Last updated: 12/22/2008

Malt Beverage Wholesalers Tax Report

Start Your Free Trial $ 17.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

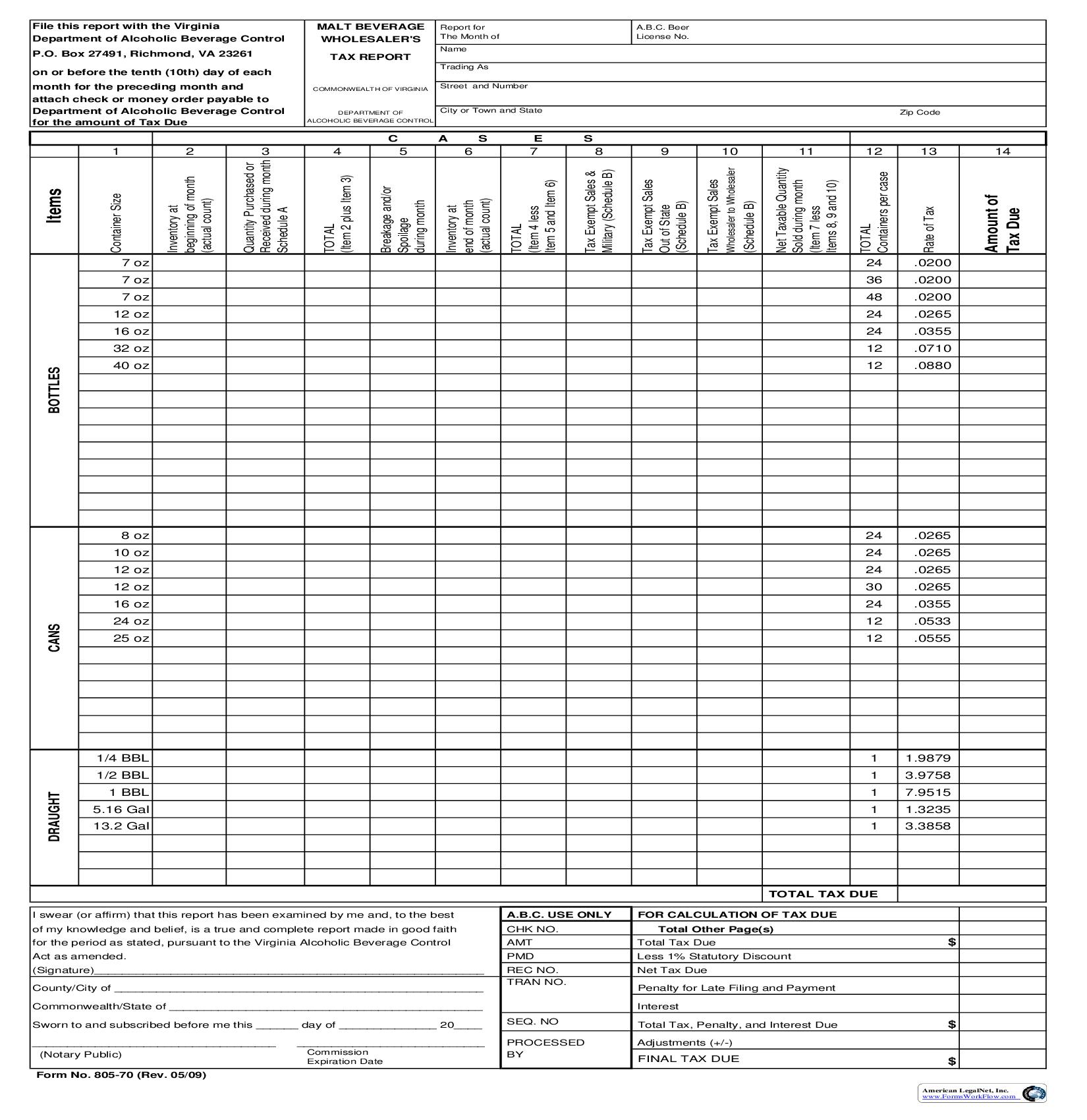

File this report with the Virginia Department of Alcoholic Beverage Control P.O. Box 27491, Richmond, VA 23261 on or before the tenth (10th) day of each month for the preceding month and attach check or money order payable to Department of Alcoholic Beverage Control for the amount of Tax Due MALT BEVERAGE WHOLESALER'S TAX REPORT Report for The Month of Name Trading As A.B.C. Beer License No. COMMONWEALTH OF VIRGINIA Street and Number DEPARTMENT OF ALCOHOLIC BEVERAGE CONTROL City or Town and State Zip Code C A S E S 1 2 Inventory at beginning of month (actual count) 3 Quantity Purchased or Received during month Schedule A 4 TOTAL (Item 2 plus Item 3) 5 6 7 TOTAL (Item 4 less Item 5 and Item 6) 8 Tax Exempt Sales & Military (Schedule B) 9 Tax Exempt Sales Out of State (Schedule B) Tax Exempt Sales 10 Wholesaler to Wholesaler 11 Net Taxable Quantity Sold during month (Item 7 less Items 8, 9 and 10) 12 TOTAL Containers per case 13 14 Breakage and/or Spoilage during month Items Container Size Inventory at end of month (actual count) (Schedule B) 7 oz 7 oz 7 oz 12 oz 16 oz 32 oz BOTTLES 40 oz 24 36 48 24 24 12 12 .0200 .0200 .0200 .0265 .0355 .0710 .0880 8 oz 10 oz 12 oz 12 oz 16 oz CANS 24 oz 25 oz 24 24 24 30 24 12 12 .0265 .0265 .0265 .0265 .0355 .0533 .0555 1/4 Bbl 1/2 Bbl DRAUGHT 1 Bbl 5.16 Gal 13.2 Gal 1 1 1 1 1 1.9879 3.9758 7.9515 1.3235 3.3858 TOTAL TAX DUE I swear (or affirm) that this report has been examined by me and, to the best of my knowledge and belief, is a true and complete report made in good faith for the period as stated, pursuant to the Virginia Alcoholic Beverage Control Act as amended. (Signature)________________________________________________________ County/City of _____________________________________________________ Commonwealth/State of _____________________________________________ Sworn to and subscribed before me this ______ day of ______________ 20____ ___________________________________ (Notary Public) Form No. 805-70 (Rev. 10/08) American LegalNet, Inc. www.FormsWorkflow.com A.B.C. USE ONLY CHK NO. AMT PMD REC NO. TRAN NO. FOR CALCULATION OF TAX DUE Total Other Page(s) Total Tax Due Less 1% Statutory Discount Net Tax Due Penalty for Late Filing and Payment Interest Rate of Tax $ SEQ. NO PROCESSED BY Total Tax, Penalty, and Interest Due Adjustments (+/-) $ ___________________________ Commission Expiration Date FINAL TAX DUE $ Amount of Tax Due Report for Month of Trading as A.B.C. License No. This Schedule Must be Filled OUT in Complete Detail for Each Order Purchased or Received Page_____of______ SCHEDULE A ---- BEER, ALE, PORTER AND STOUT PURCHASED OR RECEIVED BOTTLES 7 OZ 24 12 OZ 16 OZ 32 OZ 40 OZ 8 OZ 16 OZ 24 OZ 25 OZ 7 OZ 36 7 OZ 48 10 OZ 24 12 OZ 24 12 OZ 30 1/4 BBL 1/2 BBL 1 BBL 5.16 GAL 13.2 GAL Inv Date INVOICE NO. Purchased or Received From SUPPLIER/ DISTRIBUTOR NO. CANS DRAUGHT BEER Ref No. American LegalNet, Inc. www.FormsWorkflow.com SCHEDULE A ---- CONTINUED Trading as Report for Month of A.B.C. License No. Page_____of______ Inv Date 7 OZ 24 12 OZ 16 OZ 32 OZ 40 OZ 8 OZ 16 OZ 24 OZ 25 OZ 7 OZ 36 7 OZ 48 10 OZ 24 12 OZ 24 12 OZ 30 1/4 BBL 1/2 BBL 1 BBL 5.16 GAL 13.2 GAL INVOICE NO. Purchased or Received From SUPPLIER/ DISTRIBUTOR NO. BOTTLES CANS DRAUGHT BEER Ref No. American LegalNet, Inc. www.FormsWorkflow.com SCHEDULE A TOTALS (Item 3) Report for Month of Trading as A.B.C. License No. This Schedule Must be Filled OUT in Complete Detail for Each Tax Exempt Order Page_____of______ SCHEDULE B ---- BEER, ALE, PORTER AND STOUT TAX EXEMPT QUANTITIES BOTTLES 7 OZ 48 12 OZ 16 OZ 32 OZ 40 OZ 8 OZ 16 OZ 24 OZ 25 OZ 10 OZ 24 12 OZ 24 12 OZ 30 1/4 BBL 1/2 BBL 1 BBL 5.16 GAL 13.2 GAL Name and Address of Purchaser Inv Date INVOICE NO. CANS DRAUGHT BEER 7 OZ 24 7 OZ 36 MILITARY Tax Exempt & Military (Schedule B) TOTAL (Item 8) OUT OF STATE TOTAL (Item 9) WHOLESALER/WHOLESALER (NAME/LICENSE NO.) American LegalNet, Inc. www.FormsWorkflow.com TOTAL (Item 10)