Last updated: 2/13/2007

Application For Exemption From Erie County Real Property Taxes

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

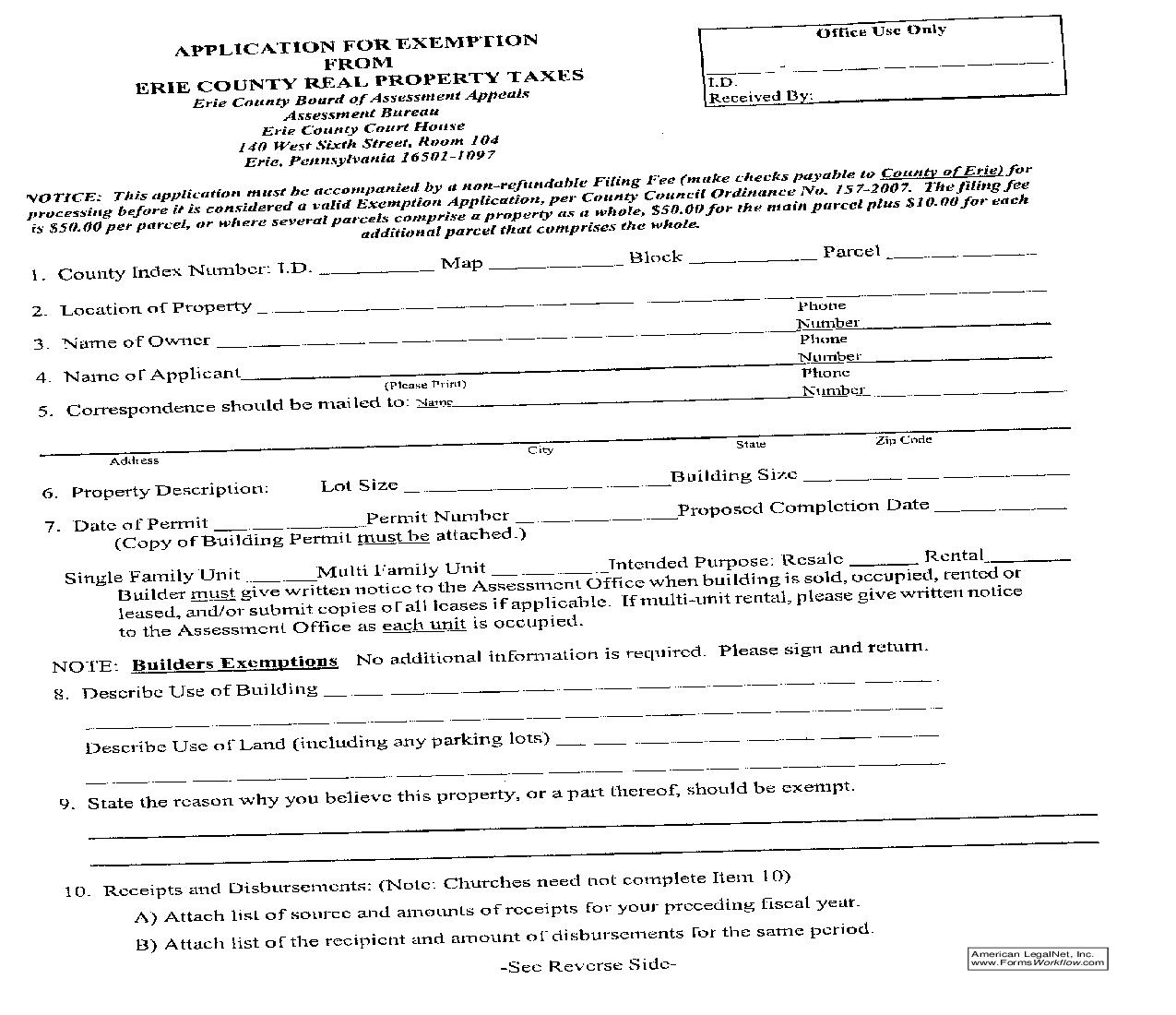

APPLICATION FOR EXEMPTION FROM ERIE COUNTY REAL PROPERTY TAXES Erie County Board of Assessment Appeals Assessment Bureau Erie County Court House 140 West Sixth Street, Room 104 Erie, Pennsylvania 16501-1097 Office Use Only _______ - ___________________________ I.D. Received By: ________________________ 1. County Index Number: I.D. Map Block Parcel _____________ Phone 2. Location of Property ____________________________________________________________________ 3. Name of Owner __________________________________________________Number ________________ 4. 5. Phone Name of Applicant _______________________________________________ Number ________________ (Please Print) Phone Correspondence should be mailed to: Name____________________________________________ Number _________________ _________________________________________________________________________________________ Address City State Zip Code 6. Property Description: Lot Size _______________________Building Size _______________________ 7. Date of Permit _____________Permit Number ______________Proposed Completion Date ____________ (Copy of Building Permit must be attached.) Single Family Unit ______Multi Family Unit __________Intended Purpose: Resale ______ Rental _______ Builder must give written notice to the Assessment Office when building is sold, occupied, rented or leased, and/or submit copies of all leases if applicable. If multi-unit rental, please give written notice to the Assessment Office as each unit is occupied. NOTE: Builders Exemptions No additional information is required. Please sign and return. 8. Describe Use of Building _____________________________________________________ __________________________________________________________________________ Describe Use of Land (including any parking lots) _________________________________ __________________________________________________________________________ 9. State the reason why you believe this property, or a part thereof, should be exempt. _______________________________________________________________________________________ _______________________________________________________________________________________ 10. Receipts and Disbursements: (Note: Churches need not complete Item 10) A) Attach list of source and amounts of receipts for your preceding fiscal year. B) Attach list of the recipient and amount of disbursements for the same period. -See Reverse Side11. Attach a copy of your Charter. (If none, then attach copy of the by-laws.) American LegalNet, Inc. www.FormsWorkflow.com 12. Are any of your funds used or distributed for any