Last updated: 1/23/2007

Motion And Notice Of Proposed Income Deduction Order For Support {CC-1450}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

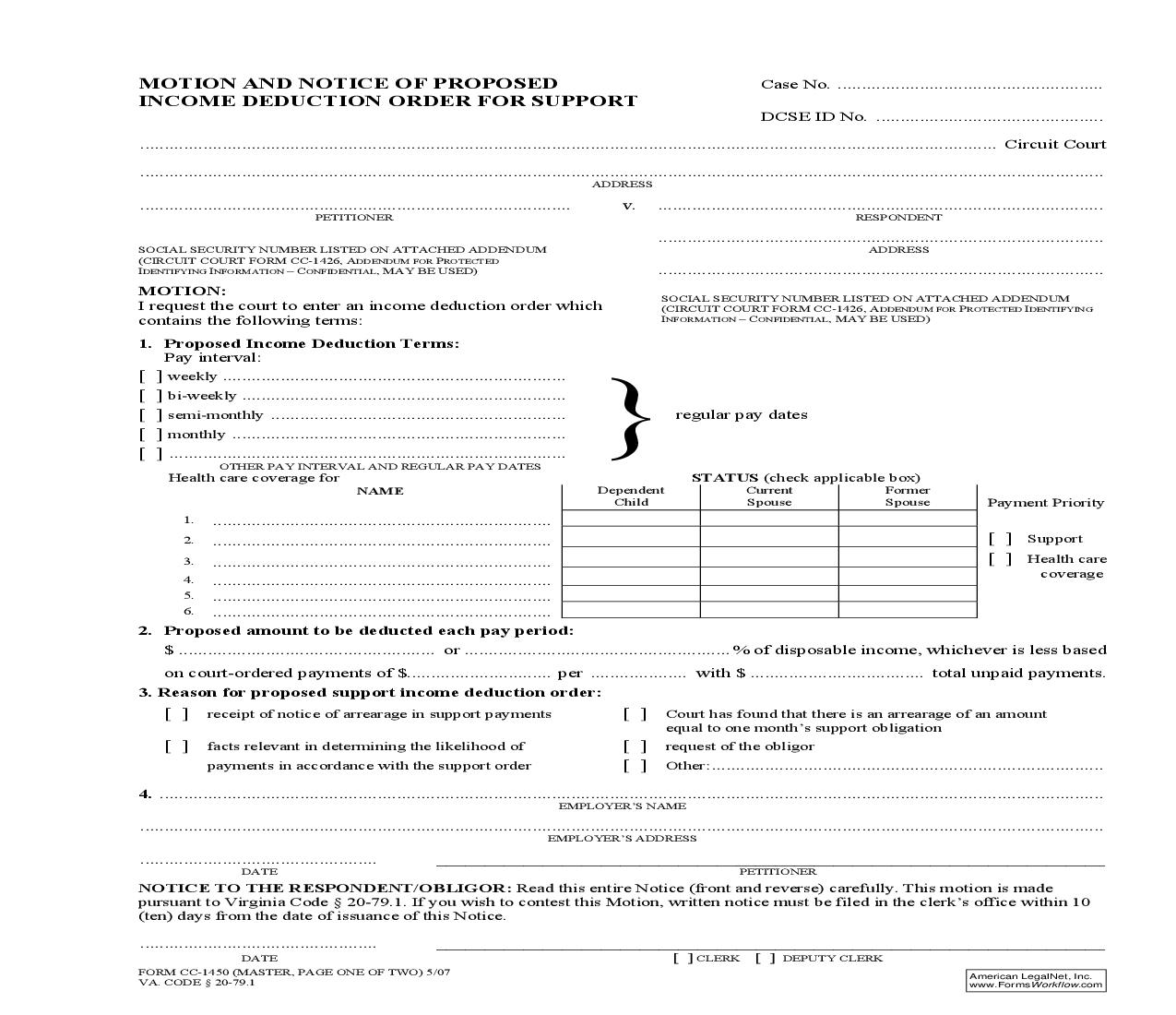

MOTION AND NOTICE OF PROPOSED INCOME DEDUCTION ORDER FOR SUPPORT COMMONWEALTH OF VIRGINIA VA. CODE § 20-79.1 Case No.: ........................................ DCSE ID No.: .................................. .................................................................................................................................................. Circuit Court ........................................................................................................................................................................ ADDRESS ........................................................................... PETITIONER V. ............................................................................................ RESPONDENT ........................................................................... SOCIAL SECURITY NUMBER .............................................................................. ADDRESS MOTION: I request the court to enter an income deduction order which contains the following terms: 1. Proposed Income Deduction Terms: Pay interval: weekly ............................................................ bi-weekly......................................................... semi-monthly .................................................... monthly........................................................... .............................................................................. .............................................................................. SOCIAL SECURITY NUMBER ..................................................................... OTHER PAY INTERVAL AND REGULAR PAY DATES } regular pay dates Health care coverage for NAME 1. 2. 3. 4. 5. 6. Dependent Child STATUS (check applicable box) Current Spouse Former Spouse Payment Priority Support Health care coverage ........................................................... ........................................................... ........................................................... ........................................................... ........................................................... ........................................................... 2. Proposed amount to be deducted each pay period: $ ............................................. or ..............................................% of disposable income, whichever is less based on court-ordered payments of $ .........................per ..................with $ ............................... total unpaid payments. 3. Reason for proposed support income deduction order: receipt of notice of arrearage in support payments Court has found that there is an arrearage of an amount equal to one month's support obligation facts relevant in determining the likelihood of request of the obligor payments in accordance with the support order Other:.................................................................... 