

Order On Stipulation To Vacate Chapter 7 Filing Fee Waiver

Order On Stipulation To Vacate Chapter 7 Filing Fee Waiver

California/Federal/USBC Southern/General/ -

Stipulation To Vacate Chapter 7 Filing Fee Waiver Order

Stipulation To Vacate Chapter 7 Filing Fee Waiver Order

California/Federal/USBC Southern/General/ -

Lodged Order Template For Relief From Stay

Lodged Order Template For Relief From Stay

California/Federal/USBC Southern/General/ -

Application To Have Chapter 7 Filing Fee Waived

Application To Have Chapter 7 Filing Fee Waived

California/Federal/USBC Southern/General/ -

Request For Services Or Equipment In Bankruptcy Court Proceedings

Request For Services Or Equipment In Bankruptcy Court Proceedings

California/Federal/USBC Southern/General/ -

Declaration Of Inmate Filing

Declaration Of Inmate Filing

California/Federal/USBC Southern/General/ -

Notice Of Appeal And Statement Of Election (Adversary) {CSD 417A(Adv.)}

Notice Of Appeal And Statement Of Election (Adversary) {CSD 417A(Adv.)}

California/Federal/USBC Southern/General/ -

Special Power Of Attorney

Special Power Of Attorney

California/Federal/USBC Southern/General/ -

Pre Confirmation Modification To Chapter 13 Plan

Pre Confirmation Modification To Chapter 13 Plan

California/Federal/USBC Southern/General/ -

Writ Of Attachment

Writ Of Attachment

California/Federal/USBC Southern/General/ -

Certification Of Judgment For Registration In Another District

Certification Of Judgment For Registration In Another District

California/Federal/USBC Southern/General/ -

Bill Of Costs

Bill Of Costs

California/Federal/USBC Southern/General/ -

Motion To Be Relieved As Counsel

Motion To Be Relieved As Counsel

California/4 Federal/USBC Southern/General/ -

Order Appointing Mediator And Assignment To Mediation

Order Appointing Mediator And Assignment To Mediation

California/4 Federal/USBC Southern/General/ -

Notice Of Conversion Of Case Under Chapter 12 To A Case Under Chapter 7 By Debtor

Notice Of Conversion Of Case Under Chapter 12 To A Case Under Chapter 7 By Debtor

California/Federal/USBC Southern/General/ -

Notice Of Conversion Of Case Under Chapter 13 To A Case Under Chapter 7 By Debtor

Notice Of Conversion Of Case Under Chapter 13 To A Case Under Chapter 7 By Debtor

California/Federal/USBC Southern/General/ -

Pro Hac Vice Application And Order Thereon

Pro Hac Vice Application And Order Thereon

California/Federal/USBC Southern/General/ -

Order On (Lodged Template For R-S Motions)

Order On (Lodged Template For R-S Motions)

California/Federal/USBC Southern/General/ -

Application To Join Voluntary Mediation Panel

Application To Join Voluntary Mediation Panel

California/Federal/USBC Southern/General/ -

Trustees Motion To Dismiss Case And Order

Trustees Motion To Dismiss Case And Order

California/Federal/USBC Southern/General/ -

Chapter 13 Plan (Mandatory)

Chapter 13 Plan (Mandatory)

California/Federal/USBC Southern/General/ -

Mandatory Chapter 13 Plan

Mandatory Chapter 13 Plan

California/Federal/USBC Southern/General/ -

Corporate Ownership Statement

Corporate Ownership Statement

California/4 Federal/USBC Southern/General/ -

Declaration Regarding Electronic Filing Of Self-Represented Individual

Declaration Regarding Electronic Filing Of Self-Represented Individual

California/Federal/USBC Southern/General/ -

Administrative Procedures

Administrative Procedures

California/Federal/USBC Southern/General/ -

Certificate Of Compliance With Early Conference Of Counsel

Certificate Of Compliance With Early Conference Of Counsel

California/Federal/USBC Southern/General/ -

Lessors Objection To Debtors Certification And-Or Debtors Continuing Certification

Lessors Objection To Debtors Certification And-Or Debtors Continuing Certification

California/Federal/USBC Southern/General/ -

Mediators Certificate Of Compliance

Mediators Certificate Of Compliance

California/Federal/USBC Southern/General/ -

Proof Of Interest

Proof Of Interest

California/Federal/USBC Southern/General/ -

Suggestion Of Death

Suggestion Of Death

California/Federal/USBC Southern/General/ -

Notice And Motion On Suggestion Of Death

Notice And Motion On Suggestion Of Death

California/Federal/USBC Southern/General/ -

Application To Pay Filing Fees In Installments

Application To Pay Filing Fees In Installments

California/Federal/USBC Southern/General/ -

Request For Hearing On Motion For Relief From Automatic Stay And Notice Of Hearing

