Last updated: 7/12/2018

Limited Power Of Attorney {LGL-003}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

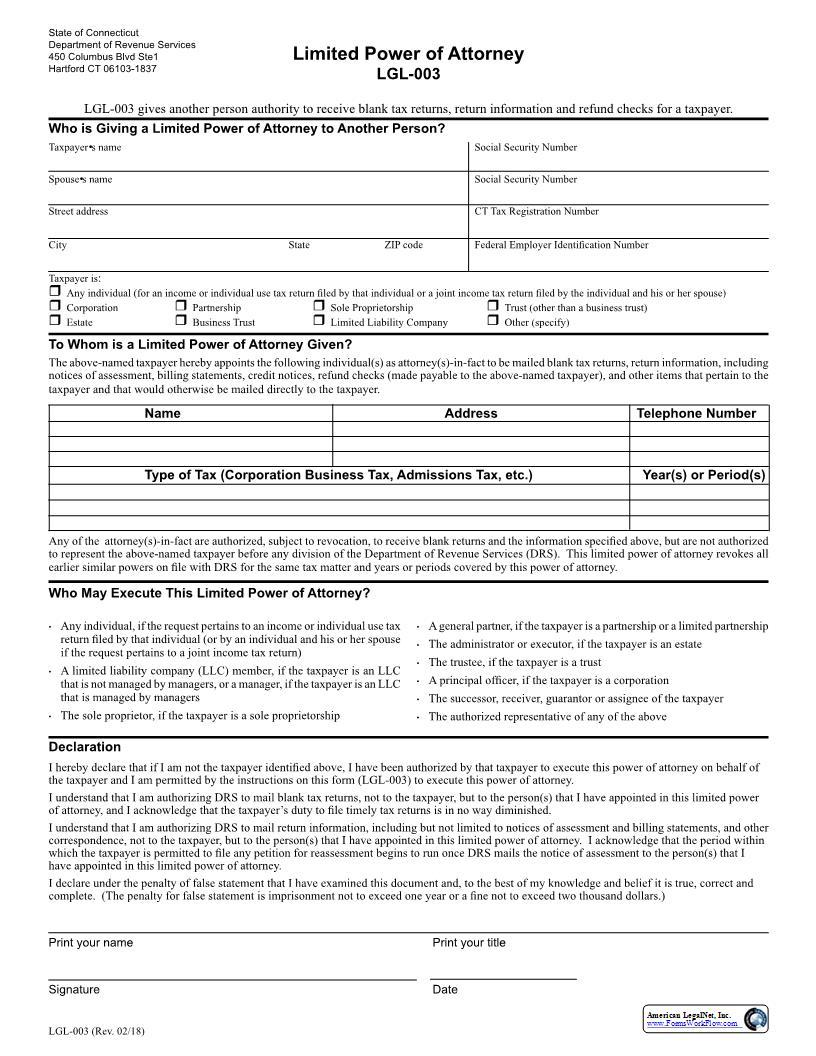

State of ConnecticutDepartment of Revenue Services450 Columbus Blvd Ste1Hartford CT 06103-1837Limited Power of AttorneyLGL-003LGL-003 gives another person authority to receive blank tax returns, return information and refund checks for a taxpayer.Who is Giving a Limited Power of Attorney to Another Person? Taxpayer222s name þ Social Security Number Spouse222s name þ Social Security Number Street address þ CT Tax Registration Number þ þ þ þ Taxpayer is: þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ Corporation þ Partnership þ Sole Proprietorship þ þ þ þ þ þ Estate þ Business Trust þ Limited Liability Company þ þ To Whom is a Limited Power of Attorney Given? þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ taxpayer and that would otherwise be mailed directly to the taxpayer. Name þ Address þ Telephone Number Type of Tax (Corporation Business Tax, Admissions Tax, etc.) þ Year(s) or Period(s) þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ Who May Execute This Limited Power of Attorney? þ þ Any individual, if the request pertains to an income or individual use tax þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ that is not managed by managers, or a manager, if the taxpayer is an LLCthat is managed by managers The sole proprietor, if the taxpayer is a sole proprietorship A general partner, if the taxpayer is a partnership or a limited partnership The administrator or executor, if the taxpayer is an estate The trustee, if the taxpayer is a trust þ þ þ þ þ þ þ þ The successor, receiver, guarantor or assignee of the taxpayer þ þ þ þ þ þ þ Declaration þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ have appointed in this limited power of attorney.I declare under the penalty of false statement that I have examined this document and, to the best of my knowledge and belief it is true, correct and þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ Print your name þ Print your title Signature Date American LegalNet, Inc. www.FormsWorkFlow.com