Last updated: 9/21/2009

Certification For Title 38 Physicians And Dentists {RI 38-133}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

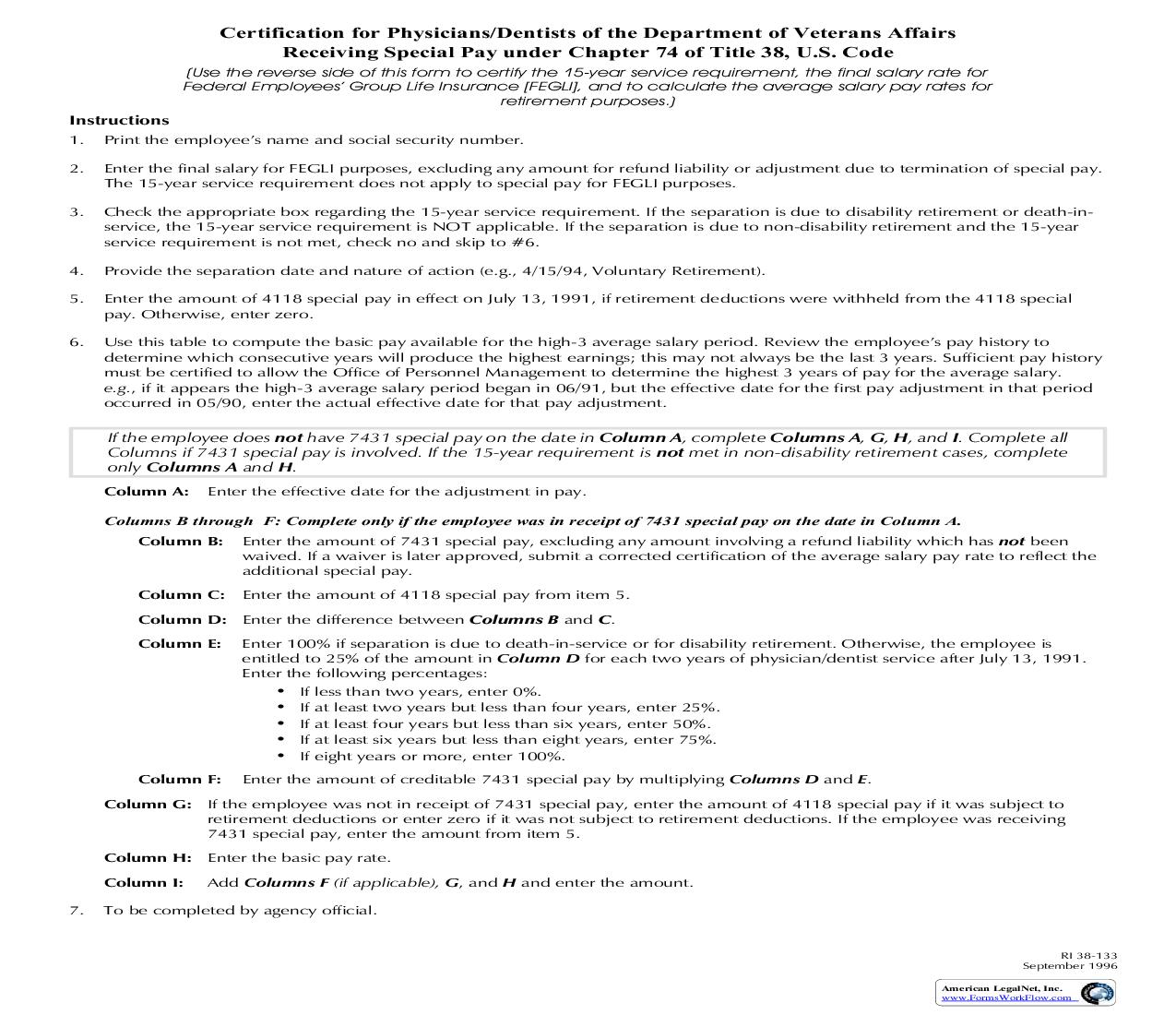

Certification for Physicians/Dentists of the Department of Veterans Affairs Receiving Special Pay under Chapter 74 of Title 38, U.S. Code (Use the reverse side of this form to certify the 15-year service requirement, the final salary rate for Federal Employees' Group Life Insurance [FEGLI], and to calculate the average salary pay rates for retirement purposes.) Instructions 1. 2. Print the employee's name and social security number. Enter the final salary for FEGLI purposes, excluding any amount for refund liability or adjustment due to termination of special pay. The 15-year service requirement does not apply to special pay for FEGLI purposes. Check the appropriate box regarding the 15-year service requirement. If the separation is due to disability retirement or death-inservice, the 15-year service requirement is NOT applicable. If the separation is due to non-disability retirement and the 15-year service requirement is not met, check no and skip to #6. Provide the separation date and nature of action (e.g., 4/15/94, Voluntary Retirement). Enter the amount of 4118 special pay in effect on July 13, 1991, if retirement deductions were withheld from the 4118 special pay. Otherwise, enter zero. Use this table to compute the basic pay available for the high-3 average salary period. Review the employee's pay history to determine which consecutive years will produce the highest earnings; this may not always be the last 3 years. Sufficient pay history must be certified to allow the Office of Personnel Management to determine the highest 3 years of pay for the average salary. e.g., if it appears the high-3 average salary period began in 06/91, but the effective date for the first pay adjustment in that period occurred in 05/90, enter the actual effective date for that pay adjustment. 3. 4. 5. 6. If the employee does not have 7431 special pay on the date in Column A, complete Columns A, G, H, and I. Complete all Columns if 7431 special pay is involved. If the 15-year requirement is not met in non-disability retirement cases, complete only Columns A and H. Column A: Enter the effective date for the adjustment in pay. Columns B through F: Complete only if the employee was in receipt of 7431 special pay on the date in Column A. Column B: Enter the amount of 7431 special pay, excluding any amount involving a refund liability which has not been waived. If a waiver is later approved, submit a corrected certification of the average salary pay rate to reflect the additional special pay. Column C: Enter the