Last updated: 5/29/2015

Claim For New Construction Exclusion From Supplemental Assessment {740}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

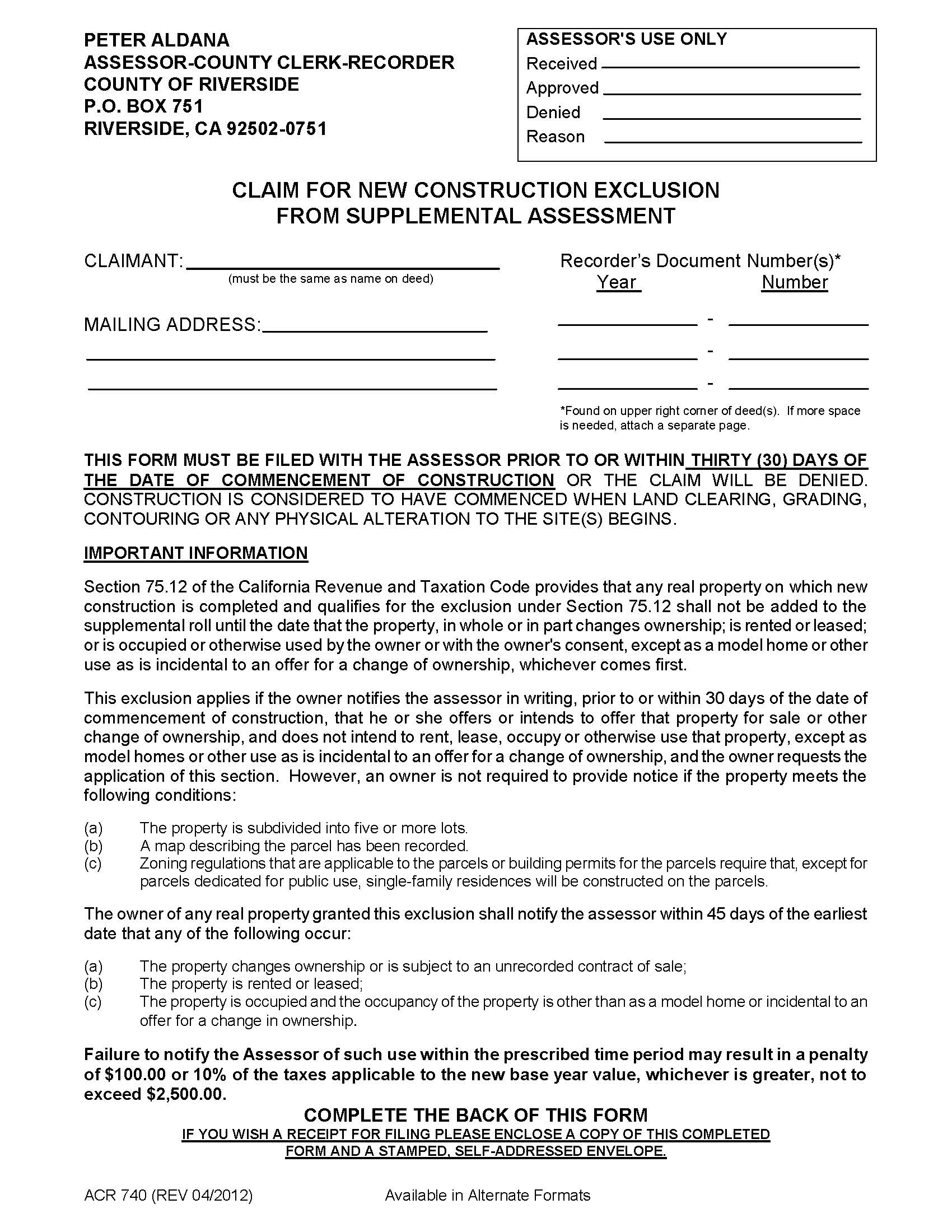

ACR 740 - CLAIM FOR NEW CONSTRUCTION EXCLUSION FROM SUPPLEMENTAL ASSESSMENT. This form is used to notify the Riverside County Assessor that a property owner is commencing new construction on a property and requests an exclusion from supplemental property tax assessments under California Revenue and Taxation Code § 75.12. The exclusion applies if the property owner does not intend to occupy, rent, or lease the property but instead plans to sell it or offer it for a change in ownership. The exclusion delays supplemental assessments for the new construction until the property is sold, leased, or otherwise used, except as a model home or for incidental purposes related to its sale. The form must be filed with the assessor before or within 30 days of the commencement of construction, which is defined as any physical alteration to the site. If the property undergoes a change in ownership or use, the owner must notify the assessor within 45 days to avoid penalties. www.FormsWorkflow.com