Request For Hearing On Motion For Relief From Automatic Stay And Notice Of Hearing

California/Federal/USBC Southern/General/ -

Request By Debtor For Statement Of Position Of Chapter 13 Trustee

Request By Debtor For Statement Of Position Of Chapter 13 Trustee

California/Federal/USBC Southern/General/ -

Request And Notice Of Hearing Re Chapter 13 Trustees Notice To Dismiss

Request And Notice Of Hearing Re Chapter 13 Trustees Notice To Dismiss

California/Federal/USBC Southern/General/ -

Request And Notice Of Hearing

Request And Notice Of Hearing

California/Federal/USBC Southern/General/ -

Objection To Confirmation Of Chapter 13 Plan

Objection To Confirmation Of Chapter 13 Plan

California/Federal/USBC Southern/General/ -

Notice Of Creditors Named Debtor Added By Amendment Balance Of Schedules

Notice Of Creditors Named Debtor Added By Amendment Balance Of Schedules

California/Federal/USBC Southern/General/ -

Notice Of Pre-Confirmation Modification To Chapter 13 Plan

Notice Of Pre-Confirmation Modification To Chapter 13 Plan

California/4 Federal/USBC Southern/General/ -

Notice Of Lodgment

Notice Of Lodgment

California/Federal/USBC Southern/General/ -

Notice On Hearing On Objection To Confirmation Of Chapter 13 Plan

Notice On Hearing On Objection To Confirmation Of Chapter 13 Plan

California/Federal/USBC Southern/General/ -

Notice Of Hearing And Motion To Extend-Impose The Automatic Stay

Notice Of Hearing And Motion To Extend-Impose The Automatic Stay

California/Federal/USBC Southern/General/ -

Notice Of Hearing And Motion For Review And Conditional Approval

Notice Of Hearing And Motion For Review And Conditional Approval

California/Federal/USBC Southern/General/ -

Notice Of Hearing And Motion For Approval Of Disclosure Statement Plan Of Reorganization

Notice Of Hearing And Motion For Approval Of Disclosure Statement Plan Of Reorganization

California/Federal/USBC Southern/General/ -

Notice Of Hearing And Motion (Less All Creditors)

Notice Of Hearing And Motion (Less All Creditors)

California/Federal/USBC Southern/General/ -

Notice Of Hearing And Motion (All Creditors)

Notice Of Hearing And Motion (All Creditors)

California/Federal/USBC Southern/General/ -

Notice Of Hearing And Motion On Sale Of Property Free And Clear

Notice Of Hearing And Motion On Sale Of Property Free And Clear

California/4 Federal/USBC Southern/General/ -

Notice Of Hearing And Debtors Motion To Value Real Property

Notice Of Hearing And Debtors Motion To Value Real Property

California/Federal/USBC Southern/General/ -

Certifications Regarding Domestic Support Obligations Section 522(q) And Eligibility For Discharge

Certifications Regarding Domestic Support Obligations Section 522(q) And Eligibility For Discharge

California/Federal/USBC Southern/General/ -

Balance Of Schedules Statements And Or Chapter 13 Plan

Balance Of Schedules Statements And Or Chapter 13 Plan

California/Federal/USBC Southern/General/ -

Request To Enter Default

Request To Enter Default

California/Federal/USBC Southern/General/ -

Proof Of Service Adversary

Proof Of Service Adversary

California/Federal/USBC Southern/General/ -

Order Dismissing Chapter 13 Case On Request By Debtor

Order Dismissing Chapter 13 Case On Request By Debtor

California/Federal/USBC Southern/General/ -

Notice Of Motion And Hearing

Notice Of Motion And Hearing

California/Federal/USBC Southern/General/ -

Chapter 12 Individual Debtors Certifications Regarding Domestic Support Obligations

Chapter 12 Individual Debtors Certifications Regarding Domestic Support Obligations