amount of 4118 special pay from item 5. Column D: Enter the difference between Columns B and C. Column E: Enter 100% if separation is due to death-in-service or for disability retirement. Otherwise, the employee is entitled to 25% of the amount in Column D for each two years of physician/dentist service after July 13, 1991. Enter the following percentages: · If less than two years, enter 0%. · If at least two years but less than four years, enter 25%. · If at least four years but less than six years, enter 50%. · If at least six years but less than eight years, enter 75%. · If eight years or more, enter 100%. Enter the amount of creditable 7431 special pay by multiplying Columns D and E. Column F: Column G: If the employee was not in receipt of 7431 special pay, enter the amount of 4118 special pay if it was subject to retirement deductions or enter zero if it was not subject to retirement deductions. If the employee was receiving 7431 special pay, enter the amount from item 5. Column H: Enter the basic pay rate. Column I: 7. Add Columns F (if applicable), G, and H and enter the amount. To be completed by agency official. RI 38-133 September 1996 American LegalNet, Inc. www.FormsWorkFlow.com Certification For Title 38 Physicians and Dentists 1a. Name of employee 1b. Social security number 2. Final salary for FEGLI, adjusted for any refund liability or termination of special pay: 3. Has retiree met the 15-year service requirement as a physician or dentist? N/A (Disability Retirement or Death-in-Service; go to #4) Yes (Go to #4) No (Go to #6) $ 4. Date of separation and nature of action: 5. Enter the amount of 4118 special pay on July 13, 1991, if retirement deductions were withheld from the 4118 special pay. Otherwise, enter zero. $ 6. Basic pay for Average Salary (See Instructions): Formula For Creditable 7431 Special Pay From 7/14/91 A Effective Date B 7431 Special Pay - C 4118 Special Pay = = = = = = = = = = D Difference x x x x x x x x x x E % 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% = = = = = = = = = = F Creditable 7431 Special Pay + + + + + + + + + + G 4118 Special Pay + + + + + + + + + + H Basic Pay Rate = = = = = = = = = = I Average Salary Pay Rate 7. Agency Certification: I certify that the information on this form accurately reflects information contained in the Official Personnel and/or Payroll records in the custody of this agency. The 7431 special pay certified in Column B does not include amounts for which there is an unwaived refund liability. Print or type name Signature and Date Official title and telephone number (including area code) Agency name and address: Reverse of RI 38-133 September 1996 American LegalNet, Inc. www.FormsWorkFlow.com