Last updated: 4/18/2007

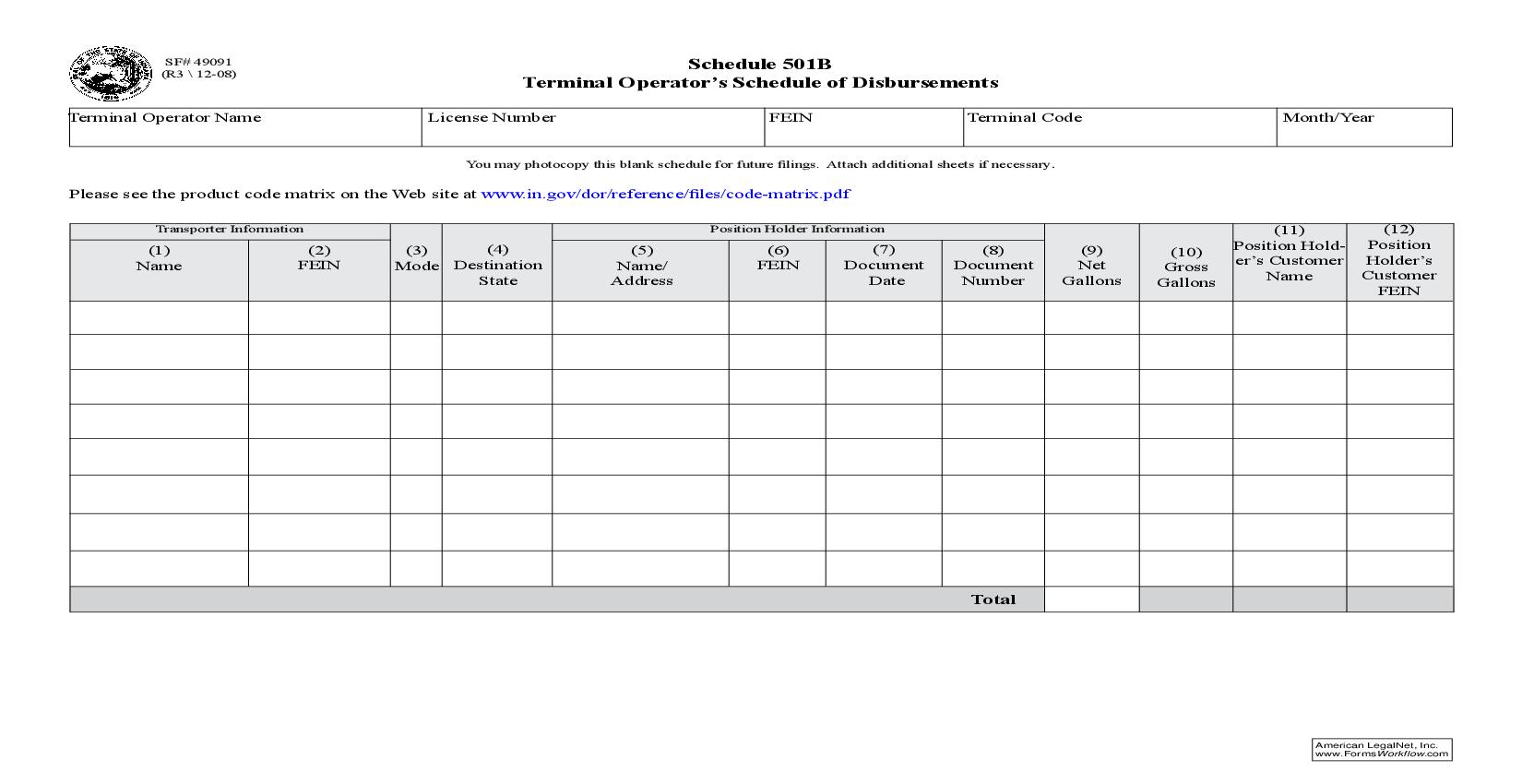

Terminal Operators Schedule Of Disbursements {Schedule 501B}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

State Form 49091 10-03 Schedule 501B Terminal Operator's Schedule of Disbursements License Number FEIN Terminal Code Month/Year Terminal Operator Name You may photocopy this blank schedule for future filings. Attach additional sheets if necessary. Product Code/Type (Check One) For Use with Reporting Special Fuel 142 Kerosene 161 Low Sulphur Diesel #1 - undyed 167 Low Sulphur Diesel #2 - undyed 226 High Sulphur Diesel - dye added 227 Low Sulphur Diesel - dye added 231 No. 1 Diesel - dye added 284 Biodiesel - undyed 290 Biodiesel - dye added OTH Other For Use with Reporting Gasoline/Oil Inspection 065 Gasoline 124 Gasohol 125 Aviation Gasoline 130 Jet Fuel Gasoline 142 Kerosene 150 #1 Fuel Oil - undyed 161 Low Sulphur Diesel #1 - undyed 231 No. 1 Diesel - dye added 241 Ethanol 243 Methanol 282 #1 High Sulfer Diesel - undyed OTH Other Transporter Information Position Holder Information (1) Name (2) FEIN (4) (3) Mode Destination State (5) Name/ Address (6) FEIN (7) Document Date (8) Document Number (9) Net Gallons (10) Gross Gallons (11) Position Holder's Customer Name (12) Position Holder's Customer FEIN Total American LegalNet, Inc. www.FormsWorkflow.com Instructions for Completing Terminal Operator's Schedule of Disbursements Schedule 501B Before You Begin: Enter your identifying information as it is reflected on your Indiana Fuel Tax License. (Be certain to complete a separate schedule for each fuel product type that you circle.) . Column Instructions: Columns 1 and 2: Enter the name and Federal Employer's Identification Number (FEIN) of the company that transports the fuel. This may be you. Column 3: Enter the mode of transport: One of the following codes should be used for each entry. J R B PL = = = = Truck Rail Barge Pipeline S = Ship (Great Lakes or Ocean Vessel) ST = Stock Transfer BA = Book Adjustment Column 4: Enter the destination state to which the fuel was transported. Columns 5, 6, 7 and 8: Enter the position holder's information as well as the shipping document date and number. The Position Holder is the person who owns/leases storage space in the terminal. Column 9: Enter the net gallons received. The grand total of all Schedule-501B, Column 9, should be carried to the FT-501, Terminal Operator's Monthly Return. For product types 142, 161, 167, 226, 227, 228, 231, 243, 284 or 290, carry this total to Line 3, Column A of the FT-501. For product types 065, 124, 125, 241 and 243, carry this total to Line 3, Column B of the FT-501. For product type 142, 130, 150, 161 or "other," carry this total to Line 3, Column C of the FT-501. Note: You must subtotal by position holder on the Schedule-501B and carry these subtotals to Schedule 501I, column 5. American LegalNet, Inc. www.FormsWorkflow.com Column 10: Enter the gross gallons disbursed. Columns 11 and 12: Enter the position holders customer name and Federal Employer's Identification Number (FEIN).