Last updated: 3/16/2010

Writ Of Attachment Domestic {WRIT}

Start Your Free Trial $ 19.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

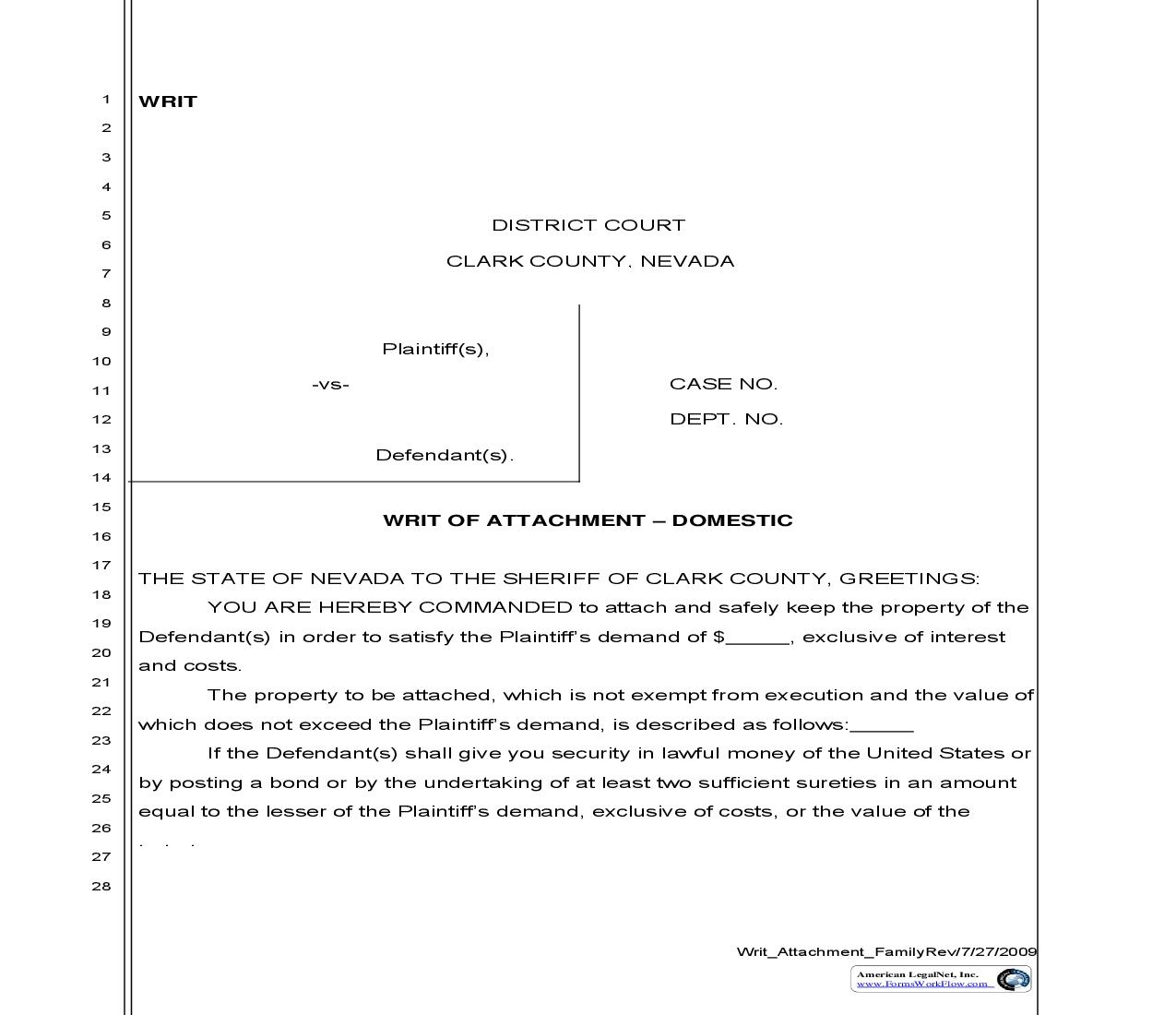

Print Form 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 WRIT DISTRICT COURT CLARK COUNTY, NEVADA Plaintiff(s), -vsCASE NO. DEPT. NO. Defendant(s). WRIT OF ATTACHMENT DOMESTIC 16 17 18 19 20 21 22 23 24 25 26 27 28 THE STATE OF NEVADA TO THE SHERIFF OF CLARK COUNTY, GREETINGS: YOU ARE HEREBY COMMANDED to attach and safely keep the property of the Defendant(s) in order to satisfy the Plaintiff's demand of $ and costs. The property to be attached, which is not exempt from execution and the value of which does not exceed the Plaintiff's demand, is described as follows: If the Defendant(s) shall give you security in lawful money of the United States or by posting a bond or by the undertaking of at least two sufficient sureties in an amount equal to the lesser of the Plaintiff's demand, exclusive of costs, or the value of the ... , exclusive of interest Writ_Attachment_FamilyRev/7/27/2009 American LegalNet, Inc. www.FormsWorkFlow.com 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 property levied upon, then you shall accept such bond or undertaking in lieu of attaching the aforesaid property. You are required to serve and return this Writ with the results of your levy endorsed thereon, and within 20 days from the day you receive it, return it to the Clerk of the Court with a copy to the party at whose direction it was issued. STEVEN D. GRIERSON, CLERK OF COURT By:______________________________________________ Deputy Clerk Date Family Court and Services Center 601 N. Pecos Rd. Las Vegas, NV 89101 Submitted By: _______________________________________ I HEREBY CERTIFY that this is a true and correct copy of the original Writ of Attachment. DOUG GILLESPIE, SHERIFF, CLARK COUNTY By:________________________________ Deputy Date I HEREBY CERTIFY that I have this date served this Writ of Attachment on the day of , 20 by: (a) taking into my possession the following described property to be held in my custody until further order of this court: ... 2 Writ_Attachment_FamilyRev/7/27/2009 American LegalNet, Inc. www.FormsWorkFlow.com 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 (b) posting a copy of this Writ of Attachment upon the real property set forth herein by affixing a copy of this Writ to the improvement thereon or upon the property if unimproved and by delivering a copy of this Writ on the to the County Recorder to be recorded. (c) serving on the day of , 20 at at .M. o'clock a Writ of , Clark County, day of , 20 Garnishment in aid of this Writ of Attachment on Nevada. A true and correct copy of said Writ of Garnishment is attached hereto. (d) returning this Writ of Attachment unsatisfied. DOUG GILLESPIE, SHERIFF, CLARK COUNTY By:________________________________ Deputy Date 3 Writ_Attachment_FamilyRev/7/27/2009 American LegalNet, Inc. www.FormsWorkFlow.com DISTRICT COURT CLARK COUNTY, NEVADA NOTICE OF EXECUTION YOUR PROPERTY IS BEING ATTACHED OR YOUR WAGES ARE BEING GARNISHED Plaintiff, , alleges that you owe him money. He has begun the procedure to collect that money. To secure satisfaction of judgment the court has ordered the garnishment of your wages, bank account or other personal property held by third persons or the taking of money or other property in your possession. Certain benefits and property owned by you may be exempt from execution and may not be taken from you. The following is a partial list of exemptions: 1. Payments received under the Social Security Act including, without limitations retirement and survivor benefits, supplemental security income benefits and disability insurance benefits. 