Last updated: 1/22/2018

Chapter 13 Plan And Motion

Start Your Free Trial $ 17.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

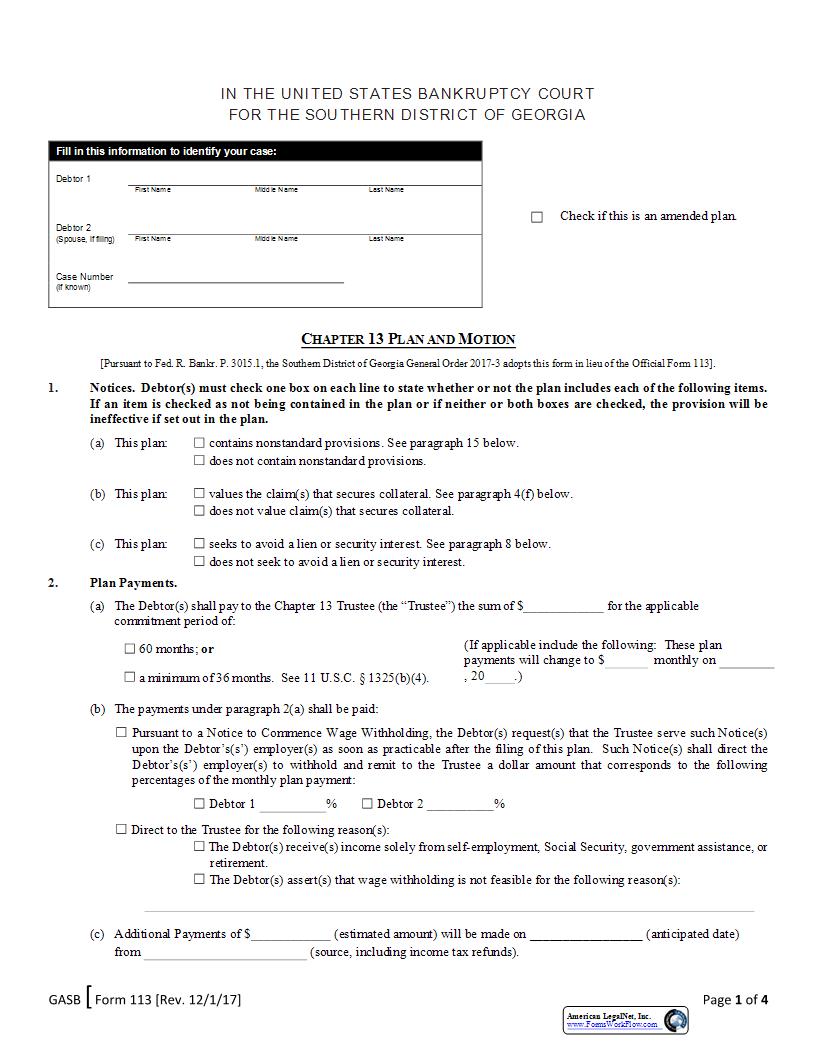

GASB 226 Form 113 [Rev. 12/1/17] Page 1 of 4 IN THE UNITED STATES BANKRUPTCY COURT FOR THE SOUTHERN DISTRICT OF GEORGIA Fill in this information to identify your case: Debtor 1 First Name Middle Name Last Name Debtor 2 (Spouse, if filing) First Name Middle Name Last Name Case Number (If known) CHAPTER 13 PLAN AND MOTION [Pursuant to Fed. R. Bankr. P. 3015.1, the Southern District of Georgia General Order 2017-3 adopts this form in lieu of the Official Form 113]. 1. Notices. Debtor(s) must check one box on each line to state whether or not the plan includes each of the following items. If an item is checked as not being contained in the plan or if neither or both boxes are checked, the provision will be ineffective if set out in the plan. (a) This plan: contains nonstandard provisions. See paragraph 15 below. does not contain nonstandard provisions. (b) This plan: values the claim(s) that secures collateral. See paragraph 4(f) below. does not value claim(s) that secures collateral. (c) This plan: seeks to avoid a lien or security interest. See paragraph 8 below. does not seek to avoid a lien or security interest. 2. Plan Payments. (a) The Debtor(s) shall pay to the Chapter 13 Trustee (the 223Trustee224) the sum of $ for the applicable commitment period of: 60 months; or (If applicable include the following: These plan payments will change to $ monthly on , 20 .) a minimum of 36 months. See 11 U.S.C. 247 1325(b)(4). (b) The payments under paragraph 2(a) shall be paid: Pursuant to a Notice to Commence Wage Withholding, the Debtor(s) request(s) that the Trustee serve such Notice(s) upon the Debtor222s(s222) employer(s) as soon as practicable after the filing of this plan. Such Notice(s) shall direct the Debtor222s(s222) employer(s) to withhold and remit to the Trustee a dollar amount that corresponds to the following percentages of the monthly plan payment: Debtor 1 % Debtor 2 % Direct to the Trustee for the following reason(s): The Debtor(s) receive(s) income solely from self-employment, Social Security, government assistance, or retirement. The Debtor(s) assert(s) that wage withholding is not feasible for the following reason(s): (c) Additional Payments of $ (estimated amount) will be made on (anticipated date) from (source, including income tax refunds). C heck if this is an amended plan. American LegalNet, Inc. www.FormsWorkFlow.com GASB 226 Form 113 [Rev. 12/1/17] Page 2 of 4 3. Long-Term Debt Payments. (a) Maintenance of Current Installment Payments. The Debtor(s) will make monthly payments in the manner specified as follows on the following long-term debts pursuant to 11 U.S.C. 247 1322(b)(5). These postpetition payments will be disbursed by either the Trustee or directly by the Debtor(s), as specified below. Postpetition payments are to be applied to postpetition amounts owed for principal, interest, authorized postpetition late charges and escrow, if applicable. Conduit payments that are to be made by the Trustee which become due after the filing of the petition but before the month of the first payment designated here will be added to the prepetition arrearage claim. CREDITOR COLLATERAL PRINCIPAL RESIDENCE (Y/N) PAYMENTS TO BE MADE BY (TRUSTEE OR DEBTOR(S)) MONTH OF FIRST POSTPETITION PAYMENT TO CREDITOR INITIAL MONTHLY PAYMENT (b) Cure of Arrearage on Long-Term Debt. Pursuant to 11 U.S.C. 247 1322(b)(5), prepetition arrearage claims will be paid in full through disbursements by the Trustee, with interest (if any) at the rate stated below. Prepetition arrearage payments are to be applied to prepetition amounts owed as evidenced by the allowed claim. CREDITOR DESCRIPTION OF COLLATERAL PRINCIPAL RESIDENCE (Y/N) ESTIMATED AMOUNT OF ARREARAGE INTEREST RATE ON ARREARAGE (if applicable) 4. Treatment of Claims. From the payments received, the Trustee shall make disbursements as follows unless designated otherwise: (a) Trustee222s Fees. The Trustee percentage fee as set by the United States Trustee. (b) Attorney222s Fees. Attorney222s