Last updated: 4/13/2015

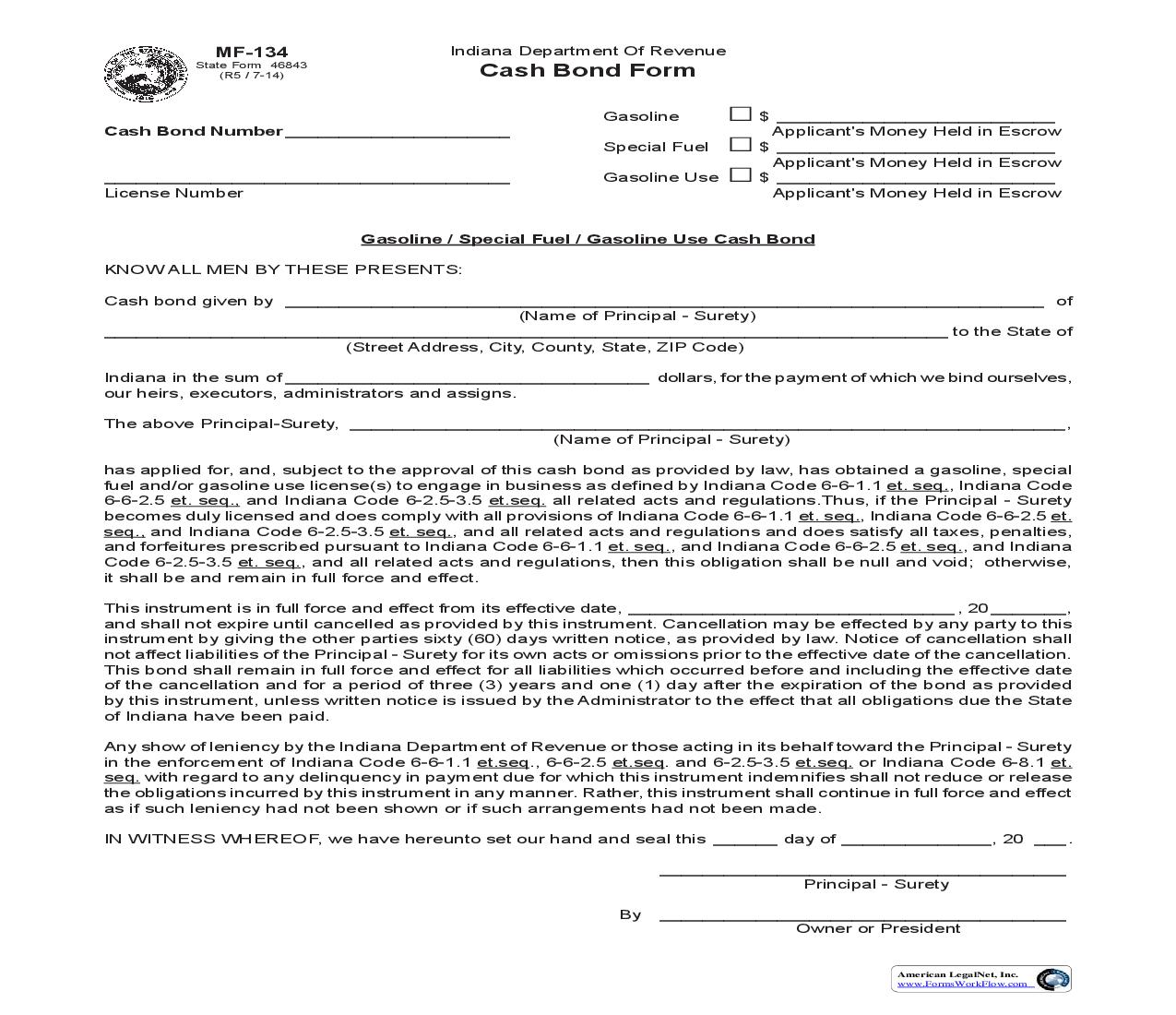

Gasoline Special Fuel Cash Bond {MF-134}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

