Last updated: 2/7/2018

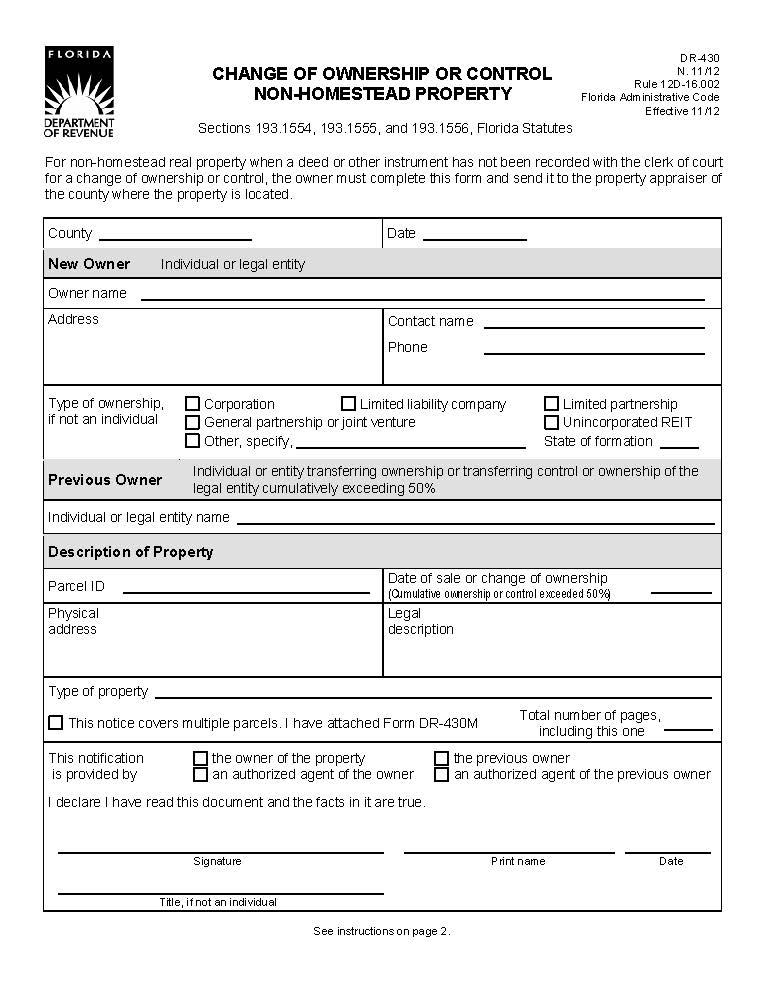

Change Of Ownership Of Control Non-Homestead Property {DR-430}

Start Your Free Trial $ 11.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

DR-430 - CHANGE OF OWNERSHIP OR CONTROL NON-HOMESTEAD PROPERTY. This is a Florida Department of Revenue form used to notify a county property appraiser of a change in ownership or control of non-homestead real property when no deed or other instrument has been recorded with the clerk of court. Authorized under Sections 193.1554, 193.1555, and 193.1556, Florida Statutes, this form applies to sales, foreclosures, transfers of legal or beneficial title, or cumulative transfers of more than 50% ownership or control of a legal entity. The filer must provide information about the new and previous owner, property details, parcel identification, and the date of the change. The completed form is sent to the property appraiser in the county where the property is located. www.FormsWorkflow.com