fees allowed pursuant to 11 U.S.C. 247 507(a)(2) of $. (c) Priority Claims. Other 11 U.S.C. 247 507 claims, unless provided for otherwise in the plan will be paid in full over the life of the plan as funds become available in the order specified by law. (d) Fully Secured Allowed Claims. All allowed claims that are fully secured shall be paid through the plan as set forth below. CREDITOR DESCRIPTION OF COLLATERAL ESTIMATED CLAIM INTEREST RATE MONTHLY PAYMENT (e) Secured Claims Excluded from 11 U.S.C. 247 506 (those claims subject to the hanging paragraph of 11 U.S.C. 247 1325(a)). The claims listed below were either: (1) incurred within 910 days before the petition date and secured by a purchase money security interest in a motor vehicle acquired for the personal use of the Debtor(s), or (2) incurred within 1 year of the petition date and secured by a purchase money security interest in any other thing of value. These claims will be paid in full under the plan with interest at the rate stated below: CREDITOR DESCRIPTION OF COLLATERAL ESTIMATED CLAIM INTEREST RATE MONTHLY PAYMENT (f) Valuation of Secured Claims to Which 11 U.S.C. 247 506 is Applicable. The Debtor(s) move(s) to value the claims partially secured by collateral pursuant to 11 U.S.C. 247 506 and provide payment in satisfaction of those claims as set forth below. The unsecured portion of any bifurcated claims set forth below will be paid pursuant to paragraph 4(h) below. The plan shall be served on all affected creditors in compliance with Fed. R. Bankr. P. 3012(b), and the Debtor(s) shall attach a certificate of service. American LegalNet, Inc. www.FormsWorkFlow.com GASB 226 Form 113 [Rev. 12/1/17] Page 3 of 4 CREDITOR DESCRIPTION OF COLLATERAL VALUATION OF SECURED CLAIM INTEREST RATE MONTHLY PAYMENT (g) Special Treatment of Unsecured Claims. The following unsecured allowed claims are classified to be paid at 100% with interest at % per annum or without interest: (h) General Unsecured Claims. Allowed general unsecured claims, including the unsecured portion of any bifurcated claims provided for in paragraph 4(f) or paragraph 9 of this plan, will be paid a % dividend or a pro rata share of $, whichever is greater. 5. Executory Contracts. (a) Maintenance of Current Installment Payments or Rejection of Executory Contract(s) and/or Unexpired Lease(s). CREDITOR DESCRIPTION OF PROPERTY/SERVICES AND CONTRACT ASSUMED/ REJECTED MONTHLY PAYMENT DISBURSED BY TRUSTEE OR DEBTOR(S) (b) Treatment of Arrearages. Prepetition arrearage claims will be paid in full through disbursements by the Trustee. CREDITOR ESTIMATED ARREARAGE 6. Adequate Protection Payments. The Debtor(s) will make pre-confirmation lease and adequate protection payments pursuant to 11 U.S.C. 247 1326(a)(1) on allowed claims of the following creditors: Direct to the Creditor; or To the Trustee. CREDITOR ADEQUATE PROTECTION OR LEASE PAYMENT AMOUNT 7. Domestic Support Obligations. The Debtor(s) will pay all postpetition domestic support obligations direct to the holder of such claim identified here. See 11 U.S.C. 247 101(14A). The Trustee will provide the statutory notice of 11 U.S.C. 247 1302(d) to the following claimant(s): CLAIMANT ADDRESS 8. Lien Avoidance. Pursuant to 11 U.S.C. 247 522(f), the Debtor(s) move(s) to avoid the lien(s) or security interest(s) of the following creditor(s), upon confirmation but subject to 11 U.S.C. 247 349, with respect to the property described below. The plan shall be served on all affected creditor(s) in compliance with Fed. R. Bankr. P. 4003(d), and the Debtor(s) shall attach a certificate of service. CREDITOR LIEN IDENTIFICATION (if known) PROPERTY American LegalNet, Inc. www.FormsWorkFlow.com GASB 226 Form 113 [Rev. 12/1/17] Page 4 of 4 9. Surrender of Collateral. The following collateral is surrendered to the creditor to satisfy the secured claim to the extent shown below upon confirmation of the plan. The Debtor(s) request(s) that upon confirmation of this plan the stay under 11 U.S.C. 247 362(a) be terminated as to the collateral only and that the stay under 11 U.S.C. 247 1301 be terminated in all respects. Any allowed deficiency balance resulting from a c