2. Payments for benefits or the return of contributions under the Public Employees' Retirement System. 3. Payments for public assistance granted through the Welfare Division of the Department of Human Resources or a local governmental entity. 4. Proceeds from a policy of life insurance if the annual premium does not exceed $15,000. 5. Payments of benefits under a program of industrial insurance. 6. Payments received as disability, illness or unemployment benefits. 7. Payments received as unemployment compensation. 8. Veteran's benefits. 9. A homestead in a dwelling or a mobile home, not to exceed $350,000, unless: (a) The judgment is for a medical bill, in which case all of the primary dwelling, including a mobile or manufactured home, may be exempt. (b) Allodial title has been established and not relinquished for the dwelling or mobile home, in which case all of the dwelling or mobile home and its appurtenances are exempt, including the land on which they are located, unless a valid waiver executed pursuant to NRS 115.010 is applicable to the judgment. 10. A vehicle, if your equity in the vehicle is less than $15,000. 11. Seventy-five percent of the take-home pay for any workweek, unless the weekly takehome pay is less than 50 times the federal minimum wage, in which case the entire amount may be exempt. 12. Money, not to exceed $500,000 in present value, held in: (a) An individual retirement arrangement which conforms with the applicable limitations and requirements of section 408 or 408A of the Internal Revenue Code, 26 U.S.C. §§ 408 and 408A; (b) A written simplified employee pension plan which conforms with the applicable limitations and requirements of section 408 of the Internal Revenue Code, 26 U.S.C. §§ 408; (c) A cash or deferred arrangement that is a qualified plan pursuant to the Internal Revenue Code; (d) A trust forming part of a stock bonus, pension or profit-sharing plan that is a qualified plan pursuant to sections 401 et seq. of the Internal Revenue Code, 26 U.S.C. §§ 401 et seq.; and (e) A trust forming part of a qualified tuition program pursuant to chapter 353B of NRS, any applicable regulations adopted pursuant to chapter 353B of NRS and section 529 of the Internal Revenue Code, 26 U.S.C. § 529, unless the money is deposited after the entry of a judgment against the purchaser or account owner or the money will not be used by any beneficiary to attend a college or university. American LegalNet, Inc. www.FormsWorkFlow.com 13. All money and other benefits paid pursuant to the order of a court of competent jurisdiction for the support, education and maintenance of a child, whether collected by the judgment debtor or the State. 14. All money and other benefits paid pursuant to the order of a court of competent jurisdiction for the support and maintenance of a former spouse, including the amount of any arrearages in