Last updated: 1/27/2018

Chapter 13 Plan {3015-a}

Start Your Free Trial $ 37.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

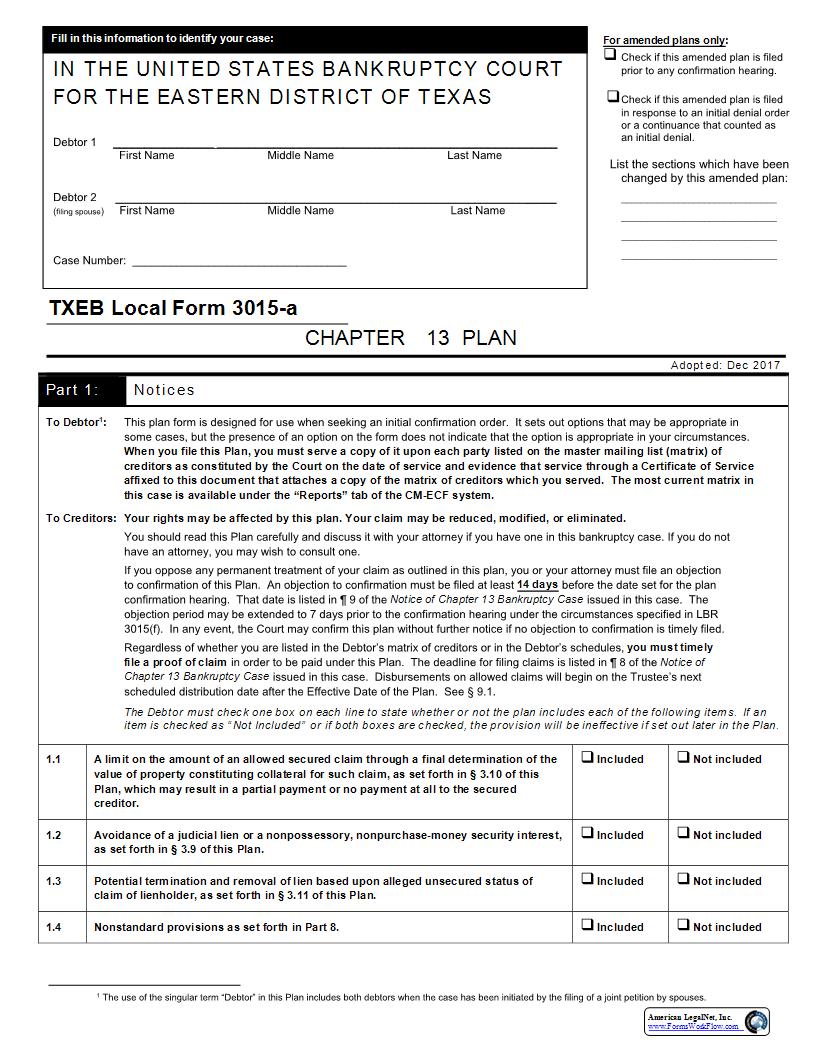

IN THE UNITED STATES BANKRUPTCY COURT FOR THE EASTERN DISTRICT OF TEXAS Debtor 1 First Name Middle Name Last Name Debtor 2 (filing spouse) First Name Middle Name Last Name Case Number: TXEB Local Form 3015-a CHAPTER 13 PLAN Adopted: Dec 2017 Part 1: Notices To Debtor1: This plan form is designed for use when seeking an initial confirmation order. It sets out options that may be appropriate in some cases, but the presence of an option on the form does not indicate that the option is appropriate in your circumstances. When you file this Plan, you must serve a copy of it upon each party listed on the master mailing list (matrix) of creditors as constituted by the Court on the date of service and evidence that service through a Certificate of Service affixed to this document that attaches a copy of the matrix of creditors which you served. The most current matrix in this case is available under the 223Reports224 tab of the CM-ECF system. To Creditors: Your rights may be affected by this plan. Your claim may be reduced, modified, or eliminated. You should read this Plan carefully and discuss it with your attorney if you have one in this bankruptcy case. If you do not have an attorney, you may wish to consult one. If you oppose any permanent treatment of your claim as outlined in this plan, you or your attorney must file an objection to confirmation of this Plan. An objection to confirmation must be filed at least 14 days before the date set for the plan confirmation hearing. That date is listed in 266 9 of the Notice of Chapter 13 Bankruptcy Case issued in this case. The objection period may be extended to 7 days prior to the confirmation hearing under the circumstances specified in LBR 3015(f). In any event, the Court may confirm this plan without further notice if no objection to confirmation is timely filed. Regardless of whether you are listed in the Debtor222s matrix of creditors or in the Debtor222s schedules, you must timely file a proof of claim in order to be paid under this Plan. The deadline for filing claims is listed in 266 8 of the Notice of Chapter 13 Bankruptcy Case issued in this case. Disbursements on allowed claims will begin on the Trustee222s next scheduled distribution date after the Effective Date of the Plan. See 247 9.1. The Debtor must check one box on each line to state whether or not the plan includes each of the following items. If an item is checked as 223Not Included224 or if both boxes are checked, the provision will be ineffective if set out later in the Plan. 1.1 A limit on the amount of an allowed secured claim through a final determination of the value of property constituting collateral for such claim, as set forth in 247 3.10 of this Plan, which may result in a partial payment or no payment at all to the secured creditor. Included Not included 1.2 Avoidance of a judicial lien or a nonpossessory, nonpurchase-money security interest, as set forth in 247 3.9 of this Plan. Included Not included 1.3 Potential termination and removal of lien based upon alleged unsecured status of claim of lienholder, as set forth in 247 3.11 of this Plan. Included Not included 1.4 Nonstandard provisions as set forth in Part 8. Included Not included 1 The use of the singular term 223Debtor224 in this Plan includes both debtors when the case has been initiated by the filing of a joint petition by spouses. For amended plans only: Check if this amended plan is filed prior to any confirmation hearing. Check if this amended plan is filed in response to an initial denial order or a continuance that counted as an initial denial. List the sections which have been changed by this amended plan: Fill in this information to identify your case: American LegalNet, Inc. www.FormsWorkFlow.com Debtor Case number TXEB Local Form 3015-a [eff. 12/2017] Chapter 13 Plan Page 2 Part 2: Plan Payments and Length of Plan 2.1 The applicable commitment period for the Debtor is months. 