Last updated: 7/29/2011

International Registration Plan Transaction (Schedule C} {INIRP-C}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

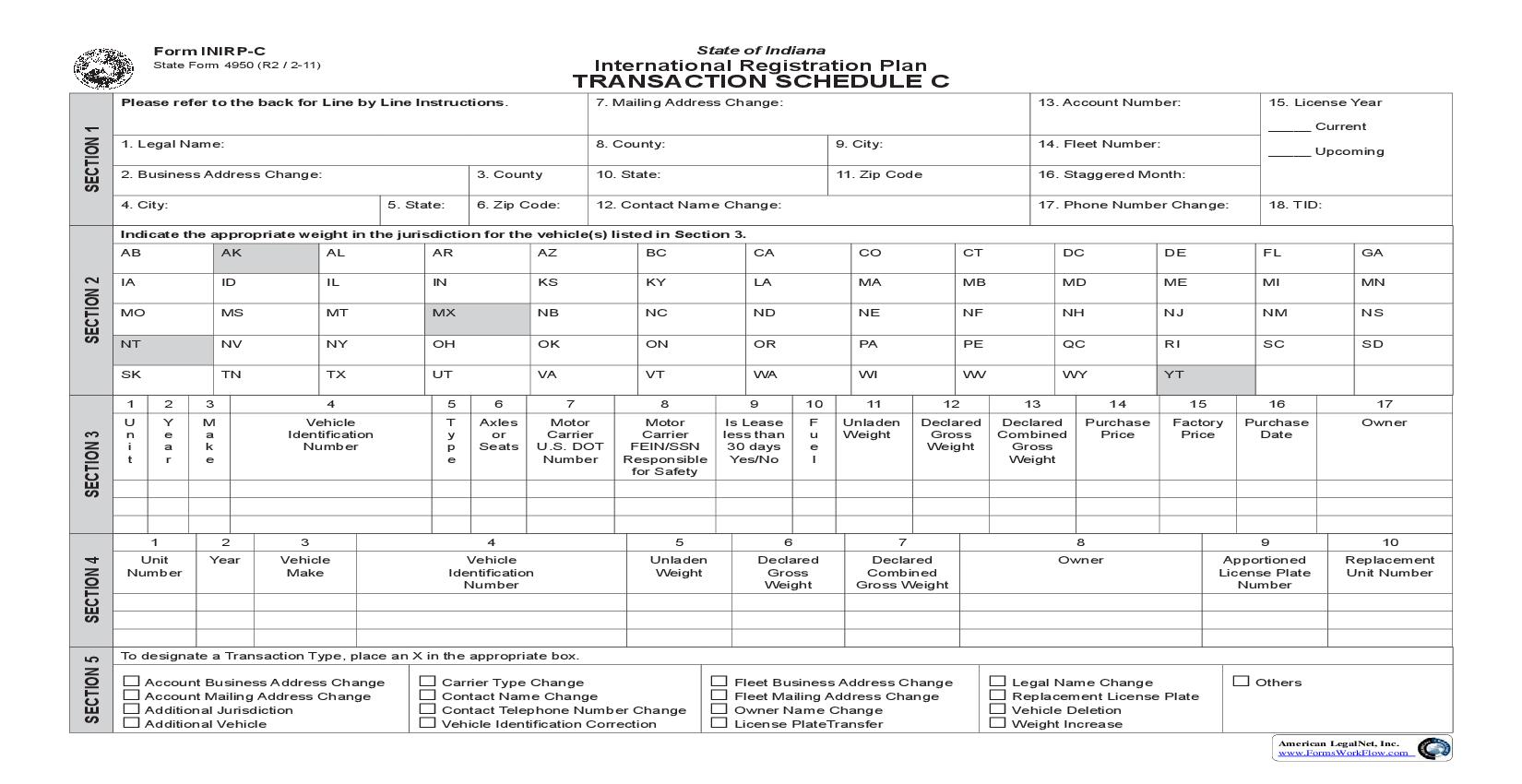

Form INIRP-C State Form 4950 (R2 / 2-11) TRANSACTION SCHEDULE C 7. Mailing Address Change: 13. Account Number: 15. License Year _____ Current 8. County: 3. County 5. State: 6. Zip Code: 10. State: 12. Contact Name Change: 9. City: 11. Zip Code 14. Fleet Number: 16. Staggered Month: 17. Phone Number Change: 18. TID: International Registration Plan State of Indiana Please refer to the back for Line by Line Instructions. SECTION 1 1. Legal Name: 2. Business Address Change: 4. City: _____ Upcoming Indicate the appropriate weight in the jurisdiction for the vehicle(s) listed in Section 3. AB AK ID MS NV TN 2 Y e a r 3 M a k e AL IL MT NY TX 4 Vehicle Identification Number AR IN MX OH UT 5 T y p e 6 Axles or Seats AZ KS NB OK VA 7 Motor Carrier U.S. DOT Number BC KY NC ON VT 8 Motor Carrier FEIN/SSN Responsible for Safety CA LA ND OR WA 9 Is Lease less than 30 days Yes/No 10 F u e l CO MA NE PA WI 11 Unladen Weight 12 Declared Gross Weight CT MB NF PE WV 13 Declared Combined Gross Weight DC MD NH QC WY 14 Purchase Price DE ME NJ RI YT 15 Factory Price 16 Purchase Date 17 Owner FL MI NM SC GA MN NS SD SECTION 2 SECTION 3 IA MO NT SK 1 U n i t 1 2 Year 3 Vehicle Make 4 Vehicle Identification Number 5 Unladen Weight 6 Declared Gross Weight 7 Declared Combined Gross Weight 8 Owner 9 Apportioned License Plate Number 10 Replacement Unit Number SECTION 4 SECTION 5 Unit Number To designate a Transaction Type, place an X in the appropriate box. Account Business Address Change Account Mailing Address Change Additional Jurisdiction Additional Vehicle Carrier Type Change Contact Name Change Contact Telephone Number Change Vehicle Identification Correction Fleet Business Address Change Fleet Mailing Address Change Owner Name Change License PlateTransfer Legal Name Change Others Replacement License Plate Vehicle Deletion Weight Increase American LegalNet, Inc. www.FormsWorkFlow.com SECTION 1 Schedule C Instructions Column 7: Enter the Motor Carrier US DOT Number of the entity responsible for the vehicle safety fitness. If the Registrant is a lessee, the responsible party will be determined via a Lease Agreement. Column 8: Enter the Motor Carrier Responsible for Safety FEIN / SSN (TIN). Column 9: Enter Y or N if Lease is Less Than 30 Days. Column 10: Enter the Fuel Type. Fuel Types are as follows: D - Diesel, G - Gasoline, P - Propane, O-Other. (Use only the abbreviation). Column 11: Enter the weight of the vehicle fully equipped for service excluding the weight of any load. Column 12: Enter the total unladen weight of the vehicle plus the maximum load to be carried on the vehicle. Column 13: Enter the total unladen weight of the combination of vehicles plus the maximum load to be carried on that combination of vehicles. Column 14: Enter the actual purchase price of the vehicle paid by the current owner, excluding trade in and the sales tax, including accessories or modifications attached to the vehicle. Column 15: Enter the manufacturer's retail price, excluding trade in and the sales tax, including accessories or modifications attached to the vehicle. Column 16: Enter the month, day and year the vehicle was purchased