Last updated: 7/11/2012

Nonprofit Application For Sales Tax Exemption {NP-20A}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

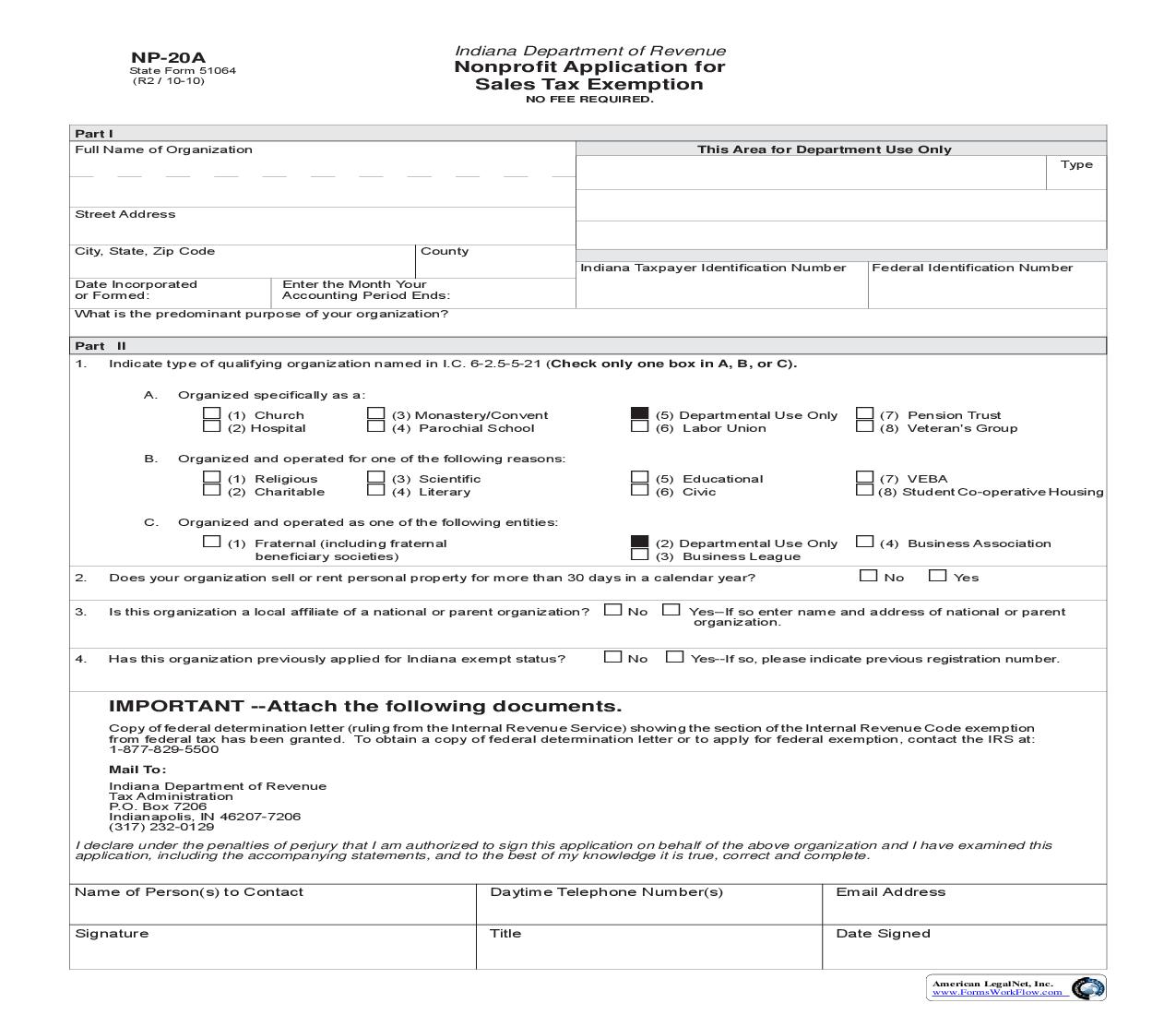

State Form 51064 (R2 / 10-10) NP-20A Indiana Department of Revenue Nonprofit Application for Sales Tax Exemption NO FEE REQUIRED. Part I Full Name of Organization This Area for Department Use Only Type Street Address City, State, Zip Code Date Incorporated or Formed: County Indiana Taxpayer Identification Number Enter the Month Your Accounting Period Ends: Federal Identification Number What is the predominant purpose of your organization? Part II 1. Indicate type of qualifying organization named in I.C. 6-2.5-5-21 (Check only one box in A, B, or C). A. Organized specifically as a: (1) Church (2) Hospital (3) Monastery/Convent (4) Parochial School No (5) Departmental Use Only (6) Labor Union (7) Pension Trust (8) Veteran's Group B. Organized and operated for one of the following reasons: (1) Religious (2) Charitable (3) Scientific (4) Literary (5) Educational (6) Civic (7) VEBA (8) Student Co-operative Housing C. Organized and operated as one of the following entities: (1) Fraternal (including fraternal beneficiary societies) (2) Departmental Use Only (3) Business League 2. 3. Does your organization sell or rent personal property for more than 30 days in a calendar year? Is this organization a local affiliate of a national or parent organization? (4) Business Association No Yes No Yes--If so enter name and address of national or parent organization. 4. Has this organization previously applied for Indiana exempt status? Yes--If so, please indicate previous registration number. IMPORTANT --Attach the following documents. Copy of federal determination letter (ruling from the Internal Revenue Service) showing the section of the Internal Revenue Code exemption from federal tax has been granted. To obtain a copy of federal determination letter or to apply for federal exemption, contact the IRS at: 1-877-829-5500 Mail To: Indiana Department of Revenue Tax Administration P.O. Box 7206 Indianapolis, IN 46207-7206 (317) 232-0129 I declare under the penalties of perjury that I am authorized to sign this application on behalf of the above organization and I have examined this application, including the accompanying statements, and to the best of my knowledge it is true, correct and complete. Name of Person(s) to Contact Signature Daytime Telephone Number(s) Title Email Address Date Signed American LegalNet, Inc. www.FormsWorkFlow.com