Last updated: 8/30/2016

Notice Of Charitable Gift {OC-06}

Start Your Free Trial $ 17.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

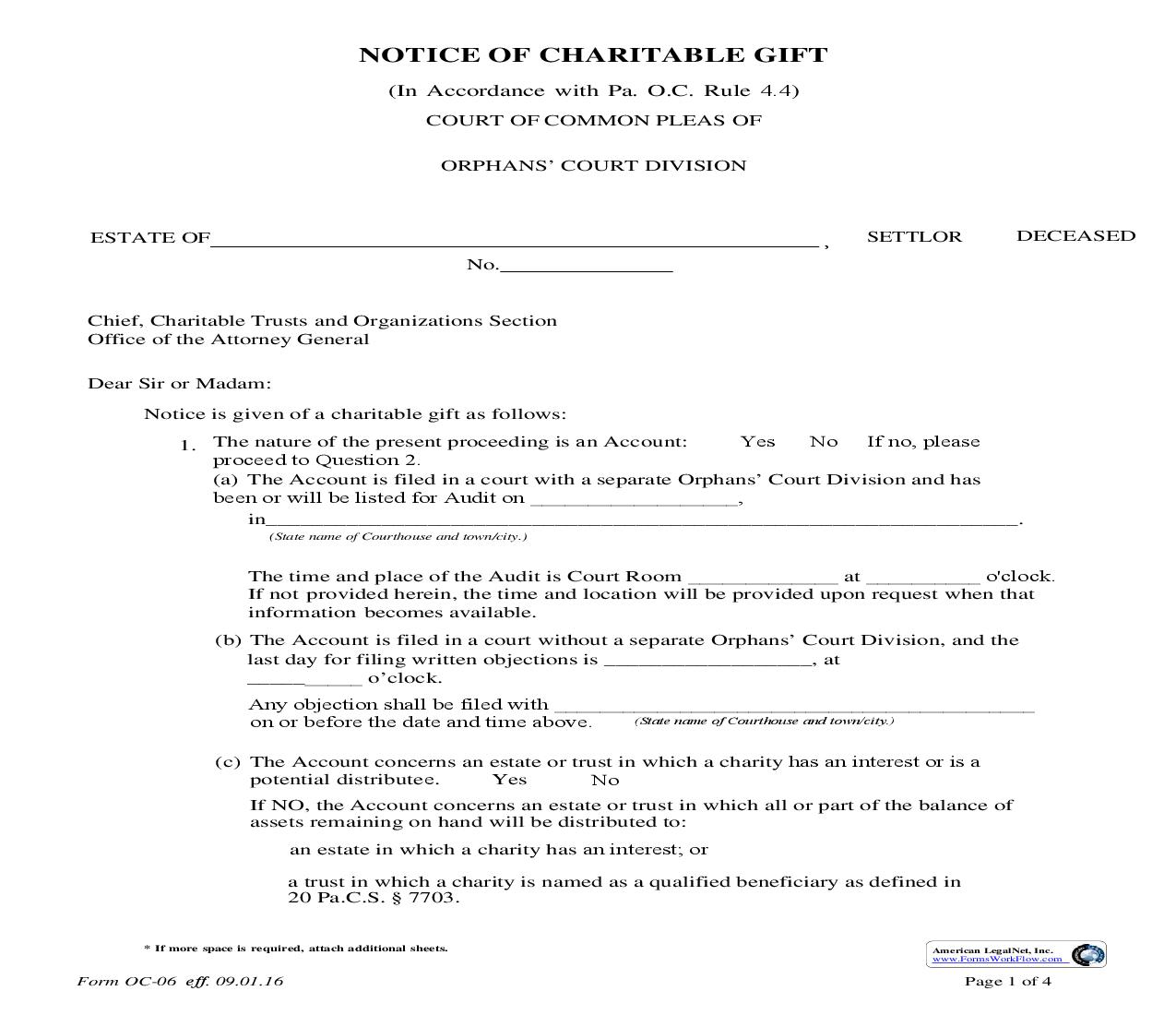

NOTICE OF CHARITABLE GIFT (In Accordance with Pa. O.C. Rule 4.4) COURT OF COMMON PLEAS OF ORPHANS' COURT DIVISION ESTATE OF No. , SETTLOR DECEASED Chief, Charitable Trusts and Organizations Section Office of the Attorney General Dear Sir or Madam: Notice is given of a charitable gift as follows: Yes No If no, please 1. The nature of the present proceeding is an Account: proceed to Question 2. (a) The Account is filed in a court with a separate Orphans' Court Division and has been or will be listed for Audit on __________________, in_________________________________________________________________. (State name of Courthouse and town/city.) The time and place of the Audit is Court Room _____________ at __________ o'clock. If not provided herein, the time and location will be provided upon request when that information becomes available. (b) The Account is filed in a court without a separate Orphans' Court Division, and the last day for filing written objections is __________________, at __________ o'clock. Any objection shall be filed with __________________________________________ (State name of Courthouse and town/city.) on or before the date and time above. (c) The Account concerns an estate or trust in which a charity has an interest or is a potential distributee. Yes No If NO, the Account concerns an estate or trust in which all or part of the balance of assets remaining on hand will be distributed to: an estate in which a charity has an interest; or a trust in which a charity is named as a qualified beneficiary as defined in 20 Pa.C.S. § 7703. * If more space is required, attach additional sheets. American LegalNet, Inc. www.FormsWorkFlow.com Form OC-06 eff. 09.01.16 Page 1 of 4 Estate of , 2. SETTLOR DECEASED If the proceedings are other than an Account, state the nature of the proceedings and the place, date and time fixed for hearing: ___________________________________________________________________________ ___________________________________________________________________________ ___________________________________________________________________________ ___________________________________________________________________________ 3. Charitable gifts are made as follows: (a) Give full names and addresses of charities, and the names and addresses of counsel for any charity who has received notice or has appeared for it: ________________________________________________________________________ ________________________________________________________________________ ________________________________________________________________________ ________________________________________________________________________ ________________________________________________________________________ ________________________________________________________________________ (b) If pecuniary legacies, state exact amounts and indicate whether legacies will be or have been paid in full; if not, give reasons therefor. ________________________________________________________________________ ________________________________________________________________________ ________________________________________________________________________ ________________________________________________________________________ ________________________________________________________________________ ________________________________________________________________________ (c) If the charitable interest is a future interest and the estimated present value of the charity's future interest exceeds $25,000, a brief description thereof including the conditions precedent to its vesting in enjoyment and possession, the names and ages of persons known to have interests preceding such charitable interest, and the approximate market value of the property involved. ________________________________________________________________________ ________________________________________________________________________ ________________________________________________________________________ ________________________________________________________________________ ________________________________________________________________________ ________________________________________________________________________ American LegalNet, Inc. www.FormsWorkFlow.com Form OC-06 eff. 09.01.16 Page 2 of 4 Estate of (d) If residuary gift, state nature and value of share. , SETTLOR DECEASED ________________________________________________________________________ ________________________________________________________________________ ________________________________________________________________________ ________________________________________________________________________ ________________________________________________________________________ ________________________________________________________________________ 4. Provide a brief statement of all pertinent questions to be presented to the Court for adjudication or other disposition, including unresolved claims and any material questions of interpretation or distribution which may affect the value of the charitable interest. ________________________________________________________________________ ________________________________________________________________________ ________________________________________________________________________ ________________________________________________________________________ ________________________________________________________________________ ________________________________________________________________________ 5. The names and addresses of the fiduciaries are (state whether Executors and/or Trustees): ________________________________________________________________________ ________________________________________________________________________ ________________________________________________________________________ ________________________________________________________________________ ________________________________________________________________________ ________________________________________________________________________ 6. The names and addresses of counsel for the fiduciaries: ________________________________________________________________________ ________________________________________________________________________ ________________________________________________________________________ ________________________________________________________________________ ________________________________________________________________________ ______________