Last updated: 7/11/2006

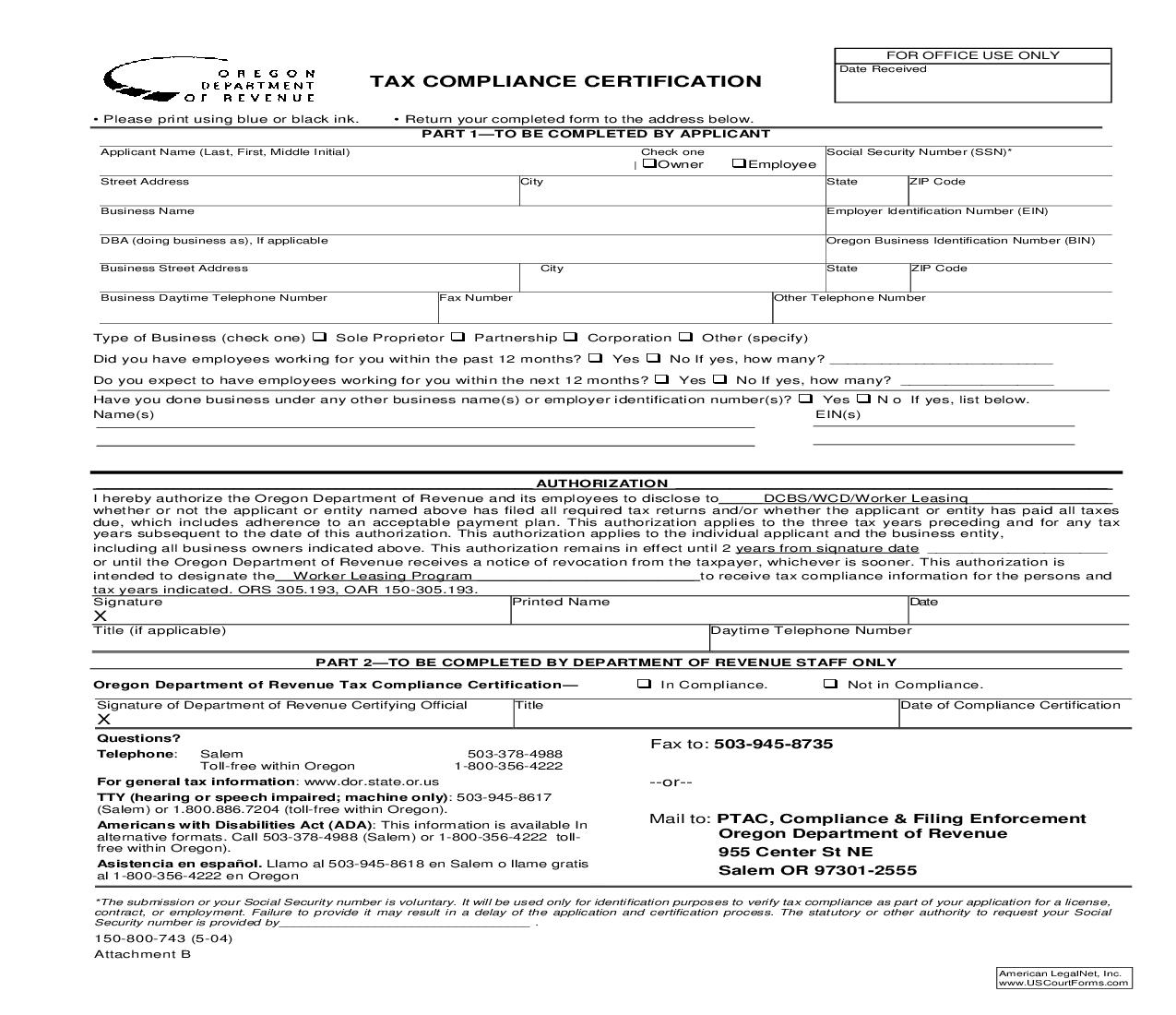

Tax Compliance Certification (Attachment B} {2466B}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

FOR OFFICE USE ONLY OREGON e Date Received IOF DEPARTMENT REVENUE TAX COMPLIANCE CERTIFICATION · Return your completed form to the address below. PART 1--TO BE COMPLETED BY APPLICANT Check one | Social Security Number (SSN)* · Please print using blue or black ink. Applicant Name (Last, First, Middle Initial) Street Address Business Name DBA (doing business as), If applicable Business Street Address Business Daytime Telephone Number Owner Employee State ZIP Code City Employer Identification Number (EIN) Oregon Business Identification Number (BIN) City Fax Number State ZIP Code Other Telephone Number Type of Business (check one) Sole Proprietor Partnership Corporation Yes Other (specify) Did you have employees working for you within the past 12 months? No If yes, how many? __________________________ Yes No If yes, how many? _________________ Yes EIN(s) N o If yes, list below. Do you expect to have employees working for you within the next 12 months? Have you done business under any other business name(s) or employer identification number(s)? Name(s) ___________________________________________________ AUTHORIZATION ________________________________________________ I hereby authorize the Oregon Department of Revenue and its employees to disclose to_____DCBS/WCD/Worker Leasinq _______________ whether or not the applicant or entity named above has filed all required tax returns and/or whether the applicant or entity has paid all taxes due, which includes adherence to an acceptable payment plan. This authorization applies to the three tax years preceding and for any tax years subsequent to the date of this authorization. This authorization applies to the individual applicant and the business entity, including all business owners indicated above. This authorization remains in effect until 2 years from siqnature date ____________________ or until the Oregon Department of Revenue receives a notice of revocation from the taxpayer, whichever is sooner. This authorization is intended to designate the__Worker Leasing Program ________________________ to receive tax compliance information for the persons and tax years indicated. ORS 305.193, OAR 150-305.193. Signature Printed Name Date X Title (if applicable) Daytime Telephone Number PART 2--TO BE COMPLETED BY DEPARTMENT OF REVENUE STAFF ONLY Oregon Department of Revenue Tax Compliance Certification-- Signature of Department of Revenue Certifying Official Title In Compliance. Not in Compliance. Date of Compliance Certification X Questions? Salem 503-378-4988 Toll-free within Oregon 1-800-356-4222 For general tax information: www.dor.state.or.us TTY (hearing or speech impaired; machine only): 503-945-8617 (Salem) or 1.800.886.7204 (toll-free within Oregon). Americans with Disabilities Act (ADA): This information is available In alternative formats. Call 503-378-4988 (Salem) or 1-800-356-4222 tollfree within Oregon). Asistencia en español. Llamo al 503-945-8618 en Salem o llame gratis al 1-800-356-4222 en Oregon Telephone: Fax to: 503-945-8735 --or-Mail to: PTAC, Compliance & Filing Enforcement Oregon Department of Revenue 955 Center St NE Salem OR 97301-2555 *The submission or your Social Security number is voluntary. It will be used only for identification purposes to verify tax compliance as part of your application for a license, contract, or employment. Failure to provide it may result in a delay of the application and certification process. The statutory or other authority to request your Social Security number is provided by__________________________________ . 150-800-743 (5-04) Attachment B American LegalNet, Inc. www.USCourtForms.com