Last updated: 7/11/2012

Mortgage By Business Entity {20.1.2}

Start Your Free Trial $ 17.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

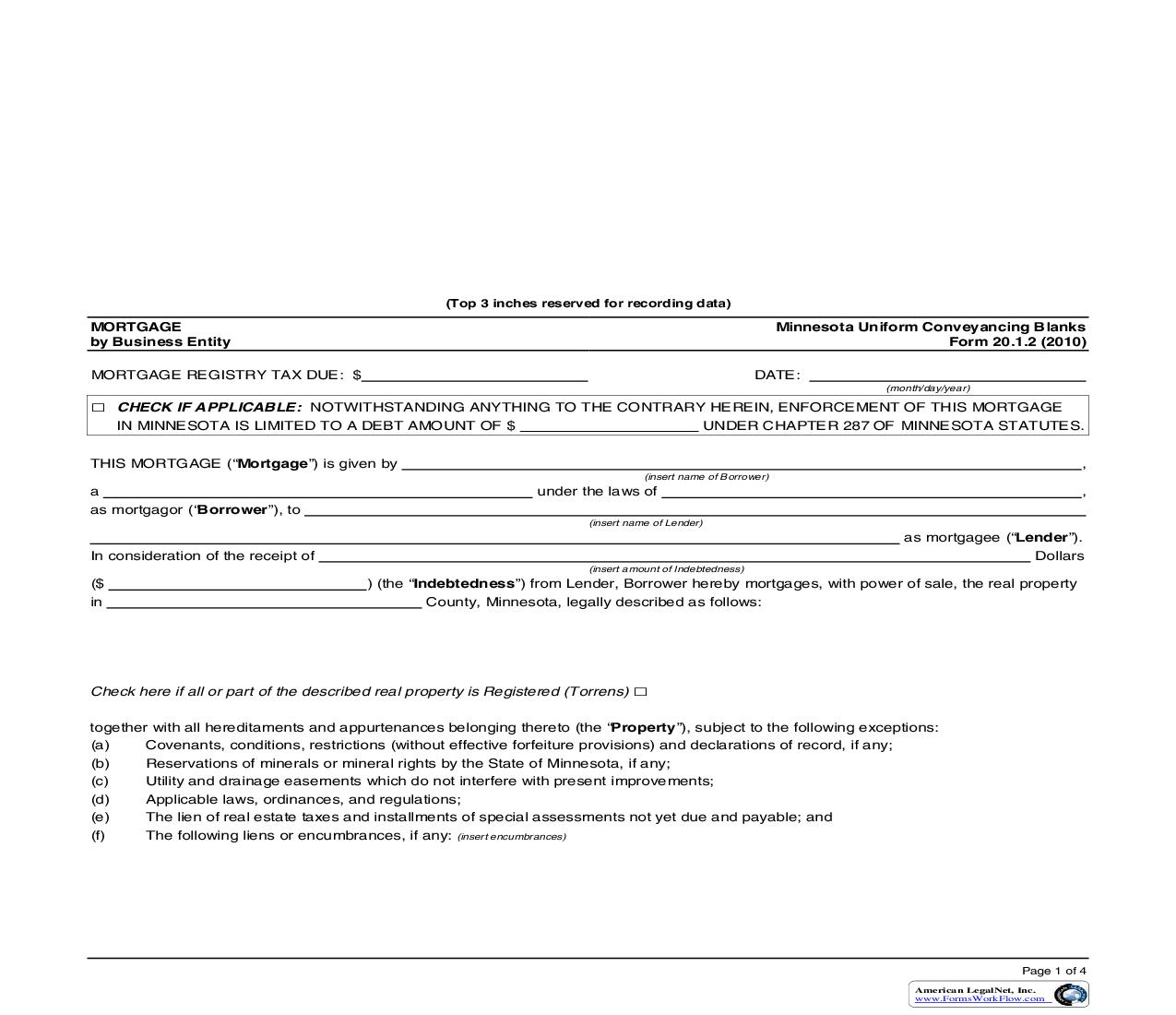

(Top 3 inches reserved for recording data) MORTGAGE by Business Entity MORTGAGE REGISTRY TAX DUE: $ Minnesota Uniform Conveyancing Blanks Form 20.1.2 (2010) DATE: (month/day/year) CHECK IF APPLICABLE: NOTWITHSTANDING ANYTHING TO THE CONTRARY HEREIN, ENFORCEMENT OF THIS MORTGAGE IN MINNESOTA IS LIMITED TO A DEBT AMOUNT OF $ THIS MORTGAGE ("Mortgage") is given by a as mortgagor ("Borrower"), to In consideration of the receipt of ($ in UNDER CHAPTER 287 OF MINNESOTA STATUTES. , , as mortgagee ("Lender"). Dollars under the laws of (insert name of Borrower) (insert name of Lender) ) (the "Indebtedness") from Lender, Borrower hereby mortgages, with power of sale, the real property County, Minnesota, legally described as follows: (insert amount of Indebtedness) Check here if all or part of the described real property is Registered (Torrens) together with all hereditaments and appurtenances belonging thereto (the "Property"), subject to the following exceptions: (a) Covenants, conditions, restrictions (without effective forfeiture provisions) and declarations of record, if any; (b) Reservations of minerals or mineral rights by the State of Minnesota, if any; (c) Utility and drainage easements which do not interfere with present improvements; (d) Applicable laws, ordinances, and regulations; (e) The lien of real estate taxes and installments of special assessments not yet due and payable; and (f) The following liens or encumbrances, if any: (insert encumbrances) Page 1 of 4 American LegalNet, Inc. www.FormsWorkFlow.com Page 2 of 4 Minnesota Uniform Conveyancing Blanks Form 20.1.2 Borrower covenants with Lender as follows: 1. Repayment of Indebtedness. If Borrower (a) pays the Indebtedness to Lender according to the terms of the promissory note or other instrument of even date herewith that evidences the Indebtedness and all renewals, extensions, and modifications thereto (the "Note"), ; (b) pays interest on the Indebtedness as provided in the Note; final payment of which is due on (c) repays to Lender, at the times and with interest as specified, all sums advanced in protecting the lien of this Mortgage, if any; and (d) keeps and performs all the covenants and agreements contained herein, then Borrower's obligations under this Mortgage will be satisfied, and Lender will deliver an executed satisfaction of this Mortgage to Borrower. It is Borrower's responsibility to record any satisfaction of this Mortgage at Borrower's expense. 2. Statutory Covenants. Borrower makes and includes in this Mortgage the following covenants and provisions set forth in Minn. Stat. 507.15, and the relevant statutory covenant equivalents contained therein are hereby incorporated by reference: (a) To warrant the title to the Property; (b) To pay the Indebtedness as herein provided; (c) To pay all taxes; (d) That the Property shall be kept in repair and no waste shall be committed; (e) To pay principal and interest on prior mortgages (if any). 