Last updated: 8/26/2015

Certificate Of Compliance By Non-Participating Manufacturer Regarding Escrow Agreement {CTP-130}

Start Your Free Trial $ 15.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

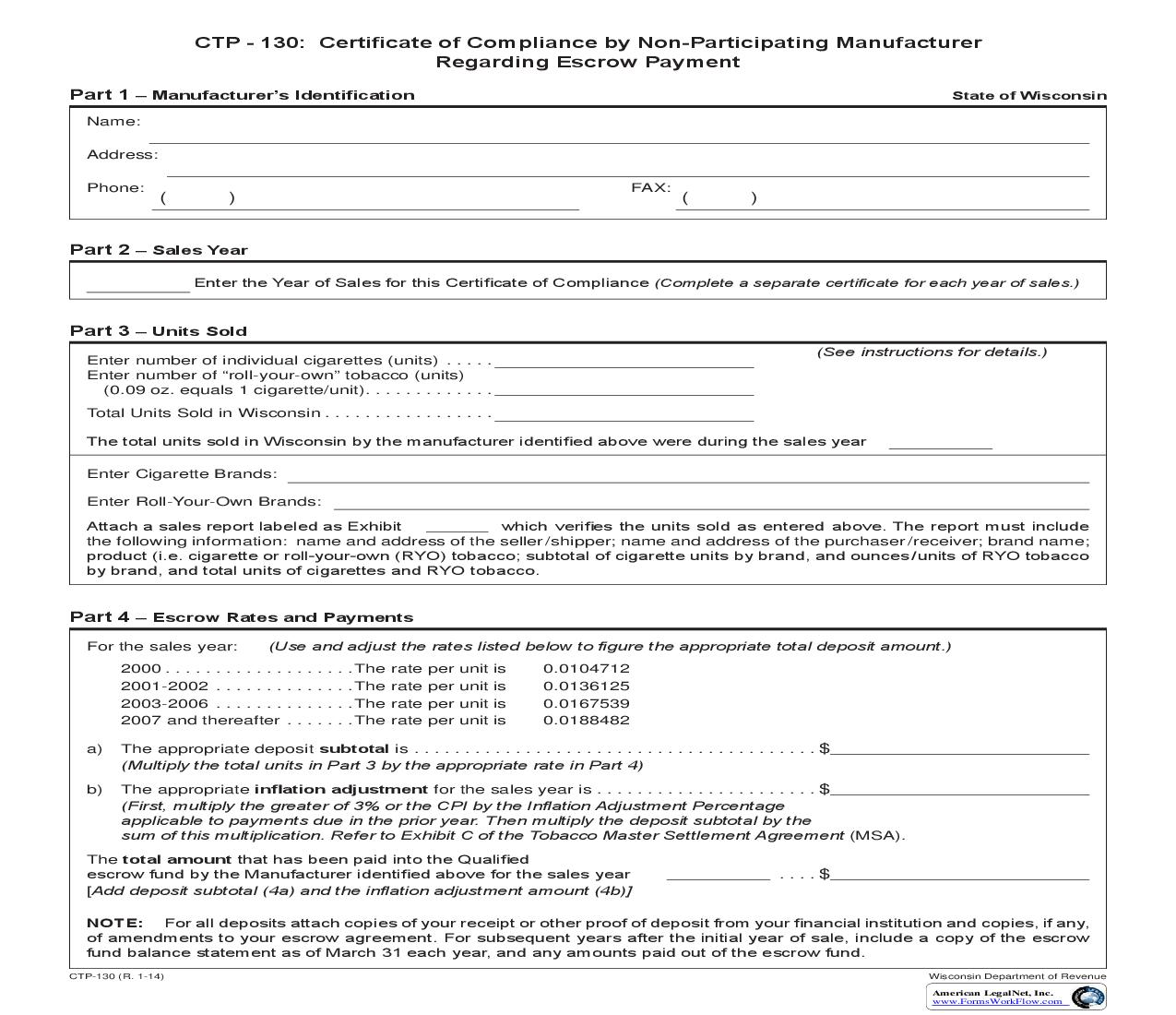

CTP - 130: Certificate of Compliance by Non-Participating Manufacturer Regarding Escrow Payment Part 1 Manufacturer's Identification Name: Address: Phone: FAX: State of Wisconsin ( ) ( ) Part 2 Sales Year EntertheYearofSalesforthisCertificateofCompliance (Complete a separate certificate for each year of sales.) Part 3 Units Sold Enter number of individual cigarettes (units) . . . . . Enter number of "roll-your-own" tobacco (units) (0.09 oz. equals 1 cigarette/unit). . . . . . . . . . . . . Total Units Sold in Wisconsin . . . . . . . . . . . . . . . . . ThetotalunitssoldinWisconsinbythemanufactureridentifiedabovewereduringthesalesyear Enter Cigarette Brands: Enter Roll-Your-Own Brands: AttachasalesreportlabeledasExhibit whichverifiestheunitssoldasenteredabove.Thereportmustinclude the following information: name and address of the seller /shipper; name and address of the purchaser /receiver; brand name; product(i.e.cigaretteorroll-your-own(RYO)tobacco;subtotalofcigaretteunitsbybrand,andounces /unitsofRYOtobacco bybrand,andtotalunitsofcigarettesandRYOtobacco. (See instructions for details.) Part 4 Escrow Rates and Payments For the sales year: (Use and adjust the rates listed below to figure the appropriate total deposit amount.) 0.0104712 0.0136125 0.0167539 0.0188482 2000 . . . . . . . . . . . . . . . . . . .The rate per unit is 2001-2002 . . . . . . . . . . . . . .The rate per unit is 2003-2006 . . . . . . . . . . . . . .The rate per unit is 2007 and thereafter . . . . . . .The rate per unit is a) b) The appropriate deposit subtotal is . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (Multiply the total units in Part 3 by the appropriate rate in Part 4) The appropriate inflation adjustment for the sales year is . . . . . . . . . . . . . . . . . . . . . . $ (First, multiply the greater of 3% or the CPI by the Inflation Adjustment Percentage applicable to payments due in the prior year. Then multiply the deposit subtotal by the sum of this multiplication. Refer to Exhibit C of the Tobacco Master Settlement Agreement (MSA). ....$ The total amountthathasbeenpaidintotheQualified escrowfundbytheManufactureridentifiedaboveforthesalesyear [Add deposit subtotal (4a) and the inflation adjustment amount (4b)] NOTE: Foralldepositsattachcopiesofyourreceiptorotherproofofdepositfromyourfinancialinstitutionandcopies,ifany, ofamendmentstoyourescrowagreement.Forsubsequentyearsaftertheinitialyearofsale,includeacopyoftheescrow fundbalancestatementasofMarch31eachyear,andanyamountspaidoutoftheescrowfund. CTP-130 (R. 1-14) Wisconsin Department of Revenue American LegalNet, Inc. www.FormsWorkFlow.com Part 5 Financial Institution NameofInstitution: Address: Escrow Account No: Total Amount Held for the State of State of Wisconsin WISCONSIN : $ Part 6 Signature Underpenaltyofperjury,Istatethat,tothebestofmyknowledge,alloftheinformationcontainedinthisCertificateof Compliance is true and accurate. This certificate of compliance must also be signed and dated by an authorized notary public. Name of Authorized Agent (please print) Title Signature of Authorized Agent Date