monetary gain or profit to the members? Yes No Or for any purpose other than those set forth herein? _____________________________________________ 13. Is any portion of the property not used by the applicant? Yes No If so, briefly describe the unused portion ______________________________________________________ _______________________________________________________________________________________ 14. If the applicant is a church, describe any portion of the property not actually used in worship services. (For example: parking lots, minister's residence, or vacant land.) _____________________________________ _______________________________________________________________________________________ 15. Is the property, or any part thereof used at any time for any other than the purposes set forth herein? Yes No If so, describe such use _______________________________________________________ _______________________________________________________________________________________ 16. Is any part of the property used for recreation of the members? Yes No If so, describe the portion so used and the extent of the recreational use. _____________________________ _______________________________________________________________________________________ 17. Is any portion of the property occupied, rented or leased to anyone other than the applicant? Yes No If so, please describe particulars and provide copies of the signed leases or agreements. ___________________ ______________________________________________________________________________________ 18. Attach four (4) copies of any supplementary information you wish the Board to consider as part of your application. Please provide a copy of your State Sales & Use Tax Certificate if you are applying for Exemption as a non-profit 501(c)3 organization. 19. In what manner does this institution (a) advance a charitable purpose; (b) donate or render gratuitously a substantial portion of its services; (c) benefit a substantial and indefinite class of persons who are legitimate subjects of charity; (d) relieve the government of some of its burden; and (e) operate entirely free from the profit motive? (Please attach appropriate documentation in support of these statements.) If you are eligible for accommodation under the AMERICANS WITH DISABILITIES ACT please contact us immediately so that arrangements may be made. I certify that the above statements are true to the best of my knowledge. Please Complete and Return to: Erie County Board of Appeals Erie County Court House 140 West Sixth St., Room 104 Erie PA 16501-1097 ____________________________________________________________ Signature Date ____________________________________________________________ Signature Date Rev. 2/02 American LegalNet, Inc. www.FormsWorkflow.com