Last updated: 5/21/2025

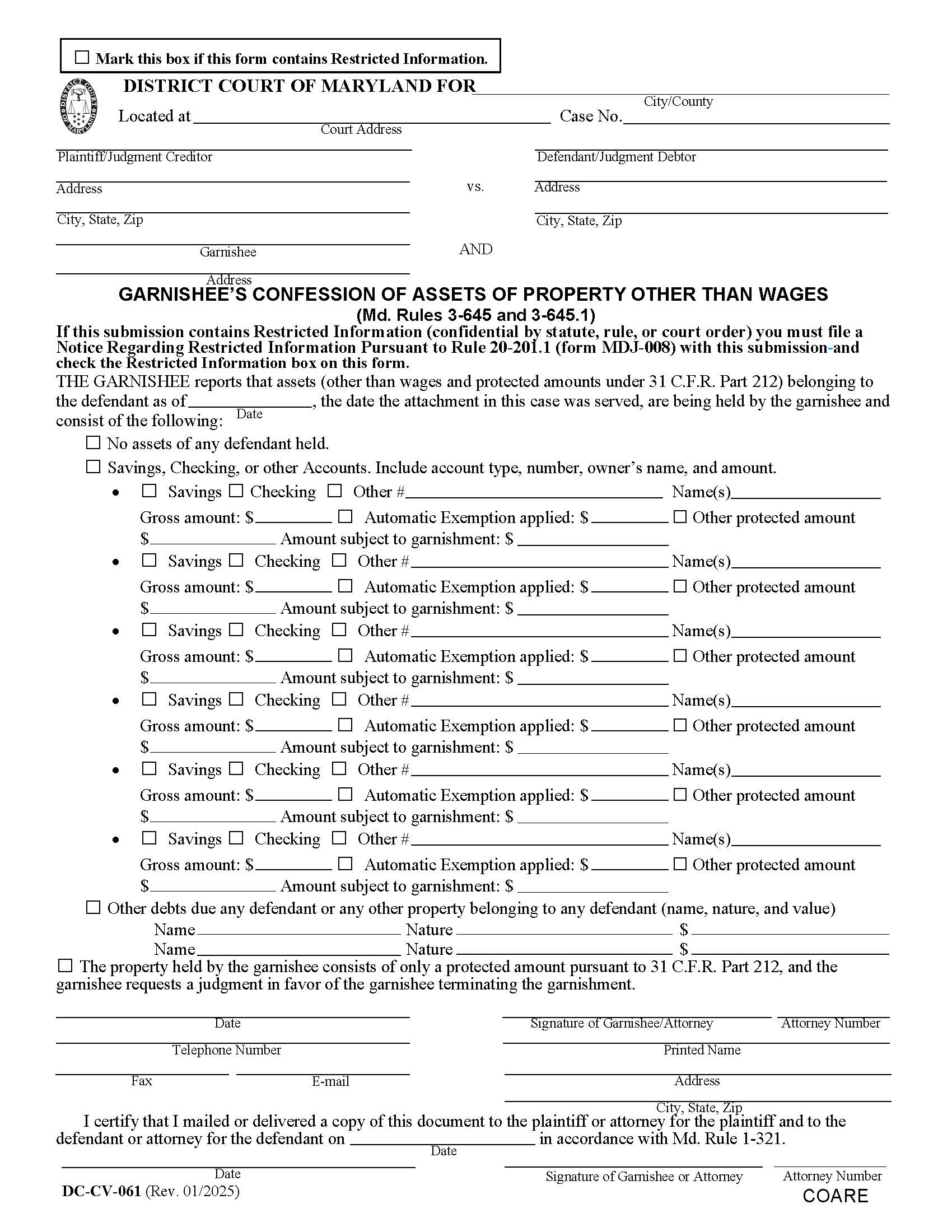

Garnishees Confession Of Assets Of Property Other Than Wages {DC-CV 61}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

