Last updated: 4/7/2017

Application For Aircraft Registration Or Exemption {7695}

Start Your Free Trial $ 17.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

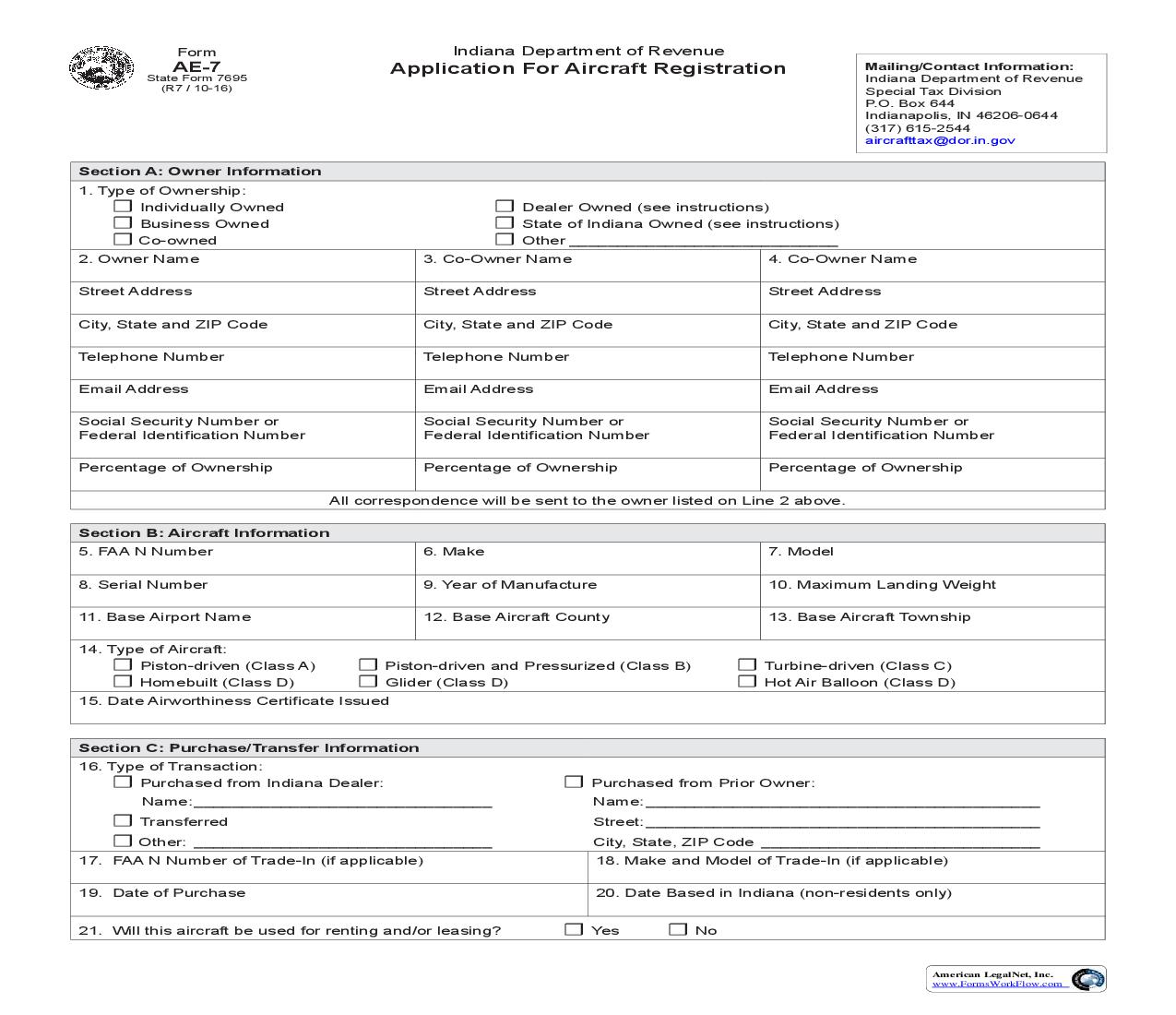

State Form 7695 (R7 / 10-16) AE-7 Form Application For Aircraft Registration Indiana Department of Revenue Mailing/Contact Information: Indiana Department of Revenue Special Tax Division P.O. Box 644 Indianapolis, IN 46206-0644 (317) 615-2544 aircrafttax@dor.in.gov Section A: Owner Information 1. Type of Ownership: Individually Owned Business Owned Co-owned 2. Owner Name Street Address City, State and ZIP Code Telephone Number Email Address Social Security Number or Federal Identification Number Percentage of Ownership Dealer Owned (see instructions) State of Indiana Owned (see instructions) Other ____________________________ 3. Co-Owner Name Street Address City, State and ZIP Code Telephone Number Email Address Social Security Number or Federal Identification Number Percentage of Ownership 4. Co-Owner Name Street Address City, State and ZIP Code Telephone Number Email Address Social Security Number or Federal Identification Number Percentage of Ownership All correspondence will be sent to the owner listed on Line 2 above. Section B: Aircraft Information 5. FAA N Number 8. Serial Number 11. Base Airport Name 14. Type of Aircraft: Piston-driven (Class A) Homebuilt (Class D) 6. Make 9. Year of Manufacture 12. Base Aircraft County 7. Model 10. Maximum Landing Weight 13. Base Aircraft Township Piston-driven and Pressurized (Class B) Glider (Class D) Turbine-driven (Class C) Hot Air Balloon (Class D) 15. Date Airworthiness Certificate Issued Section C: Purchase/Transfer Information 16. Type of Transaction: Purchased from Indiana Dealer: Transferred Other: _______________________________ 17. FAA N Number of Trade-In (if applicable) 19. Date of Purchase Name: _______________________________ Purchased from Prior Owner: Name: _________________________________________ Street: _________________________________________ City, State, ZIP Code _____________________________ 18. Make and Model of Trade-In (if applicable) 20. Date Based in Indiana (non-residents only) 21. Will this aircraft be used for renting and/or leasing? Yes No American LegalNet, Inc. www.FormsWorkFlow.com Section D: Excise Tax Computation 22. Maximum Landing Weight (Enter the amount from Section B, Line 10) 23. Tax Rate (Refer to Section B, Line 14 for the Class) Aircraft Age 0-4 Years 5-8 Years 9-12 Years 13-16 Years 17-25 Years 26 Years & Older Class A $.04 $.035 $.03 $.025 $.02 $.01 Class B $.065 $.055 $.05 $.025 $.02 $.01 Class C $.09 $.08 $.07 $.025 $.02 $.01 Class D $.0175 $.015 $.0125 $.01 $.0075 $.005 $ lbs 24. Gross Excise Tax Due (Line 22 multiplied by Line 23) 25. Excise Tax Reduction (Based on the month aircraft became subject to registration) Feb .10 Mar .20 Apr .30 May .40 Jun .50 Jul .60 Aug .70 Sep .80 Oct .90 26. Net Excise Tax Due (Line 24 minus Line 25) 27. Adjustments (See instructions) 28. Excise Tax Due (Line 26 minus Line 27) 29. Penalty (Enter the greater of $20 or 20% of Line 28) 30. Interest (See instructions) 31. Total Excise Tax Amount Due (Line 28 plus Line 29 plus Line 30) Section E: Sales/Use Tax Computation 32. Purchase Price 33. Trade-in Allowance 34. Amount Subject to Sales Tax (Line 32 minus Line 33) 