Last updated: 2/12/2019

Order Confirming Plan Of Reorganization {LBF 3020-1}

Start Your Free Trial $ 17.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

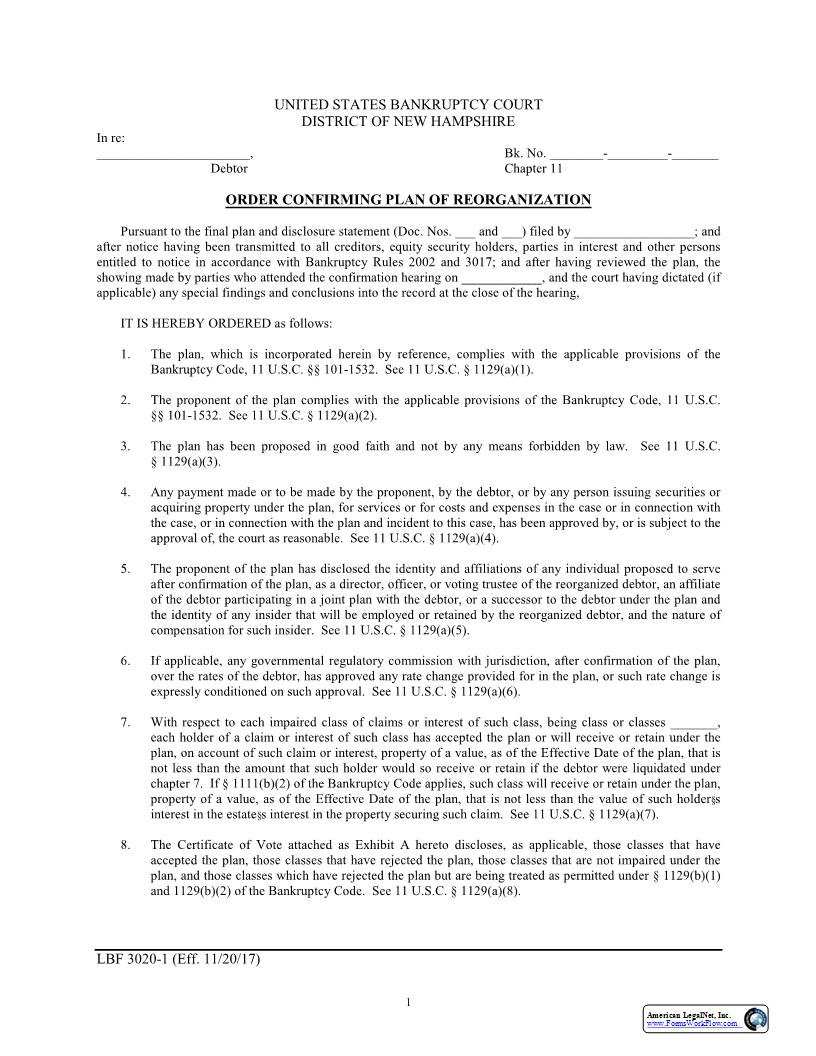

1 UNITED STATES BANKRUPTCY COURT DISTRICT OF NEW HAMPSHIRE In re: , Bk. No. -- Debtor Chapter 11 ORDER CONFIRMING PLAN OF REORGANIZATION Pursuant to the final plan and disclosure statement (Doc. Nos. and ) filed by ; and after notice having been transmitted to all creditors, equity security holders, parties in interest and other persons entitled to notice in accordance with Bankruptcy Rules 2002 and 3017; and after having reviewed the plan, the showing made by parties who attended the confirmation hearing on , and the court having dictated (if applicable) any special findings and conclusions into the record at the close of the hearing, IT IS HEREBY ORDERED as follows: 1. The plan, which is incorporated herein by reference, complies with the applicable provisions of the Bankruptcy Code, 11 U.S.C. 247247 101-1532. See 11 U.S.C. 247 1129(a)(1). 2. The proponent of the plan complies with the applicable provisions of the Bankruptcy Code, 11 U.S.C. 247247 101-1532. See 11 U.S.C. 247 1129(a)(2). 3. The plan has been proposed in good faith and not by any means forbidden by law. See 11 U.S.C. 247 1129(a)(3). 4. Any payment made or to be made by the proponent, by the debtor, or by any person issuing securities or acquiring property under the plan, for services or for costs and expenses in the case or in connection with the case, or in connection with the plan and incident to this case, has been approved by, or is subject to the approval of, the court as reasonable. See 11 U.S.C. 247 1129(a)(4). 5. The proponent of the plan has disclosed the identity and affiliations of any individual proposed to serve after confirmation of the plan, as a director, officer, or voting trustee of the reorganized debtor, an affiliate of the debtor participating in a joint plan with the debtor, or a successor to the debtor under the plan and the identity of any insider that will be employed or retained by the reorganized debtor, and the nature of compensation for such insider. See 11 U.S.C. 247 1129(a)(5). 6. If applicable, any governmental regulatory commission with jurisdiction, after confirmation of the plan, over the rates of the debtor, has approved any rate change provided for in the plan, or such rate change is expressly conditioned on such approval. See 11 U.S.C. 247 1129(a)(6). 7. With respect to each impaired class of claims or interest of such class, being class or classes , each holder of a claim or interest of such class has accepted the plan or will receive or retain under the plan, on account of such claim or interest, property of a value, as of the Effective Date of the plan, that is not less than the amount that such holder would so receive or retain if the debtor were liquidated under chapter 7. If 247 1111(b)(2) of the Bankruptcy Code applies, such class will receive or retain under the plan, property of a value, as of the Effective Date of the plan, that is not less than the value of such holder222s interest in the estate222s interest in the property securing such claim. See 11 U.S.C. 247 1129(a)(7). 8. The Certificate of Vote attached as Exhibit A hereto discloses, as applicable, those classes that have accepted the plan, those classes that have rejected the plan, those classes that are not impaired under the plan, and those classes which have rejected the plan but are being treated as permitted under 247 1129(b)(1) and 1129(b)(2) of the Bankruptcy Code. See 11 U.S.C. 247 1129(a)(8). LBF 3020-1 (Eff. 11/20/17) American LegalNet, Inc. www.FormsWorkFlow.com 2 9. Except to the extent that the holder of a particular claim has agreed to a different treatment of such claim, the plan provides that, with respect to a claim of a kind specified in 247 507(a)(2) or 507(a)(3) of the Bankruptcy Code, being class or classes , on the Effective Date of the plan, the holder of such claim will receive on account of such claim cash equal to the allowed amount of such claim. See 11 U.S.C. 247 1129(a)(9)(A). 