by the current owner. Column 17: Enter the name of the titled owner, if the vehicle is not owned by the Applicant. Line 1: Enter the Legal Name as it is registered with the Indiana Secretary of State or the Indiana Department of Revenue. (The IRP Unit will register the Registrant/Applicant in the same name as registered with the Indiana Secretary of State or Indiana Department of Revenue.) Lines 2 through 6: TO BE COMPLETED FOR CHANGES ONLY. Enter the Business Address Change for an Account or Fleet. Be certain to designate the appropriate change in Section 5, Transactions Types. Lines 7 through 11: TO BE COMPLETED FOR CHANGES ONLY. Enter the Mailing Address Change for an Account or Fleet. Be certain to designate the appropriate change in Section 5, Transactions Types. Lines 12 and 17: TO BE COMPLETED FOR CHANGES ONLY. Enter the name of the new Contact Person and Contact Person Telephone Number. Be certain to designate the appropriate change in Section 5, Transaction Types. Line 13: Enter the IRP Account Number. Line 14: Enter the Fleet Number. Line 15: Enter an X in the appropriate License Year for the Transaction Type. If both boxes are marked with an X, then the transaction will be processed for the current Registration Year and the next Registration Year. Line 16: Enter the Staggered Month associated wilth your IRP account. Line 17: Enter the telephone number change. Line 18: Enter the Taxpayer Identification Number of the applicant. All business entities must register with the Indiana Department of Revenue and obtain a Taxpayer Identification Number. SECTION 2 Indicate the appropriate weight in the jurisdiction for the vehicle(s) listed in Section 3. The weight must be the "Declared Combined Gross Weight" or the "Declared Gross Vehicle Weight" as shown in Section 3, Columns 10 and 11. California weight is shown at the "Unladen Weight" as shown in Section 3, Column 9. SECTION 4 If the Transaction Type is an apportioned license plate transfer, the apportioned license plate will be transferred, in the order they are listed in Section 4, to the vehicles listed in Section 3. Column 1: See Section 3, Column 1 instruction. Column 2: See Section 3, Column 2 instruction. Column 3: See Section 3, Column 3 instruction. Column 4: See Section 3, Column 4 instruction. Column 5: See Section 3, Column 11 instruction. Column 6: See Section 3, Column 12 instruciton. Column 7: See Section 3, Column 13 instructin. Column 8: See Section 3, Column 17 instruction. Column 9: Enter the apportioned license plate number that is to be transferred or returned to the IRP Unit. Column 10: Enter the Unit Number of the vehicle replacing the deleted vehicle. SECTION 3 Column 1: Enter the Registrant assigned Unit Number or Equipment Number for the vehicle. Column 2: Enter the last two digits of the Model Year of the vehicle. Column 3: Enter the Vehicle Make using the three letter abbreviation that is shown on the Vehicle Title or Title Application. Column 4: Enter the entire Vehicle Identification Number (VIN) as shown on the Certificate of Title or Title Application. Column 5: Enter the Vehicle Type: Vehicle Types: TK-Truck (single), TR-Tractor, TT-Truck Tractor, RT-Road Tractor, ST-Semi-Trailer, FT-Full Trailer, BS-Bus, WR-Wrecker, CG-Converter Gear. (Use only the abbreviation.) For a complete description and i