Last updated: 3/5/2007

Assets And Liabilities Of Estate To Be Relieved From Administration {5.1}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

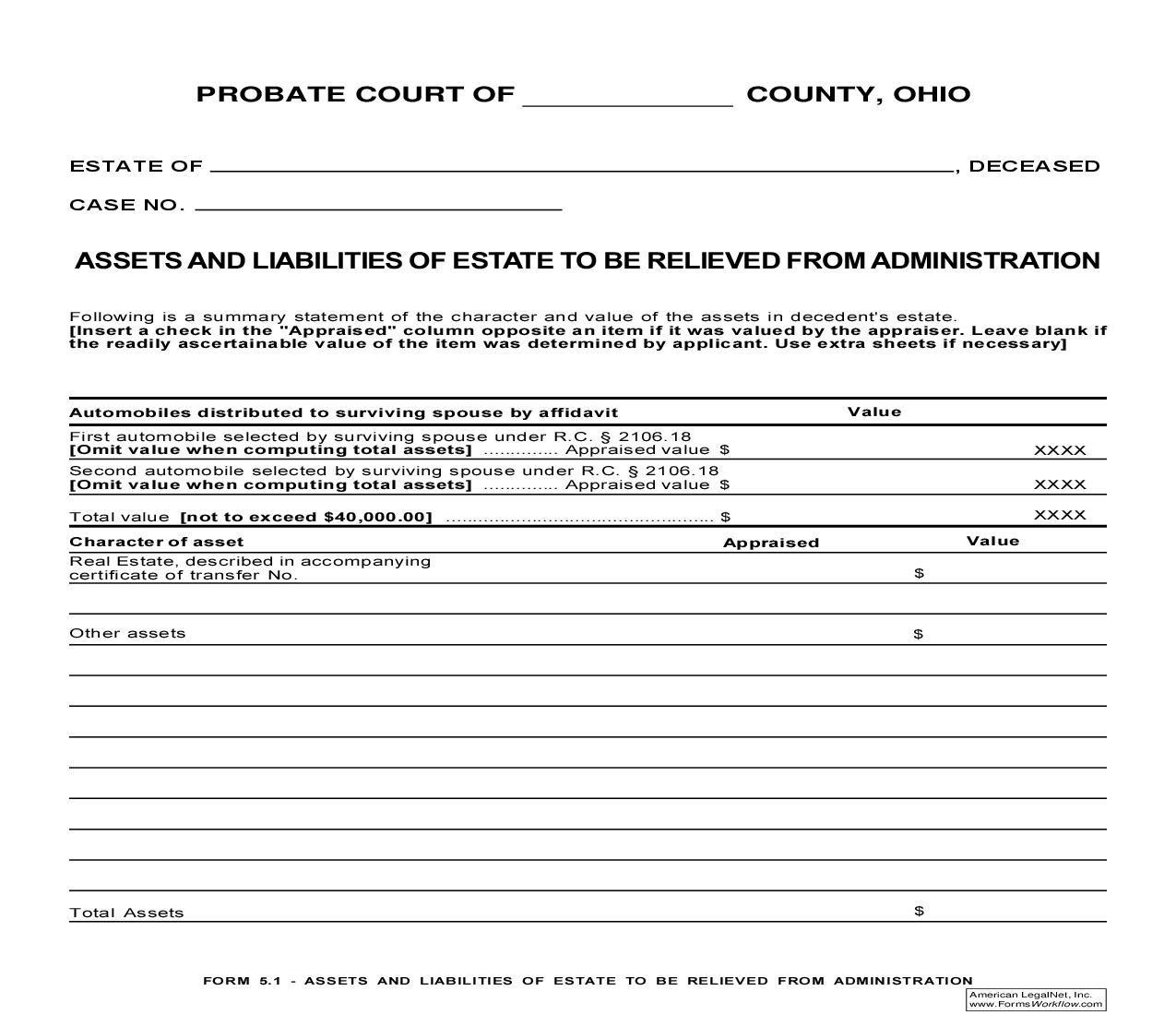

PROBATE COURT OF ESTATE OF CASE NO. COUNTY, OHIO , DECEASED ASSETS AND LIABILITIES OF ESTATE TO BE RELIEVED FROM ADMINISTRATION Following is a summary statement of the character and value of the assets in decedent's estate. [Insert a check in the "Appraised" column opposite an item if it was valued by the appraiser. Leave blank if the readily ascertainable value of the item was determined by applicant. Use extra sheets if necessary] Automobiles distributed to surviving spouse by affidavit First automobile selected by surviving spouse under R.C. § 2106.18 [Omit value when computing total assets] .............. Appraised value $ Second automobile selected by surviving spouse under R.C. § 2106.18 [Omit value when computing total assets] .............. Appraised value $ Total value [not to exceed $40,000.00] .................................................. $ Character of asset Real Estate, described in accompanying certificate of transfer No. Appraised Value XXXX XXXX XXXX Value $ Other assets $ Total Assets $ FORM 5.1 - ASSETS AND LIABILITIES OF ESTATE TO BE RELIEVED FROM ADMINISTRATION American LegalNet, Inc. www.FormsWorkflow.com CASE NO. Following is a list of decedent's known debts. [Use extra sheets if necessary] Name of Creditor Nature of Debt Amount $ Total debts $ CERTIFICATION The undersigned appraiser agreed to act as appraiser of decedent's estate, and to appraise the property exhibited truly, honestly, impartially, and to the best of the appraiser's knowledge and ability. The appraiser further says that those assets whose values were not readily ascertainable are indicated above by a check in the "Appraised" column opposite each such item, and that such values are correct. The undersigned applicant determined the value of those assets whose values were readily ascertainable and were not appraised by the appraiser, and that such values are correct, and to applicant's knowledge the above list of decedent's debts is correct. Date Appraiser Applicant FORM 5.1 - ASSETS AND LIABILITIES OF ESTATE TO BE RELIEVED FROM ADMINISTRATION American LegalNet, Inc. www.FormsWorkflow.com