Last updated: 3/28/2025

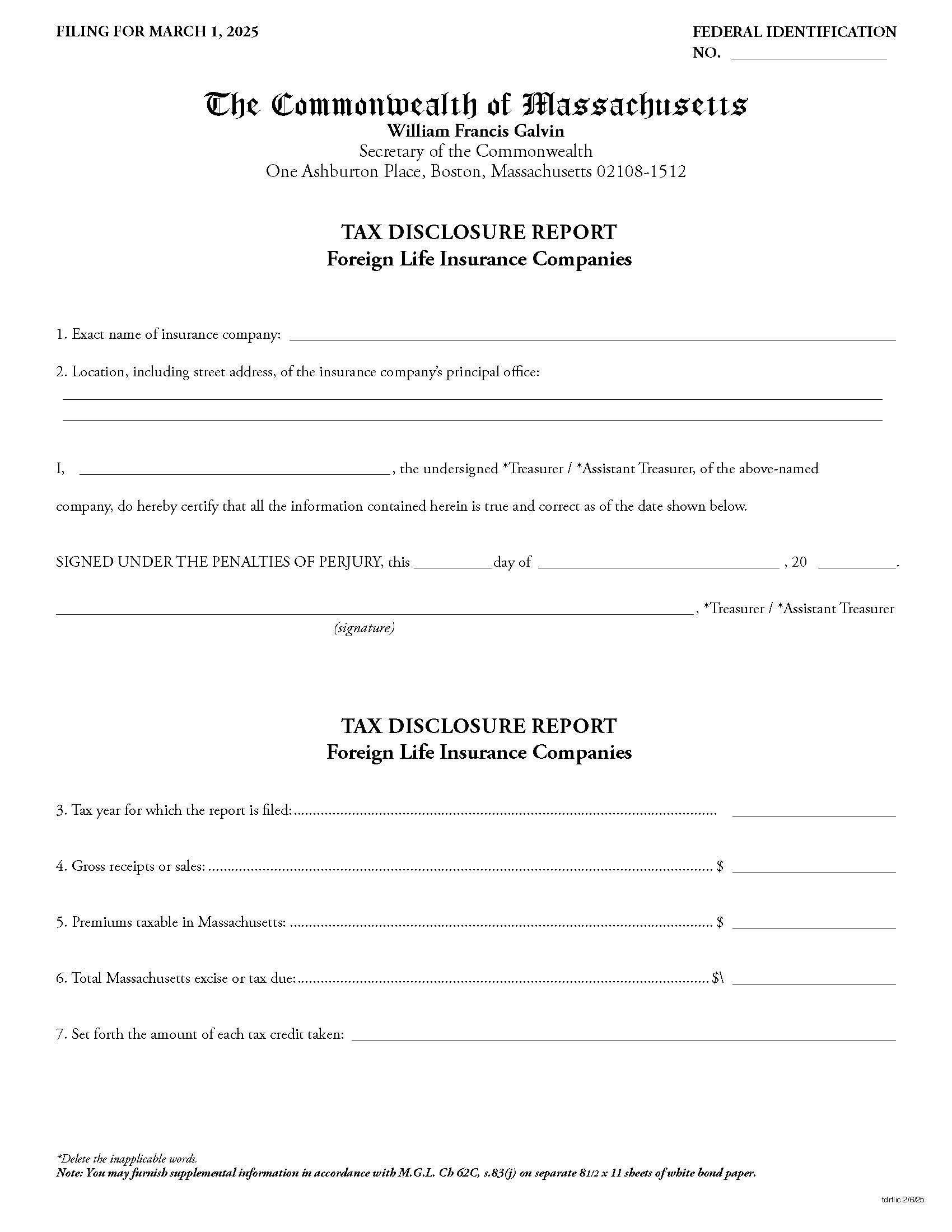

Tax Disclosure Report-Foreign Life Insurance Companies

Start Your Free Trial $ 0.00What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

TAX DISCLOSURE REPORT - FOREIGN LIFE INSURANCE COMPANIES. This form is used to report their tax information to the Commonwealth of Massachusetts. It requires the company to provide details about its gross receipts or sales, premiums taxable in Massachusetts, and the total Massachusetts excise or tax due. The form also asks for a breakdown of any tax credits taken. The purpose of this report is to ensure that foreign life insurance companies operating in Massachusetts comply with state tax laws by providing accurate and up-to-date financial data regarding their operations within the state. The information must be based on the most recently filed tax return or other document filed on or before June 30, 2024. www.FormsWorkflow.com