DC-CV-061 - GARNISHEE’S CONFESSION OF ASSETS OF PROPERTY OTHER THAN WAGES (Md. Rules 3-645 and 3-645.1). This form from the District Court of Maryland is used in post-judgment proceedings when a creditor seeks to collect on a court judgment by garnishing assets belonging to a debtor that are held by a third party (the garnishee), such as a bank or financial institution. This form is completed by the garnishee to disclose whether they are in possession of any non-wage property or assets of the judgment debtor as of the date the writ of garnishment was served. The garnishee must list and describe any accounts or property held—such as savings or checking accounts—along with the amounts held, any automatic exemptions applied, and the balance subject to garnishment. If no assets are held, the garnishee must state that as well. The form includes a certification that copies were sent to both the plaintiff and the defendant, as required by court rules. The form includes a Notice to the Judgment Debtor explaining the debtor’s rights to claim certain legal exemptions to protect some or all of their assets from garnishment. These exemptions may include federal benefits (such as Social Security), certain types of property (like household goods or tools of the trade), and a general exemption of up to $6,000. The notice emphasizes the importance of acting promptly—within 30 days—to file a motion with the court if the debtor wishes to claim any exemptions. www.FormsWorkflow.com

Related forms

-

Notice Of Dismissal

Notice Of Dismissal

Maryland/Statewide/District Court/Civil/ -

Notice Of Publication - Attachment Before Judgment

Notice Of Publication - Attachment Before Judgment

Maryland/Statewide/District Court/Civil/ -

Notice To Renew Judgment

Notice To Renew Judgment

Maryland/Statewide/District Court/Civil/ -

Show Cause Order In Action Of Replevin

Show Cause Order In Action Of Replevin

Maryland/Statewide/District Court/Civil/ -

Assignment Of Judgment

Assignment Of Judgment

Maryland/Statewide/District Court/Civil/ -

Declaration Of Trust Of Real Estate To Secure Performance Of A Bond

Declaration Of Trust Of Real Estate To Secure Performance Of A Bond

Maryland/Statewide/District Court/Civil/ -

Claimants Motion

Claimants Motion

Maryland/Statewide/District Court/Civil/ -

Request For Writ Of Possession

Request For Writ Of Possession

Maryland/Statewide/District Court/Civil/ -

Motion For Release Of Property From Levy-Garnishment

Motion For Release Of Property From Levy-Garnishment

Maryland/Statewide/District Court/Civil/ -

Petition For Levy In Distress

Petition For Levy In Distress

Maryland/Statewide/District Court/Civil/ -

Property Damage Affidavit

Property Damage Affidavit

Maryland/Statewide/District Court/Civil/ -

Proof Of Service Motion For Order Declaring Judgment Satisfied

Proof Of Service Motion For Order Declaring Judgment Satisfied

Maryland/1 Statewide/District Court/Civil/ -

Declaration Of Compliance With CARES Act

Declaration Of Compliance With CARES Act

Maryland/1 Statewide/District Court/Civil/ -

Motion For First Class Mail Service Of Plaintiff Judgment Creditor

Motion For First Class Mail Service Of Plaintiff Judgment Creditor

Maryland/1 Statewide/District Court/Civil/ -

Order Of Satisfaction And Notice Of Satisfaction Of Lien

Order Of Satisfaction And Notice Of Satisfaction Of Lien

Maryland/Statewide/District Court/Civil/ -

Request For Transmittal Of Judgment

Request For Transmittal Of Judgment

Maryland/Statewide/District Court/Civil/ -

Request And Order For Release Of Wages Or Other Debts Attached On Confessed Judgment

Request And Order For Release Of Wages Or Other Debts Attached On Confessed Judgment

Maryland/Statewide/District Court/Civil/ -

Request For Judgment-Garnishment

Request For Judgment-Garnishment

Maryland/Statewide/District Court/Civil/ -

Request For Trial-Garnishment

Request For Trial-Garnishment

Maryland/Statewide/District Court/Civil/ -

Judgment Creditors Monthly Report

Judgment Creditors Monthly Report

Maryland/Statewide/District Court/Civil/ -

Motion To Sell Distrained Goods

Motion To Sell Distrained Goods

Maryland/Statewide/District Court/Civil/ -

Agreement After Oral Exam

Agreement After Oral Exam

Maryland/Statewide/District Court/Civil/ -

Motion For Order Declaring Judgment Satisfied

Motion For Order Declaring Judgment Satisfied

Maryland/Statewide/District Court/Civil/ -

Motion For Order To Follow Goods Under Distress

Motion For Order To Follow Goods Under Distress

Maryland/Statewide/District Court/Civil/ -

Plaintiffs Affidavit To Secure Service By Posting Or Publication

Plaintiffs Affidavit To Secure Service By Posting Or Publication

Maryland/Statewide/District Court/Civil/ -

Request For An Order For The Issuance Of A Writ Of Attachment Before Judgment

Request For An Order For The Issuance Of A Writ Of Attachment Before Judgment

Maryland/Statewide/District Court/Civil/ -

Request For Writ Of Execution

Request For Writ Of Execution

Maryland/Statewide/District Court/Civil/ -

Request To Shield Court Records Related To Repossession Of Residential Property For Failure To Pay Rent