10. With respect to a class of claims of a kind specified in 247 507(a)(1), 507(a)(4), 507(a)(5), 507(a)(6) and 507(a)(7) of the Bankruptcy Code, being class or classes , each holder of a claim of such class will receive, if such class has accepted the plan, deferred cash payments of a value, as of the Effective Date of the plan, equal to the allowed amount of such claim, or, if such class has not accepted the plan, cash on the Effective Date of the plan equal to the allowed amount of such claim. See 11 U.S.C. 247 1129(a)(9)(B). 11. With respect to a claim of a kind specified in 247 507(a)(8) of the Bankruptcy Code, being class or classes , the holder of such claim will receive on account of such claim regular installment payments in cash of a value, as of the Effective Date of the plan, equal to the allowed amount of such claim over a period ending not later than five (5) years after the date of the order for relief and in a manner not less favorable than the most favored nonpriority unsecured claim provided for by the plan, other than cash payment made to a class of creditors under 247 1122(b) of the Bankruptcy Code. With respect to a secured claim which would otherwise meet the description of an unsecured claim of a governmental unit under 247 507(a) of the Bankruptcy Code, but for the secured status of that claim, the holder of that claim will receive on account of such claim, cash payments in the same manner and over the same period as described in 247 1129(a)(9)(C) of the Bankruptcy Code. See 11 U.S.C. 247 1129(a)(9)(C) and (D). 12. If a class of claims is impaired under the plan, at least one class of claims that is impaired under the plan, being class or classes , has accepted the plan, determined without including any acceptance of the plan by an insider. See 11 U.S.C. 247 1129(a)(10). 13. Confirmation of this plan is not likely to be followed by liquidation, or the need for further financial reorganization, of this debtor or any successor to the debtor under the plan, unless such liquidation or reorganization is proposed in the plan. See 11 U.S.C. 247 1129(a)(11). 14. All fees due and all quarterly fees payable to the United States Trustee have been paid as of the confirmation date. See 11 U.S.C. 247 1129(a)(12) and LBR 3020-1(c). 15. If applicable, the plan provides for the continuation after the Effective Date of payment of all retiree benefits, as that term is defined in 247 1114 of the Bankruptcy Code, at the level established pursuant to 247 1114(e)(1)(B) or 1141(g) of the Bankruptcy Code, at any time prior to confirmation of the plan, for the duration of the period the debtor has obligated itself to provide such benefits. See 11 U.S.C. 247 1129(a)(13). 16. If the debtor is required by a judicial or administrative order, or by statute, to pay a domestic support obligation, the debtor has paid all amounts payable under such order or such statute for such obligation that first became payable after the date of the filing of the petition. See 11 U.S.C. 247 1129(a)(14). 17. In a case in which the debtor is an individual and in which the holder of an allowed unsecured claim objected to confirmation of the plan, the value, as of the Effective Date of the plan, of the property to be distributed under the plan on account of such claim is not less than the amount of such claim or the value of the property to be distributed under the plan is not less than the projected disposable income of the debtor, as defined in 247 1325(b)(2) of the Bankruptcy Code, to be received during the five (5) year period beginning on the date that the first payment is due under the plan, or during the period for which the plan provides payments, whichever is longer. See 11 U.S.C. 247 1129(a)(15). LBF 3020-1 (Eff. 11/20/17) American LegalNet, Inc. www.FormsWorkFlow.com 3 18. All transfers of property of the plan shall be made in accordance with any applicable provisions of nonbankruptcy law that govern the transfer of property by a corporation or trust that is not a moneyed, business, or commercial corporation or trust. See 11 U.S.C. 247 1129(a)(16). 19. The plan is hereby determined to be fair and equitable and does not discriminate unfairly with regard to any class of claims or in