35. Sales Tax Rate 36. Sales Tax Due (Line 34 multiplied by Line 35) 37. Use Tax Credit (See Instructions) 38. Sales/Use Tax Amount Due (Line 36 minus Line 37) 39. Penalty (Enter the greater of $5 or 10% of Line 38) 40. Interest (See Instructions) 41. Total Sales/Use Tax Amount Due (Line 38 plus Line 39 plus Line 40) Section F: Tax/Fee Summary 42. Total Excise Tax Amount Due (Section D, Line 31) 43. Total Sales/Use Tax Amount Due (Section E, Line 41) 44. Registration/Transfer Fee Due (See Instructions) 45. Total Amount Due (Line 42 plus Line 43 plus Line 44) $ $ $ $ $ $ $ $ $ .07 $ $ $ $ $ $ $ $ $ $ I hereby certify, under penalty of perjury, that the information contained herein is true, correct, and complete to the best of my knowledge. _______________________________________ Signature of Owner _______________________________________ Signature of Owner _______________________________________ Signature of Owner ___________________________________ Printed Name of Owner ___________________________________ Printed Name of Owner ___________________________________ Printed Name of Owner ________________________ Date ________________________ Date ________________________ Date American LegalNet, Inc. www.FormsWorkFlow.com Instructions for Completing the Application for Aircraft Registration What is the AE-7? The AE-7 is used to register an aircraft with the Indiana Department of Revenue. Who should submit the AE-7? · Any resident of Indiana who owns an aircraft must submit this form within 31 days of purchase date or within 31 days of the Federal Aviation Administration (FAA) issuing the airworthiness certificate in the case of homebuilt aircraft · Any nonresident who bases an aircraft in Indiana more than 60 days must submit this form within 60 days of establishing a base in Indiana · Any dealer with an inventory aircraft that during a year has total time in service exceeding 50 hours must submit this form within 31 days after the date the total time in service exceeds 50 hours · Any dealer with an inventory aircraft used for any purpose other than resale or demonstration flights must submit this form within 31 days after the date the improper use began Where do I send the completed AE-7? Indiana Department of Revenue Special Tax Division P.O. Box 644 Indianapolis, IN 46206-0644 Are there any supporting documents that I should include? Yes. A bill of sale, Form AE-5, or other written evidence should be included to support the purchase price of the aircraft. If the transaction is exempt from sales/use tax, include Form ST-108AIR or other supporting documentation. If the aircraft is being purchased for use on your farm, include Form AGQ-100. What are the payment options? You can write a check and include it with the AE-7 or you can pay electronically by visiting www.payINgov.com/specialtax. Who do I contact if I have questions? You can reach us at (317)615-2544 or aircrafttax@dor.in.gov. Section A: Owner Information 1. Mark only one box. Dealer Owned should only be selected when the aircraft is used for a purpose other than resale, or if the total time in service during the year exceeds 50 hours. If State of Indiana Owned is selected, the aircraft must be reported for registration but taxes and fees do not apply. 2. An entry is required in all fields except email address. If the aircraft is not co