Request To Shield Court Records Related To Repossession Of Residential Property For Failure To Pay Rent

Maryland/Statewide/District Court/Civil/ -

Complaint For Grantor In Possession

Complaint For Grantor In Possession

Maryland/1 Statewide/District Court/Civil/ -

Request To File Foreign Judgment

Request To File Foreign Judgment

Maryland/Statewide/District Court/Civil/ -

Request For Summons Or Summons Renewal

Request For Summons Or Summons Renewal

Maryland/Statewide/District Court/Civil/ -

Request For Service, Order For Service, Proof Of Service

Request For Service, Order For Service, Proof Of Service

Maryland/1 Statewide/District Court/Civil/ -

Request For Show Cause Order For Contempt

Request For Show Cause Order For Contempt

Maryland/Statewide/District Court/Civil/ -

Complaint And Affidavit For Judgment By Confession

Complaint And Affidavit For Judgment By Confession

Maryland/Statewide/District Court/Civil/ -

Civil Appeal Or Request For Transcript

Civil Appeal Or Request For Transcript

Maryland/Statewide/District Court/Civil/ -

Complaint For Wrongful Detainer

Complaint For Wrongful Detainer

Maryland/Statewide/District Court/Civil/ -

Petition For Warrant Of Restitution (Prince George)

Petition For Warrant Of Restitution (Prince George)

Maryland/1 Statewide/District Court/Civil/ -

Request For Order Directing Judgment Debtor To Appear For Examination

Request For Order Directing Judgment Debtor To Appear For Examination

Maryland/Statewide/District Court/Civil/ -

Bond

Bond

Maryland/Statewide/District Court/Civil/ -

Notice Of Publication Or Posting

Notice Of Publication Or Posting

Maryland/1 Statewide/District Court/Civil/ -

Request To File Notice Of Lien

Request To File Notice Of Lien

Maryland/Statewide/District Court/Civil/ -

Request For Writ Of Garnishment Of Wages

Request For Writ Of Garnishment Of Wages

Maryland/Statewide/District Court/Civil/ -

Request For Writ Of Garnishment Of Property Other Than Wages

Request For Writ Of Garnishment Of Property Other Than Wages

Maryland/Statewide/District Court/Civil/ -

Notice Of Intent To File A Complaint For Summary Ejectment

Notice Of Intent To File A Complaint For Summary Ejectment

Maryland/1 Statewide/District Court/Civil/ -

Complaint For Rent Escrow Or Injunction

Complaint For Rent Escrow Or Injunction

Maryland/Statewide/District Court/Civil/ -

Motion And Order Compelling Answers To Interrogatories

Motion And Order Compelling Answers To Interrogatories

Maryland/Statewide/District Court/Civil/ -

Cost Schedule

Cost Schedule

Maryland/Statewide/District Court/Civil/ -

Garnishees Confession Of Assets Of Property Other Than Wages

Garnishees Confession Of Assets Of Property Other Than Wages

Maryland/Statewide/District Court/Civil/ -

Complaint And Summons Against Tenant Holding Over

Complaint And Summons Against Tenant Holding Over

Maryland/Statewide/District Court/Civil/ -

Petition For Warrant Of Restitution

Petition For Warrant Of Restitution

Maryland/Statewide/District Court/Civil/ -

Complaint And Summons Against Tenant In Breach Of Lease

Complaint And Summons Against Tenant In Breach Of Lease

Maryland/Statewide/District Court/Civil/ -

Complaint Assigned Consumer Debt

Complaint Assigned Consumer Debt

Maryland/Statewide/District Court/Civil/ -

Application And Affidavit In Support Of Judgment

Application And Affidavit In Support Of Judgment

Maryland/Statewide/District Court/Civil/

Form Preview

Contact Us

Success: Your message was sent.

Thank you!