2.2 Payment Schedule. Unless the Court orders otherwise, beginning on the 30th day after the Petition Date2 or the entry date of any order converting this case to Chapter 13, whichever is later, the Debtor will make regular payments to the Trustee throughout the applicable commitment period and for such additional time as may be necessary to make the payments to claimants specified in Parts 3 through 5 of this Plan (the 223Plan Term224). The payment schedule shall consist of: Constant Payments: The Debtor will pay $ per month for months. Variable Payments: The Debtor will pay make variable plan payments throughout the Plan Term. The proposed schedule for such variable payments are set forth in Exhibit A to this Order and are incorporated herein for all purposes. 2.3 Mode of Payment. Regular payments to the Trustee will be made from future income in the following manner: [Check one] Debtor will make payments pursuant to a wage withholding order directed to an employer. Debtor will make electronic payments through the Trustee222s authorized online payment system. Debtor will make payments by money order or cashier222s check upon written authority of the Trustee. Debtor will make payments by other direct means only as authorized by motion and separate court order. 2.4 Income tax refunds. In addition to the regular monthly payments to the Trustee, and in the absence of a court order to the contrary, the Debtor is required to: (1) supply a copy of each federal income tax return, including all supporting schedues, filed during the Plan Term to the Trustee within 14 days of filing the return; and (2) remit to the Trustee within 14 days of receipt all federal income tax refunds received by each Debtor during the plan term which will be added to the plan base; provided, however, that the Debtor may retain from each such refund up to $2,000.00 in the aggregate on an annual basis if the Debtor is current on the payment obligations to the Trustee under this Plan at the time of the receipt of such tax refund. The Debtor hereby authorizes the Trustee to endorse any federal income tax refund check made payable to the Debtor during the plan term. 2.5 Additional payments. [Check one] None. If 223None224 is checked, the rest of 247 2.5 need not be completed. The Debtor will make additional payments to the Trustee from other sources, as specified below. Describe the source, estimated amount, and date of each proposed payment. 2.6 Plan Base. The total amount due and owing to the Trustee under 247247 2.2 and 2.5 is $ which, when combined with any income tax refunds due to the Trustee under 247 2.4, any litigation proceeds due to the Trustee under 247 9.3, and any other funds received by the Trustee on the Debtor222s behalf during the Plan Term, constitutes the 223Plan Base.224 American LegalNet, Inc. www.FormsWorkFlow.com Debtor Case number TXEB Local Form 3015-a [eff. 12/2017] Chapter 13 Plan Page 3 2The use of the term 223Petition Date224 in this Plan refers to the date that the Debtor filed the voluntary petition in this case.3All statutory references contained in this Plan refer to the Bankruptcy Code, located in Title 11, United States Code. Part 3: Treatment of Secured Claims 3.1 Post-Petition Home Mortgage Payments. [Check one] No Home Mortgage. If 223No Home Mortgage224 is checked, the remainder of 247 3.1 and 247 3.2 need not be completed. Home Mortgage Maturing Before or During Plan Term. If 223Mortgage Maturing224 is checked, the claim will be addressed in 247 3.4. The remainder of 247 3.1 and 247 3.2 need not be completed. Direct Home Mortgage Payments by Debtor Required. On the Petition Date, the Debtor owed the following claims secured only by a security interest in real property that is the Debtor222s principal residence. The listed monthly payment amount is correct as of the Petition Date. Such mortgage claims (other than related Cure Claims addressed in 247 3.2), shall be paid directly by the Debtor in accordance with the pre-petition contract, including any rate changes or other modifications required by such documents and noticed in conformity with any applicable rules, as such payments become due during the Plan Term. The fulfillment of this requirement is critical to the Deb