State Form 46843 (R5 / 7-14) MF-134 Indiana Department Of Revenue Cash Bond Form Gasoline Cash Bond Number _____________________ ______________________________________ License Number $ Applicant's Money Held in Escrow __________________________ Special Fuel $ __________________________ Applicant's Money Held in Escrow Gasoline Use $ __________________________ Applicant's Money Held in Escrow Gasoline / Special Fuel / Gasoline Use Cash Bond KNOW ALL MEN BY THESE PRESENTS: Cash bond given by _______________________________________________________________________ of (Name of Principal - Surety) _______________________________________________________________________________ to the State of (Street Address, City, County, State, ZIP Code) Indiana in the sum of __________________________________ dollars, for the payment of which we bind ourselves, our heirs, executors, administrators and assigns. The above Principal-Surety, ___________________________________________________________________, (Name of Principal - Surety) has applied for, and, subject to the approval of this cash bond as provided by law, has obtained a gasoline, special fuel and/or gasoline use license(s) to engage in business as defined by Indiana Code 6-6-1.1 et. seq., Indiana Code 6-6-2.5 et. seq., and Indiana Code 6-2.5-3.5 et.seq. all related acts and regulations.Thus, if the Principal - Surety becomes duly licensed and does comply with all provisions of Indiana Code 6-6-1.1 et. seq., Indiana Code 6-6-2.5 et. seq., and Indiana Code 6-2.5-3.5 et. seq., and all related acts and regulations and does satisfy all taxes, penalties, and forfeitures prescribed pursuant to Indiana Code 6-6-1.1 et. seq., and Indiana Code 6-6-2.5 et. seq., and Indiana Code 6-2.5-3.5 et. seq., and all related acts and regulations, then this obligation shall be null and void; otherwise, it shall be and remain in full force and effect. This instrument is in full force and effect from its effective date, _______________________________ , 20 _______, and shall not expire until cancelled as provided by this instrument. Cancellation may be effected by any party to this instrument by giving the other parties sixty (60) days written notice, as provided by law. Notice of cancellation shall not affect liabilities of the Principal - Surety for its own acts or omissions prior to the effective date of the cancellation. This bond shall remain in full force and effect for all liabilities which occurred before and including the effective date of the cancellation and for a period of three (3) years and one (1) day after the expiration of the bond as provided by this instrument, unless written notice is issued by the Administrator to the effect that all obligations due the State of Indiana have been paid. Any show of leniency by the Indiana Department of Revenue or those acting in its behalf toward the Principal - Surety in the enforcement of Indiana Code 6-6-1.1 et.seq., 6-6-2.5 et.seq. and 6-2.5-3.5 et.seq. or Indiana Code 6-8.1 et. seq. with regard to any delinquency in payment due for which this instrument indemnifies shall not reduce or release the obligations incurred by this instrument in any manner. Rather, this instrument shall continue in full force and effect as if such leniency had not been shown or if such arrangements had not been made. IN WITNESS WHEREOF, we have hereunto set our hand and seal this ______ day of ______________, 20 ___ . ______________________________________ Principal - Surety By ______________________________________ Owner or President American LegalNet, Inc. www.FormsWorkFlow.com Attest: ________________________________ Secretary of Corporation STATE OF ______________________ ________________________________ COUNTY Before me, the undersigned, a Notary Public within and for the County and State aforesaid, this _________ day of ____________________ , 20 ________ , personally appeared by ___________________________________ and Owner or President acknowledged the execution of the foregoing bond. Witness my hand and seal this date. __________________________________ . Notary Public My commission expires ____________________________________. Instructions for Completing Form MF-134 To post a cash bond with the Indiana Department of Revenue, you must complete the enclosed cash bond form and submit it with a money order or cashier's check made payable to the Indiana Department of Revenue for the amount of the bond. In lieu of obtaining a money order or cashier's check, you may choose to submit the bond amount in cash with a properly completed cash bond form. Because the department does not accept cash sent by mail, the department will reject all cash payments which are not submitted in person. Also, personal checks will not be accepted. When completing the bond form, all blanks must be completed and your signature must be notarized. If the bond form is submitted after the date the license being requested becomes effective, the effective date of the bond must be retroactive to the effective date of the license. Upon receipt of the bond, the bond amount will be held in escrow and will not expire until the bond is cancelled. After the cancellation date, the bond will remain in effect for a period of three (3) years and one (1) day after the expiration date unless you are notified in writing by the administrator of the Indiana Department of Revenue that all obligations due to the State of Indiana have been paid following an audit. After the bond is released, the bond amount will be returned to you. If you have any questions, please contact our office at (317) 615-2625. American LegalNet, Inc. www.FormsWorkFlow.com