Subscribed and sworn to before me on this date: Signature of Notary Public City or County (circle one) Date my Commission Expires Mail this Certificate of Compliance to: Office of the Attorney General at Tobacco NPM Enforcement Coordinator Wisconsin Department of Justice PO Box 7857 MadisonWI53707-7857 and Secretary of Revenue at Excise Tax Unit Wisconsin Department of Revenue PO Box 8900 MadisonWI53708-8900 CTP-130 (R. 1-14) Wisconsin Department of Revenue 2 American LegalNet, Inc. www.FormsWorkFlow.com CTP-130 Instructions - Certificate of Compliance by Non-Participating Manufacturer Regarding Escrow Payment GENERAL INFORMATION Who is required to file this certificate of compliance? · Any tobacco product manufacturer which: (1) sells cigarettes and/or roll-your-own (RYO) within the state of Wisconsin (whether directly or through any distributor, retailer, or similar intermediary) and (2) has not become a participating manufacturer in the tobacco Master Settlement Agreement (MSA) executed on 11/23/98. If you satisfy these requirements, you must file this certificate of compliance to report the units of cigarettes and/or RYO manufactured by you and sold in the state of Wisconsin and pay the amount calculated into your qualified escrow fund. DEFINITION ·Tobacco product manufacturer Anyentitythatmanufacturescigarettes, includingroll-your-own,thatsuchmanufacturer intends to be sold in the United States including cigarettes and/or RYO that are intended to be sold in the United States through an importer; · The first purchaser for resale in the United States of cigarettes, including RYO, manufactured that the manufacturer does not intend to be sold in the United States; or · A successor of any entity described above. · Non-participating manufacturer A non-participating manufacturer is any tobacco product manufacturer who has not signed onto the MSA . · Qualified escrow fund A non-participating manufacturer that is required to file this certificate of compliance must establish a qualified escrow fund. This means an escrow arrangement with a U.S. federal or U.S.state-charteredfinancialinstitution having no affiliation with any tobacco product manufacturer and having assetsofatleast$1,000,000,000,where such arrangement (1) requires that the financial institution hold the escrowed funds'principalforthebenefitoftheState of Wisconsin (and possibly other "ReleasingParties"asdefinedintheMSA) and (2) prohibits the non-participating manufacturerfromusing,accessing,or directing the use of the funds' principal except as consistent with sec. 995.10(2) (b),Wis.Stats. DUE DATE · Certificate of compliance due This certificate of compliance is to be filedonorbeforeApril15thoftheyear following the sales year. For 2000, the sales year for tobacco products sold in WisconsinisMay23, 2000December31,2000.After2000, thesalesyearisacalendaryear,from January 1 through December 31. · Escrow payment You must deposit all escrow payments into your qualified escrow fund on or before April 15th of the year following the sales year. After you have made your deposit,forwardacopyofyourreceiptor otherproofofdepositfromyourfinancial institution to the Office of theAttorney GeneraloftheStateofWisconsin,along withthissignedandnotarizedcertificate of compliance. In addition, after you have made your initial deposit into the qualified es