3. Additional Covenants and Agreements of Borrower. Borrower makes the following additional covenants and agreements with Lender: (a) Borrower shall keep all buildings, improvements, and fixtures now or later located on all or any part of the Property (collectively, the "Improvements") insured against loss by fire, lightning, and such other perils as are included in a standard all-risk endorsement, and against loss or damage by all other risks and hazards covered by a standard extended coverage insurance policy, including, without limitation, vandalism, malicious mischief, burglary, theft, and if applicable, steam boiler explosion. Such insurance shall be in an amount no less than the full replacement cost of the Improvements, without deduction for physical depreciation. If any of the Improvements are located in a federally designated flood prone area, and if flood insurance is available for that area, Borrower shall procure and maintain flood insurance in amounts reasonably satisfactory to Lender. Borrower shall procure and maintain liability insurance against claims for bodily injury, death, and property damage occurring on or about the Property in amounts reasonably satisfactory to Lender and naming Lender as an additional insured, all for the protection of the Lender. (b) Each insurance policy required pursuant to Paragraph 3(a) must contain provisions in favor of Lender affording all right and privileges customarily provided under the so-called standard mortgagee clause. Each policy must be issued by an insurance company or companies licensed to do business in Minnesota and acceptable to Lender. Each policy must provide for not less than ten (10) days written notice to Lender before cancellation, non-renewal, termination, or change in coverage. Borrower will deliver to Lender a duplicate original or certificate of such insurance policies and of all renewals and modifications of such policies. (c) If the Property is damaged by fire or other casualty, Borrower must promptly give notice of such damage to Lender and the insurance company. In such event, the insurance proceeds paid on account of such damage will be applied to payment of the amounts owed by Borrower pursuant to the Note, even if such amounts are not otherwise then due, unless Borrower is permitted to make an election as described in the next paragraph. Such amounts first will be applied to unpaid accrued interest and next to the principal to be paid as provided in the Note in the inverse order of their maturity. Such payment(s) will not postpone the due date of the installments to be paid pursuant to the Note or change the amount of such installments. The balance of insurance proceeds, if any, will be the property of Borrower. (d) Notwithstanding the provisions of Paragraph 3(c), and unless otherwise agreed by Borrower and Lender in writing, if (i) Borrower is not in default under this Mortgage (or after Borrower has cured any such default); (ii) the mortgagees under any prior mortgages do not require otherwise; and (iii) such damage does not exceed ten percent (10%) of the then assessed market value of the Improvements, then Borrower may elect to have that portion of such insurance proceeds necessary to repair, replace, or restore the damaged Property (the "Repairs") deposited in escrow with a bank or title insurance company qualified to do business in Minnesota, or such other party as may be mutually agreeable to Lender and Borrower. The election may only be made by written notice to Lender within sixty