Last updated: 8/3/2015

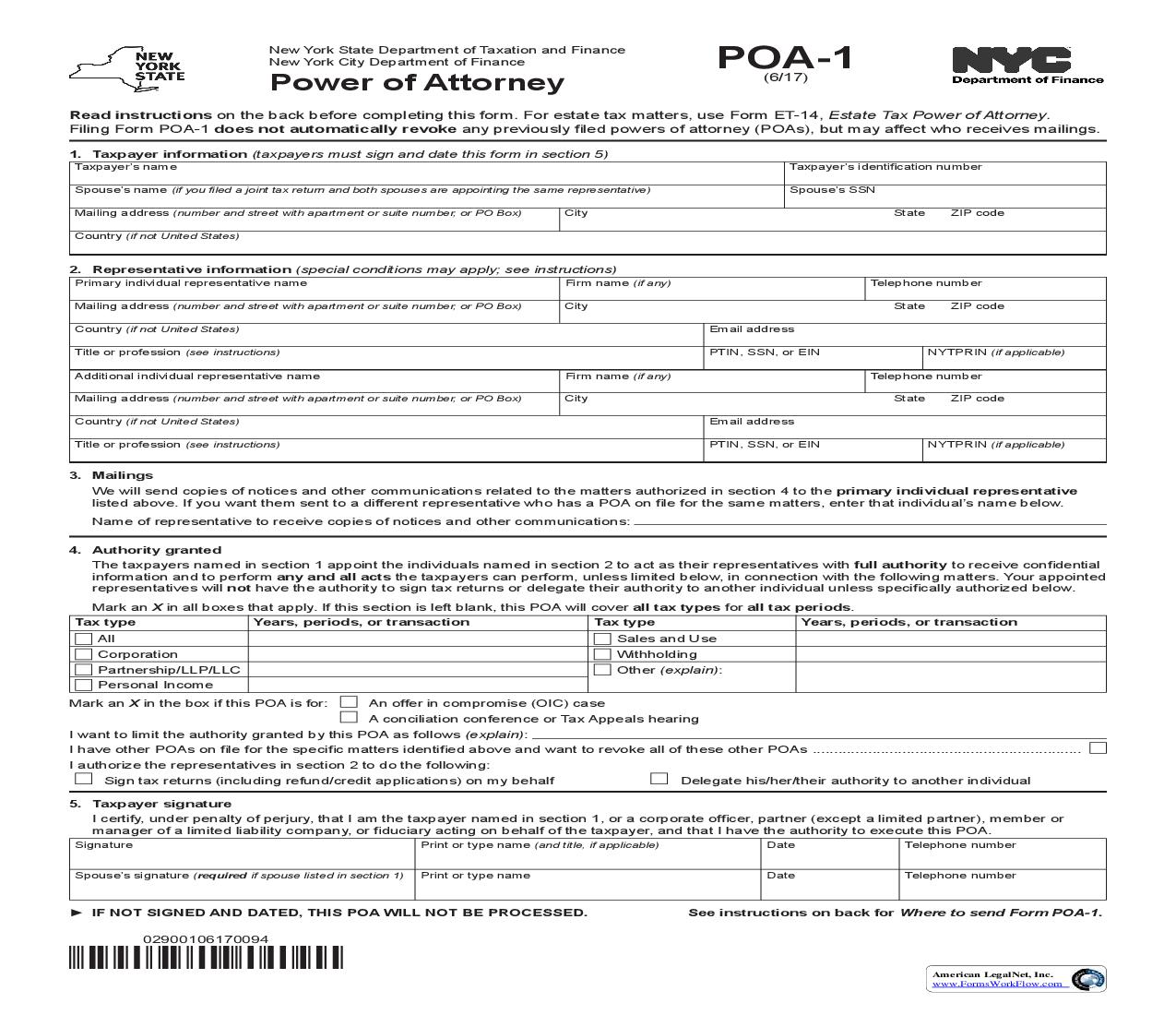

Power Of Attorney {POA-1}

Start Your Free Trial $ 21.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

New York State Department of Taxation and Finance New York City Department of Finance Power of Attorney Read Form POA-1-I, Instructions for Form POA-1, before completing. These instructions explain how the information entered on this power of attorney (POA) will be interpreted and the extent of the powers granted. 1. Taxpayer information (Taxpayer(s) must sign and date this form - please print or type.) Taxpayer's name Spouse's name (if joint tax return) Mailing address City Taxpayer's identification number (see instructions) Spouse's SSN (if applicable) State ZIP code Spouse's mailing address (if different from above) City State ZIP code The taxpayer(s) named above appoints the individual(s) named below as the taxpayer's or taxpayers' attorney(s)-in-fact: 2. Representative information (Representative(s) must complete section 8 on page 4 of this form.) Representative's name Mailing address (include firm name, if any) City Representative's name Mailing address (include firm name, if any) City Representative's name Mailing address (include firm name, if any) City State ZIP code State ZIP code State ZIP code Telephone number ( ) Fax number ( ) Representative's NYTPRIN ( if applicable) E-mail address Telephone number Fax number ( ) ( ) Representative's NYTPRIN ( if applicable) E-mail address Telephone number Fax number ( ) ( ) Representative's NYTPRIN ( if applicable) E-mail address to represent the taxpayer(s) in connection with the following tax matter(s): 3. Tax matter(s) -- For estate tax matters, use Form ET-14, Estate Tax Power of Attorney, instead of this form. Type(s) of tax(es) (may enter more than one) Tax year(s), period(s), or transaction(s) Notice/assessment/Audit ID number(s) with full power to receive confidential information and to perform any and all acts that the taxpayer(s) can perform with respect to the above specified tax matter(s), except for signing tax returns or delegating his/her/their authority (unless specifically authorized; see page 2). If you do not want any of the above representative(s) to have full power as described above, attach a signed and dated explanation and mark an X in this box .................. 029001140094 POA-1 (9/10) Page 1 of 4 American LegalNet, Inc. www.FormsWorkFlow.com Page 2 of 4 POA-1 (9/10) Taxpayer's identification number I / We authorize the above representative(s) to sign tax returns for the tax matter(s) indicated above. (If joint return, both taxpayers must sign.) Your signature Date Spouse's signature Date I / We authorize the above representative(s) to delegate his/her/their authority to another. (If joint return, both taxpayers must sign.) Your signature Date Spouse's signature Date 4. Retention/revocation of prior power(s) of attorney This power of attorney (POA) only applies to tax matters administered by the New York State Tax Department, the New York City Department of Finance, or both. Executing and filing this POA revokes all powers of attorney previously executed and filed with an agency for the same tax matter(s) and year(s), period(s) or transaction(s) covered by this document. If there is an existing POA that you do not want revoked, attach a signed and dated copy of each POA you want to remain in effect and mark an X in this box. ......... 