4. .................................................................................................................................................................... EMPLOYER'S NAME ........................................................................................................................................................................ .......................................... DATE EMPLOYER'S ADDRESS _____________________________________________________________________ PETITIONER NOTICE TO THE RESPONDENT/OBLIGOR: Read this entire Notice (front and reverse) carefully. This motion is made pursuant to Virginia Code § 20-79.1. If you wish to contest this Motion, written notice must be filed in the clerk's office within 10 (ten) days from the date of issuance of this Notice. .......................................... DATE FORM CC-1450 7/98 PC (MASTER, PAGE ONE OF TWO) _____________________________________________________________________ CLERK DEPUTY CLERK American LegalNet, Inc. www.FormsWorkflow.com TO THE RESPONDENT/OBLIGOR: This notice is to advise you that this Court has been requested for the reason stated in the Motion and Notice to enter an order requiring all of your present and future employers to deduct support payments as described above from your income. This deduction will begin with the next regular pay period for your income after your employers are served with an order. You have ten (10) days from the date of issuance of this Notice to file in the clerk's office of this court a written notice of contest of such proposed order. If no written notice of contest is filed, the court will enter such an order at the end of the ten (10) day filing period. If you file a written notice of contest, -- a hearing will be held and a decision made regarding the issuance of the Order and its contents within ten (10) days from the date that the Court receives your written notice of contest, unless good cause is shown for additional time, but not to exceed forty-five (45) days from your receipt of this notice, and -- only disputes as to mistakes of fact (error in the identity of the payor or the amount of current support or arrearage) will be heard. Alleged inability to pay is not a grounds for contest. -- payment of overdue support upon receipt of the notice shall not be the sole basis for not implementing withholding. The order will state that the deduction will start with the regular pay period for your income after your employer is served with an order. Your employer will be told the names of the petitioner, the court file number, the DCSE ID number (if any), your name, address and social security number, and the terms of the periodic support payment, and where to send payments. The employer will also be told: -- the maximum amount which can be withheld from your income, -- that the order is binding on the employer until further notice sent by the court is received by the employer, -- that the order requires income deductions for support to be paid before any other liens created under state law except that, when judicial or administrative income deduction orders for support have been previously served on the employer, the employer must prorate the amount withheld from your check among all income deduction orders of support based upon the current amounts due, with any remaining income prorated among the orders for accrued arrearages, if any, -- that deductions are to be made on your regular payday and sent that date to the Department of Child Support Enforcement of the Virginia Department of Social Services