California/Federal/USBC Southern/General/ -

Attorney Change Of Information Form

Attorney Change Of Information Form

California/Federal/USBC Southern/General/ -

Application For Payment Of Unclaimed Funds

Application For Payment Of Unclaimed Funds

California/4 Federal/USBC Southern/General/ -

Request By Debtor For Dismissal Of Chapter 13

Request By Debtor For Dismissal Of Chapter 13

California/Federal/USBC Southern/General/ -

Creditor Matrix Instructions

Creditor Matrix Instructions

California/Federal/USBC Southern/General/ -

Amendment

Amendment

California/Federal/USBC Southern/General/ -

Trustees Notice Of Public Sale And Invitation For Better Offer

Trustees Notice Of Public Sale And Invitation For Better Offer

California/Federal/USBC Southern/General/ -

Trustees Notice Of Proposed Auction

Trustees Notice Of Proposed Auction

California/Federal/USBC Southern/General/ -

Trustees Notice Of Proposed Abandonment Of Property

Trustees Notice Of Proposed Abandonment Of Property

California/Federal/USBC Southern/General/ -

Trustees Notice Of Intended Action And Opportunity For Hearing

Trustees Notice Of Intended Action And Opportunity For Hearing

California/Federal/USBC Southern/General/ -

Objection To Claim And Notice Thereof

Objection To Claim And Notice Thereof

California/Federal/USBC Southern/General/ -

Notice To Person With Communications Disabilities

Notice To Person With Communications Disabilities

California/Federal/USBC Southern/General/ -

Notice Of Pre Trial Status Conference

Notice Of Pre Trial Status Conference

California/Federal/USBC Southern/General/ -

Notice Of Objections To Debtors Claim Of Exemptions Opportunity For Hearing

Notice Of Objections To Debtors Claim Of Exemptions Opportunity For Hearing

California/Federal/USBC Southern/General/ -

Notice Of Motion For

Notice Of Motion For

California/Federal/USBC Southern/General/ -

Notice Of Intended Action And Opportunity For Hearing

Notice Of Intended Action And Opportunity For Hearing

California/Federal/USBC Southern/General/ -

Notice Of Filing Of A Motion For Relief From Automatic Stay

Notice Of Filing Of A Motion For Relief From Automatic Stay

California/Federal/USBC Southern/General/ -

Notice Of Chapter 13 Trustees Interim Final Report And Time To File Objections And Release

Notice Of Chapter 13 Trustees Interim Final Report And Time To File Objections And Release

California/Federal/USBC Southern/General/ -

Certificate Of Cure Of Entire Monetary Default Pursuant To 11 USC 362

Certificate Of Cure Of Entire Monetary Default Pursuant To 11 USC 362

California/Federal/USBC Southern/General/ -

Abstract Of Judgment

Abstract Of Judgment

California/Federal/USBC Southern/General/ -

Chapter 11 Individual Debtors Request For Discharge Certifications Regarding Domestic Support

Chapter 11 Individual Debtors Request For Discharge Certifications Regarding Domestic Support

California/Federal/USBC Southern/General/ -

Declaration In Support Of Request For Issuance Of Writ Of Execution

Declaration In Support Of Request For Issuance Of Writ Of Execution

California/Federal/USBC Southern/General/ -

Motion To Reopen Case

Motion To Reopen Case

California/Federal/USBC Southern/General/ -

Notice Of Modified Chapter 13 Plan Prior To Confirmation

Notice Of Modified Chapter 13 Plan Prior To Confirmation

California/Federal/USBC Southern/General/ -

Notice Of Motion For Exemption And Opportunity For Hearing Re Credit Counseling

Notice Of Motion For Exemption And Opportunity For Hearing Re Credit Counseling

California/Federal/USBC Southern/General/ -

Order Reopening Estate

Order Reopening Estate

California/Federal/USBC Southern/General/ -

Request For Issuance Of Writ Of Execution

Request For Issuance Of Writ Of Execution

California/Federal/USBC Southern/General/ -

Certificate Of Exigent Circumstances And Motion For Extension Of Time To File

Certificate Of Exigent Circumstances And Motion For Extension Of Time To File

California/Federal/USBC Southern/General/ -

Writ Of Execution

Writ Of Execution

California/Federal/USBC Southern/General/ -

Rights And Responsibilities Of Chapter 13 Debtors And Their Attorneys (Business Case)

Rights And Responsibilities Of Chapter 13 Debtors And Their Attorneys (Business Case)

California/Federal/USBC Southern/General/ -

Rights And Responsibilities Of Chapter 13 Debtors And Their Attorneys (Consumer Case)

Rights And Responsibilities Of Chapter 13 Debtors And Their Attorneys (Consumer Case)

California/Federal/USBC Southern/General/

Form Preview

Contact Us

Success: Your message was sent.

Thank you!