5. Notices and certain other communications In those instances where statutory notices and certain other communications involving the tax matter(s) listed on page 1 are sent to a representative, these documents will be sent to the first representative named in section 2. If you do not want notices and certain other communications sent to the first representative, enter the name of the representative designated on page 1 (or on the attached power of attorney previously filed and remaining in effect) that you want to receive notices, etc. Representative's name: _________________________________________________________________ If you do not want notices and certain other communications to go to any representative, enter None on the line above. 6. Taxpayer signature If a joint tax return was filed for New York State, New York City, or both, and both spouses request the same representative(s), both spouses must sign below. If the taxpayer named in section 1 is other than an individual: I certify that I am acting in the capacity of a corporate officer, partner (except a limited partner), member or manager of a limited liability company, or fiduciary on behalf of the taxpayer, and that I have the authority to execute this power of attorney on behalf of the taxpayer. IF NOT SIGNED AND DATED, THIS POWER OF ATTORNEY WILL BE RETURNED. Signature Name of person signing this form (type or print) Spouse's signature Spouse's telephone number ( Taxpayer's telephone number ) Taxpayer's fax number ( ) Date Title, if applicable Spouse's fax number Date ( ) ( ) Affix corporate seal here, if applicable 7. Acknowledgment or witnessing the power of attorney This power of attorney must be acknowledged by the taxpayer(s) before a notary public (see next page for acknowledgment formats) or witnessed by two disinterested individuals, unless the appointed representative(s) is licensed to practice in New York State as an attorney-at-law, certified public accountant, public accountant, or is a New York State resident enrolled as an agent to practice before the Internal Revenue Service. The person(s) signing as the above taxpayer(s) appeared before us and executed this power of attorney. Signature of witness Name of witness (type or print) Mailing address of witness (type or print) City State ZIP code Date Signature of witness Name of witness (type or print) Mailing address of witness (type or print) City State ZIP code Date 029002140094 American LegalNet, Inc. www.FormsWorkFlow.com Taxpayer's identification number POA-1 (9/10) Page 3 of 4 Acknowledgment -- individual State of ss: County of On this day of , , before me personally came, to me known to be the person(s) described in the foregoing power of attorney; and he/she/they acknowledged that he/she/they executed the same. Signature of notary public Date Notary public: affix stamp (or other indication of your notary authority) Acknowledgment -- corporate State of ss: County of On this day of , , before me personally came, to me known, who, being by me duly sworn, did say that he/she is the of , the corporation described in the foregoing power of attorney; and that he/she signed his/her name thereto by authority of the board of directors of said cor